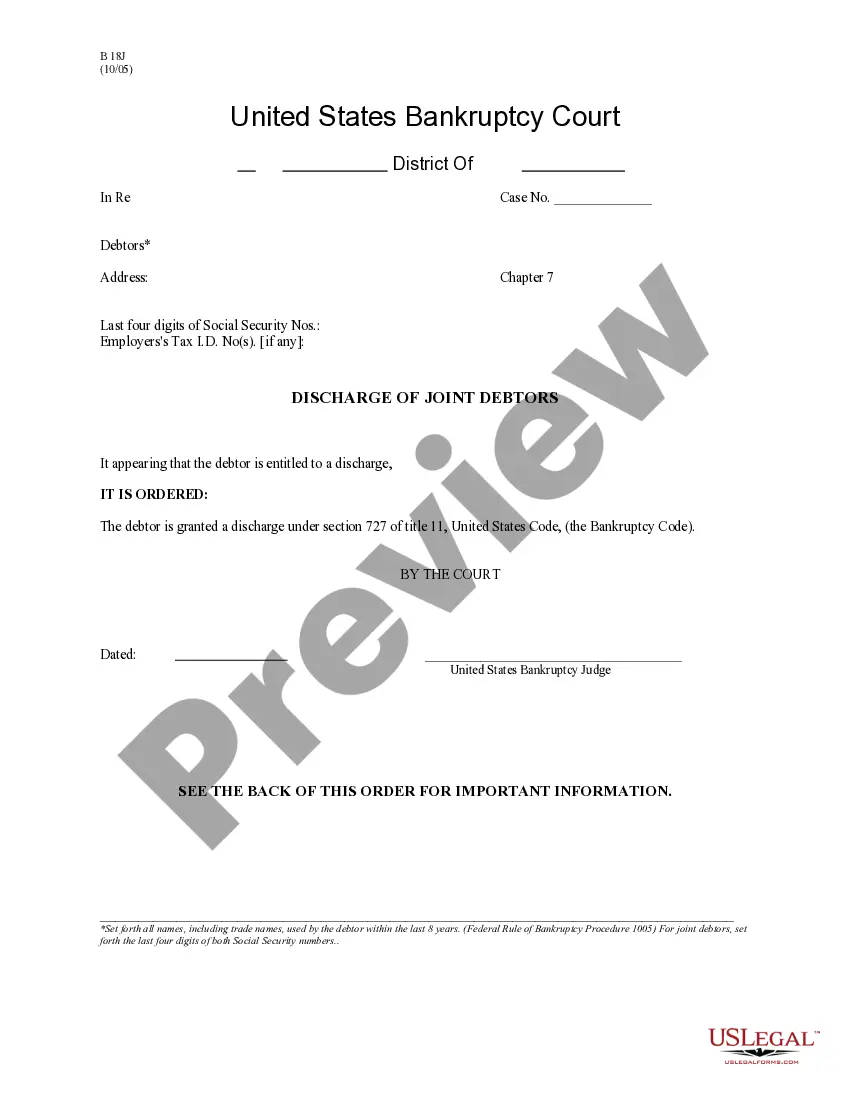

Rhode Island Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form

Description

How to fill out Order Discharging Debtor After Completion Of Chapter 12 Plan - Updated 2005 Act Form?

If you wish to comprehensive, obtain, or produce legitimate record web templates, use US Legal Forms, the greatest collection of legitimate kinds, which can be found on the Internet. Utilize the site`s easy and convenient search to discover the files you will need. Various web templates for organization and individual uses are categorized by classes and claims, or key phrases. Use US Legal Forms to discover the Rhode Island Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form within a few clicks.

Should you be currently a US Legal Forms client, log in in your bank account and click the Acquire option to get the Rhode Island Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form. You can also accessibility kinds you previously saved inside the My Forms tab of your bank account.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have selected the shape for the appropriate city/land.

- Step 2. Utilize the Review choice to check out the form`s content. Don`t neglect to see the information.

- Step 3. Should you be not satisfied together with the form, use the Research field towards the top of the display screen to discover other variations of the legitimate form format.

- Step 4. Once you have located the shape you will need, select the Purchase now option. Select the rates prepare you choose and put your credentials to register to have an bank account.

- Step 5. Approach the financial transaction. You can use your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Find the structure of the legitimate form and obtain it on your gadget.

- Step 7. Total, revise and produce or sign the Rhode Island Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form.

Each legitimate record format you purchase is your own property for a long time. You might have acces to every form you saved with your acccount. Click on the My Forms area and select a form to produce or obtain again.

Remain competitive and obtain, and produce the Rhode Island Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form with US Legal Forms. There are many expert and condition-distinct kinds you can use for your organization or individual requires.

Form popularity

FAQ

When a debt is discharged, the debtor is no longer liable for the debt and the lender is no longer allowed to make attempts to collect the debt. Debt discharge can result in taxable income to the debtor unless certain IRS conditions are met. A debt discharge occurs when a debtor qualifies through bankruptcy court.

Courts can issue a discharge ruling when the debtor meets the discharge requirements under Chapter 7 or Chapter 11 of federal bankruptcy law, or the ruling is based on a debt canceling. A canceling of debt happens when the lender agrees that the rest of the debt is forgiven. discharge (of debts) | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? discharge_(of_debts) cornell.edu ? wex ? discharge_(of_debts)

Generally, a discharge removes the debtors' personal liability for debts owed before the debtors' bankruptcy case was filed. Also, if this case began under a different chapter of the Bankruptcy Code and was later converted to chapter 7, debts owed before the conversion are discharged.

What happens when a creditor files an objection? A creditor's objection does not automatically prevent a discharge of debt. The debtor gets a chance to file an answer to the objection, and the court may hold a hearing to decide the issue. This is called an adversary proceeding, and it works much like any other lawsuit.

What is a discharge in bankruptcy? A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged. Discharge in Bankruptcy - Bankruptcy Basics | United States Courts uscourts.gov ? services-forms ? discharge-b... uscourts.gov ? services-forms ? discharge-b...

Once a debt has been discharged, the creditor can no longer take action against the debtor, such as attempting to collect the debt or seizing any collateral. Learn more about what kind of loan debt is not alleviated when you file for bankruptcy, and what kind of debt is difficult to discharge. What Debt Can't Be Discharged in Filing for Bankruptcy? - Investopedia investopedia.com ? ask ? answers ? what-de... investopedia.com ? ask ? answers ? what-de...

The Process of a Debt Discharge The bankruptcy court will look at your plan and decide whether it is fair and in ance with the law. You will also need to work with a trustee who will distribute these payments to the creditors. The trustee will pay creditors ing to priority. The Chapter 13 Debt Discharge - FindLaw findlaw.com ? bankruptcy ? the-chapter-13-... findlaw.com ? bankruptcy ? the-chapter-13-...