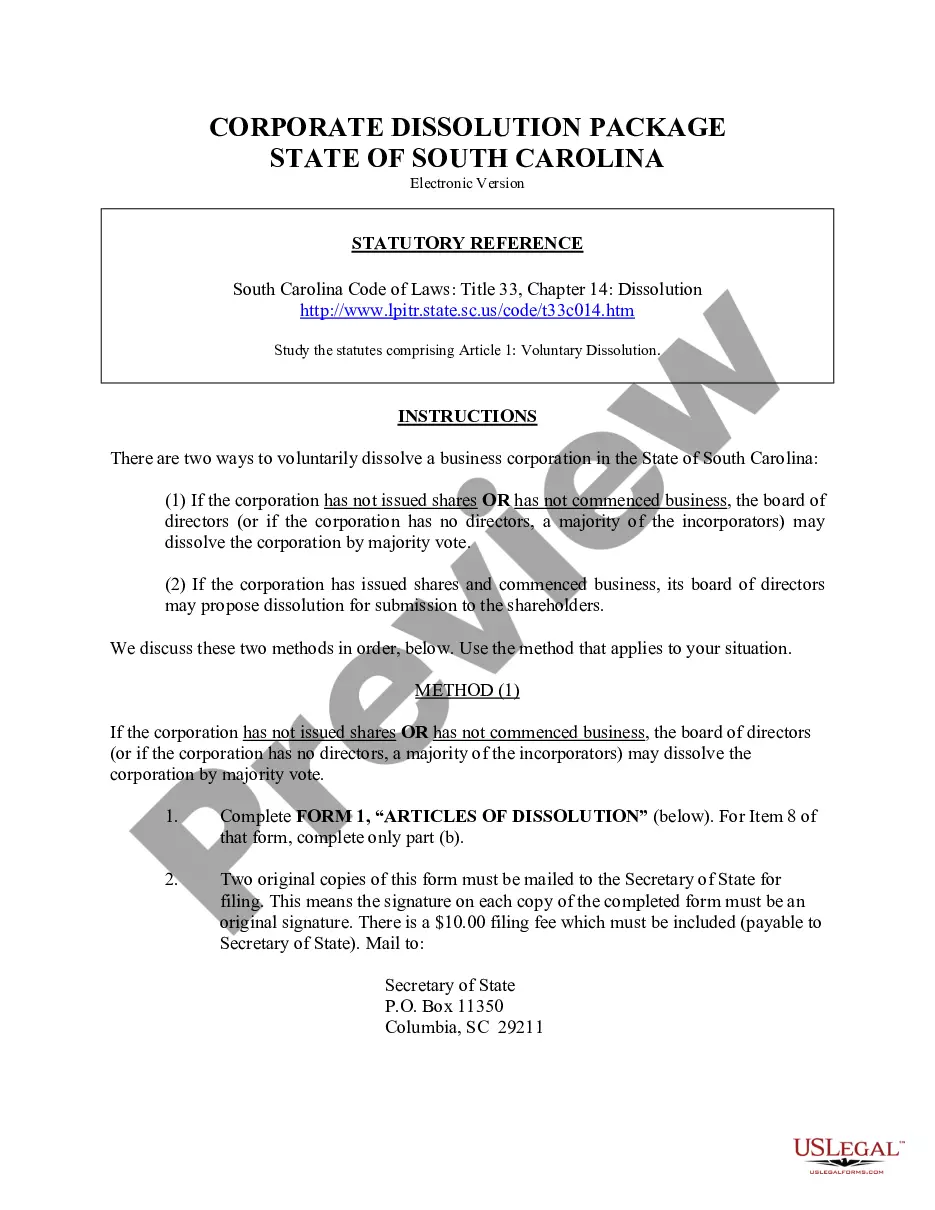

South Carolina Dissolution Package to Dissolve Corporation

Description

How to fill out South Carolina Dissolution Package To Dissolve Corporation?

Creating documents isn't the most straightforward task, especially for people who rarely work with legal papers. That's why we advise using accurate South Carolina Dissolution Package to Dissolve Corporation samples created by professional attorneys. It gives you the ability to prevent difficulties when in court or dealing with official organizations. Find the files you require on our website for top-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you are in, the Download button will immediately appear on the template web page. Soon after accessing the sample, it will be stored in the My Forms menu.

Customers without a subscription can quickly create an account. Look at this simple step-by-step guide to get your South Carolina Dissolution Package to Dissolve Corporation:

- Make sure that the document you found is eligible for use in the state it’s necessary in.

- Confirm the document. Make use of the Preview feature or read its description (if available).

- Click Buy Now if this sample is what you need or return to the Search field to get a different one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After finishing these simple steps, you can fill out the sample in a preferred editor. Check the filled in data and consider asking an attorney to examine your South Carolina Dissolution Package to Dissolve Corporation for correctness. With US Legal Forms, everything gets much simpler. Try it now!

Form popularity

FAQ

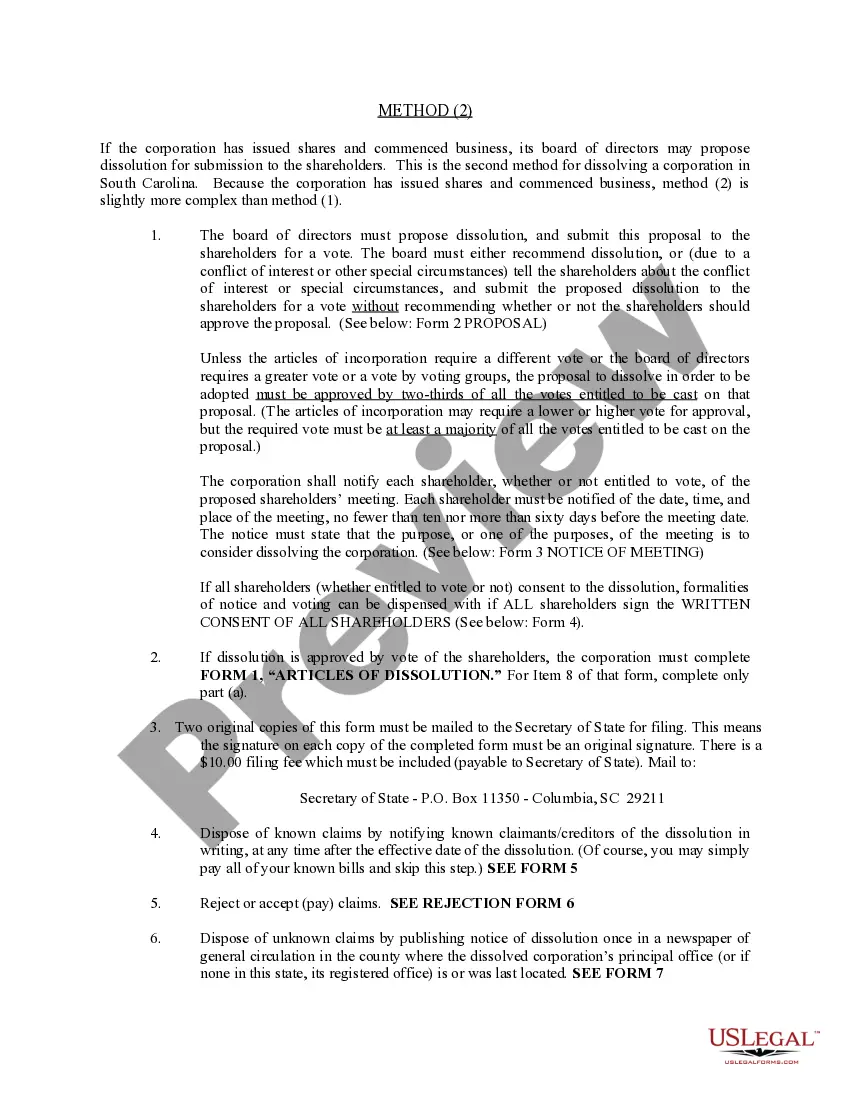

South Carolina requires business owners to submit their Articles of Termination by mail. You can also have a professional service provider file your Articles of Dissolution for you. Incfile prepares the Articles of Dissolution for you, and files them to the state for $149 + State Fees.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.

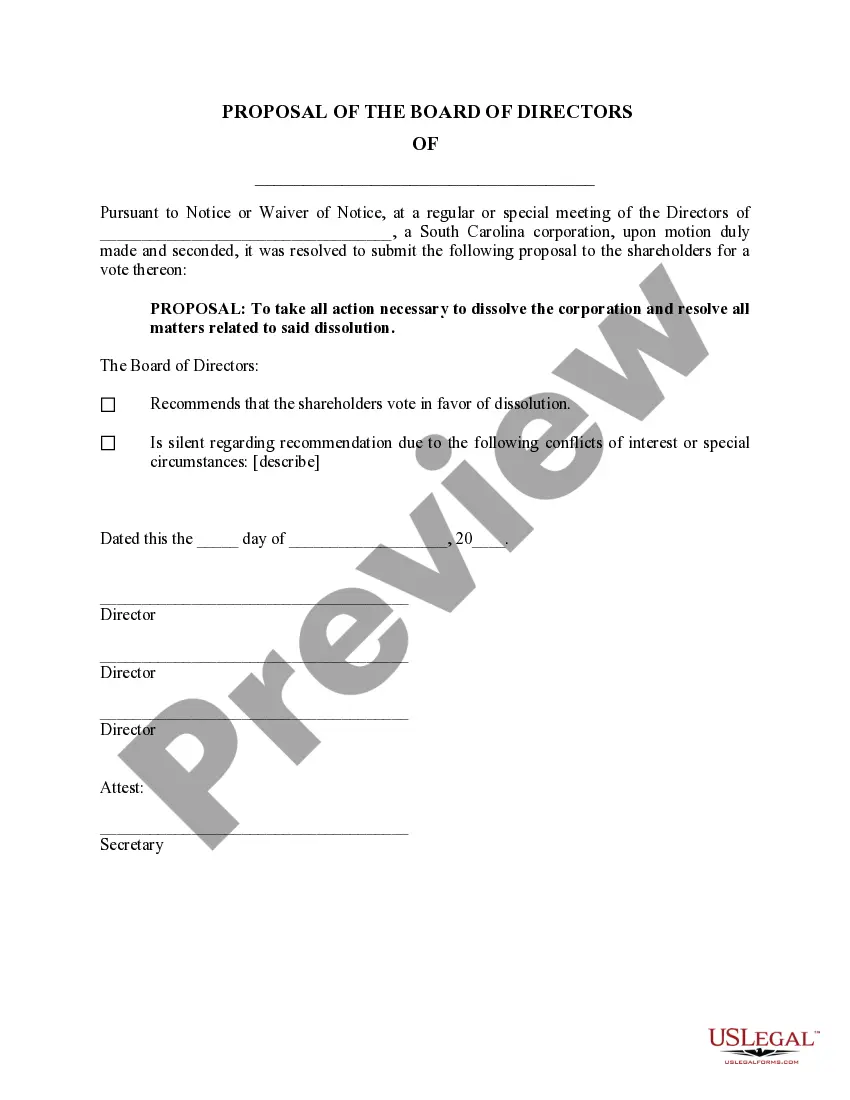

Definition. The ending of a corporation, either voluntarily by filing a notice of dissolution with the Secretary of State or as ordered by a court after a vote of the shareholders, or involuntarily through government action as a result of failure to pay taxes.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.