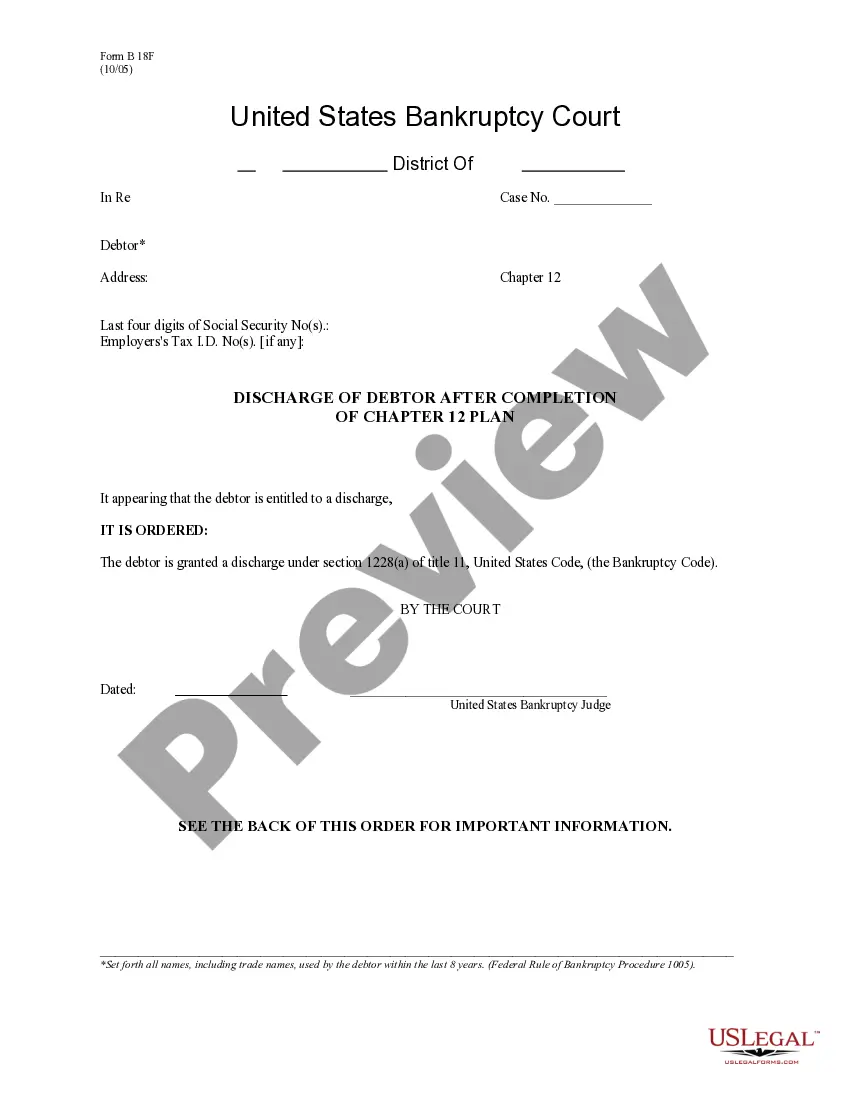

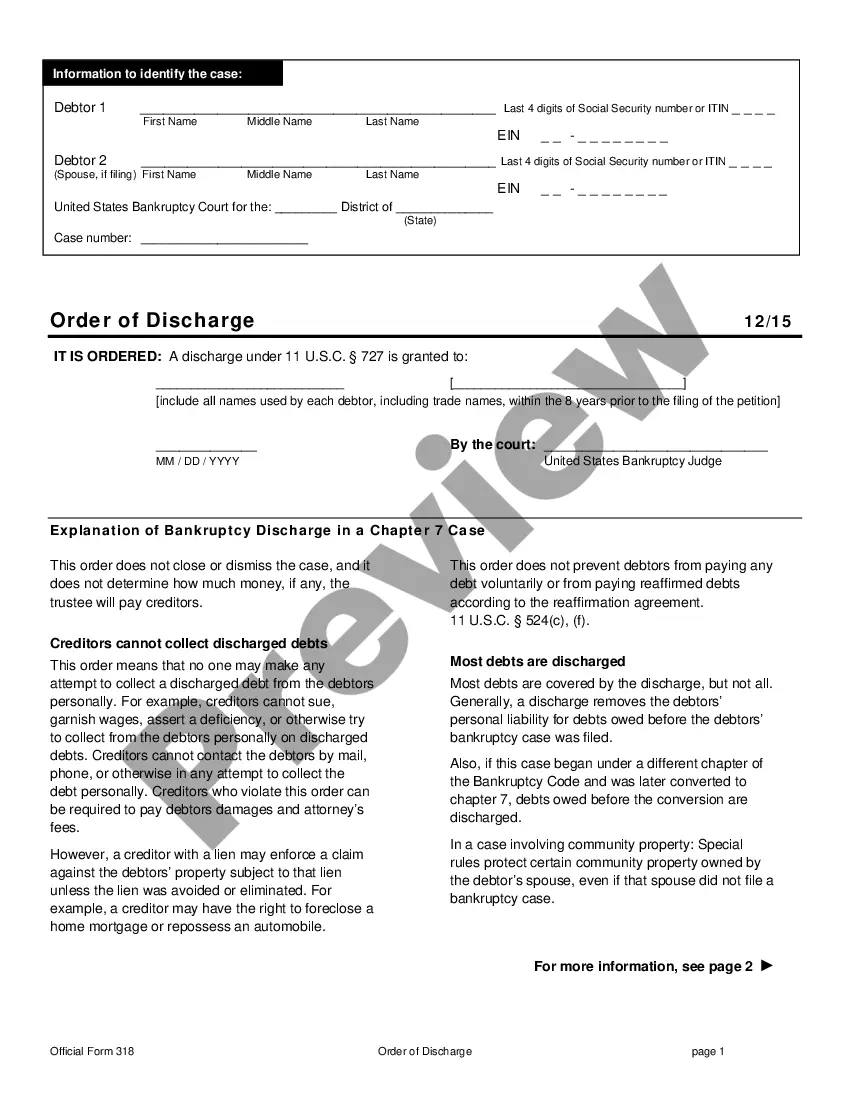

Rhode Island Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

Choosing the right lawful file design can be a have difficulties. Needless to say, there are plenty of layouts available on the net, but how will you obtain the lawful develop you require? Utilize the US Legal Forms web site. The service offers a large number of layouts, such as the Rhode Island Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form, that can be used for organization and private demands. Each of the forms are examined by pros and meet up with federal and state specifications.

When you are presently registered, log in for your account and click the Download button to obtain the Rhode Island Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form. Utilize your account to appear from the lawful forms you might have bought formerly. Visit the My Forms tab of the account and have one more copy of the file you require.

When you are a new user of US Legal Forms, listed below are easy instructions that you should adhere to:

- First, be sure you have selected the proper develop for the city/area. You can look through the shape utilizing the Preview button and browse the shape description to make sure this is the best for you.

- When the develop is not going to meet up with your requirements, utilize the Seach industry to find the correct develop.

- Once you are positive that the shape is proper, go through the Purchase now button to obtain the develop.

- Choose the prices program you need and type in the necessary info. Make your account and pay for an order utilizing your PayPal account or credit card.

- Opt for the file formatting and download the lawful file design for your gadget.

- Full, modify and print out and indication the obtained Rhode Island Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form.

US Legal Forms is the greatest collection of lawful forms where you can discover a variety of file layouts. Utilize the service to download expertly-manufactured paperwork that adhere to status specifications.

Form popularity

FAQ

Receive your bankruptcy discharge: If you have completed all necessary steps and duties, you will automatically be discharged from your remaining debts at the 9- or 21-month mark (with minor exceptions). Some remaining steps may be required, as set out in your court order.

If your case is dismissed, you are entitled to a refund of any money that is still in the trustee's possession. However, the trustee has to get approval from the court to send the money back to you, and they are allowed to take their administrative fees out of that money before refunding it.

After Plan Completion: After all payments have been completed, the Chapter 13 Trustee will file a Motion to Return any Excess Funds to Debtor and to Terminate any Payroll Deduction by Employer. If the Motion is granted, the Court will enter an order granting the motion and issue two notices.

A Chapter 13 bankruptcy will remain on your credit report for seven years from the date of filing. At the end of seven years, information on your bankruptcy will fall off, and your credit score could increase.

After Plan Completion: After all payments have been completed, the Chapter 13 Trustee will file a Motion to Return any Excess Funds to Debtor and to Terminate any Payroll Deduction by Employer. If the Motion is granted, the Court will enter an order granting the motion and issue two notices.

Don't worry about overpaying. If you overpay the trustee will issue a refund.

Chapter 11 is the chapter used by large businesses to reorganize their debts and continue operating. Corporations, partnerships, and limited liability companies cannot use chapter 13 to reorganize and must cease business operations if a chapter 7 bankruptcy is filed.

Filing a Chapter 13 after a Chapter 13 only requires a two-year waiting period, making it the shortest gap period between any two types of bankruptcies. However, it's quite rare since a Chapter 13 restructure usually takes 3 to 5 years to repay fully.