This form is a model Authority to Cancell Lien. Lienholder files with court certifying that indebtedness has been satisfied and lien should be cancelled. Adapt to fit your specific facts and circumstances.

South Carolina Authority to Cancel

Description

How to fill out Authority To Cancel?

You have the ability to invest time online searching for the appropriate legal document template that aligns with state and federal regulations you require.

US Legal Forms provides thousands of legal forms that have been vetted by professionals.

It is easy to obtain or create the South Carolina Authority to Cancel from my service.

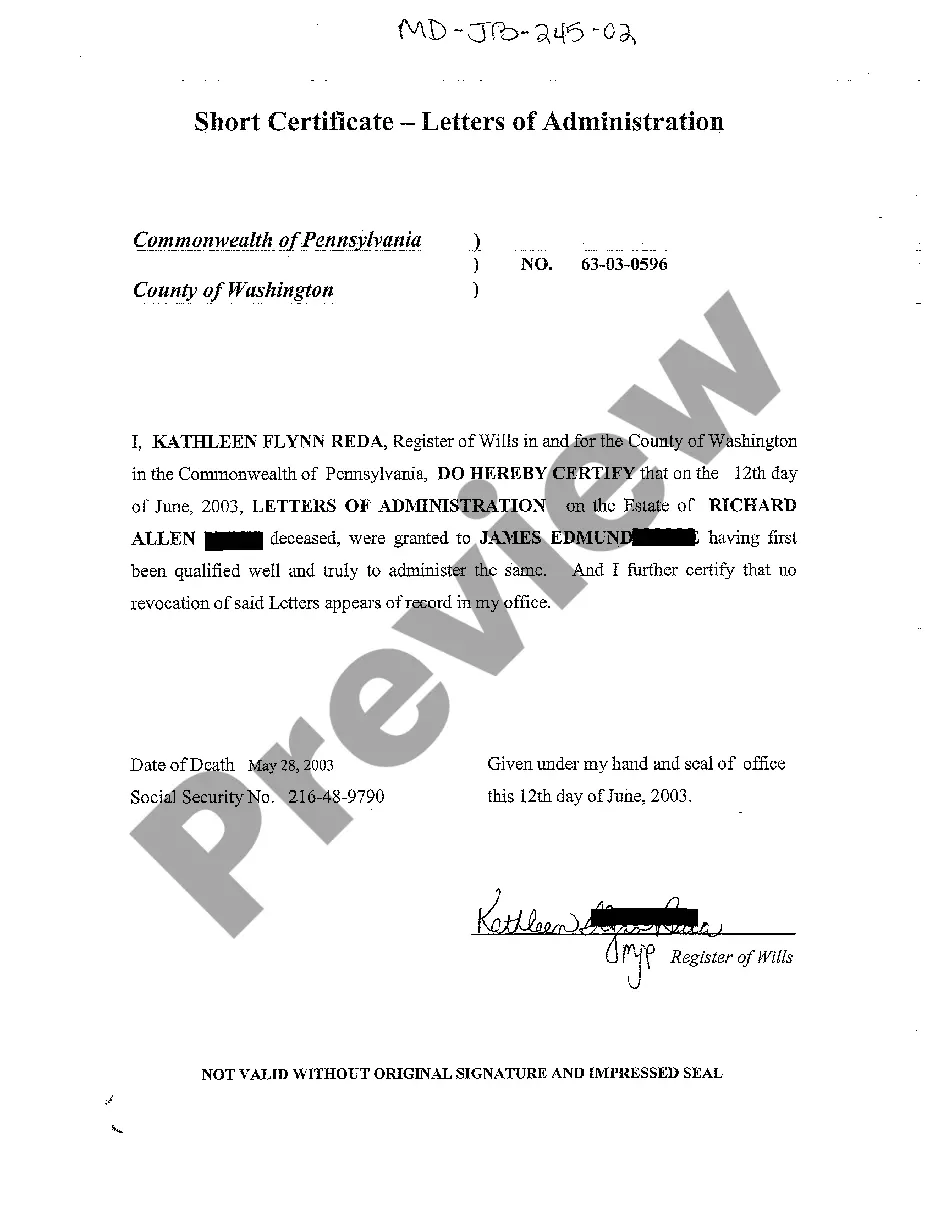

If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can complete, modify, print, or sign the South Carolina Authority to Cancel.

- Each legal document template you purchase is yours indefinitely.

- To acquire an additional copy of any purchased form, go to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, verify that you have selected the correct document template for the county/region of your choice.

- Review the form description to ensure you have chosen the right document.

Form popularity

FAQ

To close your account online go to dew.sc.gov/suits. To close your account by paper form use the Employers Report of Change (UCE-101-s)

To withdraw or cancel your foreign corporation in California, you must provide the completed Certificate of Surrender of Right to Transact Intrastate Business form to the Secretary of State by mail or in person.

Making a South Carolina Articles of Incorporation Amendment requires that you file two copies of the Articles of Amendment with the South Carolina Secretary of State, Division of Business Filings.

If a foreign corporation or LLC is no longer doing business in South Carolina, the entity should file an application to cancel its registration with the South Carolina Secretary of State, Division of Business Filings (SOS).

Is there a filing fee to dissolve or cancel a South Carolina LLC? There is a $10 filing fee to dissolve an LLC or corporation. Your South Carolina registered agent service may be able to help you terminate your LLC.

South Carolina allows domestication of corporations ONLY. Owners of LLCs looking to domesticate in South Carolina need to dissolve in home state and form a new LLC in South Carolina.

Closing a business or accountTo close SC Dept. of Revenue accounts online, go to MyDORWAY.dor.sc.gov.To close SC Dept. of Revenue accounts by paper use the form C-278 Account Closing Form.To close your Alcohol and Tobacco account use the L-1278 Form.

How do you dissolve a South Carolina Corporation? To dissolve a South Carolina corporation, file Articles of Dissolution with the South Carolina Secretary of State, Division of Business Filings (SOS). Submit the form in duplicate, with a self-addressed stamped envelope, so the SOS can return a copy to you.

South Carolina requires business owners to submit their Articles of Termination by mail. You can also have a professional service provider file your Articles of Dissolution for you. Incfile prepares the Articles of Dissolution for you, and files them to the state for $149 + State Fees.

Follow these steps to closing your business:Decide to close.File dissolution documents.Cancel registrations, permits, licenses, and business names.Comply with employment and labor laws.Resolve financial obligations.Maintain records.