New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

US Legal Forms - among the most prominent collections of legal documents in the United States - offers a variety of legal template forms that you can download or create.

By utilizing the website, you can access thousands of forms for business and personal applications, categorized by type, state, or keywords. You can find the most recent versions of forms such as the New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause within moments.

If you already have a monthly membership, Log In and retrieve the New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause from the US Legal Forms collection. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and obtain the form to your device. Make modifications. Complete, edit, print, and sign the downloaded New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. Each template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or create another version, simply visit the My documents section and click on the form you need. Gain access to the New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of specialized and state-specific templates that meet your business or personal needs and specifications.

- If you are using US Legal Forms for the first time, here are simple steps to help you begin.

- Ensure you have chosen the correct form for your city/area.

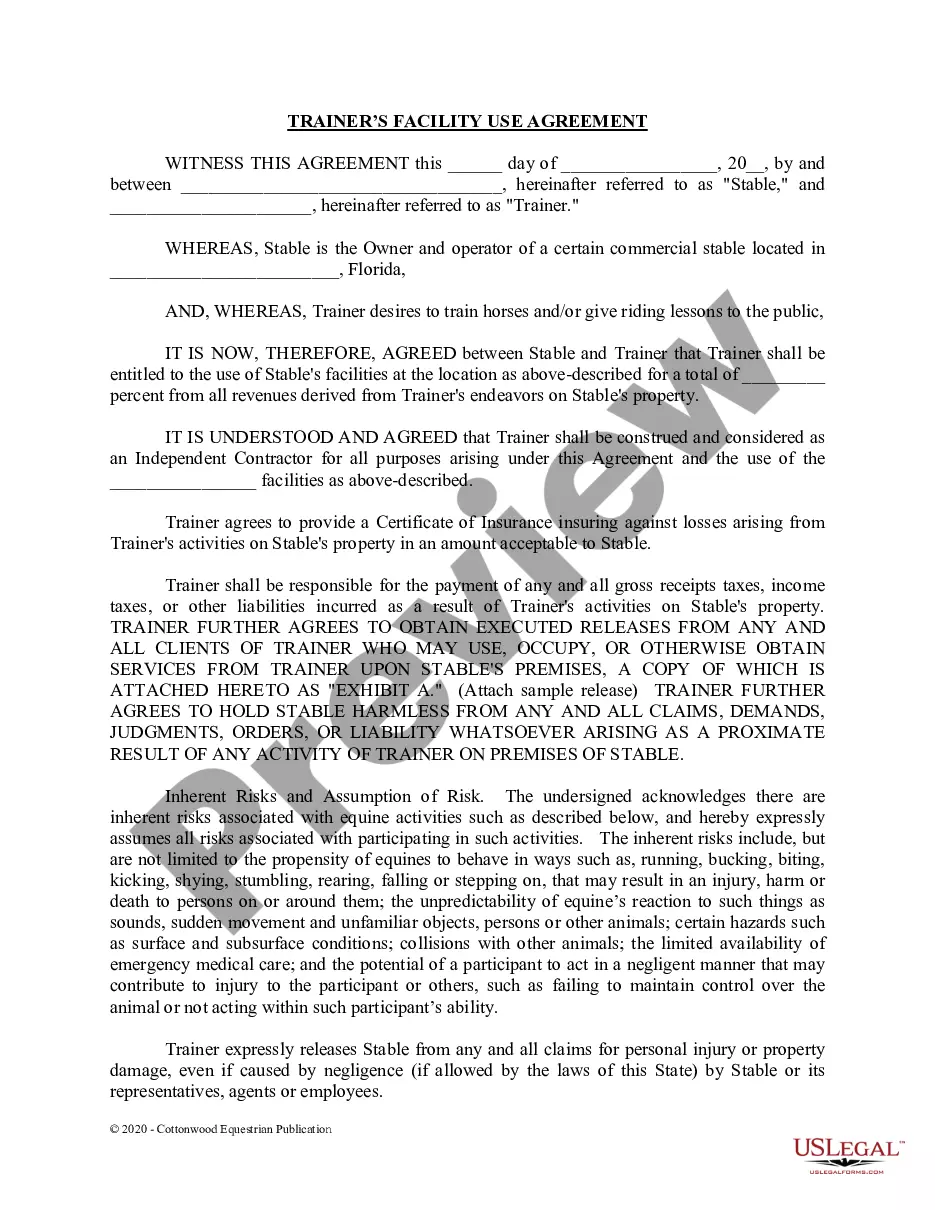

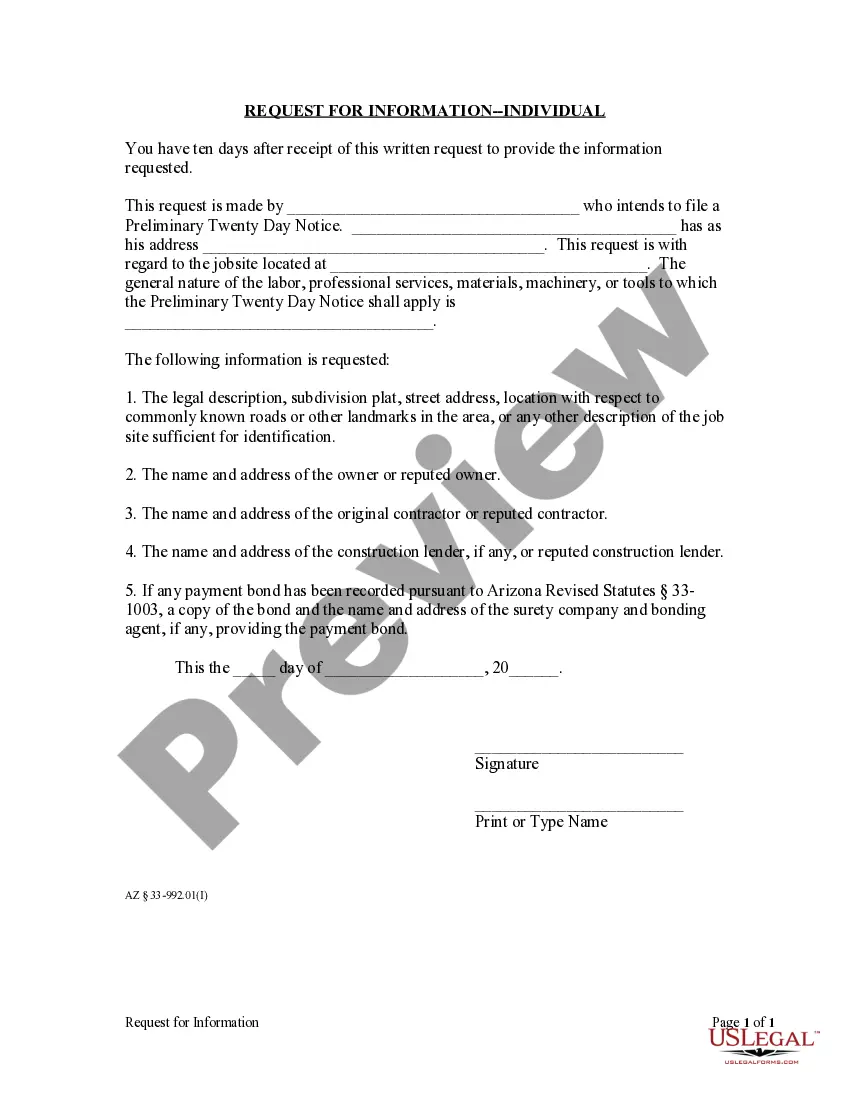

- Click the Preview button to review the form's details.

- Consult the form outline to confirm that you have selected the appropriate form.

- If the form does not meet your requirements, utilize the Search area at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose the subscription plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Yes, a US company can hire an independent contractor in Mexico, but it is essential to understand the legal requirements. Both parties should agree on terms that comply with local and international laws. Additionally, utilizing a New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can help structure the agreement effectively and ensure mutual understanding.

Writing an independent contractor agreement involves outlining the details of the working relationship, including scope, payment, and deadlines. Clearly state each party's responsibilities and include any provisions for termination or dispute resolution. Using a New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause enhances the clarity and protection of the agreement.

To write a simple contract agreement, include essential details such as the names of the parties, the services to be provided, and payment terms. Ensure that you outline beginning and ending dates for the work and add a termination clause if necessary. For added protection, consider incorporating a New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

In New Mexico, an independent contractor agreement outlines the relationship between the contractor and the hiring company. It details the nature of the work, payment arrangements, and expectations. To ensure legal protection, consider incorporating a New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause in your agreement.

The best contract for contractors is one that clearly defines the scope of work, payment terms, and expectations. It should also address potential liabilities and disputes. A well-structured New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can help ensure that both parties understand their rights and responsibilities.

The agreement between a company and a contractor is typically formalized through a contract that specifies the contractor's obligations. This agreement covers aspects such as project scope, payment terms, and deadlines. Utilizing a New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause provides a legal framework for accountability.

To write a contract for a contractor, start by identifying the parties involved and the services to be performed. Clearly outline the payment terms, deadlines, and expectations. Incorporating a New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can further clarify responsibilities and protect all parties.

As an independent contractor, you typically need to fill out a W-9 form to provide your taxpayer identification information. This form allows the company hiring you to report payments to the IRS. Additionally, having a clearly defined New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause helps protect both parties.

Self-employment tax in New Mexico includes Social Security and Medicare taxes, which total 15.3% on your net earnings. This tax applies to independent contractors and self-employed individuals, making it essential to factor this into your financial planning. When drafting your New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, understanding these obligations helps you establish clear payment terms. Consider consulting a tax professional to manage these aspects effectively and ensure compliance.

In New Mexico, independent contractors generally do not require a state business license, but it can vary by locality. Cities or counties may have specific regulations that necessitate a local license, especially for certain professions. Therefore, it is advisable to check your local guidelines when establishing your New Mexico Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. Ensuring compliance with local requirements helps you avoid potential penalties and ensures smooth business operations.