Rhode Island Letter to Shareholders regarding meeting of shareholders

Description

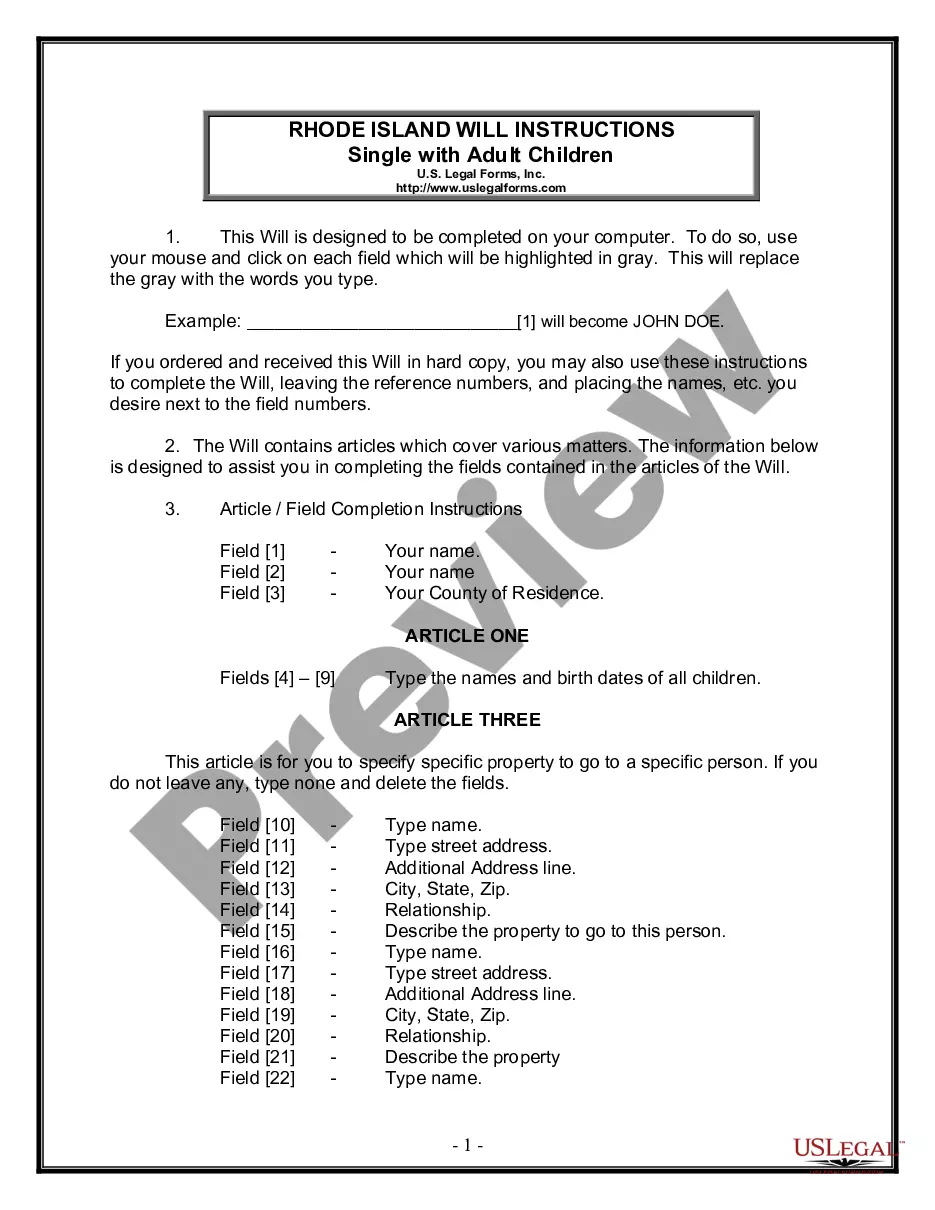

How to fill out Letter To Shareholders Regarding Meeting Of Shareholders?

Discovering the right legal papers format can be quite a struggle. Of course, there are a variety of web templates available online, but how can you get the legal type you require? Utilize the US Legal Forms site. The support gives thousands of web templates, like the Rhode Island Letter to Shareholders regarding meeting of shareholders, that you can use for enterprise and personal demands. All the types are examined by professionals and meet state and federal needs.

In case you are currently signed up, log in in your bank account and click the Down load option to find the Rhode Island Letter to Shareholders regarding meeting of shareholders. Use your bank account to check through the legal types you possess purchased formerly. Go to the My Forms tab of the bank account and have yet another copy of your papers you require.

In case you are a new end user of US Legal Forms, listed here are simple recommendations that you should comply with:

- First, make certain you have chosen the right type for your area/region. It is possible to check out the shape while using Preview option and look at the shape outline to ensure this is the right one for you.

- In the event the type will not meet your requirements, take advantage of the Seach discipline to find the appropriate type.

- When you are certain that the shape is suitable, click the Get now option to find the type.

- Pick the pricing program you would like and enter the necessary details. Make your bank account and pay for an order utilizing your PayPal bank account or credit card.

- Select the document file format and download the legal papers format in your gadget.

- Total, revise and print out and sign the attained Rhode Island Letter to Shareholders regarding meeting of shareholders.

US Legal Forms will be the most significant library of legal types where you will find various papers web templates. Utilize the service to download appropriately-made files that comply with condition needs.

Form popularity

FAQ

An LLC has distinct advantages in the areas of legal protection and liability. While there are filing fees for setting up an LLC, that cost can be well worth it when compared to the thousands of dollars you could be liable for as a sole proprietor. On the other hand, it costs no money to start a sole proprietorship.

Written notice stating the place, day, and hour of the meeting and the purpose or purposes for which the meeting is called shall be delivered not fewer than 20 nor more than 50 days before the date of the meeting, either personally or by mail, by or at the direction of the chairman of the board, the president, the ... 12 CFR § 239.26 - Shareholders. | US Law | LII / Legal Information Institute cornell.edu ? cfr ? text cornell.edu ? cfr ? text

LLC Disadvantages: Increased paperwork compared to a sole proprietor including any industry-specific licensing. Annual state filings required. Additional taxes such as a state business tax or unemployment taxes. Costs for forming and completing a tax return for an LLC are higher than those of forming a sole proprietor.

How is a sole proprietorship different from an LLC or freelancing? A Rhode Island LLC is a limited liability company that can be formed by one or multiple people. The primary difference in an LLC is that it is a separate legal entity from the owner. In other words, your business and your personal assets are separate. How to Start a Sole Proprietorship in Rhode Island chamberofcommerce.org ? sole-proprietorship chamberofcommerce.org ? sole-proprietorship