Virginia Agreement to Sell Partnership Interest to Third Party

Description

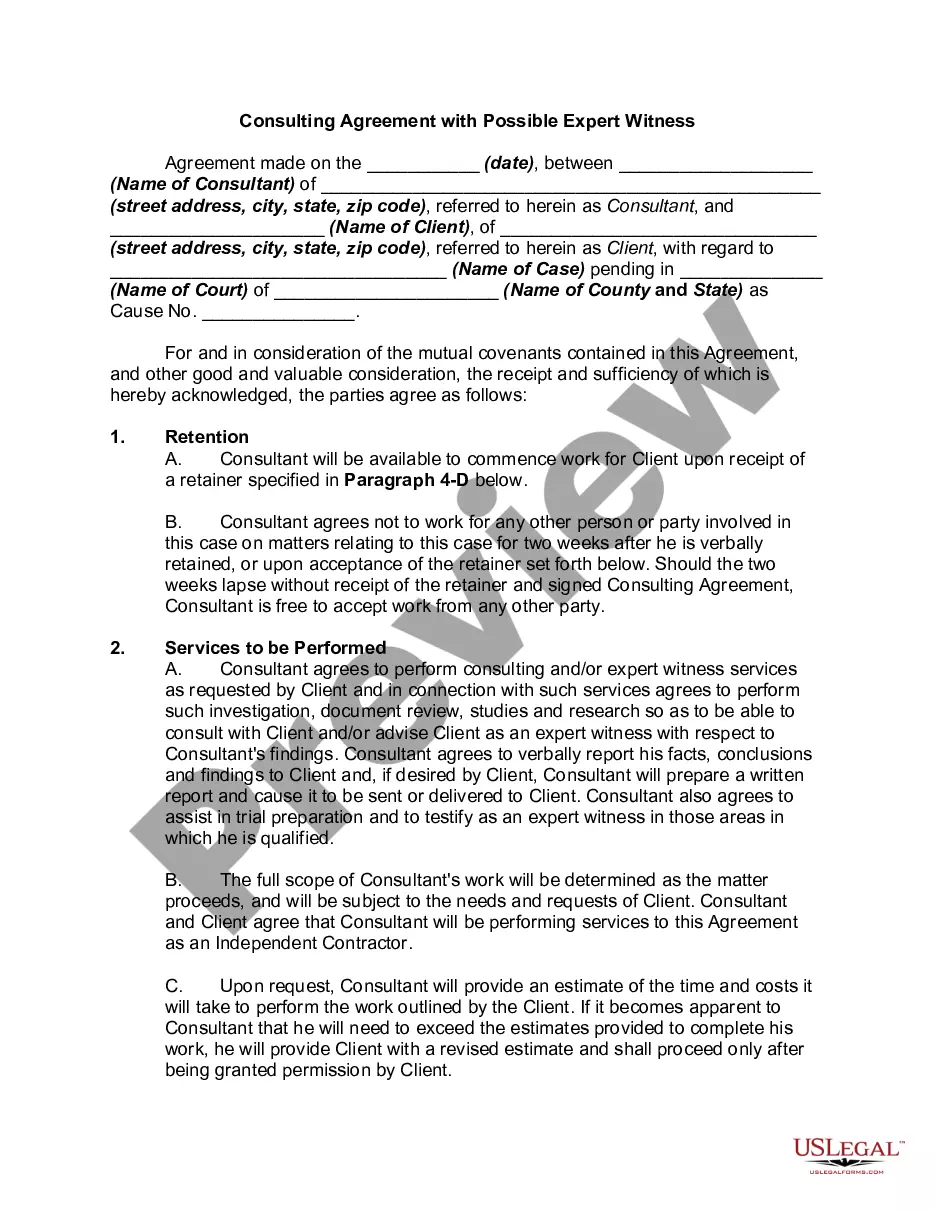

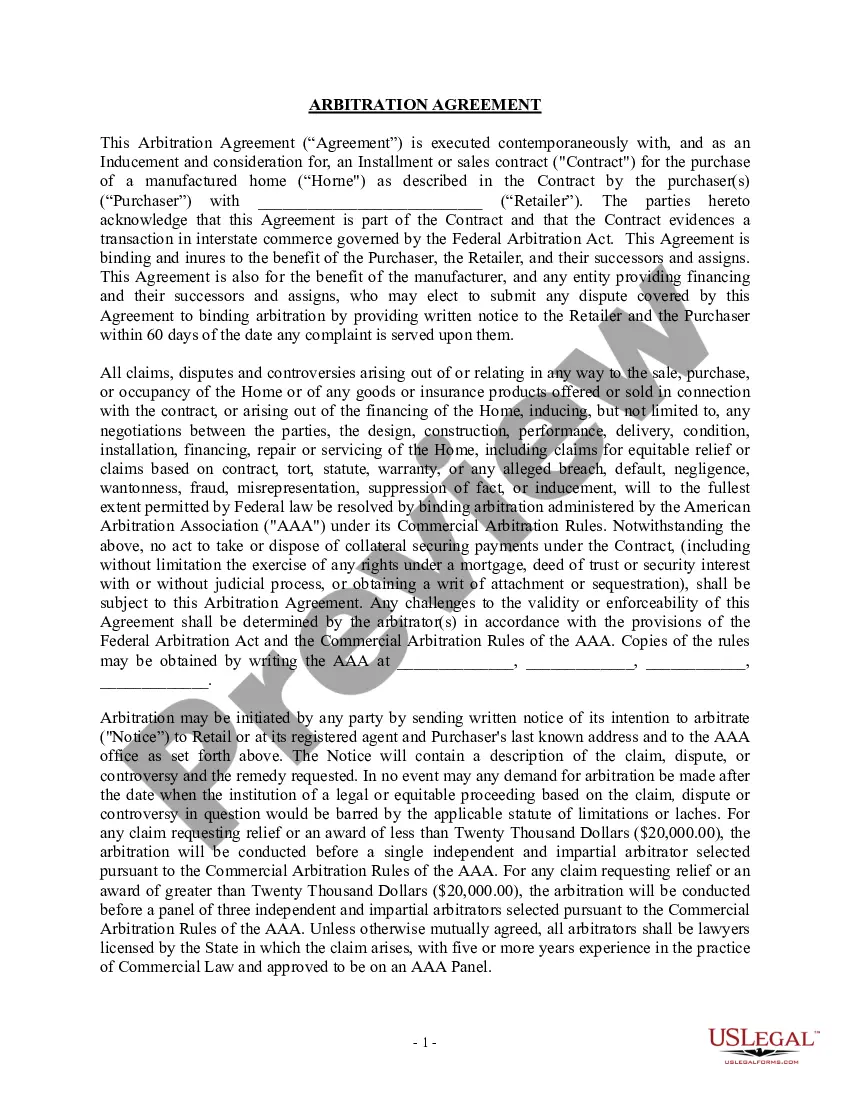

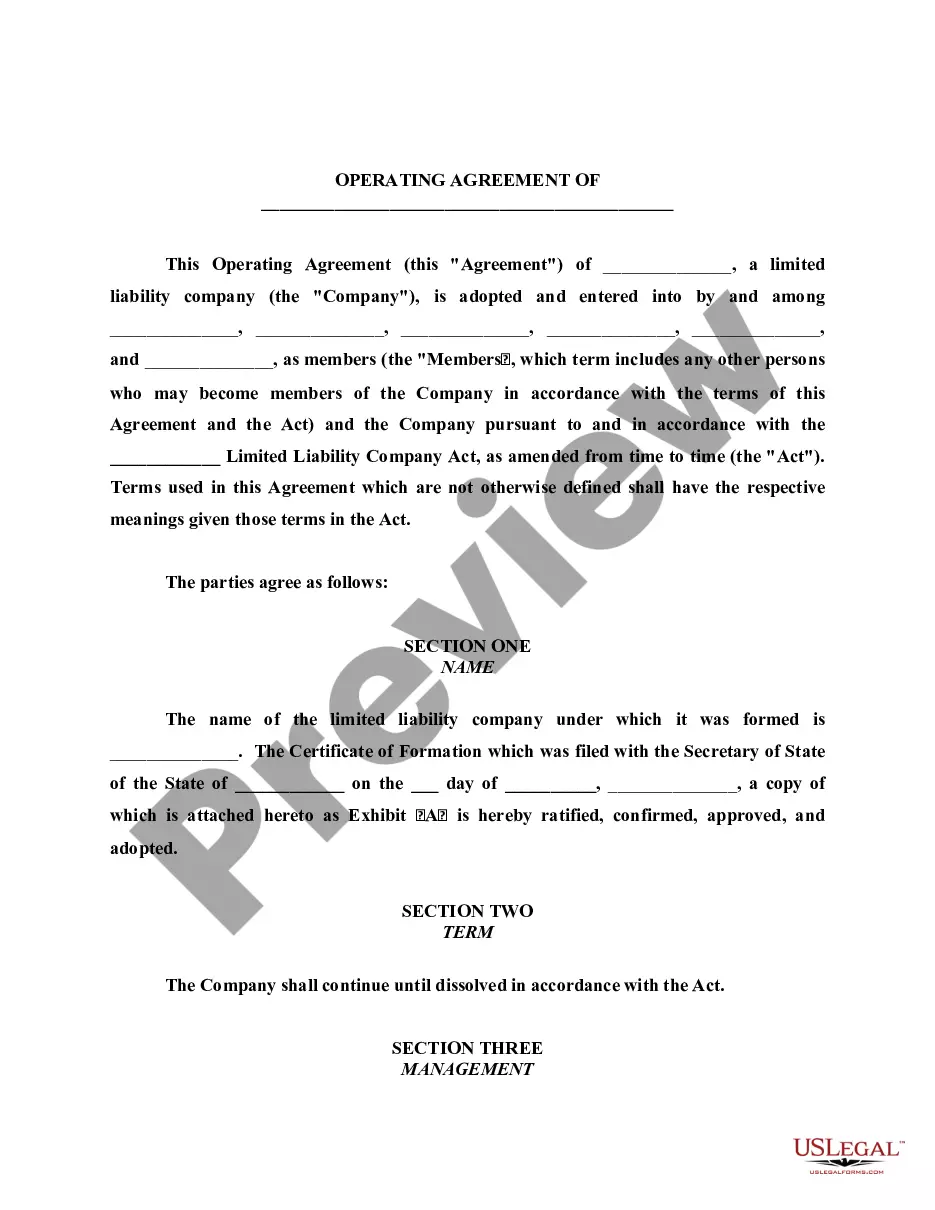

How to fill out Agreement To Sell Partnership Interest To Third Party?

If you wish to be thorough, download, or create official document templates, utilize US Legal Forms, the largest assortment of legal forms, accessible online.

Employ the site's straightforward and user-friendly search to locate the documents you require.

Different templates for business and personal purposes are categorized by type and jurisdiction, or by keywords. Utilize US Legal Forms to find the Virginia Agreement to Sell Partnership Interest to Third Party with just a few clicks.

Every legal document template you purchase is yours indefinitely. You will have access to every form you acquired in your account. Go to the My documents section and select a form to print or download again.

Be proactive and download, and print the Virginia Agreement to Sell Partnership Interest to Third Party using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to obtain the Virginia Agreement to Sell Partnership Interest to Third Party.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure that you have selected the form for your correct city/state.

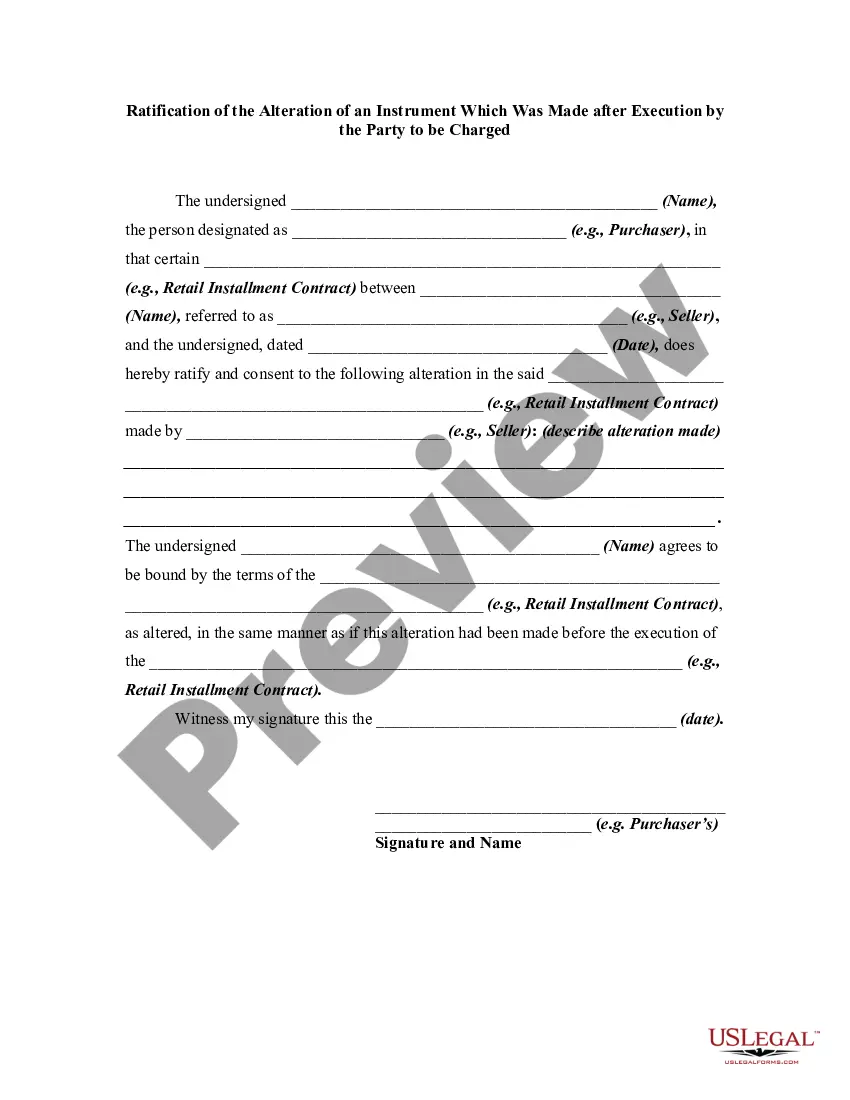

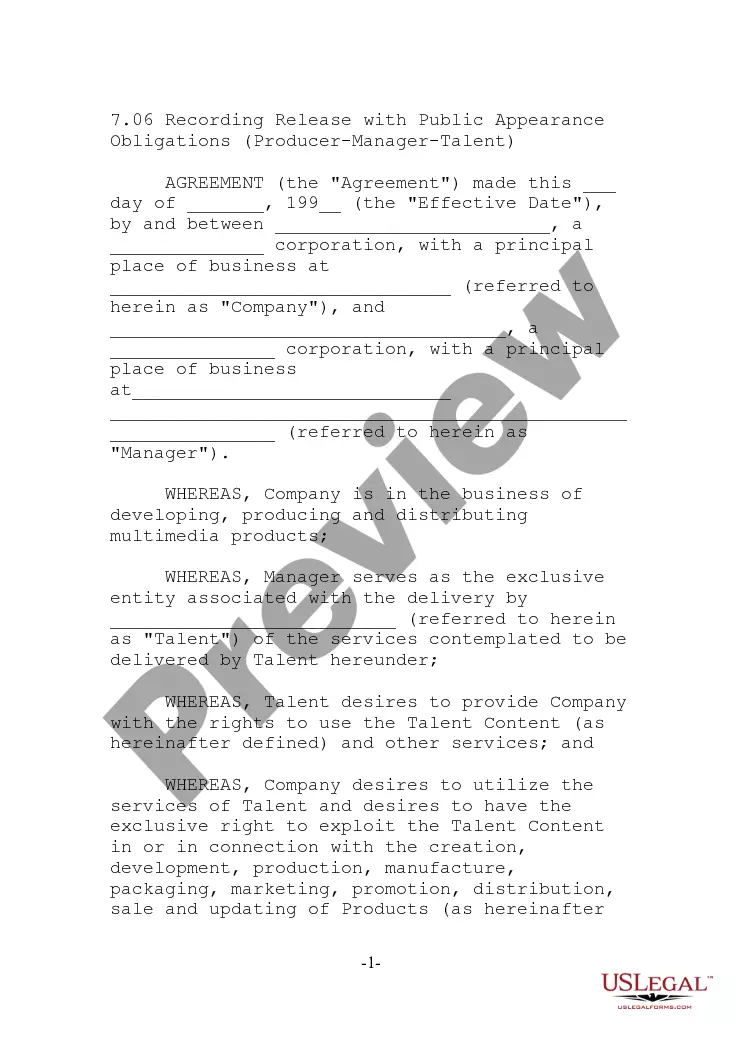

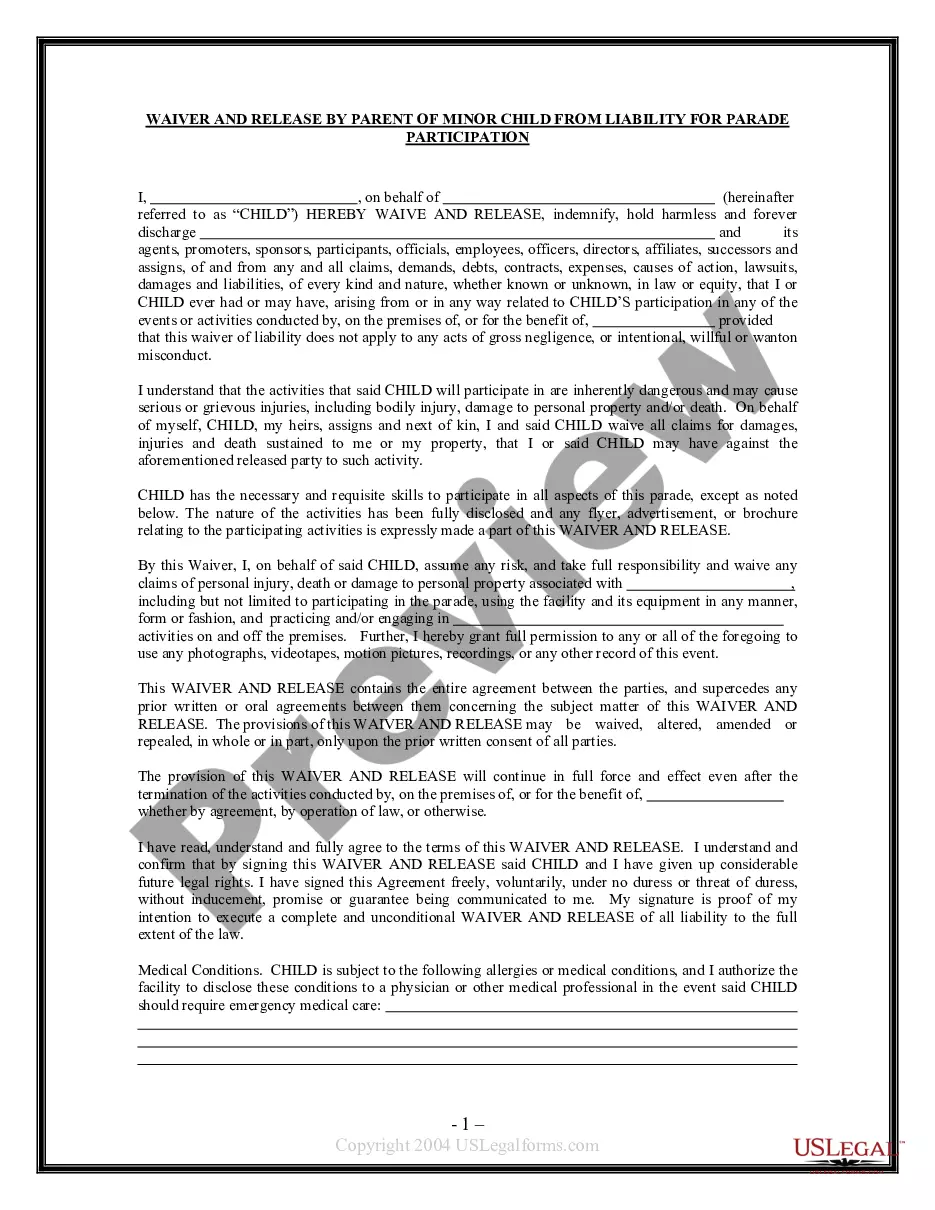

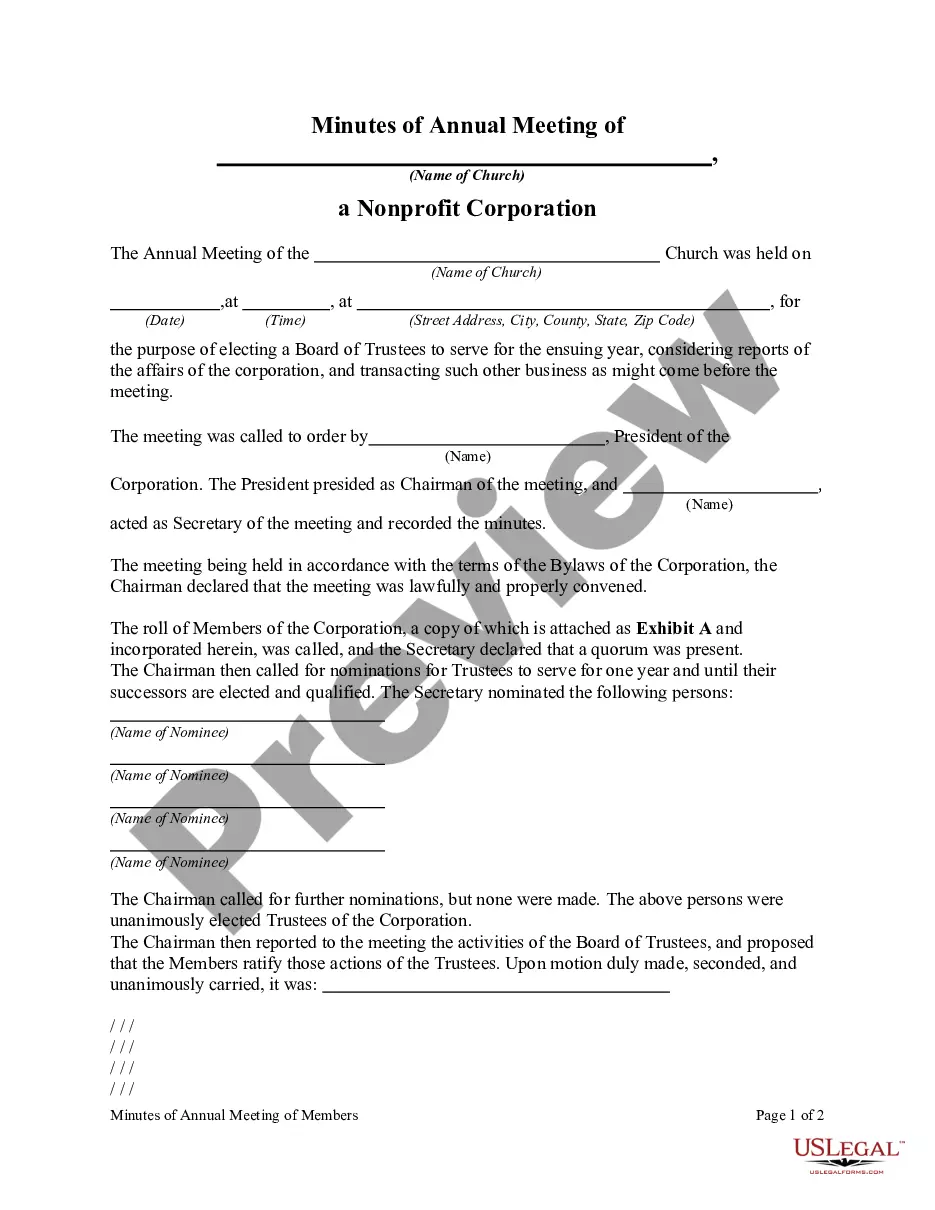

- Step 2. Use the Review option to inspect the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Virginia Agreement to Sell Partnership Interest to Third Party.

Form popularity

FAQ

When accounting for the sale of partnership interest, begin by determining the selling partner's basis in the partnership. You must also record any gains or losses resulting from the sale, which affects the partner’s capital account. Using a Virginia Agreement to Sell Partnership Interest to Third Party can assist in documenting these transactions clearly. This ensures that all financial implications are managed correctly and supports accurate accounting practices.

If your business is a limited liability company or general partnership, your partner can't sell the company without your consent. He may, however, sell his interest in the company if you don't have a buy-sell agreement.

The liability of all the partners is joint and several even though the act of the firm may have been done by one of them. Thus a third party, if he so likes, can bring an action against any one of them severally or against any two or more of them jointly.

Partnerships are generally guided by a partnership agreement, which may allow or restrict transfers of partnership interest. Partners must follow the terms of the agreement. If the agreement allows it, a partner can transfer ownership stakes in terms of profits, voting rights and responsibilities.

A partner is an agent of the partnership. When a partner has the apparent or actual authority and acts on behalf of the business, the partner binds the partnership and each of the partners for the resulting obligations.

Liability for partnership debts Partners are 'jointly and severally liable' for the firm's debts. This means that the firm's creditors can take action against any partner. Also, they can take action against more than one partner at the same time.

A business partnership agreement is a legally binding document that outlines details about business operations, ownership stake, financials and decision-making. Business partnership agreements, when coupled with other legal entity documents, could limit liability for each partner.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

Partners in a firm are jointly and severally liable for any breach of trust committed by one partner, in which they were implicated. Persons other than partners may have authority to deal with third parties on behalf of the firm; however, such persons have no implied mandate.

Your legal partnership is essentially a single legal entity, and the situation can become complicated when one partner wants to sell his or her shares and the other partner refuses. Whether or not you can force your business partner to buy you out largely depends on your written agreement.