Puerto Rico Self-Employed Air Conditioning Services Contract

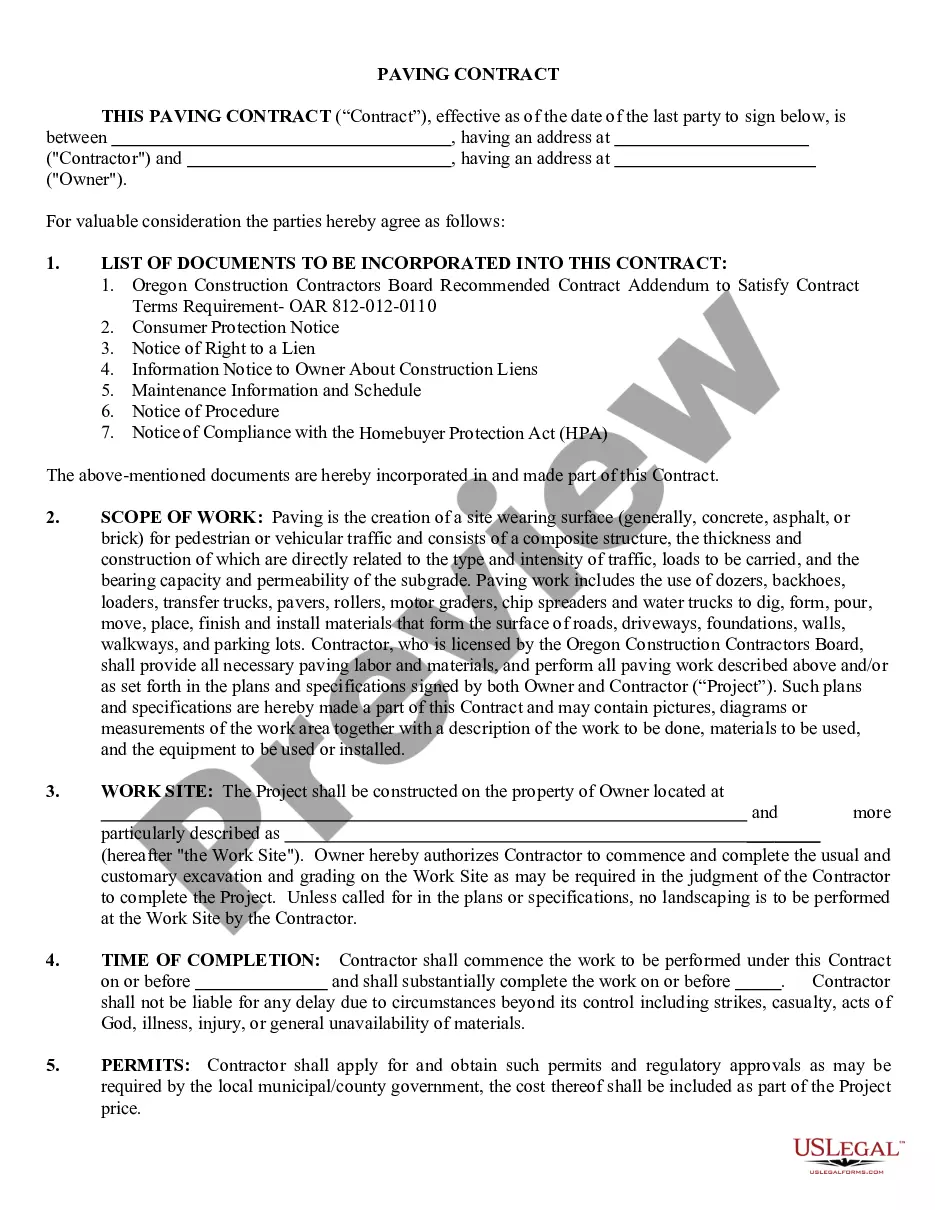

Description

How to fill out Self-Employed Air Conditioning Services Contract?

Are you currently in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legitimate document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Puerto Rico Self-Employed Air Conditioning Services Contract, designed to meet state and federal requirements.

Utilize US Legal Forms, one of the largest collections of legitimate forms, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Puerto Rico Self-Employed Air Conditioning Services Contract template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/state.

- Use the Review option to verify the form.

- Check the outline to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search section to find the form that suits your needs.

- When you locate the correct form, click Get now.

- Select the pricing plan you wish to use, provide the required information to create your account, and complete the purchase using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can obtain another version of the Puerto Rico Self-Employed Air Conditioning Services Contract at any time, if needed. Just select the necessary form to download or print the document template.

Form popularity

FAQ

A US citizen can easily start a business in Puerto Rico, enjoying the same rights and benefits as in any state. The process includes choosing a business structure and registering with local authorities. With a supportive entrepreneurial environment, Puerto Rico is a great place to establish your business. You can enhance your operations with a Puerto Rico Self-Employed Air Conditioning Services Contract to define your service terms.

Yes, obtaining a business license is necessary in Puerto Rico to operate legally. The license requirements vary based on your business type, so it’s important to research your particular situation. Having a business license also provides assurance to your clients about your legitimacy. A Puerto Rico Self-Employed Air Conditioning Services Contract will be important to have once you secure your license.

Puerto Rico does require a business license, which depends on the type of business you plan to operate. Obtaining this license helps you remain compliant with local regulations and enhances your business credibility. It’s crucial to check the specific requirements for your industry. A Puerto Rico Self-Employed Air Conditioning Services Contract can help formalize your service agreements once you have your license.

Yes, if you plan to perform construction work in Puerto Rico, you generally need a general contractor license. This license ensures that you meet the state's safety and quality standards. It is essential for protecting both you and your clients. Additionally, including a Puerto Rico Self-Employed Air Conditioning Services Contract can clarify your responsibilities as a contractor.

Operating a business without the necessary permits in Puerto Rico is generally not allowed. Each business type may require specific licenses and permits to ensure compliance with local laws. Failing to acquire these permits can lead to fines and legal issues. Therefore, a Puerto Rico Self-Employed Air Conditioning Services Contract should outline the services you provide legally.

To obtain a Doing Business As (DBA) in Puerto Rico, you must file a registration form with the Department of State. The form requires details about your business name and the owner. Once registered, your DBA allows you to operate under a name different from your legal business name. A Puerto Rico Self-Employed Air Conditioning Services Contract can reflect your DBA when dealing with clients.

Yes, a US citizen can open a business in Puerto Rico without any restrictions. The process is similar to starting a business in any other US state, making it accessible for entrepreneurs. You will need to adhere to local laws and regulations, which can include obtaining the necessary permits. Using a Puerto Rico Self-Employed Air Conditioning Services Contract can streamline your agreements with clients.

In Puerto Rico, forming a Limited Liability Company (LLC) requires filing articles of organization with the Department of State. It's essential to choose a unique name for your LLC that complies with local regulations. Additionally, you must appoint a registered agent who has a physical address in Puerto Rico. A Puerto Rico Self-Employed Air Conditioning Services Contract can help you outline the terms of service for your business.

To work as an independent contractor in the US, you need to meet certain legal and regulatory requirements. This typically includes obtaining the necessary licenses and permits relevant to your field, such as those for a Puerto Rico Self-Employed Air Conditioning Services Contract. Additionally, you should consider registering your business, maintaining proper records, and understanding tax obligations. Platforms like US Legal Forms can provide the necessary documents and guidance to help you get started on the right foot.

Self-employment tax in Puerto Rico is generally 15.3%, which includes Social Security and Medicare taxes. This tax applies to your net earnings, and as a self-employed individual, it is essential to factor this into your financial planning. If you operate under a Puerto Rico Self-Employed Air Conditioning Services Contract, make sure to set aside funds for this tax to avoid surprises at tax time. Consulting with a tax professional can help you navigate these requirements.