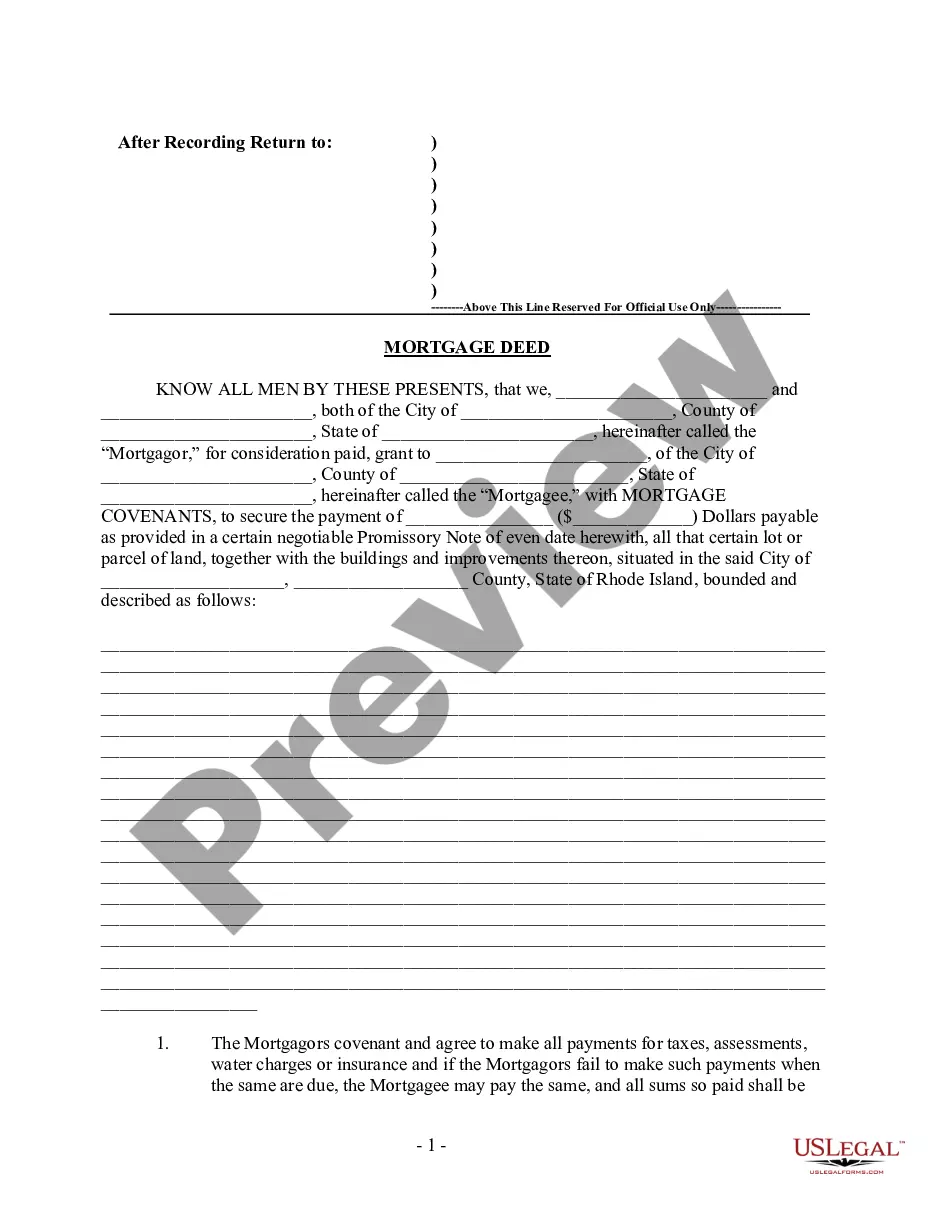

Rhode Island Mortgage Deed

Understanding this form

The Mortgage Deed is a legal document used to secure a loan against real estate in Rhode Island. It establishes a mortgage lien on the property to ensure the lender (mortgagee) can recoup their investment if the borrower (mortgagor) defaults. This form differs from other real estate documents, such as purchase agreements, as it specifically relates to the borrowing and securing of money through property collateral.

What’s included in this form

- Identification of the mortgagor and mortgagee.

- Property description, including address and boundaries.

- Details of the loan amount secured by the mortgage.

- Covenants outlining the responsibilities of the mortgagor.

- Conditions for default and foreclosure procedures.

Situations where this form applies

You should use this Mortgage Deed when you are obtaining a loan secured by real estate in Rhode Island. It is typically required when purchasing a home or refinancing an existing mortgage. This document formalizes the borrowerâs obligation to repay the loan and the lenderâs right to take possession of the property if the borrower fails to meet the terms of the loan.

Who can use this document

- Homebuyers looking to secure a mortgage for purchasing property.

- Property owners refinancing existing loans.

- Lenders providing financing for real estate transactions.

- Individuals or entities needing to legally document a mortgage agreement in Rhode Island.

Completing this form step by step

- Identify the parties involved in the mortgage by entering the names of the mortgagor and mortgagee.

- Provide the property's legal description, including its address and boundaries.

- Specify the loan amount to be secured by the mortgage.

- Details of any covenants and agreements, including payment obligations for taxes and insurance.

- Sign and date the document in the presence of a notary public for it to be legally binding.

Does this form need to be notarized?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include a complete and accurate property description.

- Not specifying the total loan amount clearly.

- Omitting the required signatures from all parties involved.

- Neglecting to have the document notarized, if necessary.

- Not providing the correct terms for foreclosure or default procedures.

Why use this form online

- Convenient access to legal forms at any time.

- Easy to download and print from the comfort of your home.

- Edit and customize the mortgage deed to suit your specific needs.

- Reliable forms created by licensed attorneys to ensure compliance with state law.

Looking for another form?

Form popularity

FAQ

The average mortgage payment is just over $1,500 per month, according to the U.S. Census Bureau. That might seem like a high price to pay.

Best Overall: Quicken Loans. Best Online: SoFi. Best for Refinancing: LoanDepot. Best for Poor Credit: New American Funding. Best for Convenience: Reali. Best for Low Income: Citi Mortgage. Best Interest-Only Mortgages: Guaranteed Rate. Best Traditional Bank: Chase.

Closing costs typically range from 3% to 6% of the home's purchase price. 1feff Thus, if you buy a $200,000 house, your closing costs could range from $6,000 to $12,000. Closing fees vary depending on your state, loan type, and mortgage lender, so it's important to pay close attention to these fees.

Assuming you have a 20% down payment ($70,000), your total mortgage on a $350,000 home would be $280,000. For a 30-year fixed mortgage with a 3.5% interest rate, you would be looking at a $1,257 monthly payment.

Typically the buyer is responsible for these costs but they can ask the seller to contribute to the cost of closing costs. The person buying your property typically has three potential home loans or mortgages: VA, FHA, or CONV. Depending on which types of loan they take, who pays which fee can get a little mixed up.

Not including your downpayment on a home, closing costs usually range between 2-5% of the purchase price. This means if an average home in Rhode Island costs between $300,000-$400,000, you can expect to pay between $2,600-$4600 in closing costs.

The best guess most financial advisors and websites will give you is that closing costs are typically between 2 and 5% of the home value. True enough, but even on a $150,000 house, that means closing costs could be anywhere between $3,000 and $7,500 that's a huge range!

FHA loans are some of the easiest mortgages to qualify for, especially as the down payment requirements are as low as 3.5%.

The median monthly mortgage payment is just over $1,500, according to the U.S. Census Bureau. That can vary of course, based on the size of the house and where you live, but that's the ballpark number.