Rhode Island Agreement and Release for Working at a Novelty Store - Self-Employed

Description

How to fill out Agreement And Release For Working At A Novelty Store - Self-Employed?

Selecting the appropriate legitimate document template can be challenging.

Clearly, there is a multitude of templates accessible online, but how can you find the authentic document you require.

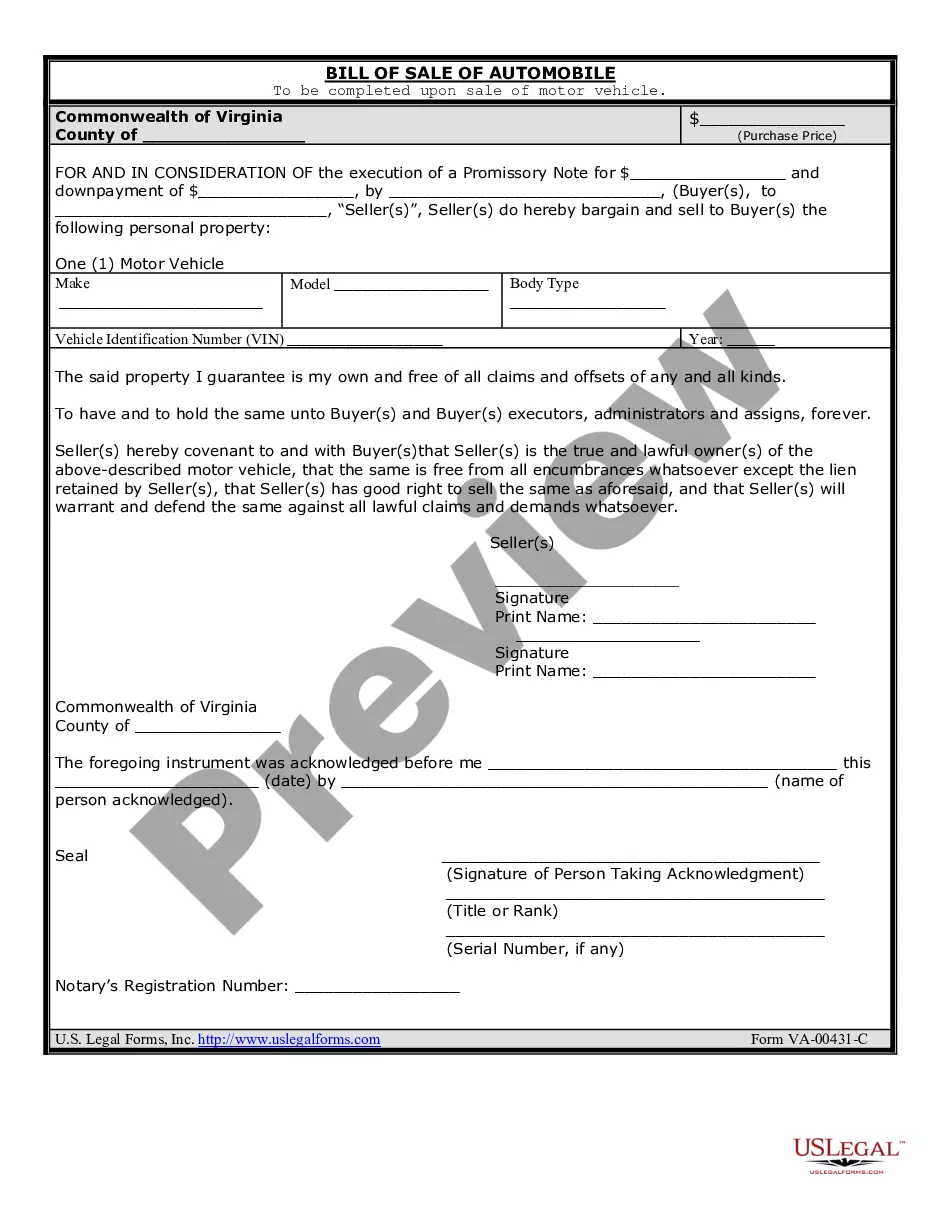

Utilize the US Legal Forms website. This service offers a plethora of templates, including the Rhode Island Agreement and Release for Working at a Novelty Store - Self-Employed, which can be utilized for business and personal needs.

First, ensure you have chosen the correct document for your city/state. You can preview the form using the Review button and check the form description to confirm it is the right one for you. If the document does not meet your criteria, use the Search field to find the correct document. Once you are confident the document is correct, click the Buy now button to obtain the document. Select the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the legitimate document template to your device. Complete, modify, print, and sign the obtained Rhode Island Agreement and Release for Working at a Novelty Store - Self-Employed. US Legal Forms is the largest collection of legitimate documents where you can find various file templates. Use this service to access professionally-crafted paperwork that adhere to state requirements.

- All templates are verified by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the Rhode Island Agreement and Release for Working at a Novelty Store - Self-Employed.

- Use your account to browse the legitimate documents you have previously acquired.

- Navigate to the My documents section of your account to access another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

Form popularity

FAQ

Rule 5.5 in Rhode Island pertains to the unauthorized practice of law. It prohibits individuals who are not licensed attorneys from providing legal services, which can include offering legal agreements without proper qualifications. For self-employed individuals, such as those working under a Rhode Island Agreement and Release for Working at a Novelty Store, it's vital to consult with licensed attorneys to ensure compliance. This understanding can prevent legal issues and promote accountability in your business operations.

The Fair Employment Practices Act in Rhode Island is legislation that prohibits discriminatory practices in employment. This Act covers hiring, promotions, wages, and other employment aspects, ensuring everyone is treated justly at work. If you operate as a self-employed individual using a Rhode Island Agreement and Release for Working at a Novelty Store, understanding this Act is essential. It not only protects employees but also helps employers foster a culture of inclusivity.

The Fair Employment Practices Act established protections against workplace discrimination in Rhode Island. This Act aims to ensure that employees are treated fairly in their employment regardless of their race, gender, or other protected characteristics. It plays a critical role in supporting a safe working environment, even for those self-employed under a Rhode Island Agreement and Release for Working at a Novelty Store. Familiarizing yourself with these protections can empower you in your business.

Wrongful termination in Rhode Island occurs when an employee is let go for illegal reasons, such as discrimination or retaliation. Under state laws, if you have a Rhode Island Agreement and Release for Working at a Novelty Store - Self-Employed, it can help outline your rights and provide clarity in case of a dispute. Understanding your position can strengthen your defense against wrongful termination. Always seek legal advice if you think you may have a claim.

In Rhode Island, the minimum tax for an LLC is currently set at $400 per year. This tax ensures that your LLC remains in good standing with state regulations. As you venture into self-employment, consider having a Rhode Island Agreement and Release for Working at a Novelty Store - Self-Employed to manage your financial accountability and compliance.

Registering a sole proprietorship in Rhode Island is simple, as it typically does not require formal registration with the state. However, you should consider obtaining a business license and register a fictitious business name if you plan to operate under a name different from your own. Additionally, acquiring a Rhode Island Agreement and Release for Working at a Novelty Store - Self-Employed can protect your interests and clarify client interactions.

To obtain a certificate of good standing in Rhode Island, you need to request it through the Secretary of State's office. This document confirms that your LLC is compliant and up-to-date with state filings. Having a Rhode Island Agreement and Release for Working at a Novelty Store - Self-Employed can be beneficial when seeking this certificate, as it shows your commitment to legal compliance.

Creating an LLC in Rhode Island typically takes about 1 to 2 weeks when filing online, and a bit longer for paper submissions. After preparing and submitting your Articles of Organization, the Secretary of State will process your application. Ensuring you have the right paperwork, including a Rhode Island Agreement and Release for Working at a Novelty Store - Self-Employed, can help streamline the process.

To start an LLC in Rhode Island, you need to choose a unique name and file the Articles of Organization with the Secretary of State. It is beneficial to have an operating agreement to outline the management and operational aspects of your LLC. You may also want to consider obtaining a Rhode Island Agreement and Release for Working at a Novelty Store - Self-Employed to protect your interests as you begin operating.

Yes, Rhode Island may require you to obtain a business license based on the nature of your services or products. Local municipalities often have specific regulations, so it's important to check with them to determine what you'll need. A Rhode Island Agreement and Release for Working at a Novelty Store - Self-Employed can guide you through compliance, ensuring you have all necessary permits.