Puerto Rico Employee Evaluation Form for Nanny

Description

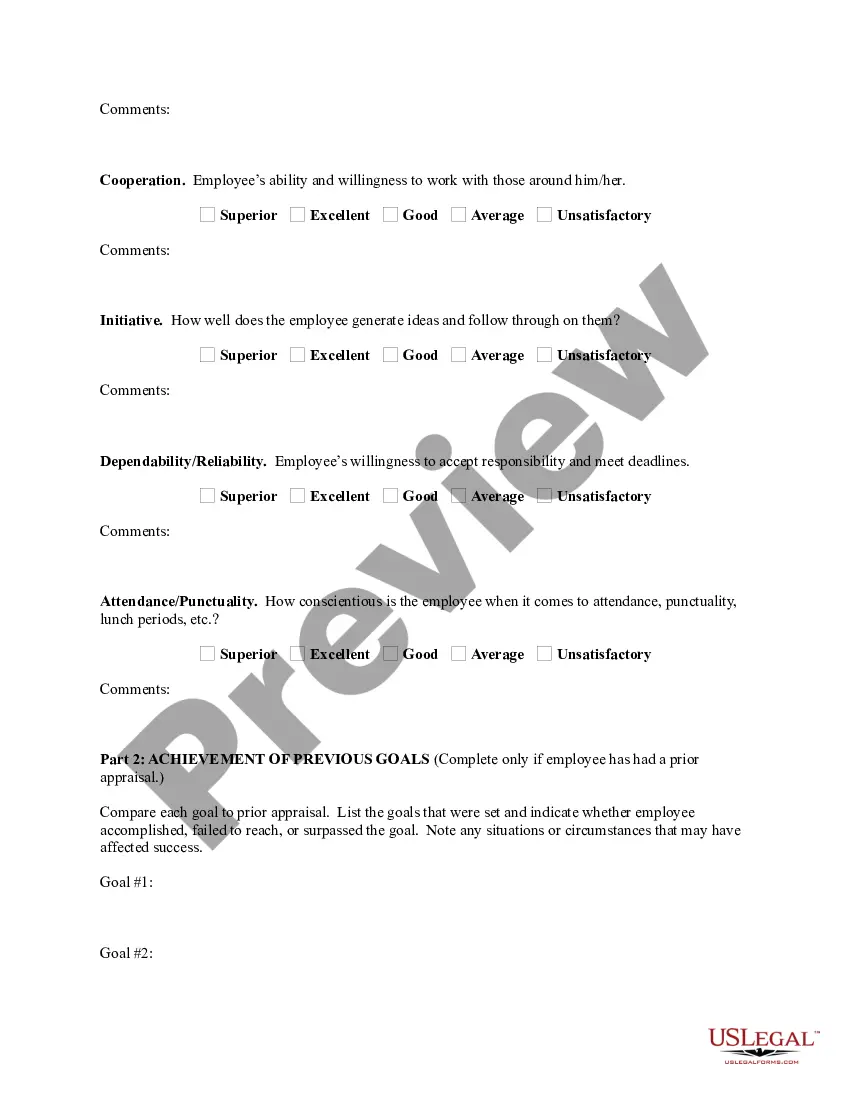

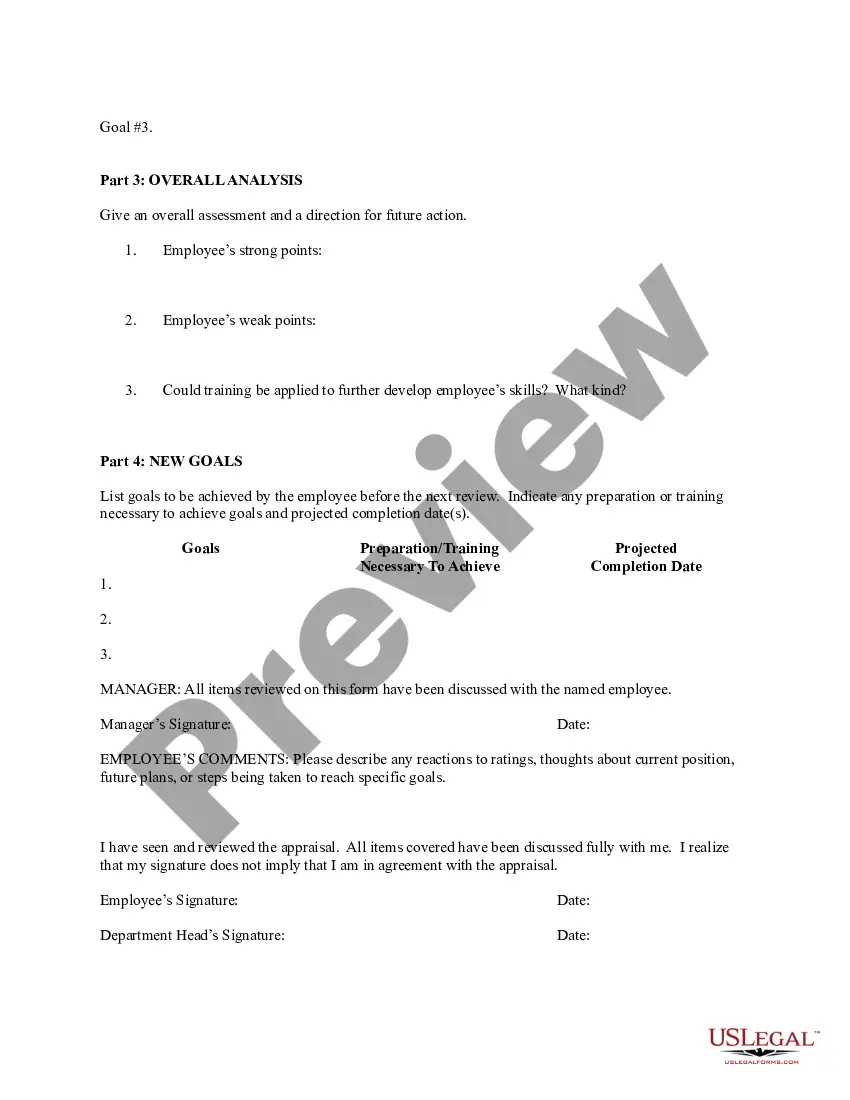

How to fill out Employee Evaluation Form For Nanny?

Locating the appropriate sanctioned document template can be rather challenging.

It goes without saying, there are numerous templates accessible online, but how do you find the sanctioned document you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, such as the Puerto Rico Employee Evaluation Form for Nanny, which can be utilized for both business and personal purposes.

First, ensure you have selected the correct document for your locality/region. You can view the form using the Preview button and examine the form details to confirm it is suitable for you.

- All the documents are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the Puerto Rico Employee Evaluation Form for Nanny.

- Use your account to review the sanctioned forms you have purchased previously.

- Navigate to the My documents section of your account and download another copy of the documents you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

No, a nanny cannot be considered self-employed. Self-employed usually refers to a situation where a contractor is not on a payroll (receiving a regular check). Typically, a self-employed contractor provides their own equipment and determines their own hours.

Does my nanny get a W-2 or 1099 form? As your employee, your nanny gets a W-2 form so they can file their tax return. Independent contractors get a 1099 form for their taxes. Both report income a person earns throughout the tax year, but they differ in tax withholdings and the information each form shows.

In many Canadian households, a nanny is an essential and beloved member of the family. However, unlike other family members, a nanny is also an employee whose employment relationship is governed by law.

Employers must file Form W-2, the IRS Wage and Tax Statement, for each employee who receives at least $600 in wages from your business, even if you did not withhold any income, Medicare or Social Security tax, though you would have had to withhold income tax if an employee did not claim an exemption from withholding on

You must provide your nanny with Form W-2 if you: Paid them $2,300 or more in 2021 (or will pay them $2,400 or more in 2022) or; Withheld federal taxes regardless of their wages.

If you're a nanny or other worker who cares for others' children in their employer's home and you have specific job duties assigned to you, the IRS considers you a household employee, not an independent contractor.

If you're a nanny or other worker who cares for others' children in their employer's home and you have specific job duties assigned to you, the IRS considers you a household employee, not an independent contractor.

Firms and workers file Form SS-8 to request a determination of the status of a worker for purposes of federal employment taxes and income tax withholding.

One of the most common questions (and misunderstandings) surrounding household employment is whether a family can provide their nanny a Form 1099-MISC (or 1099-NEC) at tax time and consider them an independent contractor rather than a household employee. The short answer is no. You can't give your nanny a 1099.

According to the IRS, babysitters do need to report their income when filing their taxes if they earned $400 or more (net income) for their work. This income is basically from self-employment, so you don't have to issue a 1099 if you pay a babysitter unless they earned $600 or more.