Rhode Island Shareholders Agreement - Short Form

Description

How to fill out Shareholders Agreement - Short Form?

Are you presently in a situation where you need documents for either business or personal purposes almost every day? There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers an extensive array of document templates, including the Rhode Island Shareholders Agreement - Short Form, which are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the Rhode Island Shareholders Agreement - Short Form template.

- Acquire the document you need and verify it is for the correct city/county.

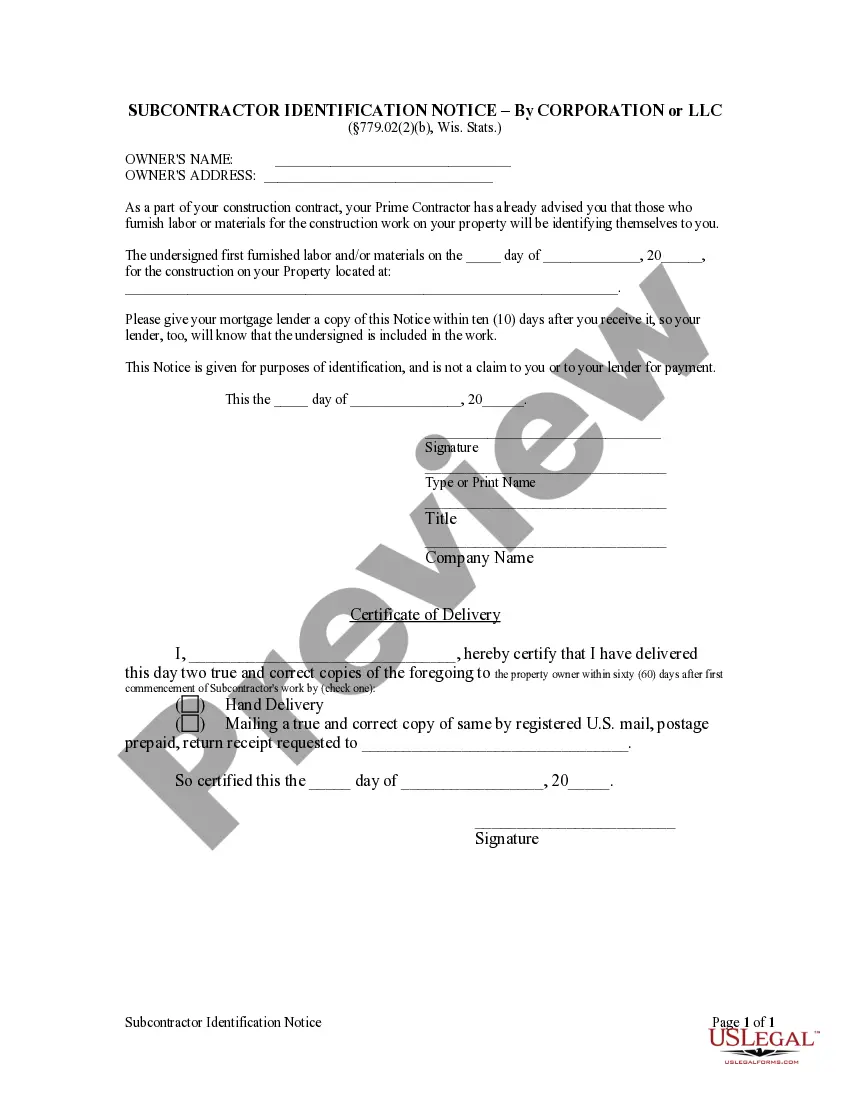

- Utilize the Preview button to inspect the form.

- Review the description to confirm you have selected the appropriate document.

- If the document isn't exactly what you want, use the Search field to find the form that fits your needs and requirements.

- Once you find the correct document, click Buy now.

- Choose the payment plan you prefer, provide the necessary information to create your account, and complete the transaction using PayPal or credit card.

- Select a suitable file format and download your copy.

Form popularity

FAQ

Yes, you can write your own Rhode Island Shareholders Agreement - Short Form, but caution is advisable. While DIY options may seem appealing, failure to address critical components could lead to legal complications. To ensure your agreement meets legal standards and effectively serves your business, consider using tools from uslegalforms for guidance.

Creating a Rhode Island Shareholders Agreement - Short Form involves a few key steps. First, identify all shareholders and their respective contributions. Next, outline important aspects such as governance structure, voting rights, and succession planning. Using a reliable platform, such as uslegalforms, can streamline this process and provide professionally crafted templates.

Typically, anyone involved in the business can draft a Rhode Island Shareholders Agreement - Short Form. However, it’s highly advisable to involve individuals with legal expertise to ensure all provisions are enforceable. Legal experts can help tailor the agreement to match your specific business needs and protect your interests.

A significant shareholder with 25% ownership holds considerable influence within the company. This level of ownership commonly entitles them to participate actively in decision-making processes and can grant them more power compared to smaller shareholders. Incorporating guidelines in a Rhode Island Shareholders Agreement - Short Form allows these significant shareholders to secure their rights and emphasizes their role in company operations.

The common abbreviation for shareholder agreement is 'SA'. When discussing business documents or contracts, using this abbreviation can streamline communication. If you're drafting your own agreement, consider including a Rhode Island Shareholders Agreement - Short Form to ensure you cover all necessary details while maintaining clarity in language.

The maximum amount a shareholder can lose is usually limited to their investment in the company. In most cases, shareholders are not personally liable for the debts of the corporation beyond their investment amount. Therefore, having a Rhode Island Shareholders Agreement - Short Form can help clarify these terms and protect shareholders from unforeseen financial burdens, defining limits on exposure.

A basic shareholder agreement outlines the rights and responsibilities of shareholders within a corporation. This document typically includes provisions about management, voting rights, and share transfers. Utilizing a Rhode Island Shareholders Agreement - Short Form provides a solid foundation for crafting this essential document, ensuring that all critical aspects are addressed and established in clear terms.

Yes, a 25% shareholder can be removed, but the process is often governed by the company's articles of incorporation or existing shareholders agreement. Depending on the terms outlined in the Rhode Island Shareholders Agreement - Short Form, certain voting thresholds may need to be met. It's advisable to review these documents to understand the conditions under which removal may occur.

A 25% shareholder typically has significant rights, such as voting on major decisions and being consulted during important corporate actions. This level of ownership can grant the shareholder a voice in selecting directors or approving amendments to the shareholders agreement. With a Rhode Island Shareholders Agreement - Short Form, the rights of shareholders, including minority shareholders, can be clearly defined to protect their interests and foster transparent decision-making.

Writing a shareholders agreement begins with identifying the essential elements like ownership stakes, voting rights, and management structure. You should outline the process for resolving disputes and the protocol for transferring shares. Utilizing a Rhode Island Shareholders Agreement - Short Form can simplify this process, providing a streamlined template to guide you through each necessary section. This ensures your agreement meets all legal requirements and addresses your business needs.