Rhode Island Nonresidential Simple Lease

Description

How to fill out Nonresidential Simple Lease?

Are you presently in the situation where you need documents for both organizational or specific aims almost every workday.

There is a multitude of legal document formats available online, but finding reliable templates is challenging.

US Legal Forms provides a wide array of form templates, including the Rhode Island Nonresidential Simple Lease, which can be tailored to meet both state and federal requirements.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Rhode Island Nonresidential Simple Lease at any time if needed. Click the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Rhode Island Nonresidential Simple Lease template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and make sure it corresponds to the correct city/county.

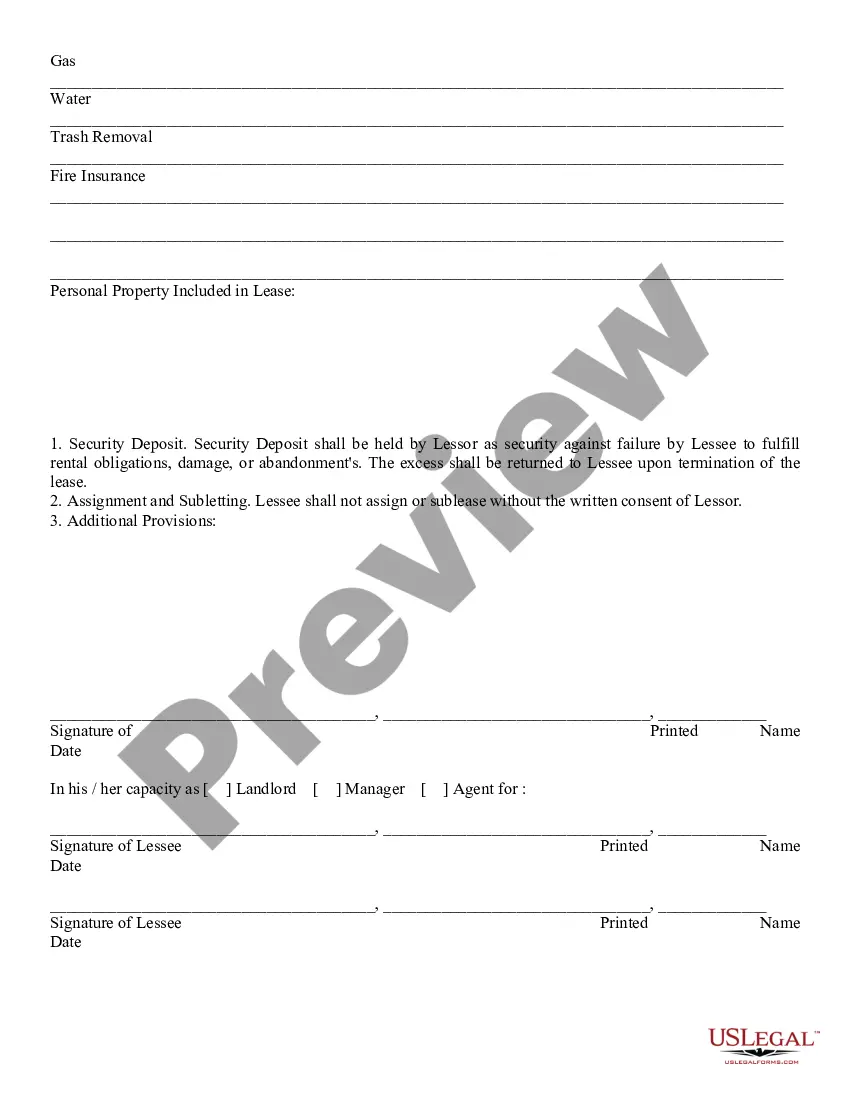

- Use the Preview function to review the document.

- Check the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Research section to find the form that meets your needs and criteria.

- Once you locate the correct form, click Get now.

- Choose the pricing plan you prefer, enter the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

Form popularity

FAQ

Yes, a U.S. citizen can be classified as a non-resident for tax purposes, depending on their living situation and income sources. Living outside the state or largely outside the country while conducting business in Rhode Island may lead to a non-resident designation. If you rent a property through a Rhode Island Nonresidential Simple Lease, your tax responsibilities will depend on how much time you spend in the state. Consulting with a tax expert can clarify your status.

Non-residents in Rhode Island generally file using a specific tax form designed for non-resident income. This tax status applies to individuals earning income from sources within the state, including rental income linked to a Rhode Island Nonresidential Simple Lease. Properly categorizing your filing status will help ensure compliance and minimize potential issues with the tax authorities. It's advisable to keep accurate records of your income.

To be recognized as a resident of Rhode Island, you typically need to reside in the state for at least 183 days within a calendar year. This standard helps determine your tax obligations and eligibility for local benefits. If you have a Rhode Island Nonresidential Simple Lease, it could indicate your intent to occupy space in the state. Understanding this timeline is crucial for your residency status.

Your filing status depends on your residency duration and income source. If you spend a significant amount of time in Rhode Island and earn income there, you might file as a resident. However, if you primarily live elsewhere and only generate income through a Rhode Island Nonresidential Simple Lease, nonresident status is appropriate. Always evaluate your circumstances for the best filing decision.

Generally, non-residents who earn income in Rhode Island must file taxes. This includes income from rental properties or work performed within the state. By using a Rhode Island Nonresidential Simple Lease, you formalize your rental agreement, which can be relevant for your tax filings. It's wise to review your specific situation to determine your filing obligations.

Yes, as a non-resident, you may need to file taxes in Rhode Island. This requirement often depends on your income generated within the state. If you have signed a Rhode Island Nonresidential Simple Lease and earned income, you should consider consulting a tax professional. Filing taxes will ensure you comply with state tax laws.

If your husband is not on the lease, you may have grounds to ask him to leave, but the situation can be complex. Depending on your state laws and any verbal agreements, this could lead to disputes. For individuals in Rhode Island navigating such issues, knowing the provisions of the Rhode Island Nonresidential Simple Lease and consulting uslegalforms can provide essential guidance.

A nonresidential lease is a contract between a landlord and tenant for a property that is not intended for residential use. This includes agreements for commercial spaces and other facilities that support business activities. Understanding the specifics of a Rhode Island Nonresidential Simple Lease ensures that both parties meet their obligations and that the terms reflect the intended use of the property.

Rhode Island offers a balanced approach to tenants' and landlords' rights, making it important for both parties to be informed. There are protections for tenants, but compliance with the Rhode Island Nonresidential Simple Lease is critical for safeguarding your interests. Being aware of local laws can help you navigate rental agreements effectively.

residential property is any real estate used primarily for business or commercial activities rather than residential living. This includes offices, industrial spaces, and retail locations. When entering into a Rhode Island Nonresidential Simple Lease, it's important to understand how these properties function and the specific obligations of both tenants and landlords.