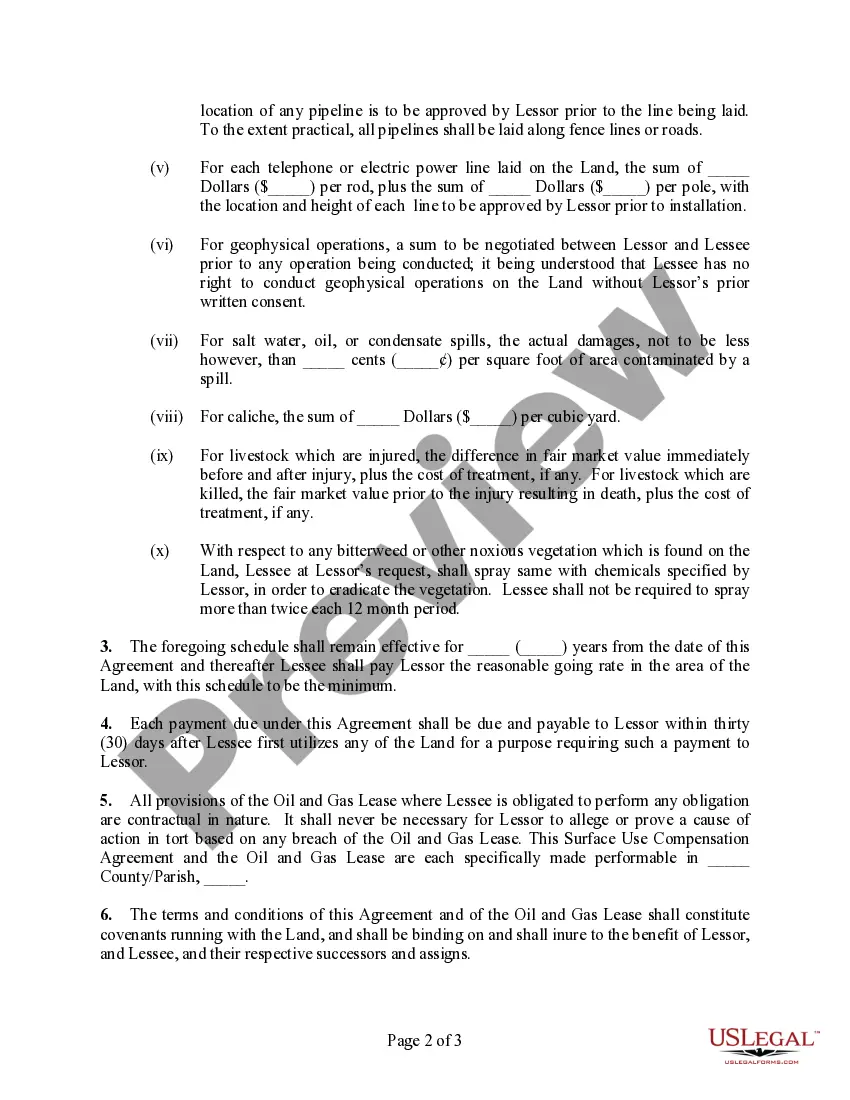

Puerto Rico Surface Use Compensation Agreement

Description

How to fill out Surface Use Compensation Agreement?

US Legal Forms - among the greatest libraries of authorized forms in the USA - delivers a wide range of authorized file templates you can down load or produce. Using the website, you may get a huge number of forms for organization and person functions, sorted by classes, states, or keywords and phrases.You can find the newest variations of forms like the Puerto Rico Surface Use Compensation Agreement within minutes.

If you have a monthly subscription, log in and down load Puerto Rico Surface Use Compensation Agreement through the US Legal Forms library. The Download switch will appear on every single kind you perspective. You have accessibility to all earlier saved forms inside the My Forms tab of the bank account.

If you want to use US Legal Forms initially, listed here are straightforward guidelines to help you started out:

- Be sure you have chosen the correct kind for your area/state. Go through the Preview switch to review the form`s content material. Browse the kind explanation to actually have chosen the right kind.

- If the kind does not satisfy your needs, make use of the Search area near the top of the monitor to obtain the one that does.

- In case you are happy with the form, confirm your decision by simply clicking the Acquire now switch. Then, opt for the rates program you want and offer your credentials to sign up to have an bank account.

- Method the financial transaction. Use your bank card or PayPal bank account to finish the financial transaction.

- Choose the structure and down load the form on your own device.

- Make changes. Load, modify and produce and indication the saved Puerto Rico Surface Use Compensation Agreement.

Every format you put into your account does not have an expiry day and it is yours permanently. So, in order to down load or produce yet another copy, just go to the My Forms section and click about the kind you need.

Gain access to the Puerto Rico Surface Use Compensation Agreement with US Legal Forms, the most extensive library of authorized file templates. Use a huge number of expert and state-certain templates that meet up with your business or person requirements and needs.

Form popularity

FAQ

Personal income tax rates Net taxable income (USD)TaxNot over 9,0000%Over 9,000, but not over 25,0007% of the excess over USD 9,000Over 25,000, but not over 41,500USD 1,120 plus 14% of the excess over USD 25,000Over 41,500, but not over 61,500USD 3,430 plus 25% of the excess over USD 41,5001 more row

As of November 28, 2020, inheritances are distributed in two parts. 50% is of free disposition and the other half (legitimate) is divided equally among the forced heirs, which are the children and now include the widow or widower.

Most types of U.S. source income received by a foreign person are subject to U.S. tax of 30%. A reduced rate, including exemption, may apply if an Internal Revenue Code Section provides for a lower rate, or there is a tax treaty between the foreign person's country of residence and the United States.

While the Commonwealth government has its own tax laws, Puerto Rico residents are also required to pay US federal taxes, but most residents do not have to pay the federal personal income tax.

Corporations not engaged in a trade or business in Puerto Rico are subject to a 29% WHT at source on certain gross income items (considered fixed or determinable, annual or periodical [FDAP]) from Puerto Rico sources.

The initial cost to start an LLC in Puerto Rico is $250 to register your business with the Department of State. After that, you'll have a yearly recurring cost of $150 for your Annual Fee, which keeps your LLC current with the state.

In Puerto Rico, a DBA is called a trade name. To register a DBA in Puerto Rico, submit a Trade Name Application to the Puerto Rico Department of State, along with the $150 filing fee.

Any natural or legal person doing business in Puerto Rico who makes payments (Payer) for rendered services must deduct and withhold 29% from the payment made to Foreign non-resident individuals and foreign corporations and partnerships that are not registered in the Puerto Rico State Department to engage in trade or ...