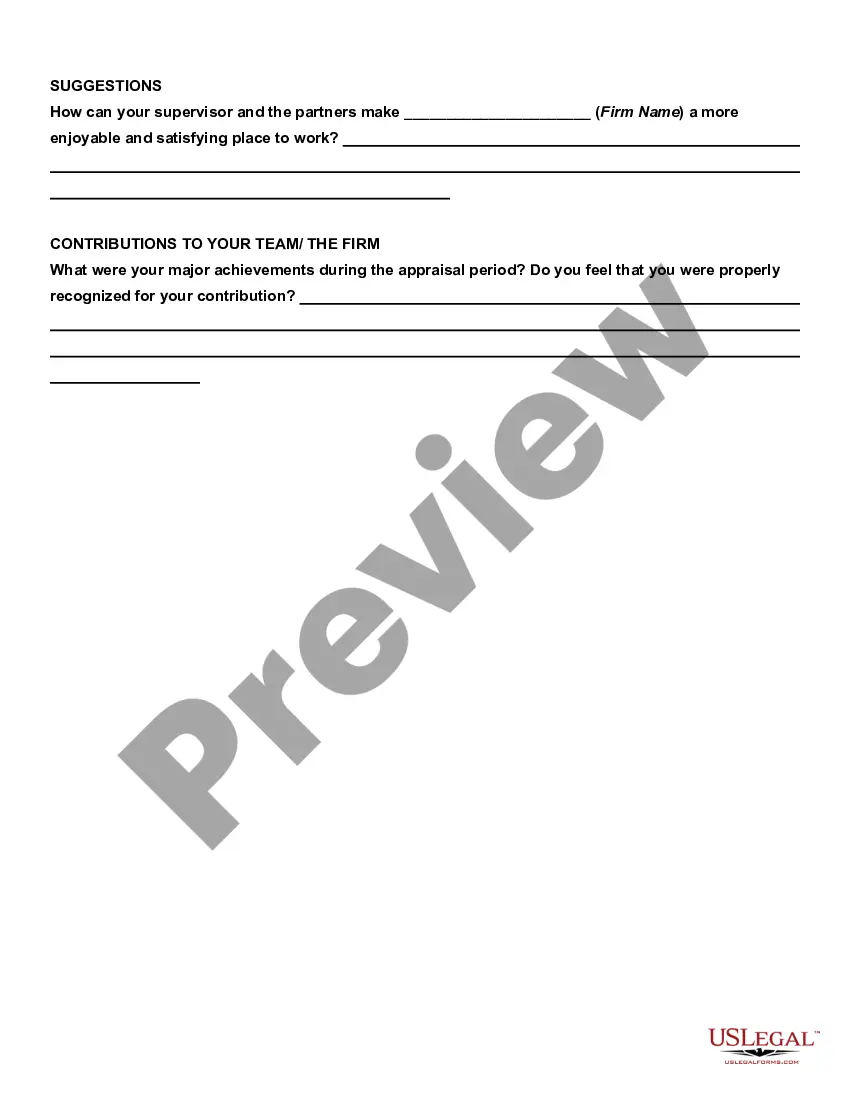

Puerto Rico Employee Self-Appraisal Form

Description

How to fill out Employee Self-Appraisal Form?

Are you in a scenario where you require documents for both organizational or personal purposes almost every day.

There is a large number of approved document templates accessible online, but locating reliable ones is not easy.

US Legal Forms provides thousands of form templates, including the Puerto Rico Employee Self-Appraisal Form, which are designed to meet state and federal guidelines.

Choose the pricing plan you prefer, fill out the required information to create your account, and pay for the order using your PayPal or credit card.

Select a suitable paper format and download your copy. You can find all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Puerto Rico Employee Self-Appraisal Form anytime, if needed. Just click on the needed form to download or print the document template. Utilize US Legal Forms, the largest collection of official forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the design of the Puerto Rico Employee Self-Appraisal Form.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct state/region.

- Use the Preview button to examine the form.

- Check the description to ensure you have selected the right form.

- If the form is not what you are looking for, utilize the Search box to find the form that meets your needs and preferences.

- Once you locate the appropriate form, click on Buy now.

Form popularity

FAQ

Puerto Rico form 482 is a tax form designated for reporting payments made to individuals by businesses and organizations. This form is essential for ensuring that both employers and employees are aware of their tax consequences. As you evaluate your financial health with the Puerto Rico Employee Self-Appraisal Form, recognizing the importance of form 482 will provide a more complete picture of your tax obligations.

Form 480.7 C is utilized to report payments made to individuals who are not Puerto Rican residents, covering income distributions and capital gains. This form plays a critical role in ensuring that taxes are properly accounted for on payments made to non-residents. When completing your Puerto Rico Employee Self-Appraisal Form, be mindful of various forms that pertain to your income reporting.

Income earned in Puerto Rico is generally not subject to U.S. federal income tax for residents living there. However, residents may have other federal tax obligations, such as payroll taxes. Staying informed about these details allows you to better assess your financial position while completing your Puerto Rico Employee Self-Appraisal Form.

Form 482 in Puerto Rico is used to report income from various sources, including wages and other employment-related compensation. Completing this form accurately is key to fulfilling local tax obligations. By integrating this understanding with your Puerto Rico Employee Self-Appraisal Form, you can ensure a thorough evaluation of your income and its tax implications.

Puerto Ricans typically do not file a federal Form 1040, as they are generally not subject to U.S. federal income tax on income earned in Puerto Rico. However, they must file a local tax return, which can take different forms, depending on their financial situation. Understanding these nuances can help you effectively navigate local tax laws while using the Puerto Rico Employee Self-Appraisal Form.

A form 1099C is known as the Cancellation of Debt form, used to report forgiven or canceled debt by a lender. This information is important for tax purposes, as it may be considered taxable income. When filling out your Puerto Rico Employee Self-Appraisal Form, it’s wise to be aware of various tax forms that may influence your financial assessments.

Form 480.6 C is a tax form used in Puerto Rico for reporting specific income received by residents during the calendar year. This form provides crucial information regarding wages, commissions, and other compensation. As you prepare your Puerto Rico Employee Self-Appraisal Form, understanding various tax forms can help ensure you remain compliant with local tax regulations.

When rating yourself in an appraisal form, consider your performance against established criteria and goals. It is essential to be honest and objective in your evaluation of your work. The Puerto Rico Employee Self-Appraisal Form can provide a helpful framework for assessing your contributions and areas for improvement.

An example of a self-appraisal may include an employee describing a project where they played a key role, detailing their contributions and outcomes. By utilizing the Puerto Rico Employee Self-Appraisal Form, they can structure their response effectively to showcase their impact and growth.

To write a self-assessment for appraisal, concentrate on your contributions, skills, and growth over time. Be honest about your weaknesses while emphasizing your achievements. Using the Puerto Rico Employee Self-Appraisal Form can aid in aligning your narrative with the appraisal criteria.