South Carolina FILING FALSE TAX RETURN

Description

How to fill out South Carolina FILING FALSE TAX RETURN?

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state regulations and are examined by our specialists. So if you need to prepare South Carolina FILING FALSE TAX RETURN, our service is the perfect place to download it.

Getting your South Carolina FILING FALSE TAX RETURN from our library is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they find the correct template. Later, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a brief guide for you:

- Document compliance check. You should attentively review the content of the form you want and ensure whether it satisfies your needs and meets your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate template, and click Buy Now once you see the one you want.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your South Carolina FILING FALSE TAX RETURN and click Download to save it on your device. Print it to complete your papers manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service today to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

The penalty for filing a false tax return is less severe than outright evasion but it's still enough to make it sting. Individuals may be fined up to $100,000 for filing a false return in addition to being sentenced to prison for up to three years. This is a felony and a form of fraud.

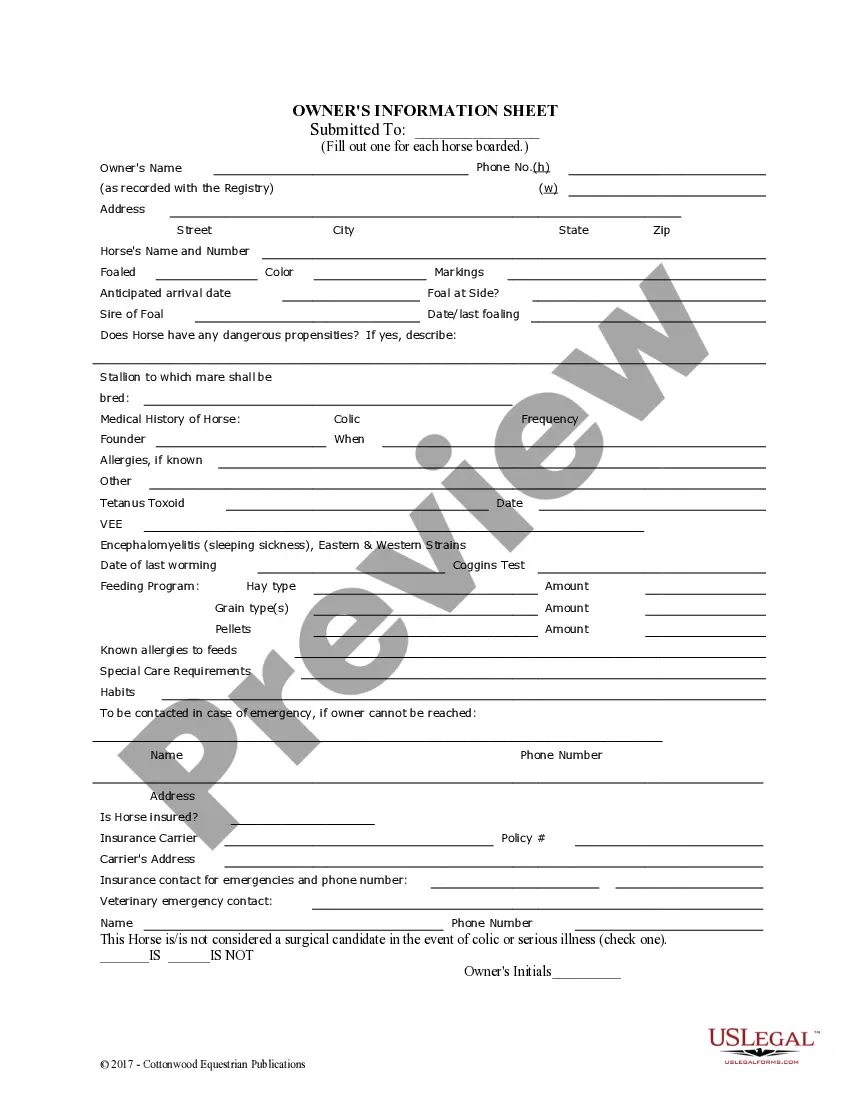

10 Estimated Tax paid and tax withheld (see instructions on page 4 under How to Calculate Your Underpayment). For column A only, enter the amount from line 10 on line 14. If line 10 is equal to or greater than line 9 for all payment periods, stop here; you do not owe a penalty.

Frivolous return penalty The purported return does not contain sufficient information to judge the substantial correctness of the self-assessment or contains information that, on its face, indicates that the self-assessment is substantially incorrect.

The making and signing of a false IRS document which states that the document is being signed under the ?penalties of perjury?; The document was false as to a material matter; The taxpayer making the false IRS document did not believe it was true and correct as to every material matter; and. Willfulness.

Will I get caught if I lie on my taxes? The IRS gets all of the W-2s and 1099s that you receive, so it knows if you don't report all of your income. Even if the income you're trying to hide came in the form of cash payments, your financial activity can send up a red flag with the IRS that might trigger an audit.

Filing a false tax return or other document is treated seriously by the Internal Revenue Service. If its investigation turns up substantive information, civil cases can be referred for criminal tax investigation. Arrests and tax-related criminal charges could follow.

SCAM PREVENTION DURING TAX SEASON Scammers use stolen names and Social Security numbers to file phony electronic tax returns and receive fraudulent refunds in the mail.