South Carolina Summary Administration Package for Estates not More than $25,000 - Small Estates

Overview of this form

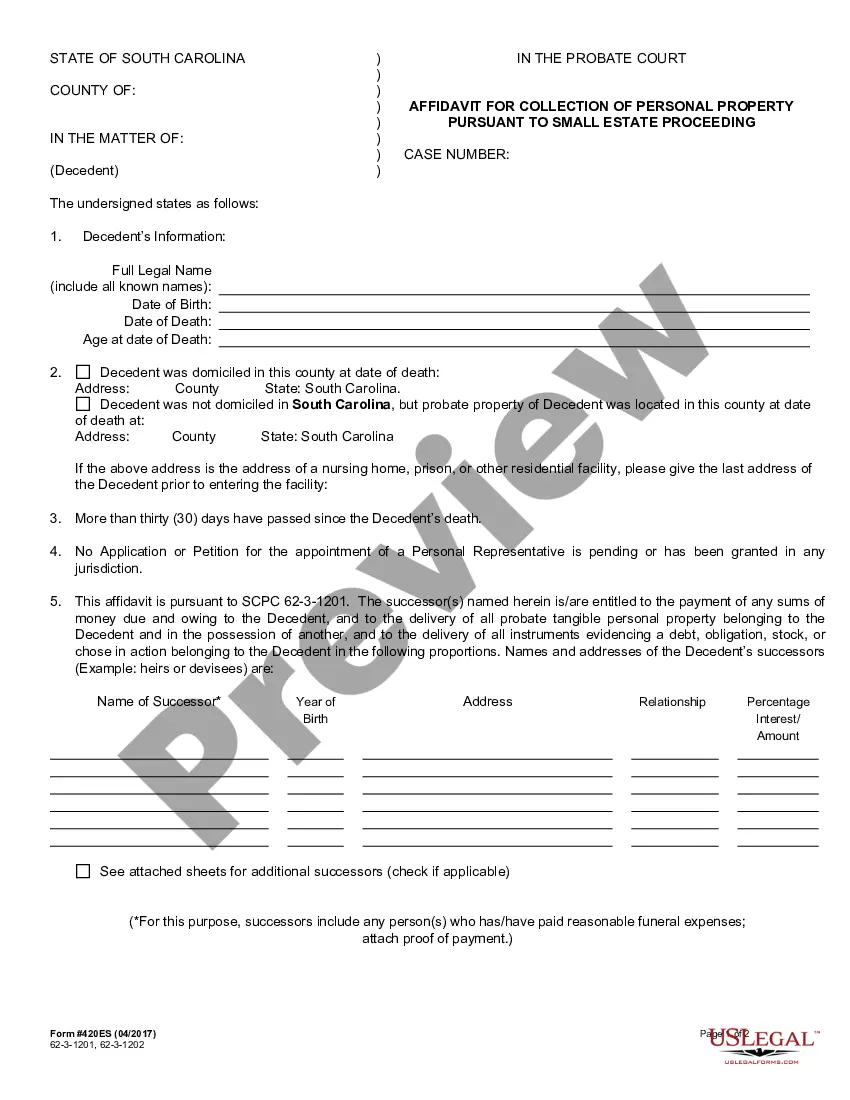

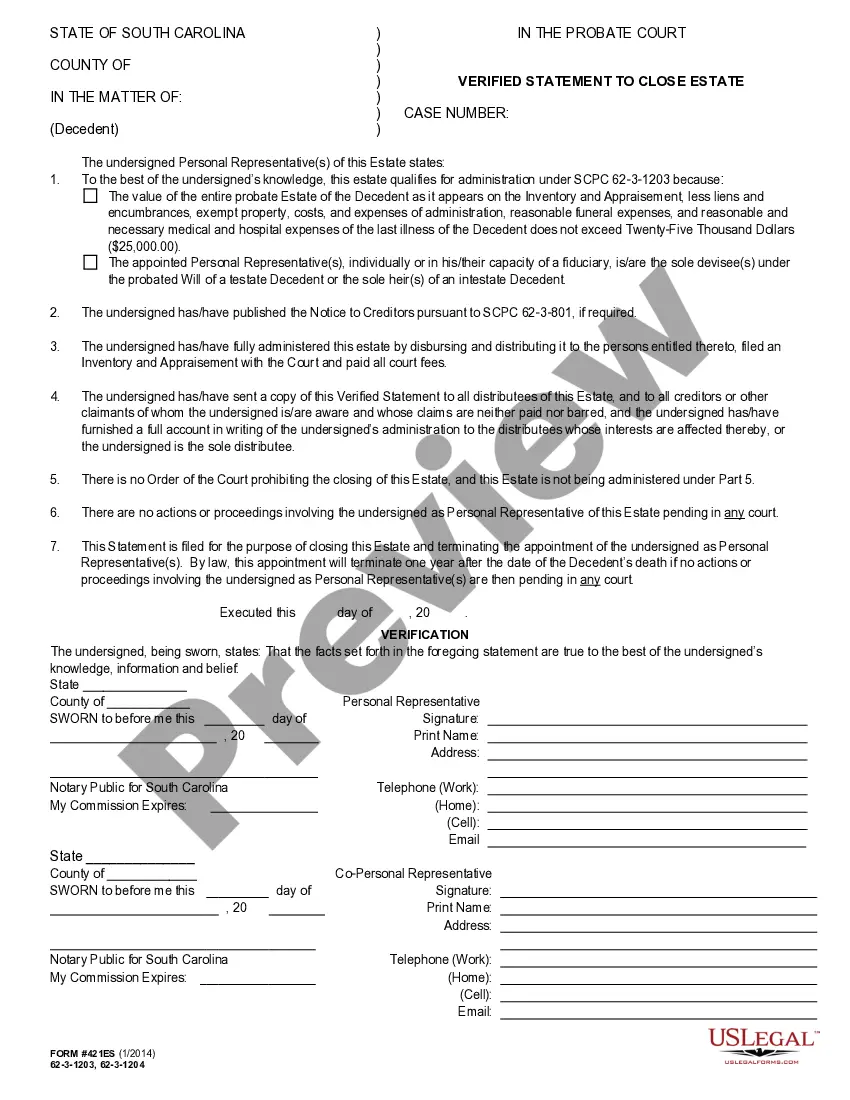

The Summary Administration Package for Estates not More than $25,000 is a legal form designed for the expedited distribution of small estates in South Carolina. This form allows the personal representative of a decedent to manage and distribute estate assets without the need for formal court proceedings, as long as the estate's total value does not exceed $25,000. This streamlined process differentiates it from traditional probate proceedings, providing a simpler and quicker option for settling smaller estates.

Form components explained

- Eligibility confirmation based on estate value not exceeding $25,000.

- Notice published to creditors, if required by law.

- Verification of asset distribution among rightful heirs or devisees.

- Full accounting of the estate administration must be provided to all interested parties.

- Confirmation of no pending legal actions affecting the estate.

When this form is needed

This form is used when you are dealing with an estate that is valued at $25,000 or less and you are the personal representative or heir of the decedent. It is particularly beneficial in situations where a decedent's estate includes few assets, requiring quick resolution without extensive legal processes. Common scenarios include estates with limited bank accounts, personal property, or minimal investment holdings.

Who needs this form

- Personal representatives who have been designated to handle the estate of a decedent.

- Heirs or heirs who may need to administer the estate without extensive court involvement.

- Individuals managing small estates not exceeding $25,000 in total value.

How to prepare this document

- Identify the total value of the decedent's estate, ensuring it is under $25,000.

- Publish a Notice to Creditors, as required by South Carolina law.

- Disburse the assets to the entitled heirs or devisees in accordance with the will or intestate succession laws.

- File an Inventory and Appraisement of the estate's assets with the appropriate court.

- Provide a full accounting of the estate distribution to all heirs and creditors.

- Confirm there are no legal impediments to closing the estate.

Does this form need to be notarized?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Typical mistakes to avoid

- Failing to verify that the total estate value is below $25,000.

- Not publishing the required Notice to Creditors.

- Omitting to provide a full accounting to heirs and creditors.

- Distributing assets without ensuring all claims against the estate are addressed.

- Ignoring local court requirements for closing the estate.

Advantages of online completion

- Convenient access to legal forms without the need for a physical visit to an attorney.

- Editable templates allow users to tailor the form to their specific estate circumstances.

- Reliable resources crafted by licensed attorneys ensure compliance with South Carolina law.

- Instant download options facilitate immediate use and processing.

Summary of main points

- The Summary Administration Package is ideal for small estates in South Carolina valued under $25,000.

- It allows for quicker estate resolution without extensive court involvement.

- Personal representatives must ensure compliance with local laws regarding notifications and asset distribution.

Form popularity

FAQ

If the total value of all the assets you leave behind is less than a certain amount, the people who inherit your personal property -- that's anything except real estate -- may be able to skip probate entirely. The exact amount depends on state law, and varies hugely.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

In South Carolina, it will take a minimum of eight months to probate because the law requires it to remain open to allow creditors to file claims. Beyond the minimum eight months, several factors determine how long probate takes to conclude. Factors that may delay probate in South Carolina include: Intestate estate.

Typical Time Requirements Many states impose a limit on the executor to begin the probate process, typically one to three years. Other states do not have a time limit, but executors are encouraged to open the estate within a reasonable time so as to avoid late payments of estate debts.

Probate is the process by which assets are transferred from the decedent to his or her heirs or devisees. If I have someone's original will, what do I do with it? South Carolina law requires that you deliver the will to the Probate Court within thirty (30) days after the person's death.

In South Carolina, probate for small estates is required. A small estate is considered to be an estate that is valued at $25,000 or less in assets and no real property. If those two conditions are met for a small estate, a case will have to be filed with the probate court.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

But the law does allow up to 5% in total. Regardless of all of the above, the minimum executor fee is $50 (unless waived). See South Carolina Code of Laws § 62-3-719.