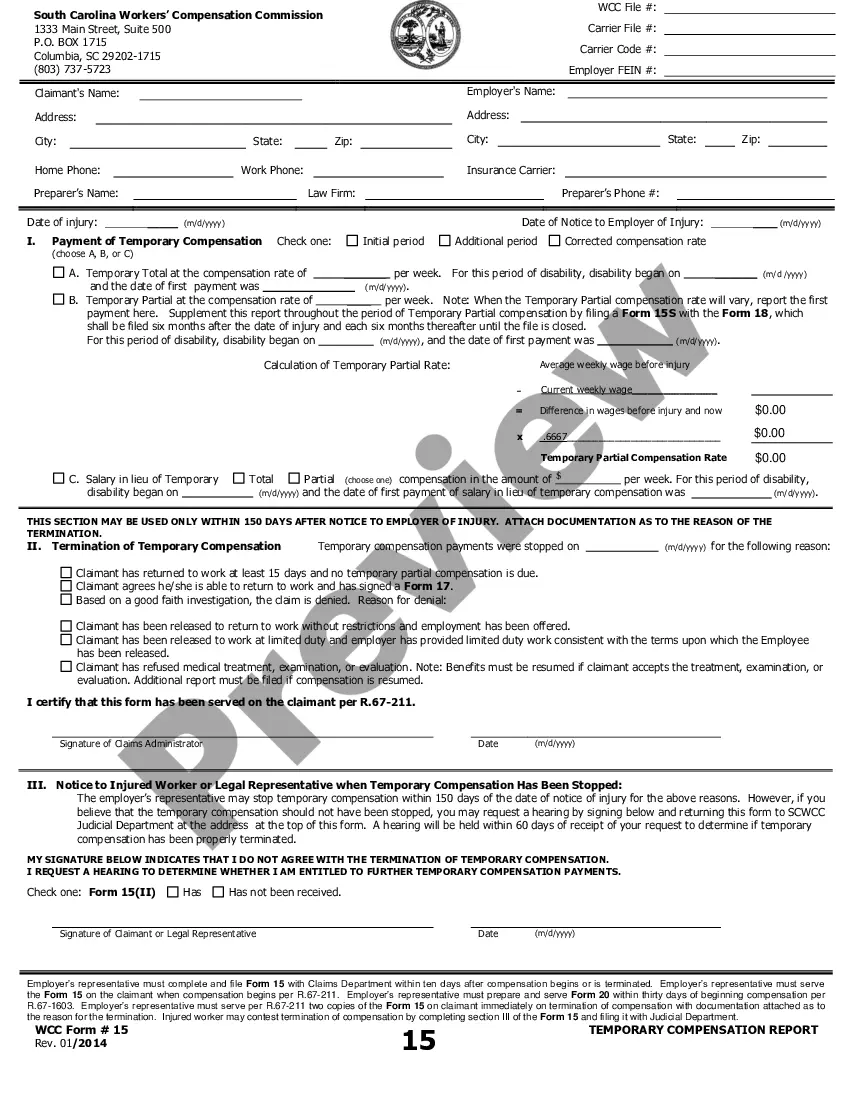

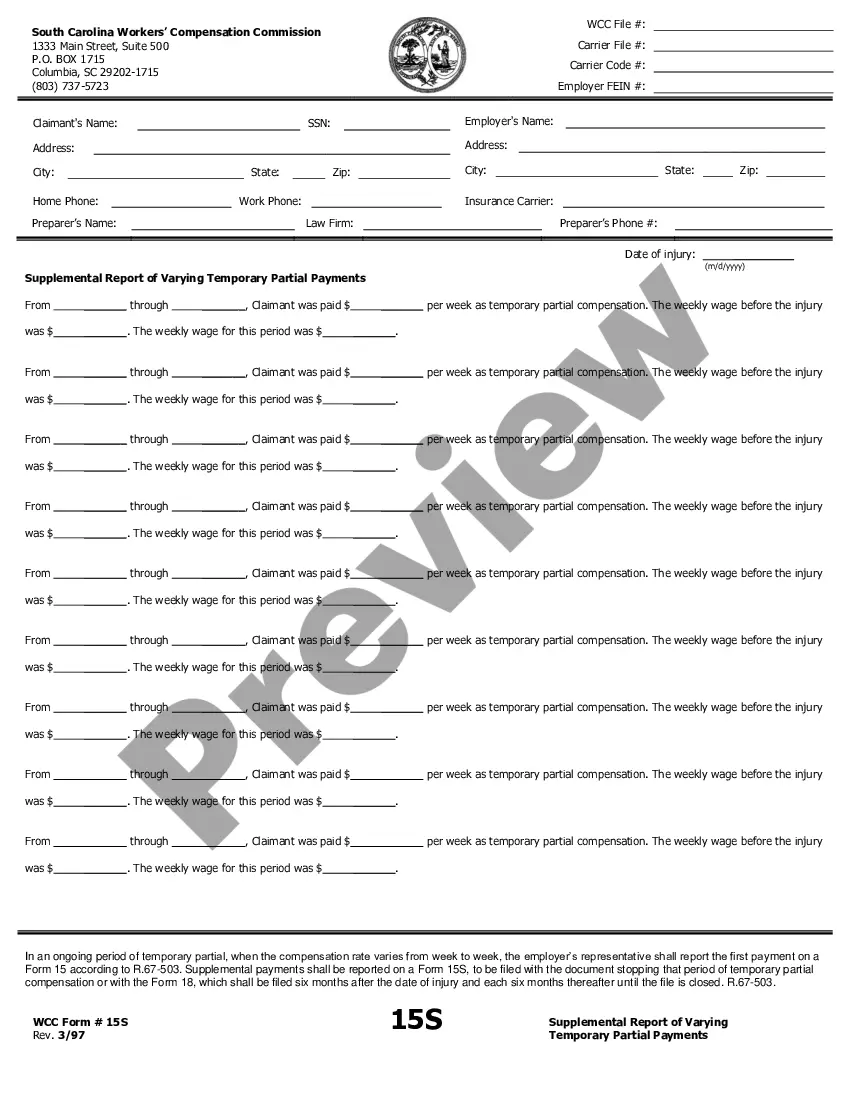

The South Carolina Supplemental Report of Varying Temporary Partial Payments is a form used by employers to report varying temporary partial payments made to employees. It is used to supplement the regular wage payment report, and is required to be filed with the South Carolina Department of Employment and Workforce within the same month the payment is made. The report must include information regarding the amount of the varying payment, the employee's name and Social Security Number, and the reason for the payment. There are two types of South Carolina Supplemental Reports of Varying Temporary Partial Payments: one used for regular wage payments, and one used for overtime payments.

South Carolina Supplemental Report of Varying Temporary Partial Payments

Description

How to fill out South Carolina Supplemental Report Of Varying Temporary Partial Payments?

US Legal Forms is the most simple and affordable way to locate appropriate legal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and verified by legal professionals. Here, you can find printable and fillable blanks that comply with national and local regulations - just like your South Carolina Supplemental Report of Varying Temporary Partial Payments.

Getting your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted South Carolina Supplemental Report of Varying Temporary Partial Payments if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make sure you’ve found the one corresponding to your demands, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you like most.

- Create an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Select the preferred file format for your South Carolina Supplemental Report of Varying Temporary Partial Payments and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more efficiently.

Take full advantage of US Legal Forms, your trustworthy assistant in obtaining the required official paperwork. Try it out!

Form popularity

FAQ

2023 Maximum Weekly Compensation Rate The South Carolina Department of Employment and Workforce has certified the average weekly wage in South Carolina for the period July 1, 2021 through June 30, 2022. For accidents occurring on or after January 1, 2023 the maximum weekly compensation rate shall be $1,035.78.

There is no law in South Dakota requiring any employer to carry workers' compensation insurance. However, it is highly recommended. An uninsured employer may be sued in civil court by an injured worker.

In general, the overarching rule is that you have two years from the date of your injury to bring a claim before the South Carolina Workers' Compensation Commission. If you do not file a claim within that two-year period, you will invariably lose out on your rights.

Do I need a Workers' Compensation Insurance? As a general rule, businesses that regularly employ four or more employees within South Carolina are required to maintain workers' compensation coverage. Part-time workers and family members are counted as employees.

If you are entitled to temporary total compensation you will receive 66 2/3% of your average weekly wages based on the four quarters prior to your injury but no more than the maximum average weekly wage determined yearly by the South Carolina Department of Employment and Workforce.

Do I need a Workers' Compensation Insurance? As a general rule, businesses that regularly employ four or more employees within South Carolina are required to maintain workers' compensation coverage. Part-time workers and family members are counted as employees.

How to File for Workers' Compensation in South Carolina Step #1 ? Report All Injuries Immediately to Your Employer. Step #2: Ask Your Employer to Cover Your Medical Treatment and File a Workers' Comp Claim. Step #3: Consider Filing a Claim or Requesting a Hearing with the South Carolina Workers' Compensation Committee.

If you are entitled to temporary total compensation you will receive 66 2/3% of your average weekly wages based on the four quarters prior to your injury but no more than the maximum average weekly wage determined yearly by the South Carolina Department of Employment and Workforce.

South Carolina requires employers with at least four employees to have workers' compensation insurance. However, there are few exceptions, including: Casual employees, who don't work regular hours and only when it's needed. Employers with less than $3,000 in annual payroll in the previous year.