Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract

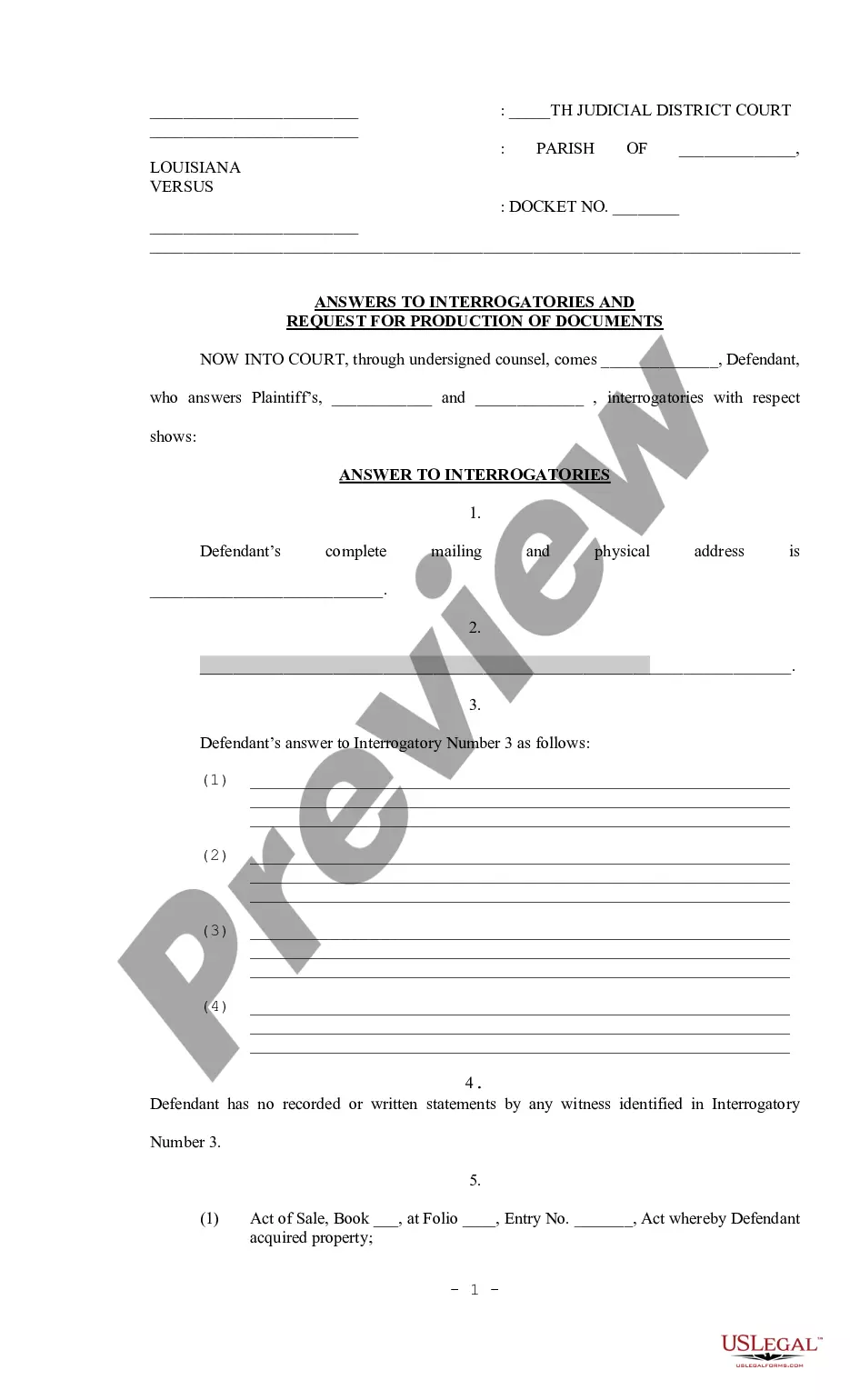

Description

How to fill out Self-Employed Independent Contractor Pyrotechnician Service Contract?

You might spend hours online looking for the official document template that meets the federal and state standards you need.

US Legal Forms offers a vast array of official forms that are reviewed by experts.

It is easy to obtain or print the Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract from my service.

If available, utilize the Preview button to examine the document template as well. If you want to find another version of the form, use the Search field to locate the template that meets your needs and requirements. Once you have found the template you desire, click on Acquire now to proceed. Choose the pricing plan you wish, enter your credentials, and register for your account on US Legal Forms. Complete the payment. You can use your credit card or PayPal account to purchase the official document. Select the file format of the document and download it to your device. Make adjustments to your document if necessary. You can complete, modify, sign, and print the Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract. Download and print a vast number of document layouts using the US Legal Forms Website, which provides the largest selection of official forms. Utilize professional and state-specific layouts to manage your business or personal needs.

- If you possess a US Legal Forms account, you can sign in and then click the Download button.

- After that, you can complete, modify, print, or sign the Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract.

- Every official document template you purchase is yours for a long time.

- To obtain another copy of the purchased form, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/city of choice.

- Review the form description to confirm that you have chosen the right document.

Form popularity

FAQ

An independent service contractor is a professional who provides specific services to clients under a contractual agreement rather than as an employee. They maintain control over how they complete their work, allowing for flexibility in their practice. In the context of pyrotechnics in Puerto Rico, independent contractors are often engaged for events and shows. It is advisable to use a Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract to clarify the relationship and expectations.

Creating an independent contractor contract involves outlining the scope of work, payment terms, and responsibilities of both parties. Start by defining the services you will provide as a pyrotechnician in Puerto Rico, including the expected outcomes. It's essential to include terms regarding confidentiality and dispute resolution. Using a template from uslegalforms can streamline this process and ensure that your Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract is comprehensive and legally sound.

To establish yourself as an independent contractor, you need to register your business in Puerto Rico, ensuring you comply with local laws. Next, obtain any necessary licenses or permits specific to your field, such as for pyrotechnics. You should also create a solid portfolio showcasing your work, which can help attract clients. Finally, consider drafting a Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract to outline your services and payment terms.

Independent contractors need to file taxes by reporting their total income and deducting any eligible business expenses. Essential forms include IRS Form 1040 and Schedule C. If you have a Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract, keep meticulous records of your income and expenses to simplify the filing process and potentially minimize your tax liability.

Yes, an independent contractor is classified as self-employed. This classification allows for more flexibility in how you manage your business and income. If you are working under a Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract, understanding this classification helps you navigate tax obligations and legal responsibilities.

To perform services as an independent contractor in the US, you should have the necessary licenses and permits specific to your industry. For pyrotechnicians, this may include safety certifications and local permits. If you are working under a Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract, ensure you meet all legal requirements to operate safely and legally.

To file as an independent contractor, you will need to gather all your income records and any relevant expenses related to your work. You typically report your earnings using IRS Form 1040, along with Schedule C. If you're operating under a Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract, ensure that you keep detailed records to streamline the filing process.

Yes, independent contractors file as self-employed individuals. This means they report their income and expenses on their tax return, usually using Schedule C. In Puerto Rico, if you provide pyrotechnician services under a Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract, you must ensure proper documentation to support your earnings and expenses.

The terms self-employed and independent contractor can often be used interchangeably, but they may carry different implications. When discussing a Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract, it might be beneficial to use 'independent contractor' to emphasize contractual agreements. Ultimately, the choice depends on the context and audience, so consider your communication goals.

Yes, a self-employed individual can be considered an independent contractor. In the context of a Puerto Rico Self-Employed Independent Contractor Pyrotechnician Service Contract, self-employment means you operate your own business and provide services directly to clients. This setup allows you the flexibility to manage your own schedule and business operations while fulfilling contractual obligations.