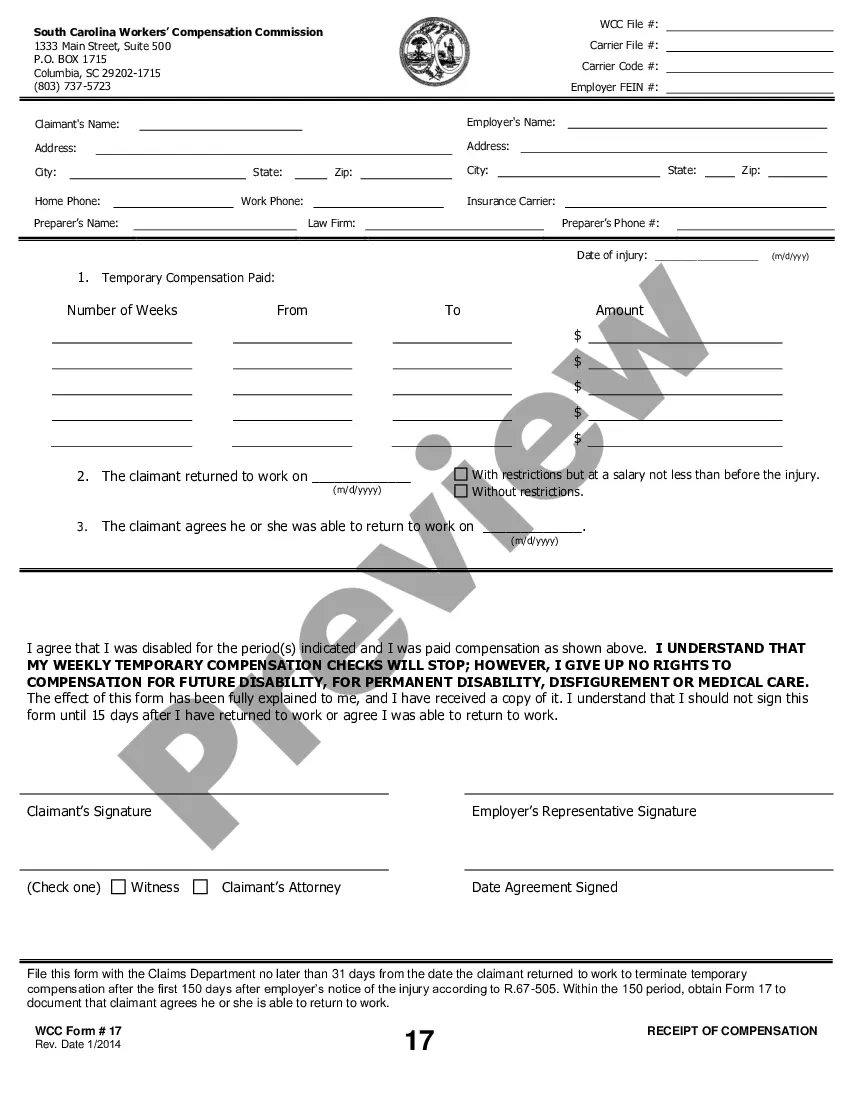

South Carolina Receipt of Compensation is a form issued by the South Carolina Department of Employment and Workforce (DEW) to document the payment of unemployment insurance benefits. This receipt is issued to individuals who are receiving unemployment benefits in the state of South Carolina. It contains information about the amount of benefits received, the date of the payment, and the name of the employer from whom the benefits are derived. There are two types of South Carolina Receipt of Compensation: the Regular Unemployment Insurance Benefits Receipt and the Extended Benefits Receipt (EBR). The Regular Unemployment Insurance Benefits Receipt is issued to individuals who have received a regular unemployment benefit claim and the Extended Benefits Receipt is issued to individuals who have received an Extended benefit claim.

South Carolina Receipt of Compensation

Description

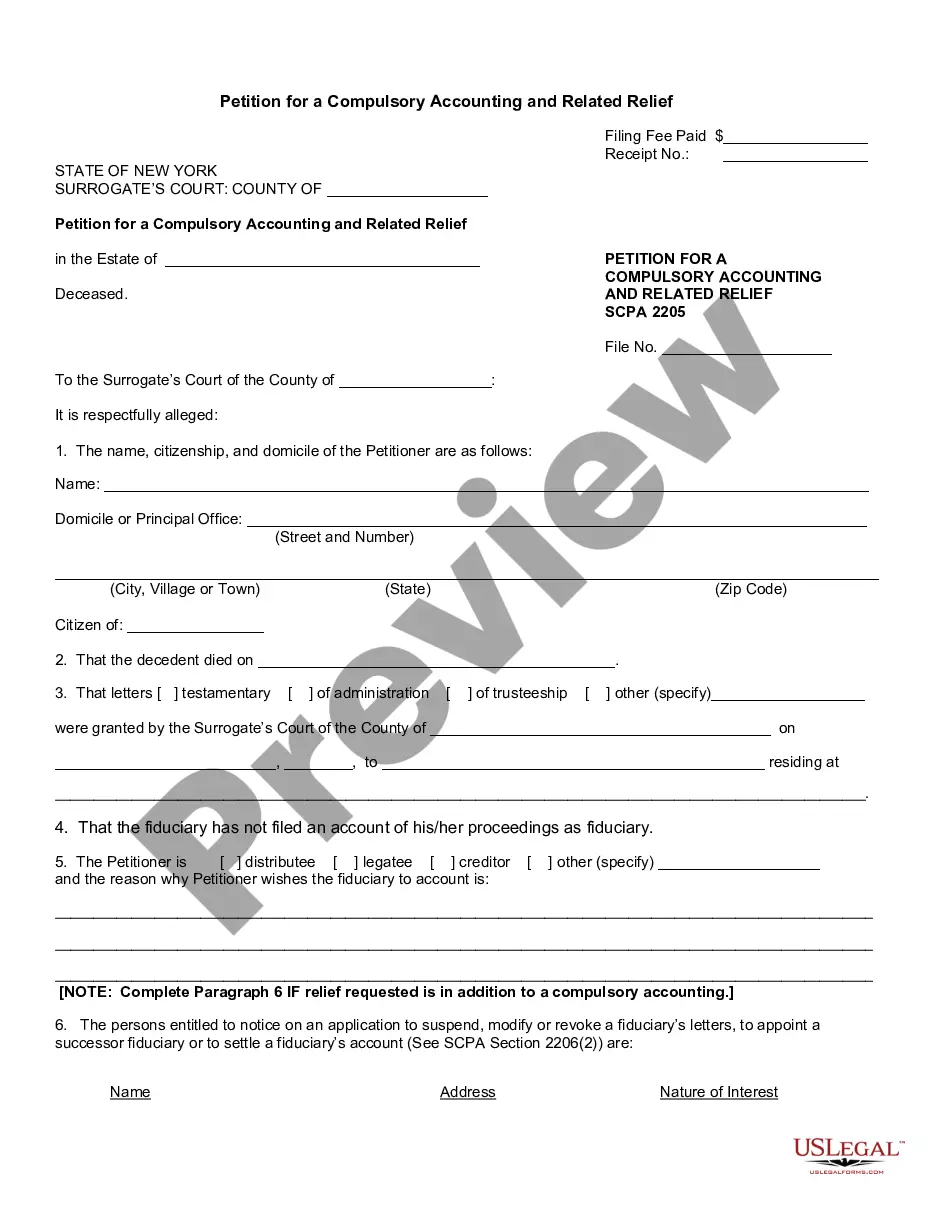

How to fill out South Carolina Receipt Of Compensation?

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state laws and are verified by our specialists. So if you need to prepare South Carolina Receipt of Compensation, our service is the perfect place to download it.

Getting your South Carolina Receipt of Compensation from our library is as simple as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they find the correct template. Later, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a brief instruction for you:

- Document compliance verification. You should attentively review the content of the form you want and make sure whether it suits your needs and complies with your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab above until you find a suitable blank, and click Buy Now when you see the one you want.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your South Carolina Receipt of Compensation and click Download to save it on your device. Print it to fill out your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any formal document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

How Much Does Workers' Comp Pay? If you are hurt on the job in South Carolina, your employer's insurance company will likely have to pay you for the time you miss from work. The amount of compensation you receive is based on two-thirds (2/3) of your pre-tax, weekly earnings.

South Carolina requires employers with at least four employees to have workers' compensation insurance. However, there are few exceptions, including: Casual employees, who don't work regular hours and only when it's needed. Employers with less than $3,000 in annual payroll in the previous year.

2023 Maximum Weekly Compensation Rate The South Carolina Department of Employment and Workforce has certified the average weekly wage in South Carolina for the period July 1, 2021 through June 30, 2022. For accidents occurring on or after January 1, 2023 the maximum weekly compensation rate shall be $1,035.78.

If you are entitled to temporary total compensation you will receive 66 2/3% of your average weekly wages based on the four quarters prior to your injury but no more than the maximum average weekly wage determined yearly by the South Carolina Department of Employment and Workforce.

Do I need a Workers' Compensation Insurance? As a general rule, businesses that regularly employ four or more employees within South Carolina are required to maintain workers' compensation coverage. Part-time workers and family members are counted as employees.

Once you have the average weekly rate, you need to multiply it by 66 ? percent to get the compensation rate. So in our example, Worker x makes $500 as his average weekly rate, so we need to multiply that by 66 ? percent. So: $500 x 66 ? percent = $333, rounded to the nearest dollar.

Estimated employer rates for workers' compensation in South Carolina are $1.60 per $100 in covered payroll. Your cost is based on a number of factors, including: Payroll. Location.

In general, the overarching rule is that you have two years from the date of your injury to bring a claim before the South Carolina Workers' Compensation Commission. If you do not file a claim within that two-year period, you will invariably lose out on your rights.