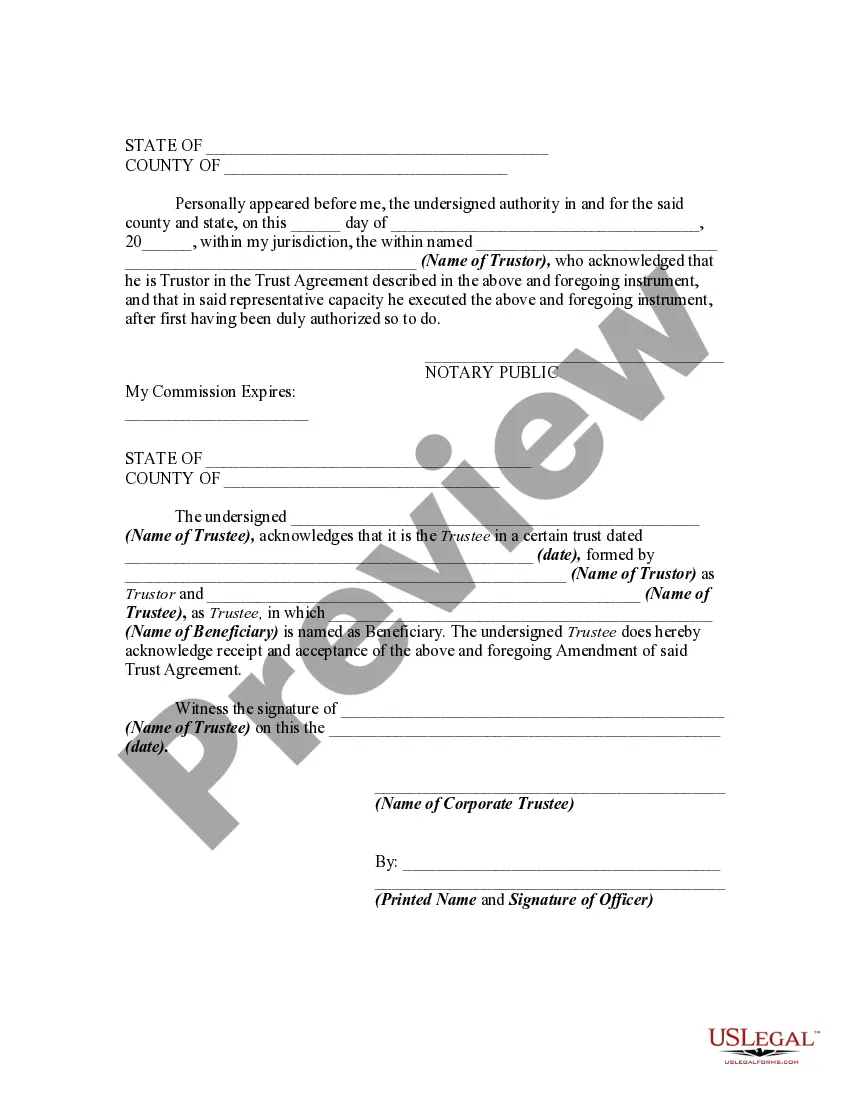

In this form, the trustor is amending the trust, pursuant to the power and authority he/she retained in the original trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nevada Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee

Description

How to fill out Amendment Of Declaration Of Trust With Cancellation And Addition Of Sections And The Consent Of Trustee?

United States Legal Documents - one of the largest collections of legal forms in the US - offers a wide selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest editions of documents like the Nevada Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee in moments.

If the form does not meet your needs, use the Search field at the top of the page to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Acquire now button. Then, select your preferred pricing plan and provide your information to register for an account.

- If you already have a membership, sign in and retrieve the Nevada Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee from your US Legal Forms repository.

- The Download button will be visible on every form you check out.

- You can access all the previously downloaded forms in the My documents section of your account.

- To utilize US Legal Forms for the first time, here are straightforward steps to assist you.

- Make sure you have chosen the correct form for your city/county.

- Click the Review button to examine the form's details.

Form popularity

FAQ

One disadvantage of a family trust is the potential for conflict among family members regarding the trust's administration and distribution of assets. Family dynamics can complicate decisions, especially when amendments, such as the Nevada Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, are needed. Moreover, ongoing maintenance and legal oversight can also be a burden.

Setting up a trust can come with several pitfalls, such as underestimating the ongoing management requirements or failing to fund the trust appropriately. Additionally, there can be tax implications that are overlooked, which could affect the trust's benefit to your beneficiaries. Utilizing reliable resources, like uslegalforms, can aid you in navigating these complexities.

In the UK, a common error parents make when setting up a trust fund is overlooking tax implications. Many do not factor in how inheritance tax can affect the trust's value. As in any jurisdiction, ensuring proper documentation, like a Nevada Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, can help prevent future complications.

Writing an amendment to a trust involves drafting a clear document that specifies the changes to be made. You should detail any cancellations or additions, ensuring the document aligns with the original trust's terms. It's advisable to sign the amendment in the presence of a witness or notary for legal validation, especially in Nevada, to maintain the integrity of the trust.

A major mistake parents make when establishing a trust fund is failing to communicate their intentions with their children. This often leads to confusion and disputes later on. Furthermore, neglecting to regularly review and update the trust can result in outdated provisions, particularly regarding the Nevada Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee.

One downside of a trust is the potential for complex administration, especially if amendments, like the Nevada Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, are necessary. Trusts can also incur ongoing legal fees, which can add up over time. Furthermore, if the trust is not properly funded, it may not serve as intended.

In Nevada, the statute of limitations for a deed of trust is typically five years. This means you have five years from the date of default to initiate legal action. Understanding this timeframe is essential when dealing with trust matters, including the Nevada Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee. Consulting with our resources can provide more clarity on how to protect your interests within this time frame.

Yes, a trust can be altered or revoked, depending on your circumstances. The Nevada Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee allows you to make necessary changes. It is crucial to follow the legal process to ensure your amendments are valid and binding. Using our platform can streamline this process and help you navigate the legal requirements effectively.

Obtaining a trust amendment form is straightforward. You can find the necessary forms on our website, which is designed to assist you in managing your legal documents. When amending a trust, specifically the Nevada Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, ensure you have the correct form tailored to your needs. Additionally, consider consulting with a legal professional to ensure your amendment is executed correctly.

A trust can be modified through an official amendment or restatement process, which typically requires the consent of the trustee and beneficiaries, depending on the type of trust. Implementing the Nevada Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee ensures all modifications are legally sound. Consider using platforms like uslegalforms to streamline this process.