Puerto Rico Performance Evaluation for Exempt Employees

Description

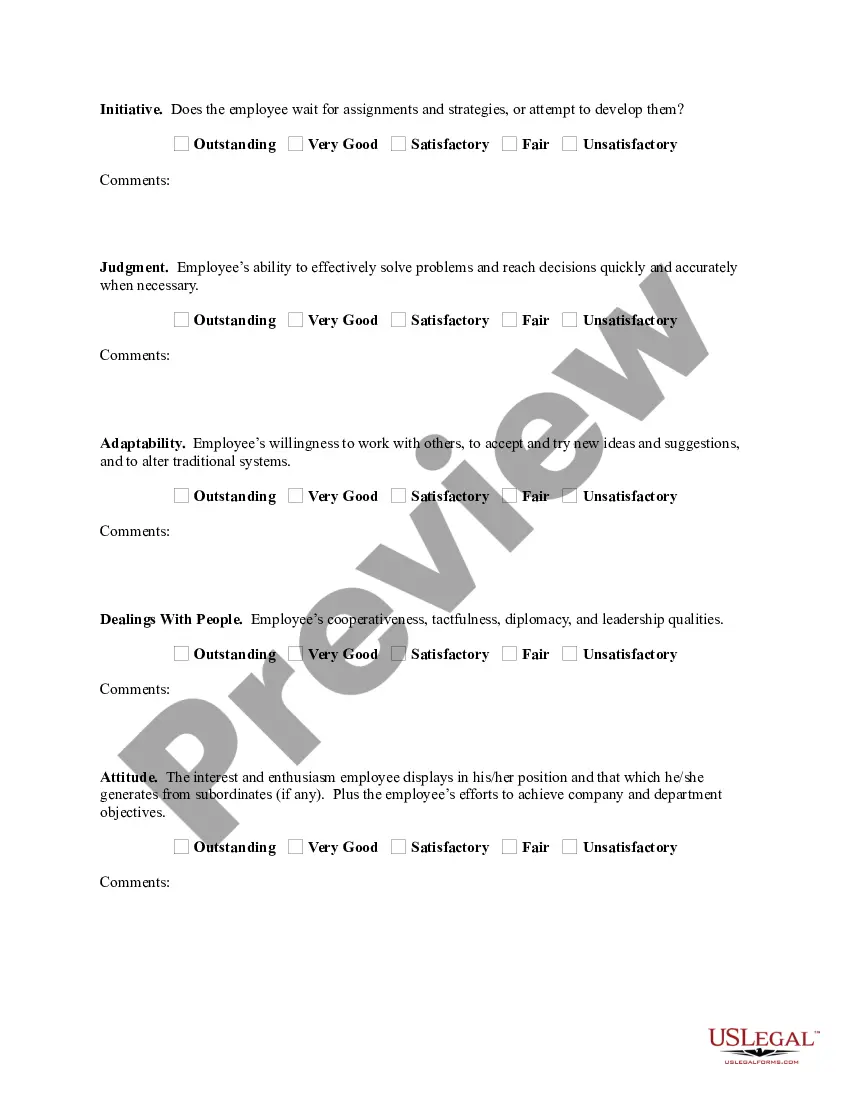

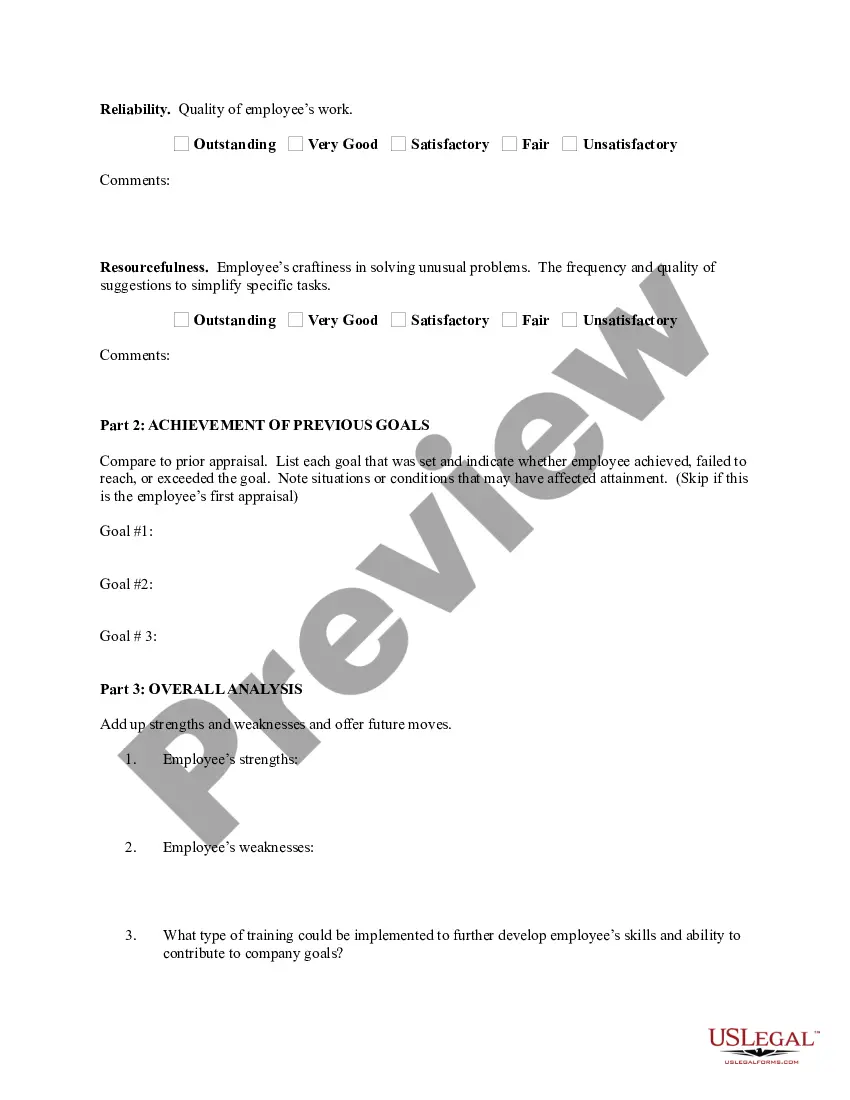

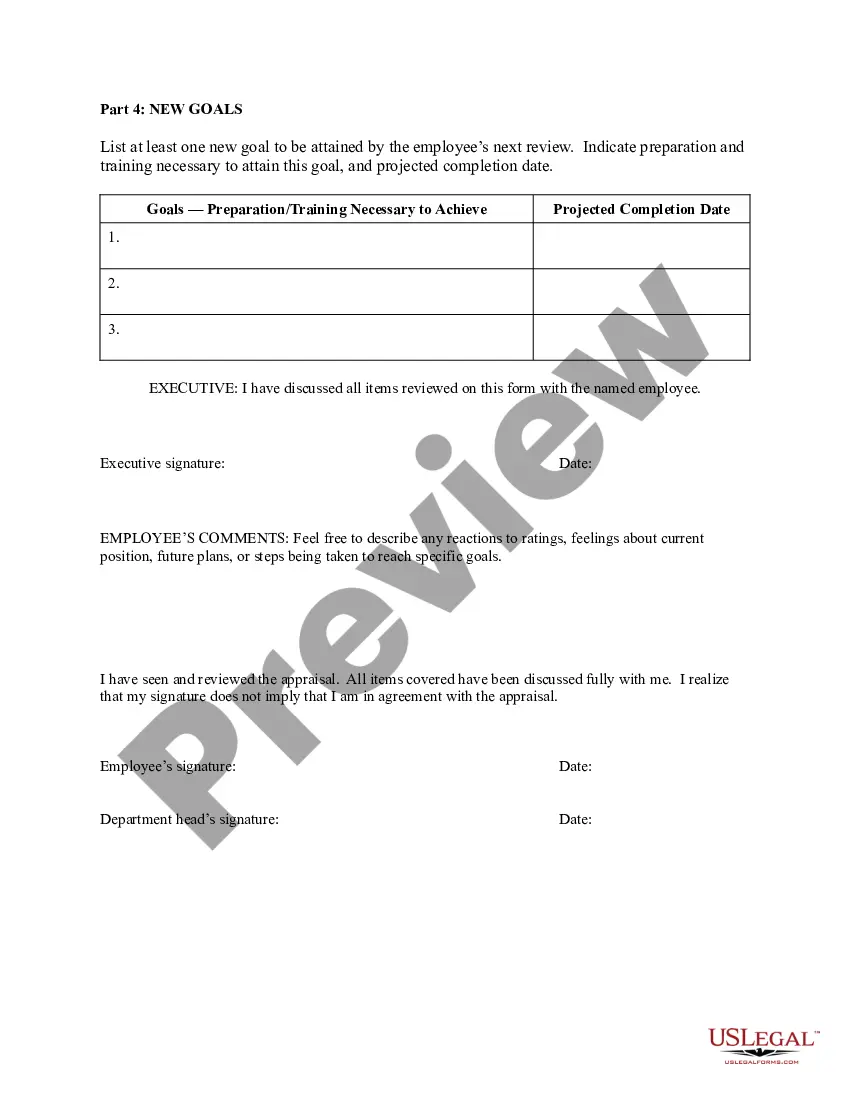

How to fill out Performance Evaluation For Exempt Employees?

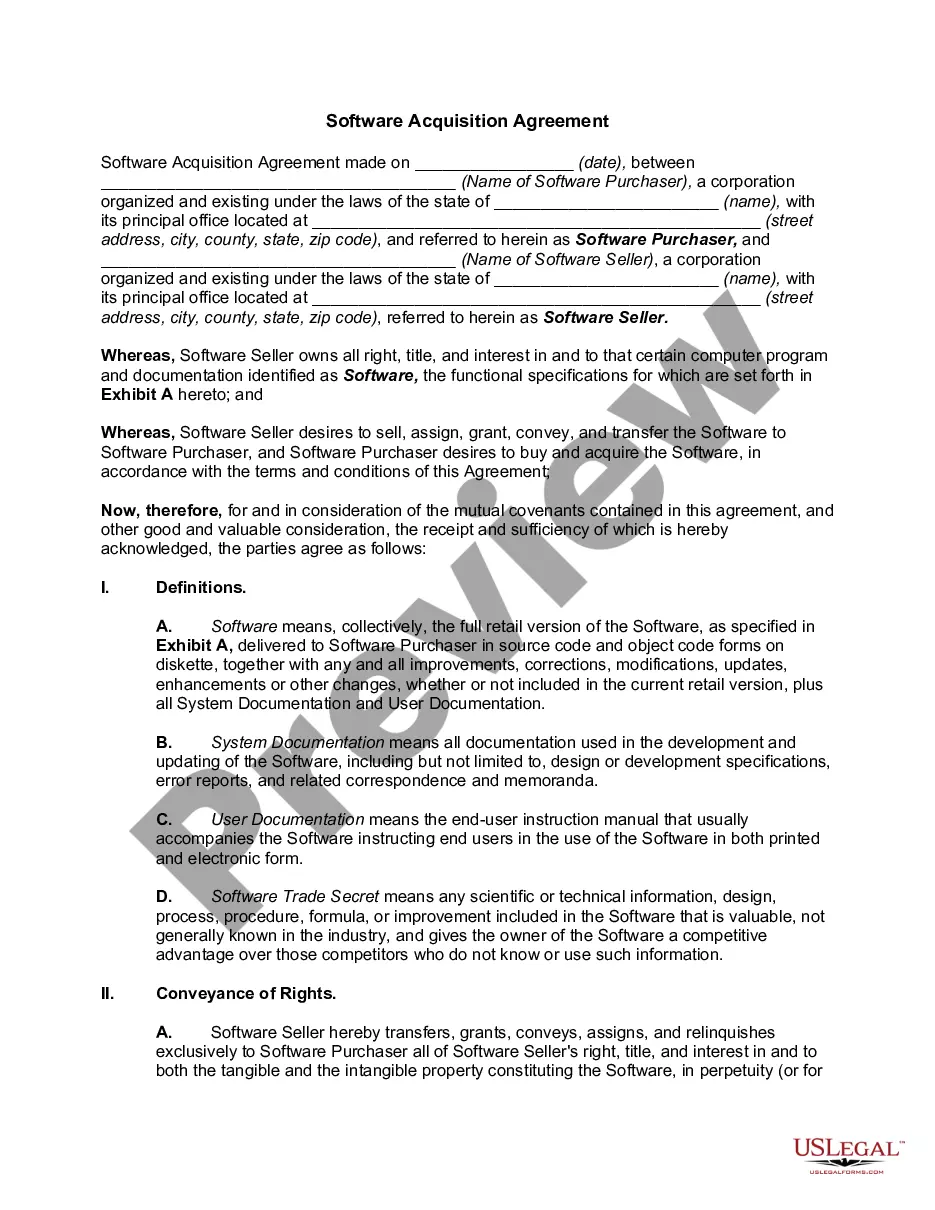

Locating the appropriate legal document template can be quite challenging. Obviously, there are numerous web templates accessible on the Internet, but how do you discover the legal type you need? Utilize the US Legal Forms website. The service provides a vast array of web templates, including the Puerto Rico Performance Evaluation for Exempt Employees, which you can use for business and personal purposes.

All of the forms are verified by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Obtain button to access the Puerto Rico Performance Evaluation for Exempt Employees. Use your account to review the legal forms you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Puerto Rico Performance Evaluation for Exempt Employees. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Use the service to download properly constructed documents that comply with state requirements.

- First, ensure you have selected the correct type for your city/state.

- You can review the form using the Review button and examine the form details to confirm it is suitable for you.

- If the form does not meet your needs, utilize the Search field to find the right type.

- When you are confident the form is correct, click on the Get now button to obtain the form.

- Select the pricing plan you need and enter the necessary information.

- Create your account and complete the payment using your PayPal account or credit card.

Form popularity

FAQ

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

The minimum wage under the Fair Labor Standards Act (FLSA) is generally applicable to any state, territory, or possession of the United States such as Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands (CNMI).

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

Restrictive covenantsNon-compete clauses in employment contracts are valid and enforceable in Puerto Rico under general freedom of contract principles but must comply with requirements established by the Supreme Court of Puerto Rico.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.

In Puerto Rico, the payroll frequency is bi-weekly, monthly or semi-monthly. An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.