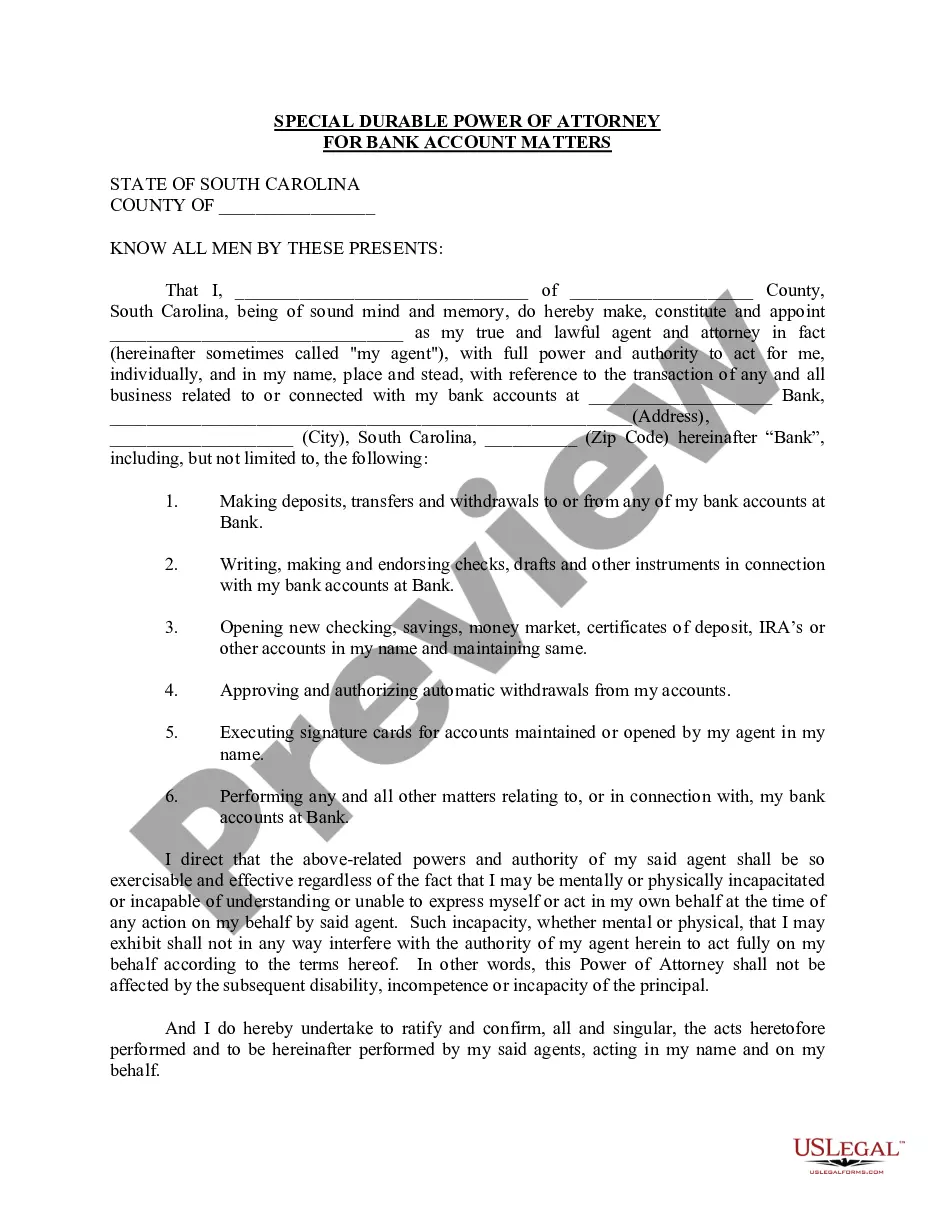

South Carolina Special Durable Power of Attorney for Bank Account Matters

About this form

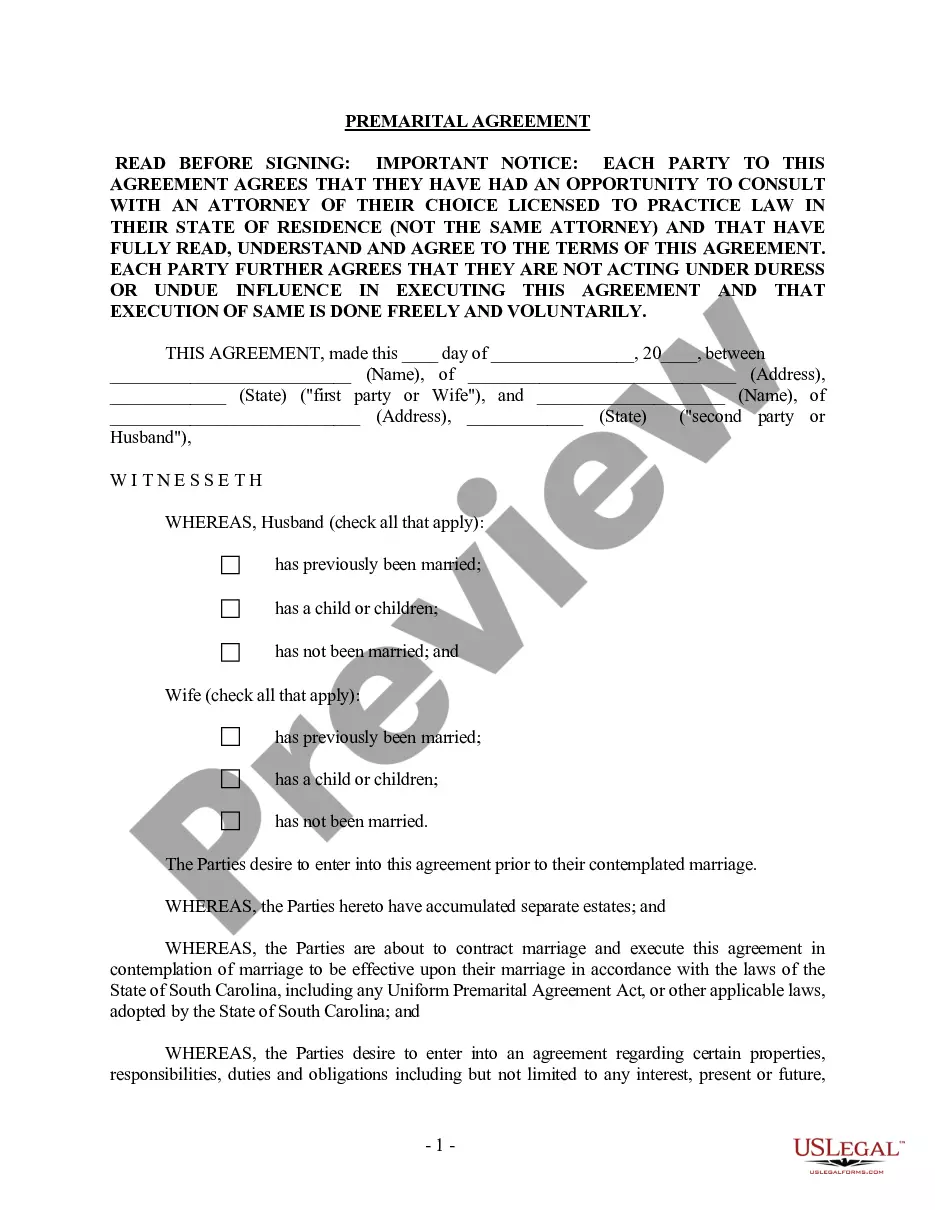

The Special Durable Power of Attorney for Bank Account Matters is a legal document that allows you to appoint an agent to manage your bank accounts on your behalf. This form is a limited power of attorney, meaning that it grants your agent specific authority to handle tasks related to your bank accounts, such as making deposits, writing checks, and opening new accounts. It remains valid even if you become mentally or physically incapacitated, making it distinct from a general power of attorney.

What’s included in this form

- Principal details: Information about the person granting authority.

- Agent details: Information about the appointed agent who will act on behalf of the principal.

- Bank information: Specific bank name and address where the power of attorney applies.

- Authority granted: A detailed list of powers the agent can perform regarding bank accounts.

- Indemnification clause: Protects the bank and the agent from liability for actions taken under this authority.

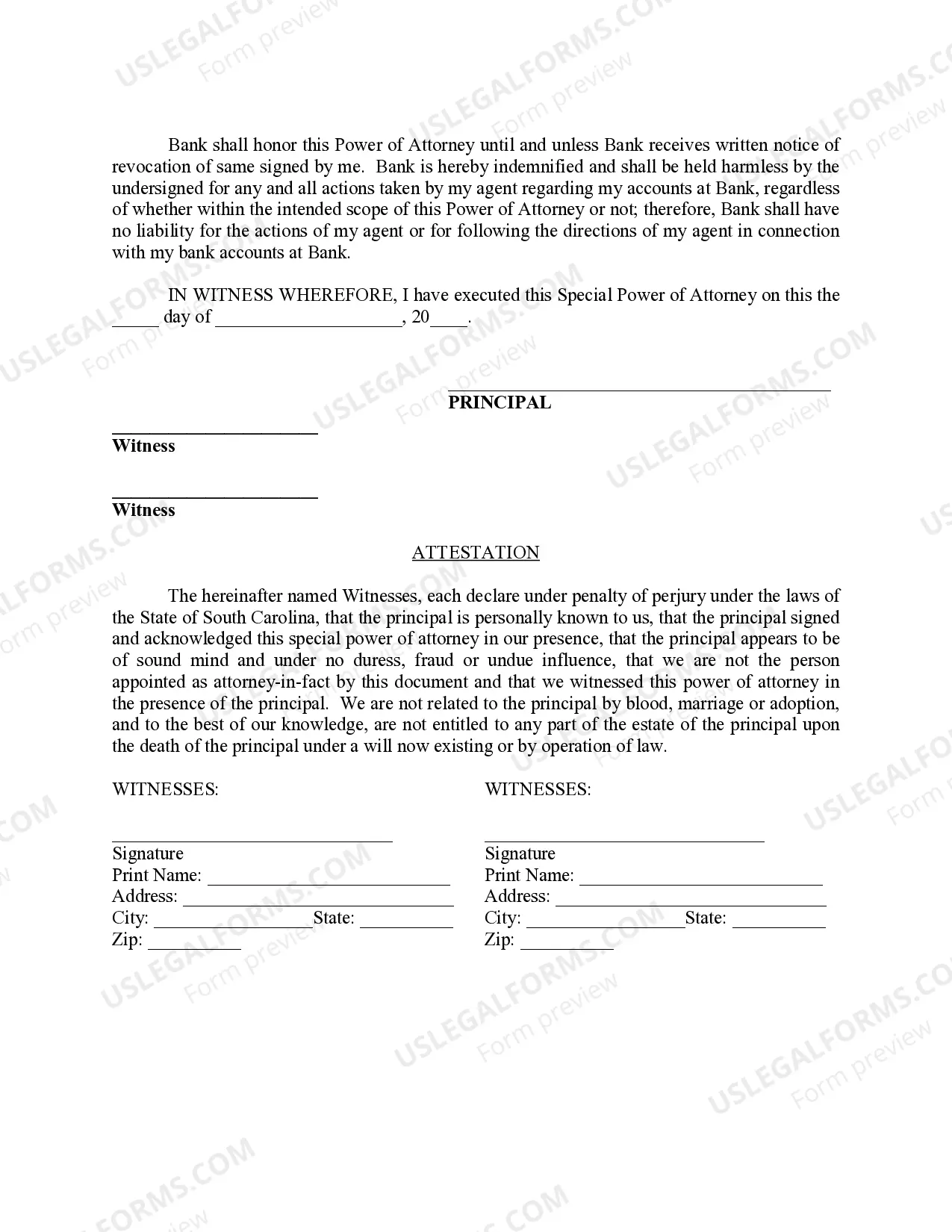

- Witness and notarization requirements: Sections for witnesses and notary public signatures.

When to use this form

This form is useful in various situations where you may need someone to handle your bank account matters, particularly if you are unavailable or incapacitated. For example, you may need this document if you're traveling abroad, undergoing medical treatment, or managing multiple responsibilities that could prevent you from attending to your finances.

Who should use this form

Individuals who may benefit from this form include:

- Individuals traveling for extended periods who require someone to manage their finances.

- People experiencing health issues that affect their ability to handle financial matters.

- Anyone who wants to ensure that their bank transactions are handled smoothly by a trusted person.

Steps to complete this form

- Identify the principal and agent: Fill in the names and addresses of both parties.

- Enter bank details: Specify the name and address of the bank where the authority is applicable.

- Define the powers: Clearly outline the specific banking tasks the agent is authorized to perform.

- Sign and date the form: The principal must sign in the presence of witnesses and a notary public, if required.

- Complete witness sections: Have witnesses sign and provide their information as required by state law.

Notarization guidance

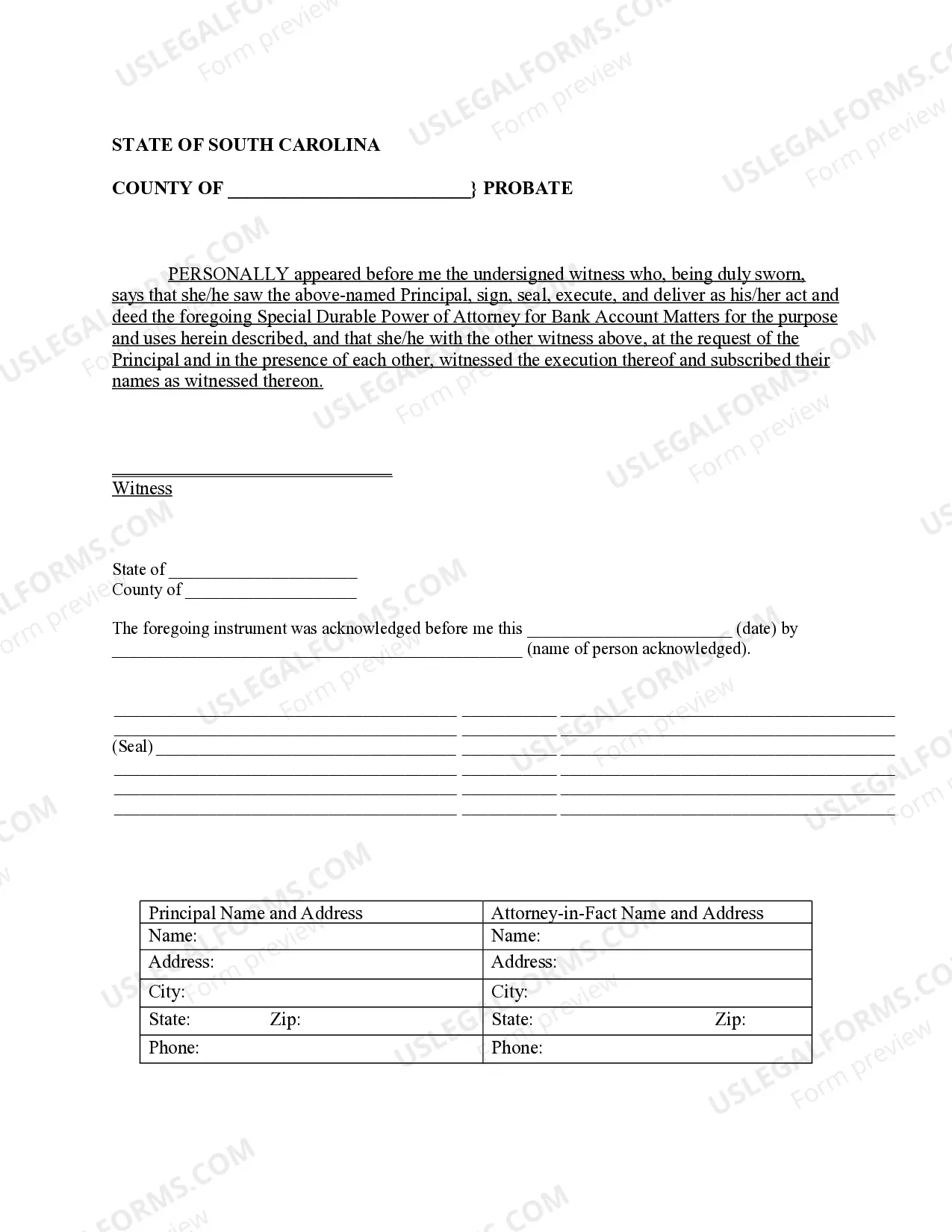

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Avoid these common issues

- Failing to specify the exact powers granted to the agent.

- Not having the document properly witnessed or notarized, if required.

- Using outdated or incorrect bank information.

- Overlooking the need to notify the bank of the power of attorney's activation.

Why complete this form online

- Convenient access to the form anytime, anywhere.

- Ability to customize the document to fit your specific needs.

- Reliable templates drafted by licensed attorneys, ensuring compliance with legal standards.

Legal use & context

- This form empowers an agent to act in financial matters; therefore, it is important to choose a trustworthy individual.

- The authority granted can cover several banking transactions but must be limited to those specified in the document.

Summary of main points

- The Special Durable Power of Attorney for Bank Account Matters is essential for delegating financial authority, especially during incapacity.

- Clear instructions must be followed for completion, including the need for notarization.

- This form safeguards your financial transactions and ensures that someone can manage your banking needs when you cannot.

Form popularity

FAQ

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

Although third parties do sometimes refuse to honor an Agent's authority under a POA agreement, in most cases that refusal is not legal.In that case, the law allows you to collect attorney's fees if the third party unreasonably refused to accept the POA.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power.If you grant a power of attorney, check with your bank to find out whether the document you intend to use is sufficient. You may want to change the document or even change your bank.

But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.The agent fought back in court and won a $64,000 judgment against the bank.

Through the use of a valid Power of Attorney, an Agent can sign checks for the Principal, withdraw and deposit funds from the Principal's financial accounts, change or create beneficiary designations for financial assets, and perform many other financial transactions.

South Carolina state law does not require a Power of Attorney to be recorded, but it does specify that it needs to be notarized. A Power of Attorney may need to be officially recorded, however, if it is intended to be used for a specific special purpose, such as a real estate transaction.