Puerto Rico Permission For Deputy or Agent To Access Safe Deposit Box

Description

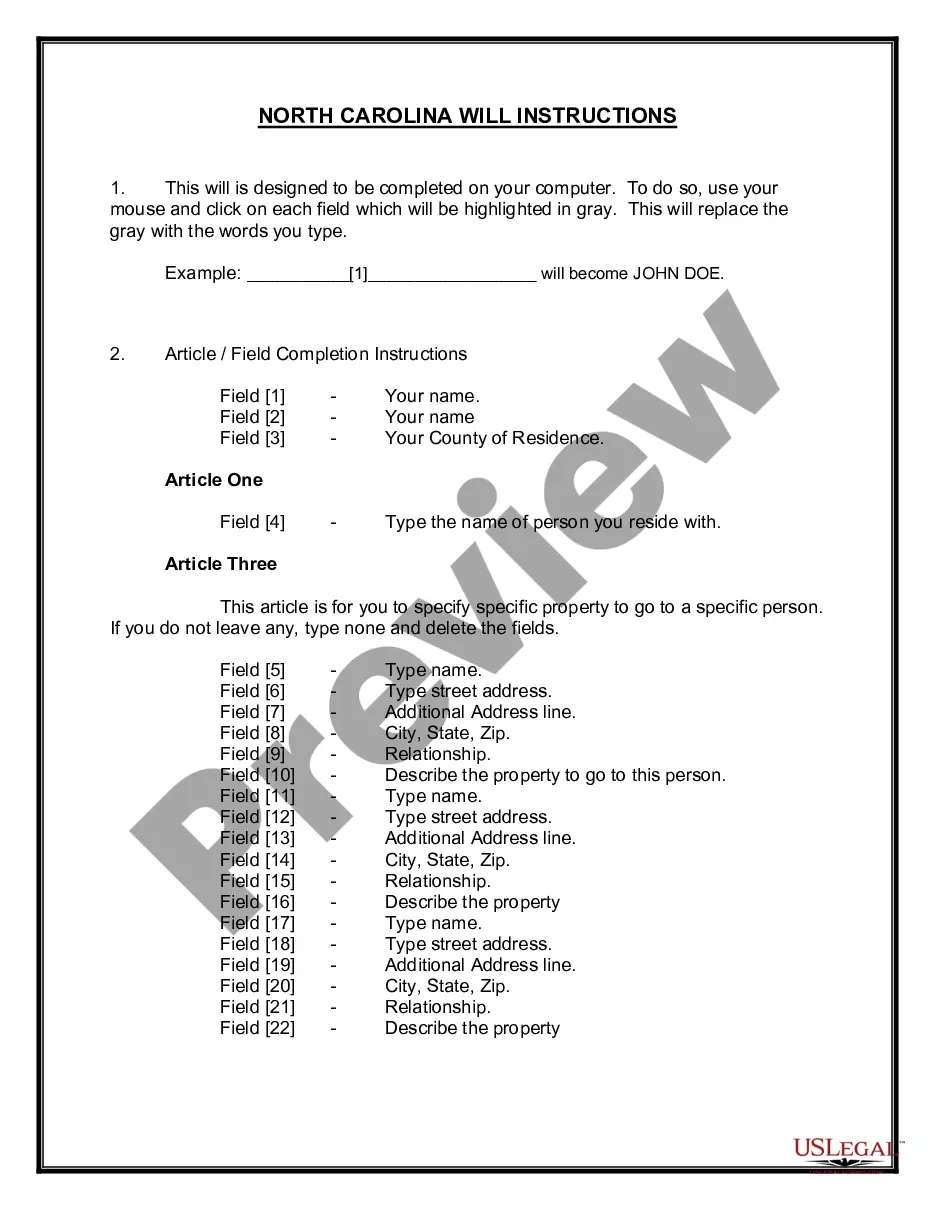

How to fill out Permission For Deputy Or Agent To Access Safe Deposit Box?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent types of forms such as the Puerto Rico Permission for Deputy or Agent to Access Safe Deposit Box within minutes.

If you have a subscription, Log In and download the Puerto Rico Permission for Deputy or Agent to Access Safe Deposit Box from the US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously downloaded forms from the My documents tab in your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill, modify, and print and sign the downloaded Puerto Rico Permission for Deputy or Agent to Access Safe Deposit Box. Each template you add to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Puerto Rico Permission for Deputy or Agent to Access Safe Deposit Box with US Legal Forms, the most extensive library of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your area/region. Click the Preview button to review the form's content.

- Read the form details to confirm you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your credentials to register for the account.

Form popularity

FAQ

Every bank branch requires a signed signature card for each person (regardless of whether or not they have an account with the branch) who wants access to your safe deposit box. The people who attempt to access your box must sign their name before they enter the bank vault.

A deputy is analogous to an attorney-in-fact. Both are appointed by the renter and either can be removed by the renter at any time. In both cases their power ends at the death of the renter. The deputy can be described as a "limited" power of attorney, the power is limited to a particular box at a specific institution.

Safe deposit boxes may be frozen or accessed if there is a judgment against your assets. These judgments can come either from private party judgments, such as collections agencies, or the IRS. Since you must supply your name in order to open a safe deposit box, the IRS can trace that box if they have reasonable cause.

After a period of time, the FDIC or the bank must transfer unclaimed property to the state. Federal law requires unclaimed deposit accounts to be transferred to the state after 18 months, and state laws differ on the period of time after which contents of safe deposit boxes must be transferred.

It's better to put the money in an interest-bearing account or certificate of deposit. Some banks expressly forbid storing cash in a safe deposit box.

What Items Should Not Be Stored in a Safe Deposit Box?Cash money. Most banks are very clear: cash should not be kept in a safe deposit box.Passports.An original will.Letters of Intent.Power of Attorney.Valuables, Jewelry or Collectibles.Spare House Keys.Illegal, Dangerous, or Liquid Items.More items...?

Dual control: Two peopleusually a bank employee and the renterare required to open the box. In this way, no one person can ever open the box and remove the contents. Authorized signature: When the safe deposit account is opened, all persons authorized to access the box sign a signature card.

Every bank branch requires a signed signature card for each person (regardless of whether or not they have an account with the branch) who wants access to your safe deposit box. The people who attempt to access your box must sign their name before they enter the bank vault.