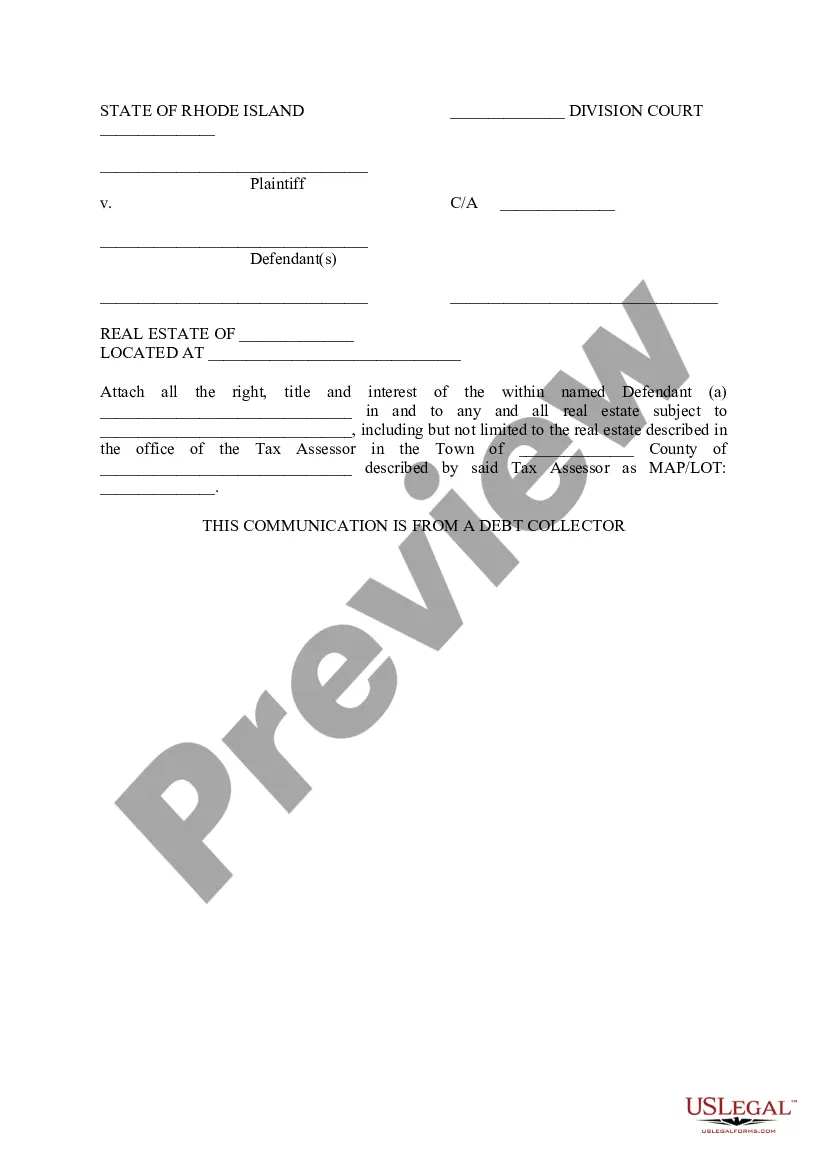

Rhode Island Communications from Debt Collector

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

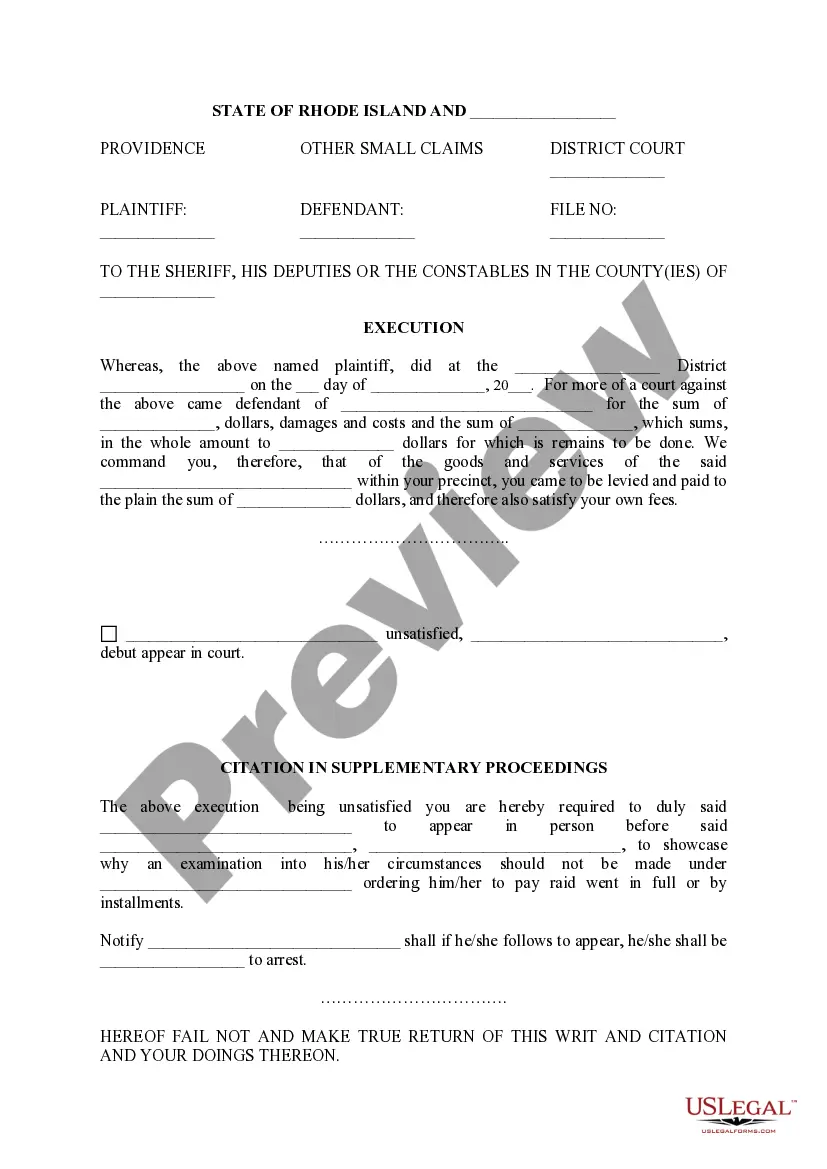

How to fill out Rhode Island Communications From Debt Collector?

The work with papers isn't the most simple task, especially for people who rarely deal with legal paperwork. That's why we recommend using accurate Rhode Island Communications from Debt Collector templates made by professional attorneys. It gives you the ability to prevent troubles when in court or working with formal organizations. Find the documents you require on our website for high-quality forms and exact descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will immediately appear on the template webpage. After downloading the sample, it’ll be saved in the My Forms menu.

Customers with no a subscription can easily get an account. Utilize this short step-by-step help guide to get the Rhode Island Communications from Debt Collector:

- Make sure that file you found is eligible for use in the state it is necessary in.

- Verify the file. Make use of the Preview option or read its description (if offered).

- Click Buy Now if this sample is what you need or use the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after doing these easy steps, it is possible to complete the form in a preferred editor. Double-check filled in data and consider asking an attorney to review your Rhode Island Communications from Debt Collector for correctness. With US Legal Forms, everything gets easier. Try it out now!

Form popularity

FAQ

But why do debt collectors call? You typically only receive collection calls when you owe a debt. Collection agencies buy past-due debts from creditors or other businesses and attempt to get you to repay them. When debt collectors call you, it's important to respond in ways that will protect your legal rights.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

Verify that it's your debt. Understand your rights. Consider the kind of debt you owe. Consider hardship programs. Offer a lump sum. Mention bankruptcy. Speak calmly and logically. Be mindful of the statute of limitations.

Your full name and address. The collections agency's name and address. A request for the amount of the debt claimed to be owed. A request for the name of the original creditor. A request for the judgment information (if applicable) A request for proof of the company's license.

This is not a good time. Please call back at 6. I don't believe I owe this debt. Can you send information on it? I prefer to pay the original creditor. Give me your address so I can send you a cease and desist letter. My employer does not allow me to take these calls at work.

When a Debt Collector Calls, How Should You Answer? The phone call from a debt collector never comes at a good timebut the best response is to confront the state of these affairs head-on. You may want to hide or ignore the situation and hope it goes awaybut that can make things worse.

The FDCPA does not permit debt collectors to disclose your personal information to any third party. This means that if your voicemail is shared with your family or roommates or if it is monitored by your employer, debt collectors are not allowed to leave a message. Messages can only be left on private voicemail.