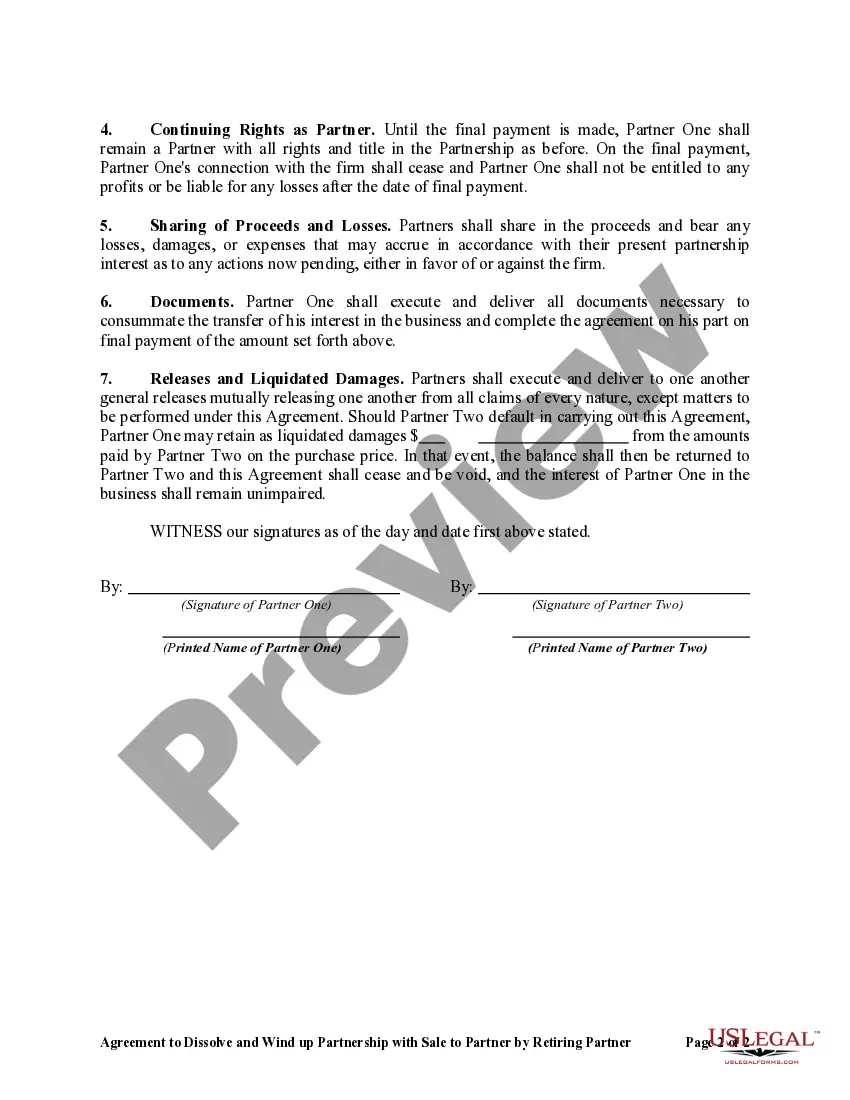

Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By using the website, you will find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner in moments.

If you have an account, Log In to download the Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner from your US Legal Forms collection. The Download button will be available on every form you view. You can access all previously saved forms from the My documents section of your account.

Complete the payment process. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Edit. Fill in, modify, print, and sign the saved Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. Every template you added to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you want. Obtain access to the Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you've chosen the correct form for the area/state.

- Click on the Preview button to review the form’s details.

- Check the form information to ensure you have selected the right one.

- If the form doesn’t fit your needs, use the Lookup field at the top of the screen to find the one that does.

- If you're satisfied with the form, confirm your selection by clicking on the Acquire now button.

- Then, choose the payment plan you prefer and enter your information to register for an account.

Form popularity

FAQ

Yes, partners can still be held liable for obligations incurred during the partnership even after it has been dissolved. The Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can specify the extent of this liability and how it should be managed. Importantly, any debts must be resolved before assets are distributed, as partners are responsible for partnership obligations that remain. Careful planning and clear agreements can protect partners from unforeseen liabilities.

Dissolving a partnership triggers a series of important steps, including winding up the business activities and addressing any outstanding debts. The Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is essential during this phase, as it outlines the proper procedures for asset distribution and obligations. Partners must communicate openly to ensure an orderly transition. Taking these measures can help minimize complications and facilitate a straightforward process.

Dissolving a partnership agreement typically starts with reviewing the partnership contract for specific clauses related to dissolution. The Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner serves as an excellent template for this process. Once the terms are agreed upon, all partners should formally agree to the dissolution in writing. Completing this procedure ensures a smooth transition and helps prevent misunderstandings later.

Partners retain several rights after the dissolution of a firm, primarily the right to claim their share of residual assets. The Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner helps clarify these rights in greater detail. Additionally, partners have the ability to make necessary decisions regarding the settlement of remaining obligations and the distribution of assets. This framework supports a fair outcome for all parties involved.

Following the dissolution of a partnership, the next steps involve winding up the business affairs. This process includes settling debts, liquidating assets, and distributing any remaining property among partners per the Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. It is vital to follow these steps diligently to avoid potential disputes. A well-structured agreement can facilitate this process efficiently.

After the dissolution of a partnership, partners maintain the right to their share of the partnership assets, subject to the partnership agreement. The Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner clearly outlines these rights and responsibilities. Partners can also participate in the process of winding up the affairs of the partnership, ensuring that all debts are settled before asset distribution. Therefore, understanding these rights is crucial for a fair and smooth transition.

The exit of a partner can alter the operational and financial structure of a partnership. Utilizing the Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is crucial in managing this transition effectively. It lays out essential procedures for settling accounts, valuing interests, and continuing business operations with minimal disruption.

A partner may withdraw at any time, but it's essential to follow the procedures set forth in the partnership agreement. The Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner outlines the steps that need to be followed during such withdrawals. Implementing this agreement can prevent potential conflicts and clarify future actions, ensuring greater stability for the remaining partners.

If a partner withdraws, it can significantly impact the partnership dynamics. The Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner helps in evaluating and compensating the exiting partner correctly. This ensures that the transition is as seamless as possible, allowing the remaining partners to continue their business without major disruptions.

Winding up a partnership involves settling the firm’s debts, distributing remaining assets, and formally dissolving the partnership. The Virginia Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner serves as a comprehensive guide for this process. It ensures that every partner’s contributions and interests are honored while simplifying the steps necessary to close the business.