North Carolina Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

If you need to compile, obtain, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's straightforward and efficient search feature to find the documents you require.

A selection of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose your payment plan and provide your details to register for an account.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the North Carolina Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the North Carolina Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

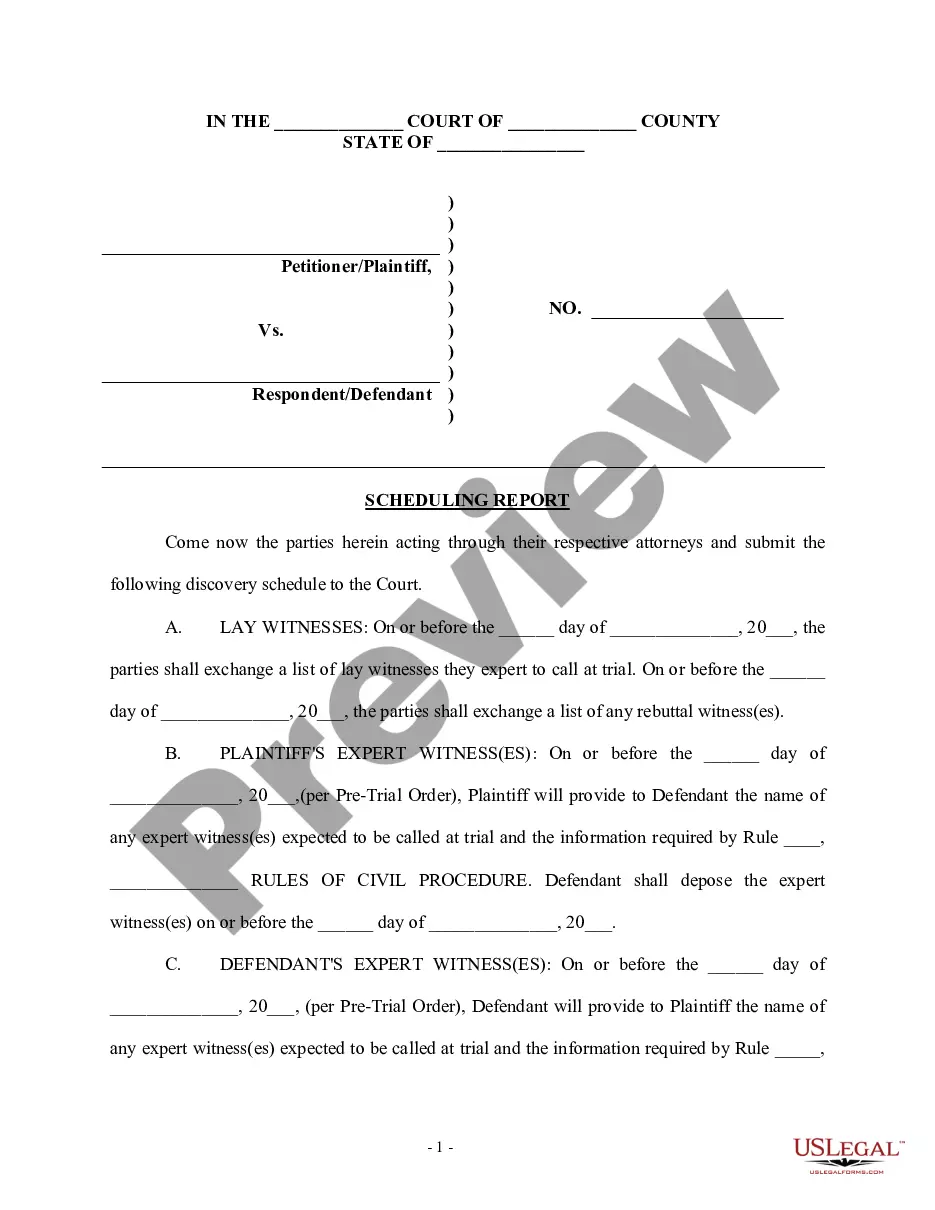

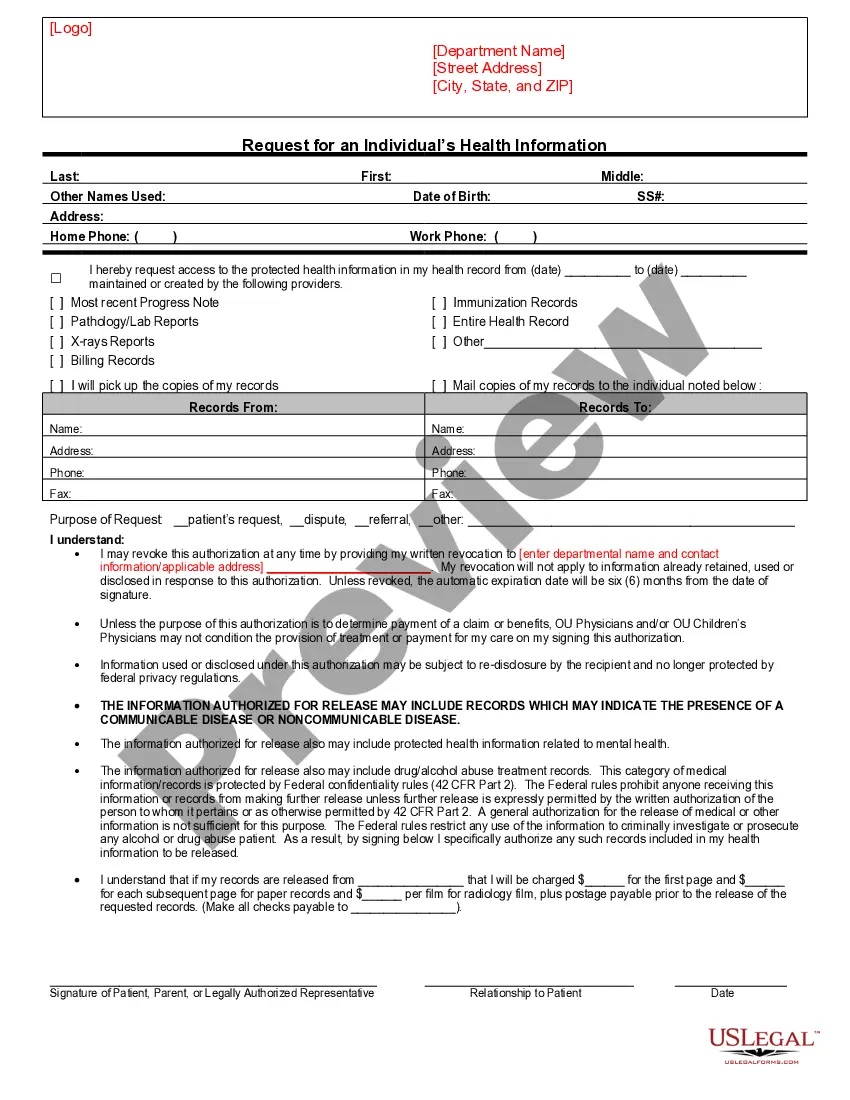

- Step 2. Utilize the Preview option to review the form's content. Be sure to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

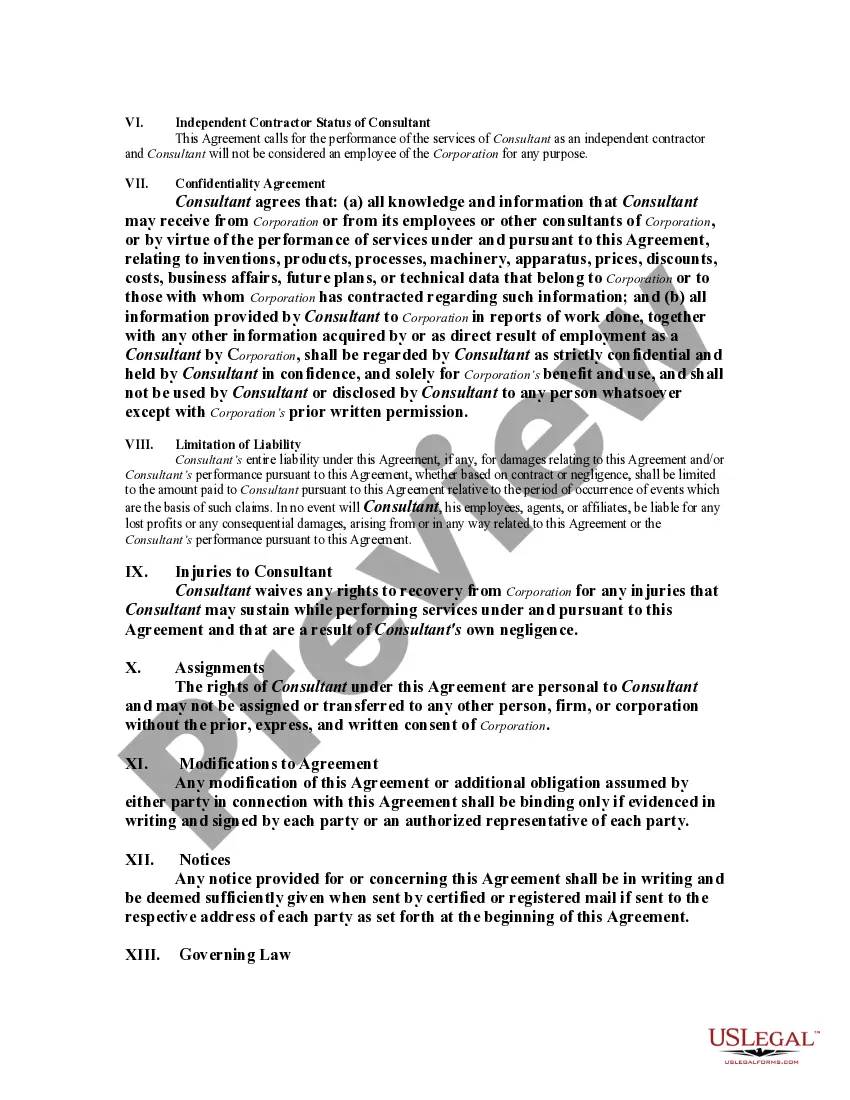

A contract becomes legally binding in North Carolina when it includes essential elements such as offer, acceptance, consideration, and mutual intent to create a legal relationship. Additionally, all parties involved must have the legal capacity to enter into the contract. For those entering into a North Carolina Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it is vital to ensure that these elements are clear and well-defined. Clarity helps prevent misunderstandings and strengthens the enforceability of the agreement.

A limitation of liability clause restricts the amount one party might be liable for in the event of a claim. In a North Carolina Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, this clause is crucial for protecting consultants from excessive financial losses while ensuring fair compensation for their services. Utilizing this clause effectively supports both consultants and clients in defining their financial responsibilities.

The standard indemnification clause typically requires one party to compensate another for losses incurred due to breaches or misconduct. In a North Carolina Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, this clause helps consultants safeguard themselves against claims arising from their work. Including a clear indemnification provision ensures that all parties understand their roles and potential liabilities.

The liabilities of a consultant often include the obligation to deliver services as outlined in the contract and accountability for any damages resulting from negligence or failure to perform. Under a North Carolina Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, consultants may limit their financial exposure to certain amounts. Understanding these liabilities helps both consultants and clients manage their expectations and responsibilities.

A liability clause in an agreement outlines the responsibilities and potential damages that one party may incur due to their actions. In the context of a North Carolina Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it helps define the extent of liability in case of non-performance or negligence. This clause is critical as it protects both parties by clearly stating the expectations and limitations.

The timeline to become a contractor in North Carolina varies based on the type of projects you undertake. For small projects, the process can be relatively quick, possibly a few weeks. For larger projects that require licensing, it may take several months to complete the required training and obtain the necessary documentation, all of which can be managed through a North Carolina Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

To become an independent contractor in North Carolina, you should start by deciding on a business structure, such as sole proprietorship or LLC. Next, you must register your business with the state and get any necessary permits or licenses. Drafting a North Carolina Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause is essential to establish terms and protect your rights.

Yes, in North Carolina, you can act as your own contractor if you are taking on a project for your own property. This means you can manage the work and hire subcontractors as needed. A North Carolina Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can provide clarity and protect you during this process.

Limitations of liability in consulting contracts often outline the extent to which a consultant can be held liable for damages. These clauses typically cap liability to a certain amount or exclude certain types of damages altogether. When drafting a North Carolina Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it’s vital to ensure that both parties understand the implications.

In North Carolina, you do not need a general contractor license if your work costs less than $30,000. However, if you plan to undertake larger projects, obtaining a license is essential. A North Carolina Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can help clarify your status and protect your interests.