Puerto Rico Affidavit of Heirship for the Owner of the Property

Description

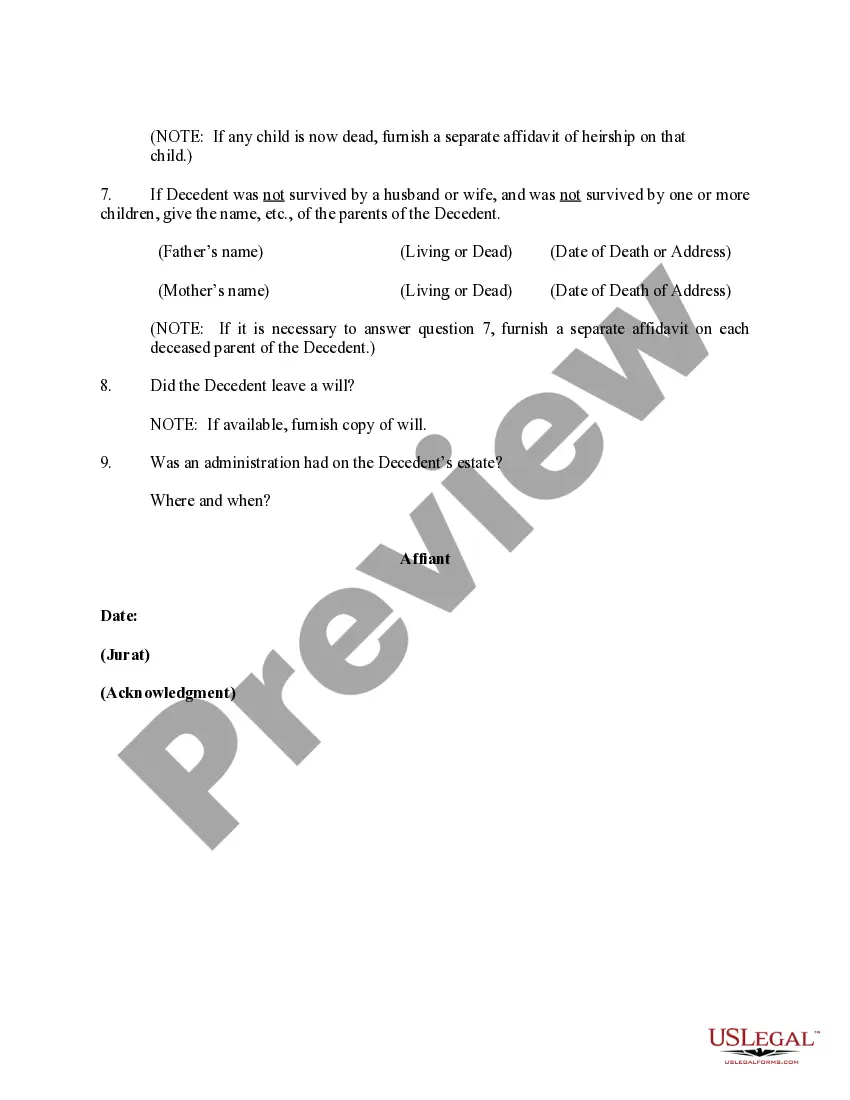

How to fill out Affidavit Of Heirship For The Owner Of The Property?

Have you been in a place the place you need paperwork for either business or person uses virtually every time? There are a lot of legitimate papers layouts available on the net, but discovering kinds you can rely isn`t straightforward. US Legal Forms offers 1000s of kind layouts, such as the Puerto Rico Affidavit of Heirship for the Owner of the Property, that are created to fulfill state and federal needs.

If you are currently knowledgeable about US Legal Forms internet site and have an account, simply log in. Next, you may acquire the Puerto Rico Affidavit of Heirship for the Owner of the Property design.

Should you not have an profile and wish to begin using US Legal Forms, adopt these measures:

- Find the kind you will need and make sure it is for your proper area/region.

- Utilize the Review key to check the form.

- See the outline to actually have chosen the correct kind.

- In the event the kind isn`t what you are trying to find, utilize the Search discipline to discover the kind that meets your needs and needs.

- If you get the proper kind, click on Get now.

- Choose the pricing program you need, fill in the necessary information to make your money, and pay for the order with your PayPal or credit card.

- Choose a practical data file formatting and acquire your duplicate.

Get each of the papers layouts you might have bought in the My Forms food selection. You can get a further duplicate of Puerto Rico Affidavit of Heirship for the Owner of the Property any time, if necessary. Just go through the essential kind to acquire or produce the papers design.

Use US Legal Forms, by far the most substantial collection of legitimate kinds, to save time as well as prevent mistakes. The support offers expertly manufactured legitimate papers layouts which can be used for a variety of uses. Produce an account on US Legal Forms and start producing your way of life a little easier.

Form popularity

FAQ

This means that if someone dies owning property in Puerto Rico, in order to transfer that property to another person, you must go to court to get the permission to transfer and register the property to the new person. This is what is commonly known in the U.S. as probating an estate.

A: After November 28, 2020, Puerto Rico rule of law determines that the heirs of an estate are the deceased's spouse and children. Before that date, the estate belongs to the deceased's children with an inheritance lien in favor of your widowed mother (called in Spanish, "la cuota viudal").

If no Puerto Rican will exists, then the court will issue a resolution declaring who are the heirs, commonly known as a "Declaratoria de Herederos". There is a possibility that an additional hearing may be needed before the judge can decide who are the heirs.

The Declaration of Heirs aims to legally establish the quality of heirs who succeed in an inheritance, establishing their legitimacy to proceed to the division of that inheritance. As a rule, the declaration is made to designate the heirs; and not some legatees who also succeed in that inheritance.

As of November 28, 2020, inheritances are distributed in two parts. 50% is of free disposition and the other half (legitimate) is divided equally among the forced heirs, which are the children and now include the widow or widower.

Puerto Rico laws grant rights of forced heirship to the children of the deceased. In the absence of children, or other descendants of such children, then to the parents of the deceased. In the absence of children, grandchildren or other direct descendants, the parents are considered forced heirs.

Property That May Avoid Probate Property held in a trust3 Jointly held property (but not common property) Death benefits from insurance policies (unless payable to the estate)4 Property given away before you die. Assets in a pay-on-death account. Retirement accounts with a named beneficiary.

If no Puerto Rican will exists, then the court will issue a resolution declaring who are the heirs, commonly known as a "Declaratoria de Herederos". There is a possibility that an additional hearing may be needed before the judge can decide who are the heirs. If so, the judge will schedule one.