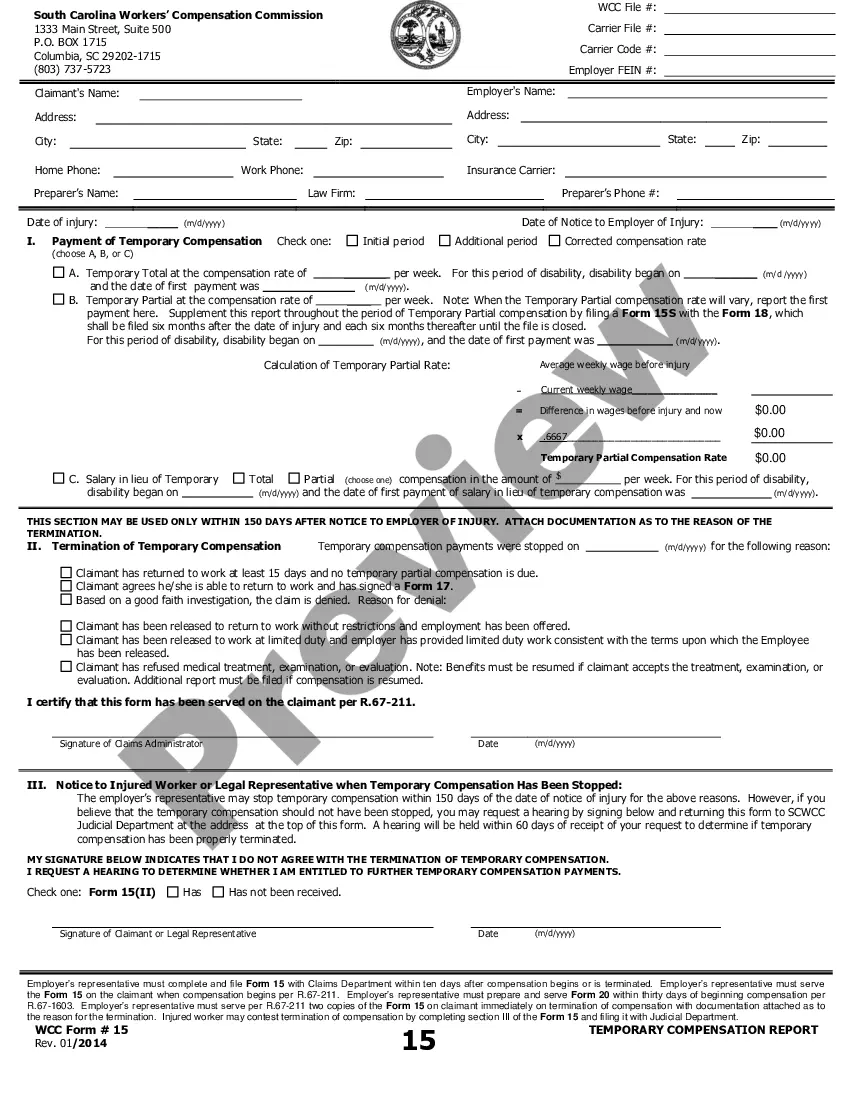

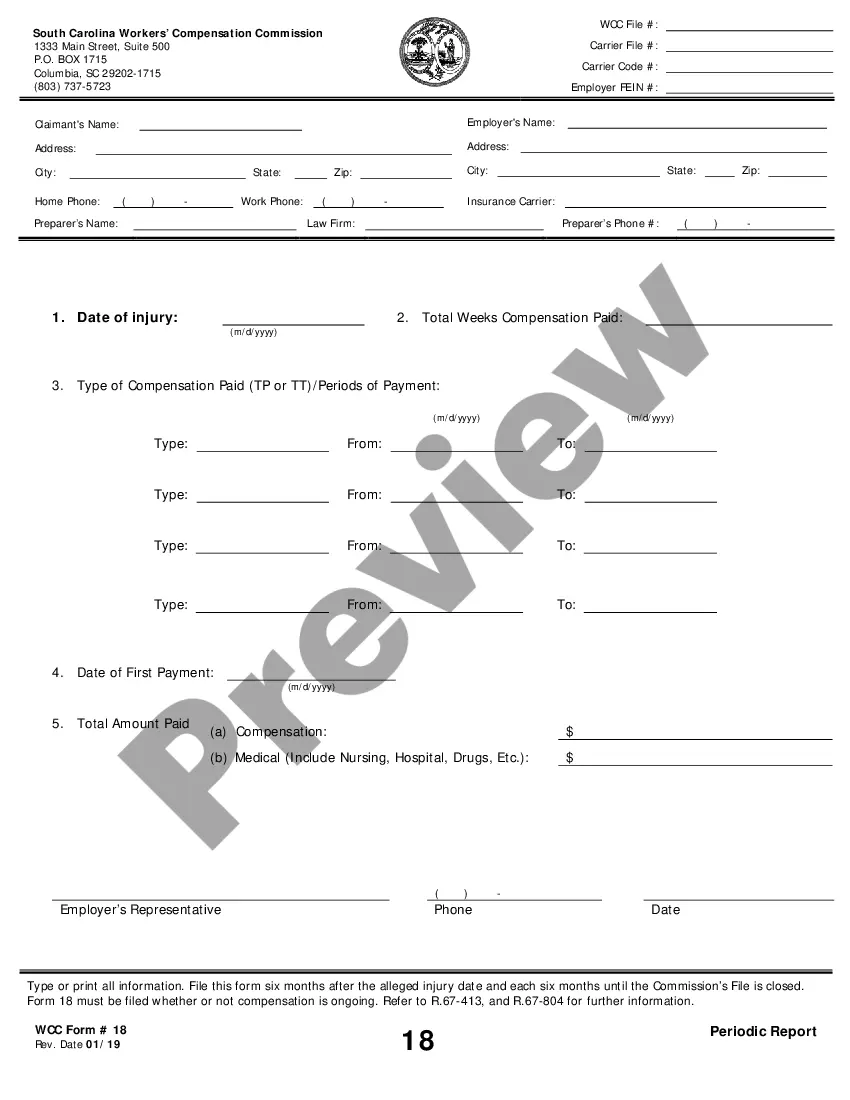

South Carolina Supplemental Report of Varying Temporary Partial Payments for Workers' Compensation

Description

How to fill out South Carolina Supplemental Report Of Varying Temporary Partial Payments For Workers' Compensation?

The work with documents isn't the most easy job, especially for people who almost never work with legal papers. That's why we advise making use of accurate South Carolina Supplemental Report of Varying Temporary Partial Payments for Workers' Compensation samples made by skilled lawyers. It allows you to eliminate problems when in court or working with official organizations. Find the documents you require on our site for high-quality forms and correct information.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the template page. Right after downloading the sample, it’ll be stored in the My Forms menu.

Customers with no a subscription can quickly get an account. Follow this short step-by-step help guide to get your South Carolina Supplemental Report of Varying Temporary Partial Payments for Workers' Compensation:

- Ensure that file you found is eligible for use in the state it’s needed in.

- Verify the file. Make use of the Preview feature or read its description (if offered).

- Click Buy Now if this form is what you need or use the Search field to find another one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a required format.

After doing these easy steps, it is possible to fill out the sample in your favorite editor. Double-check completed data and consider requesting a legal professional to examine your South Carolina Supplemental Report of Varying Temporary Partial Payments for Workers' Compensation for correctness. With US Legal Forms, everything becomes much simpler. Give it a try now!

Form popularity

FAQ

An individual who is under age 65 may claim a retirement deduction up to $3,000 on qualified retirement income from their own plan. An individual who is age 65 or older during the tax year may claim a retirement deduction up to $10,000 on qualified retirement income from their own plan.

South Carolina is tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are partially taxed.Public and private pension income are partially taxed.

To calculate your partial unemployment payments, the DEW will deduct 25 percent of your eligible weekly benefit amount from your earnings from the part time job. Then the rest of the earnings will be deducted from your eligible weekly benefit amount and that determines your partial payment.

As a result, many seniors pay no South Carolina income tax. In addition, homeowners at age 65 are exempt from property tax on the first $50,000 of the value of their legal residence, once they apply for the Homestead Exemption at their local county auditor's office.

If you filed electronically and received a confirmation from your tax preparation software, we have received your return. You can expect your refund to move through our review process within 6-8 weeks from the date you filed.

Most forms of retirement income including Social Security benefits, as well as withdrawals from your 401(k)s and traditional IRAs are taxed by Uncle Sam. And unless you live in one of nine states without a traditional income tax, you can expect your home state to ding you in retirement as well.

If you are a South Carolina resident, you are generally required to file a South Carolina Income Tax return if you are required to file a federal return.Individual Income Tax returns are due April 15 of each year.

Visit dew.sc.gov to login or register in the MyBenefits portal. Once you have logged in, you will be directed to the customer menu page. In the middle, you should see a quick link that says Certify Weekly Benefits. Click this link to complete the certification process.

The state also offers other generous exemptions on other types of retirement income. There's no inheritance or estate tax, and property taxes are on the low side: South Carolinians pay an average $601 in taxes per $100,000 of assessed home value.