South Carolina INTERFERING WITH ADMINISTRATION OF TAX LAWS

Description

How to fill out South Carolina INTERFERING WITH ADMINISTRATION OF TAX LAWS?

Coping with official paperwork requires attention, accuracy, and using properly-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your South Carolina INTERFERING WITH ADMINISTRATION OF TAX LAWS template from our service, you can be certain it meets federal and state laws.

Dealing with our service is simple and quick. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to find your South Carolina INTERFERING WITH ADMINISTRATION OF TAX LAWS within minutes:

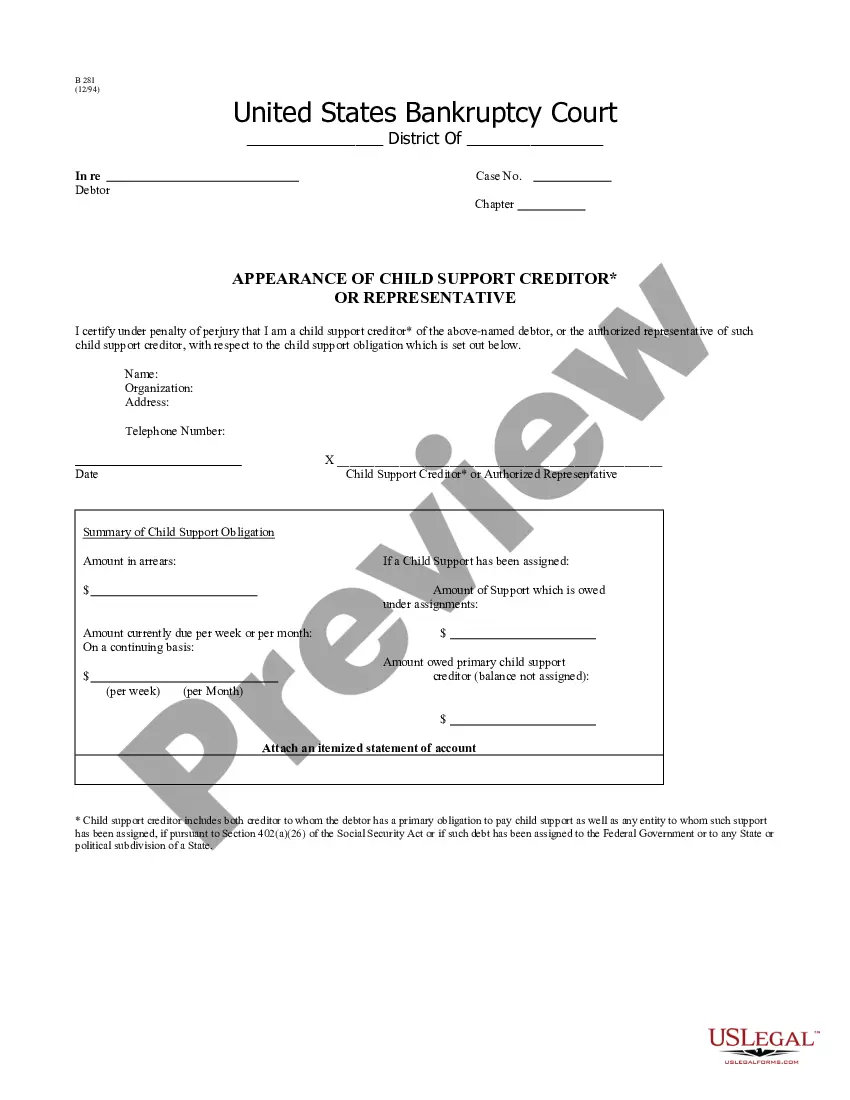

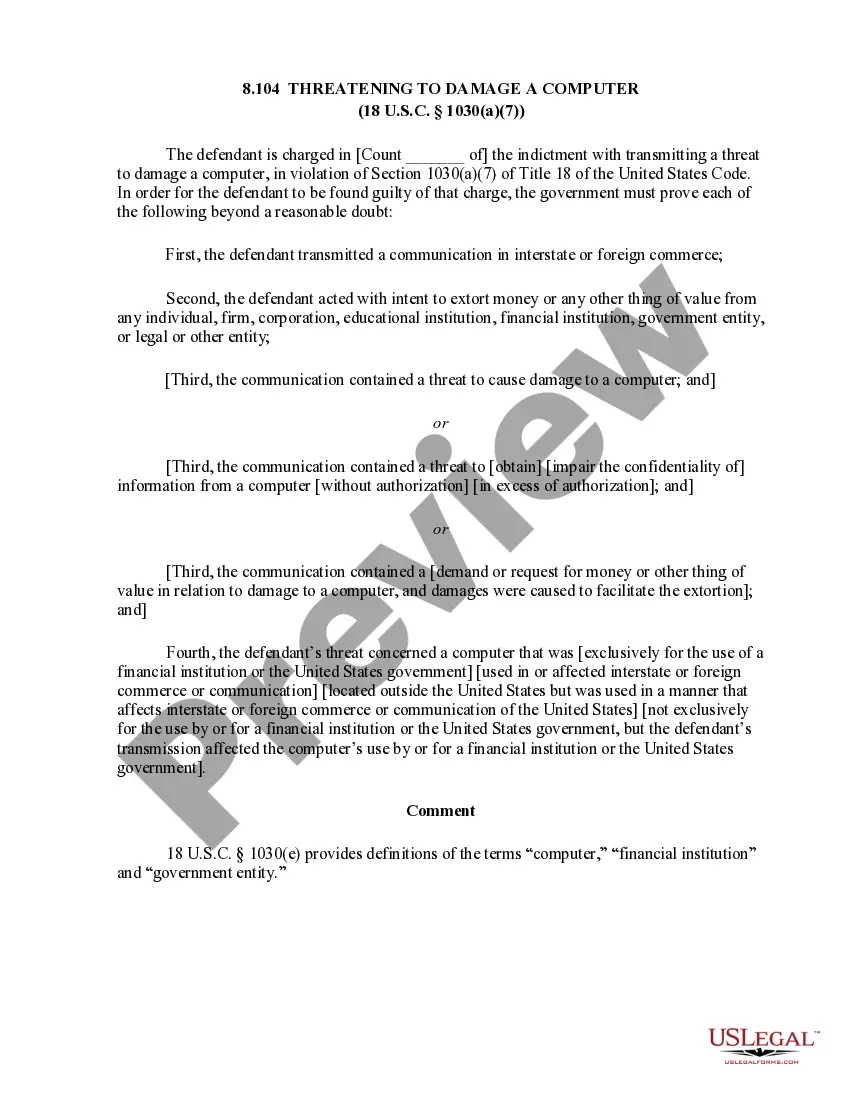

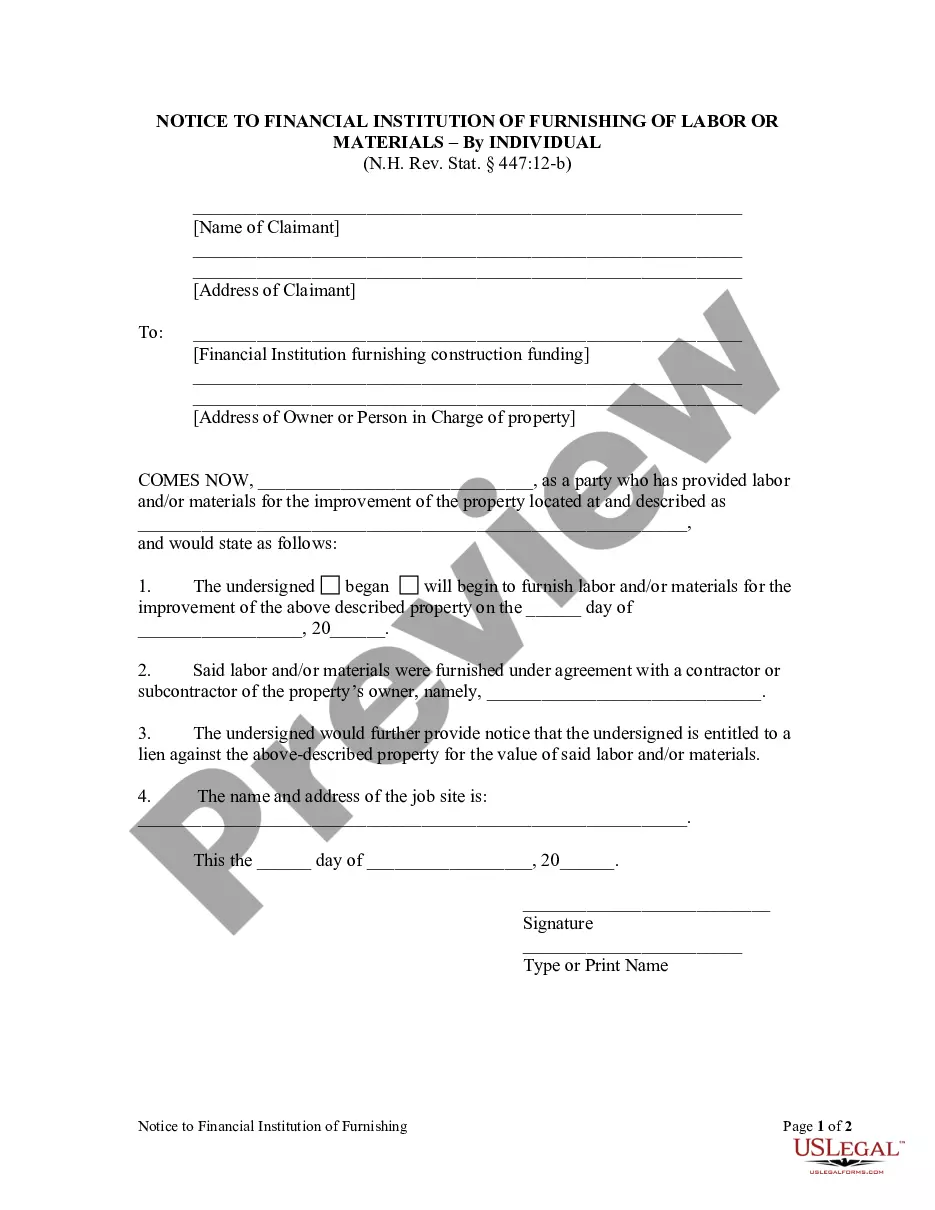

- Make sure to carefully examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative formal template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the South Carolina INTERFERING WITH ADMINISTRATION OF TAX LAWS in the format you prefer. If it’s your first experience with our service, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are created for multi-usage, like the South Carolina INTERFERING WITH ADMINISTRATION OF TAX LAWS you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

All taxes shall be levied on uniform assessment. Taxes for township, school, municipal and all other purposes provided for or allowed by law shall be levied on the same assessment, which shall be that made for county taxes.

Most property tax exemptions are found in South Carolina Code Section 12-37-220. For any real property exemptions taxation is a year in arrears, meaning to be exempt for the current year, you must be the owner of record and your effective date of disability must be on or before December 31 of the previous year.

SECTION 12-43-217. Quadrennial reassessment; postponement ordinance. (A) Notwithstanding any other provision of law, once every fifth year each county or the State shall appraise and equalize those properties under its jurisdiction.

SECTION 12-54-55. Interest on underpayment of declaration of estimated tax.

SECTION 12-8-580. Withholding by buyer of real property or associated tangible personal property from nonresident seller. (c) the entire net proceeds payable to the nonresident seller, if the amount required to be withheld in subitem (1) or (2) exceeds the net proceeds payable to the seller.

(A) The defaulting taxpayer, any grantee from the owner, or any mortgage or judgment creditor may within twelve months from the date of the delinquent tax sale redeem each item of real estate by paying to the person officially charged with the collection of delinquent taxes, assessments, penalties, and costs, together

CHAPTER 51 - ALTERNATE PROCEDURE FOR COLLECTION OF PROPERTY TAXES. SECTION 12-51-40. Default on payment of taxes; levy of execution by distress and sale; notice of delinquent taxes; seizure of property; advertisement of sale.