This office lease form is a clause regarding all direct and indirect costs incurred by the landlord in the operation, maintenance, repair, overhaul, and any owner's overhead in connection with the project.

Puerto Rico Clause Defining Operating Expenses

Description

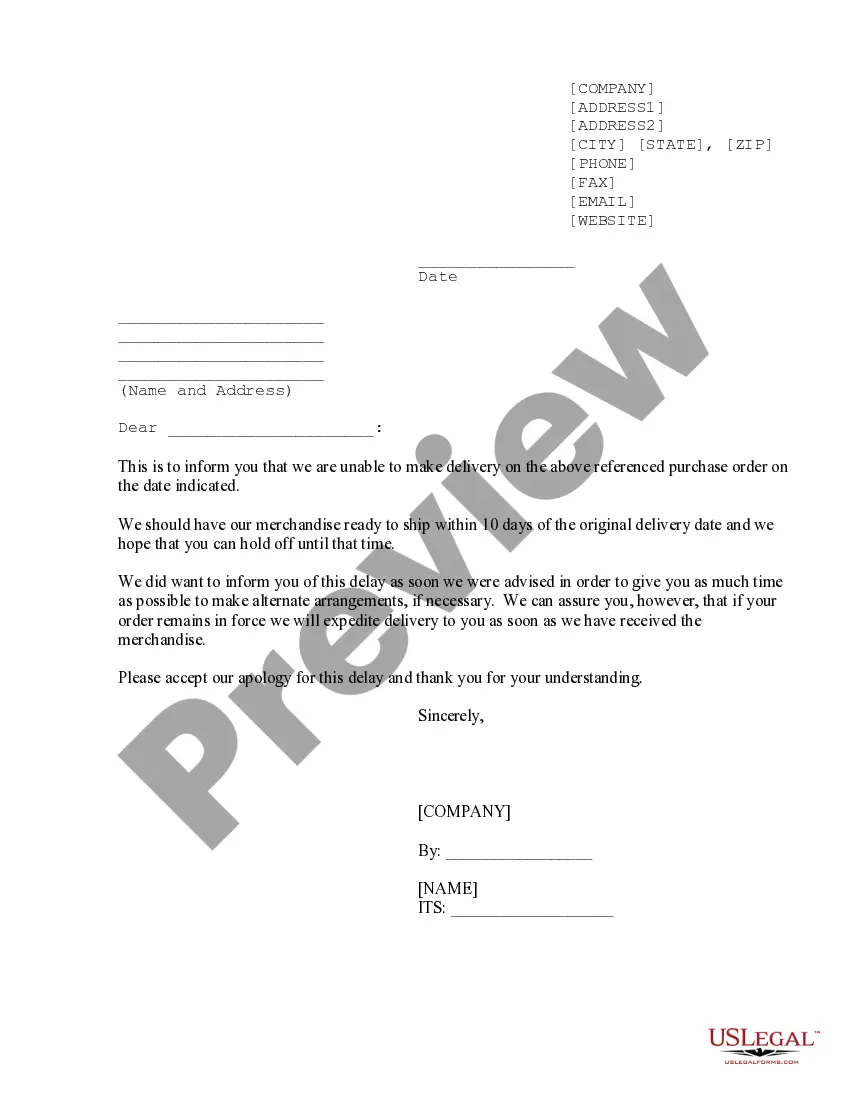

How to fill out Clause Defining Operating Expenses?

Discovering the right legitimate record web template could be a battle. Obviously, there are tons of themes accessible on the Internet, but how would you obtain the legitimate develop you need? Take advantage of the US Legal Forms internet site. The service delivers a large number of themes, including the Puerto Rico Clause Defining Operating Expenses, which you can use for organization and private demands. All of the forms are examined by professionals and fulfill state and federal demands.

When you are previously signed up, log in to the accounts and click on the Download switch to have the Puerto Rico Clause Defining Operating Expenses. Utilize your accounts to check throughout the legitimate forms you might have purchased previously. Proceed to the My Forms tab of the accounts and acquire another version of your record you need.

When you are a brand new customer of US Legal Forms, allow me to share basic guidelines that you should stick to:

- Very first, ensure you have selected the correct develop for the area/county. You can look through the form utilizing the Review switch and browse the form description to ensure this is the best for you.

- In the event the develop fails to fulfill your expectations, use the Seach industry to discover the right develop.

- When you are certain that the form is acceptable, go through the Purchase now switch to have the develop.

- Choose the rates prepare you desire and type in the needed details. Create your accounts and purchase your order making use of your PayPal accounts or credit card.

- Choose the data file formatting and obtain the legitimate record web template to the device.

- Comprehensive, change and print out and signal the acquired Puerto Rico Clause Defining Operating Expenses.

US Legal Forms may be the largest local library of legitimate forms in which you can discover different record themes. Take advantage of the company to obtain professionally-made papers that stick to condition demands.

Form popularity

FAQ

New Credits System: Act 52 authorizes the Secretary of the PR Treasury to create a tax credit management system (Tax Credit manager or TCM) as part of the PRTD's electronic platform. There will be interagency coordination to register the tax credits in the TCM system.

? Regulation 9237 issued on December 2020 In this Regulation, the Puerto Rico Treasury Department established the rules for taxpayers engaged in mail order sales to be considered a Merchant for purposes of the PR SUT (Merchant).

Act 60 was intended to boost the Puerto Rican economy by encouraging mainland U.S. citizens to do business and live in Puerto Rico, and as is the case with many incentive programs, the opportunity and temptation to abuse these programs has led some to do just that.

PR Code Section 4010.01(ddd) includes a detailed list of the Marketplace Facilitator Activities. Merchants are generally required to collect, report and remit the SUT, unless they are considered non-withholding agents for SUT purposes.

In particular, Act 40 introduced a trading in commodities safe harbour for foreign corporations and non-resident individuals, increased the threshold for submitting audited financial statements with Puerto Rico income and personal property tax returns, and clarified the date on which a partnership classification ...

Act 52-2022?enacted into law in Puerto Rico on June 30, 2022?allows taxpayers to amend their existing tax decrees to replace the existing income tax and royalty withholding tax framework with a new income tax and royalty withholding tax framework.

Along with Puerto Rico Tax Act 20, Puerto Rico adopted an additional incentive, the ?Act to Promote the Relocation of Individual Investors,? Puerto Rico Tax Act 22, to stimulate economic development by offering nonresident individuals 100% tax exemptions on all interest, all dividends, and all long-term capital gains.

Act 60 was intended to boost the Puerto Rican economy by encouraging mainland U.S. citizens to do business and live in Puerto Rico, and as is the case with many incentive programs, the opportunity and temptation to abuse these programs has led some to do just that.