West Virginia Agreement to Sell Partnership Interest to Third Party

Description

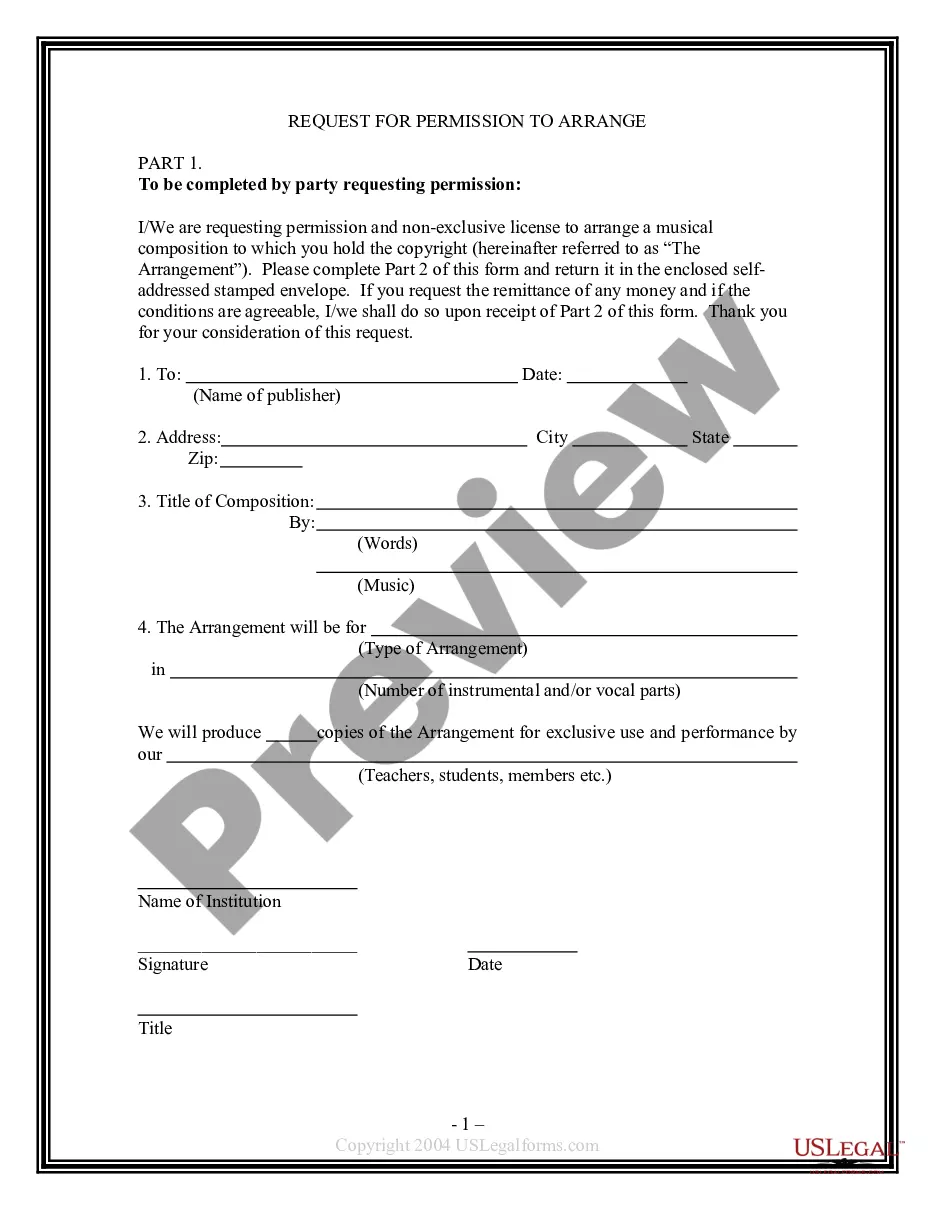

How to fill out Agreement To Sell Partnership Interest To Third Party?

You can spend hours online searching for the valid document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by experts.

You can easily obtain or create the West Virginia Agreement to Sell Partnership Interest to Third Party through their service.

If necessary, make modifications to the document. You can complete, edit, sign, and print the West Virginia Agreement to Sell Partnership Interest to Third Party.

- If you possess a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, edit, print, or sign the West Virginia Agreement to Sell Partnership Interest to Third Party.

- Each legal document template you download is yours indefinitely.

- To get another copy of the purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your state/city.

- Review the form outline to confirm you've chosen the correct form.

Form popularity

FAQ

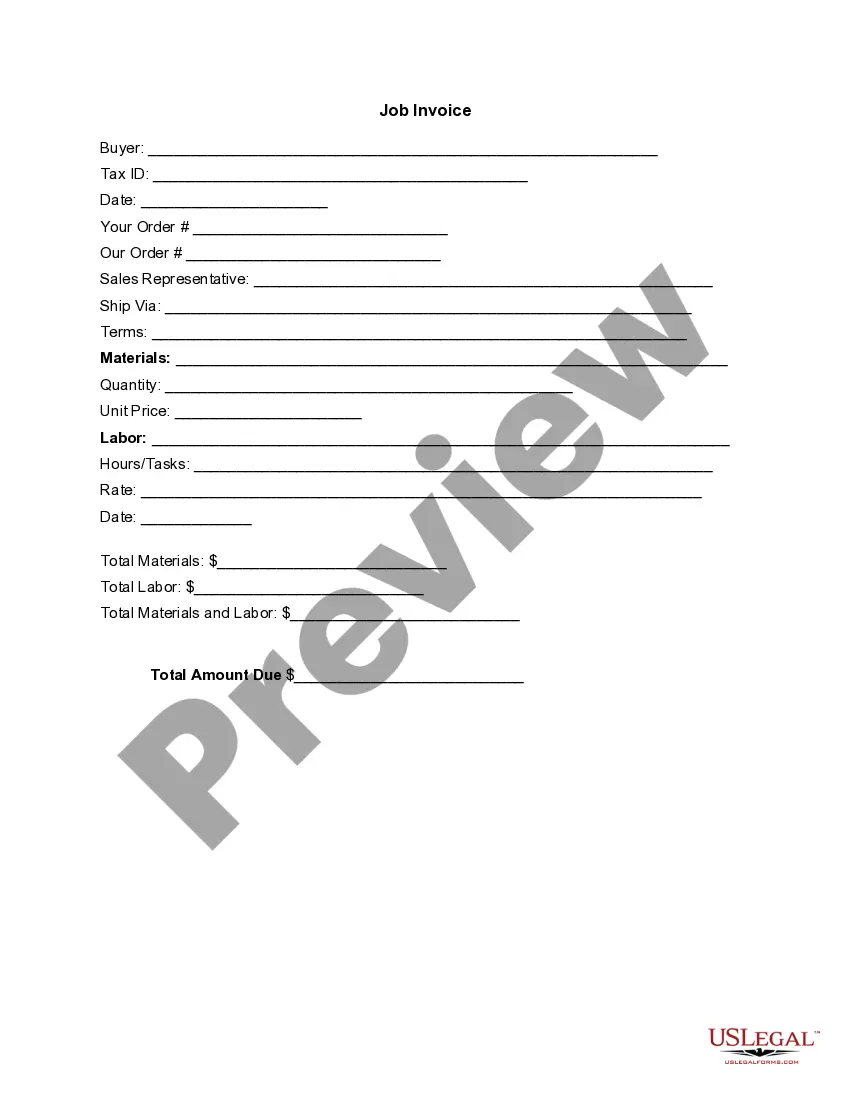

To account for the sale of partnership interest, you need to adjust the capital accounts based on the sale proceeds. The selling partner must report any financial implications, such as gains or losses, on their taxes. Using the West Virginia Agreement to Sell Partnership Interest to Third Party can help ensure you manage these accounting aspects properly.

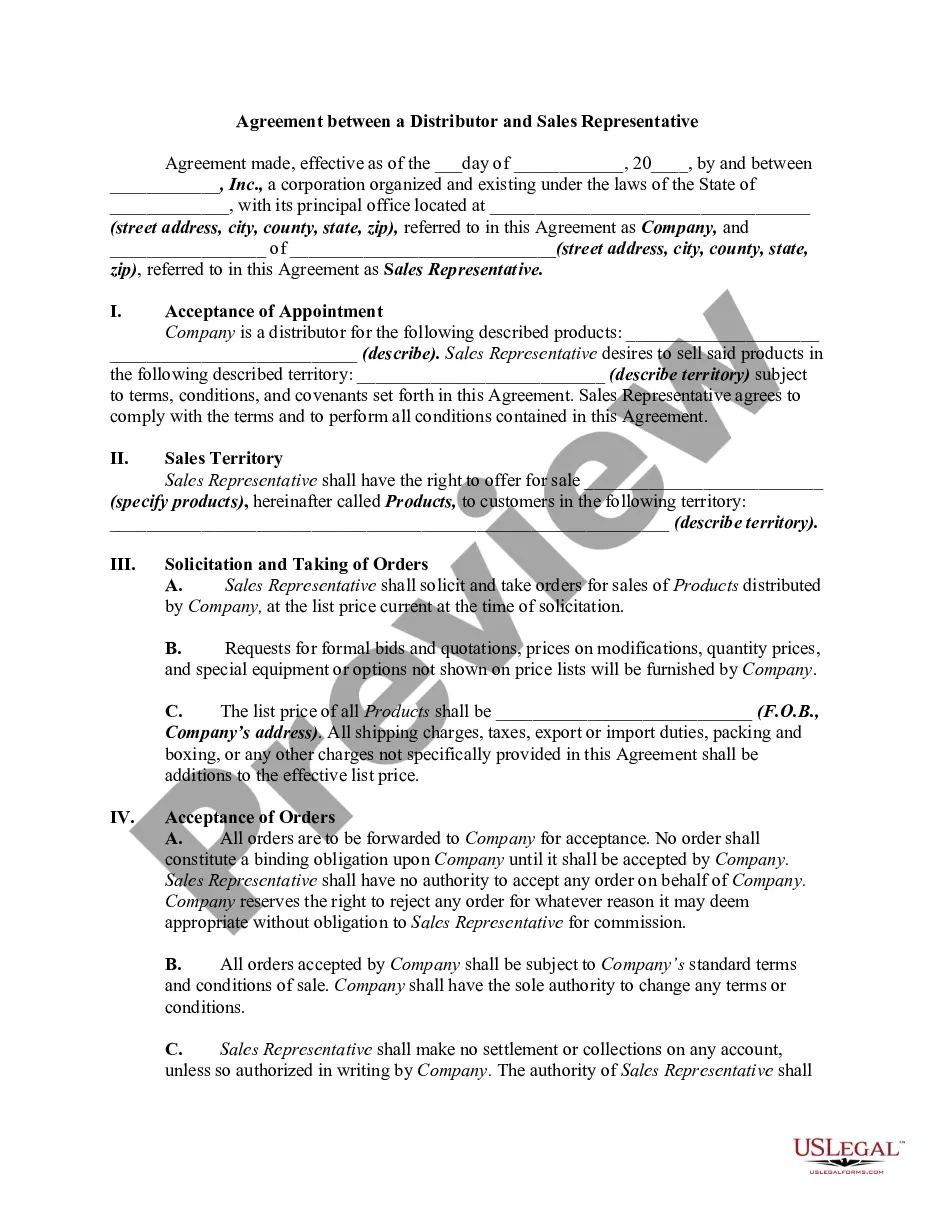

To set up a partnership agreement, start by discussing key elements with your potential partners. Clearly define each partner's roles, contributions, and share of profits in the agreement. A West Virginia Agreement to Sell Partnership Interest to Third Party can formalize your partnership, ensuring everyone is on the same page. Our platform offers user-friendly templates to help you create a comprehensive agreement.

Because of its simplicity and tax benefits, a general partnership is one of the most common legal business entities. However, it's important to note that each partner is personally responsible for the business, including debts and lawsuits, and is held liable for the actions of their partner(s).

(1) A Partnership Agreement is an agreement between two or more persons for carrying on a Business together with the object of making a profit.

West Virginia Tax Nexus Generally, a business has nexus in West Virginia when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives.

A general partnership is a business made up of two or more partners, each sharing the business's debts, liabilities, and assets. Partners assume unlimited liability, potentially subjecting their personal assets to seizure if the partnership becomes insolvent. Partners should create a written partnership agreement.

A partnership is not a separate tax entity from its owners; instead, it's what the IRS calls a "pass-through entity." This means the partnership itself does not pay any income taxes on profits.

In a partnership, co-owners report their share of the business's income and losses on their personal tax returns. A corporation, which is formed by filing articles of incorporation, is a legally separate business entity owned by shareholders. An elected board and board-appointed officers manage the corporation.

A partnership agreement is the legal document that dictates the way a business is run and details the relationship between each partner.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.