Rhode Island UCC3 Financing Statement Amendment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

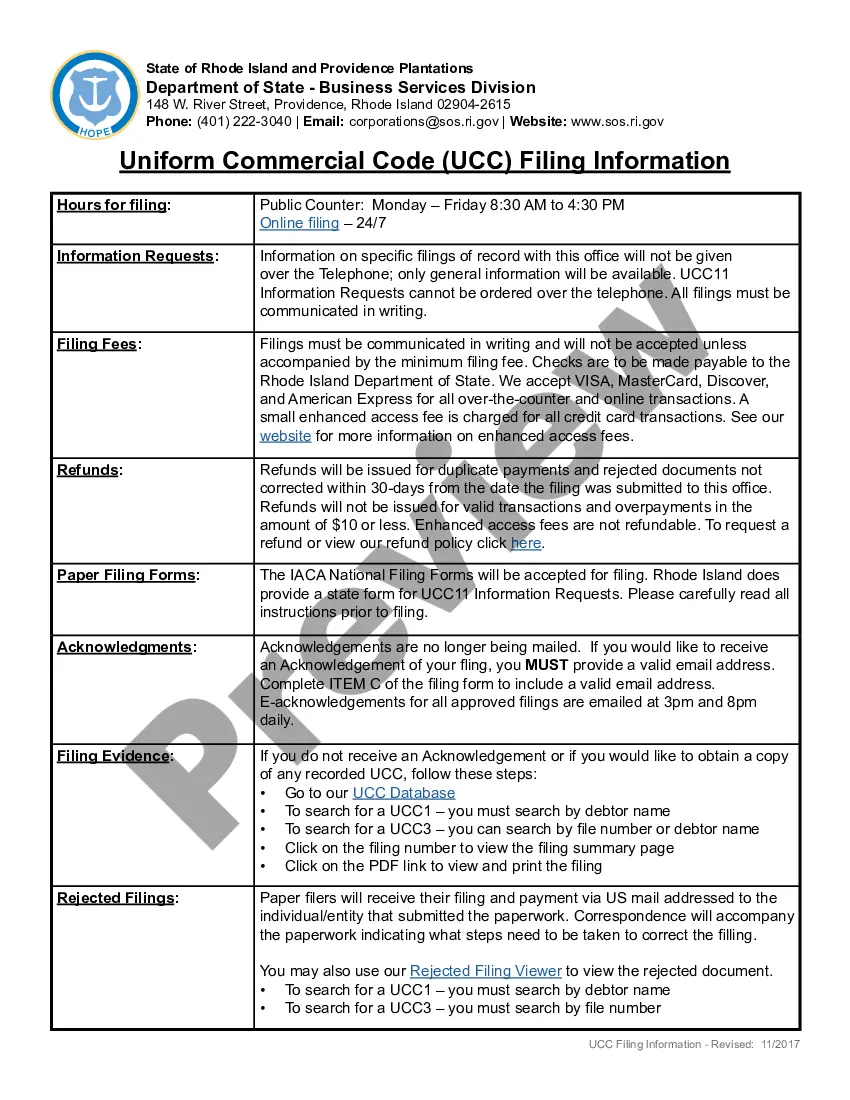

How to fill out Rhode Island UCC3 Financing Statement Amendment?

Creating documents isn't the most easy job, especially for people who almost never deal with legal papers. That's why we recommend utilizing accurate Rhode Island UCC3 Financing Statement Amendment templates made by skilled attorneys. It allows you to prevent problems when in court or working with formal organizations. Find the samples you want on our website for top-quality forms and accurate information.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will immediately appear on the template webpage. Soon after accessing the sample, it will be saved in the My Forms menu.

Users without an activated subscription can easily create an account. Utilize this short step-by-step guide to get the Rhode Island UCC3 Financing Statement Amendment:

- Make sure that file you found is eligible for use in the state it’s needed in.

- Verify the document. Utilize the Preview feature or read its description (if offered).

- Buy Now if this sample is the thing you need or utilize the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after doing these straightforward actions, you can complete the form in a preferred editor. Check the completed info and consider requesting a legal representative to review your Rhode Island UCC3 Financing Statement Amendment for correctness. With US Legal Forms, everything gets easier. Try it now!

Form popularity

FAQ

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

A UCC1 financing statement is effective for a period of five years. A record that is not continued before its lapse date will cease to be effective, costing the secured party their perfected status and perhaps their priority position to collect. Once a financing statement has lapsed, it cannot be revived.

When the debtor has satisfied all amounts owed to the lender, a UCC-3 termination statement (now called a UCC termination statement) is routinely filed to terminate the security interest perfected by the UCC-1 financing statement.

A UCC-3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC-1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC-3 with the Secretary of State's office in the appropriate state.

A UCC-3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC-1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC-3 with the Secretary of State's office in the appropriate state.

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

When the debtor has satisfied all amounts owed to the lender, a UCC-3 termination statement (now called a UCC termination statement) is routinely filed to terminate the security interest perfected by the UCC-1 financing statement.

After receiving your request, the lender has 20 days to terminate the UCC filing.

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.