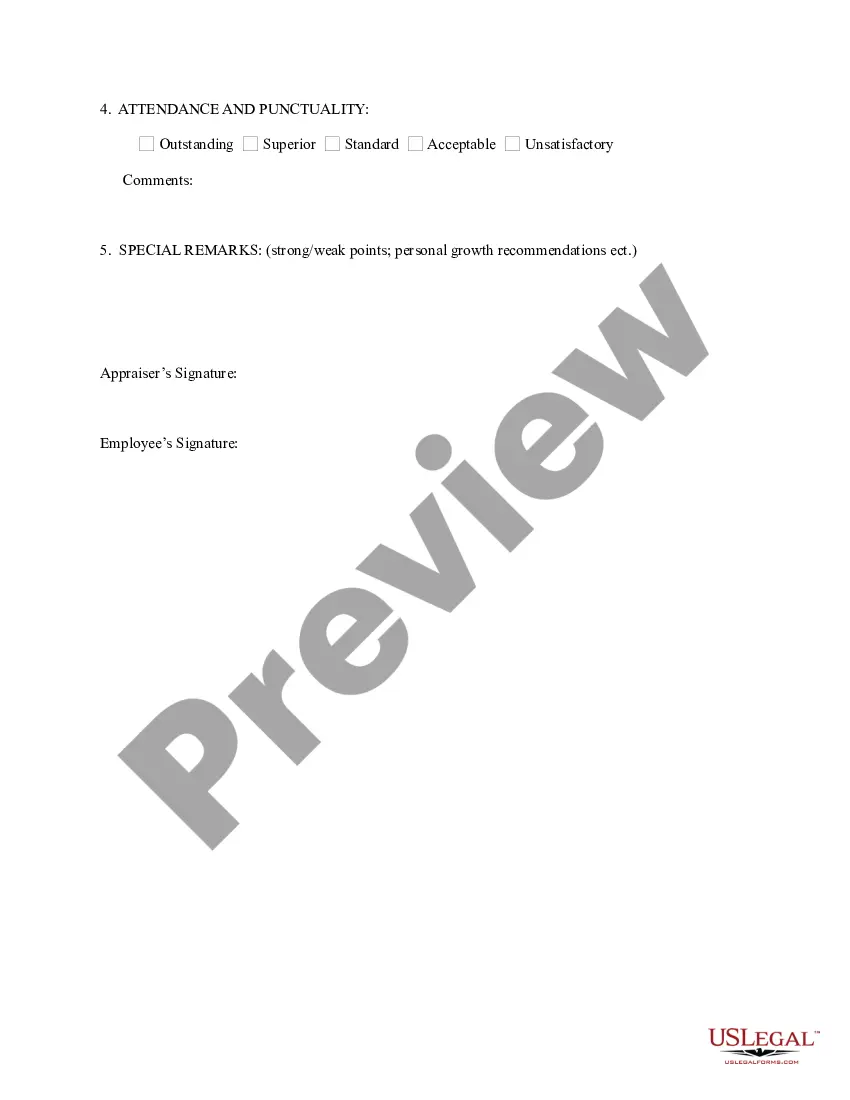

Puerto Rico Salaried Employee Appraisal Guidelines - Employee Specific

Description

How to fill out Salaried Employee Appraisal Guidelines - Employee Specific?

Are you presently in a situation where you require documentation for both business or personal purposes on a daily basis.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms provides a vast array of template forms, such as the Puerto Rico Salaried Employee Appraisal Guidelines - Employee Specific, which are designed to comply with federal and state regulations.

Choose a suitable file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Puerto Rico Salaried Employee Appraisal Guidelines - Employee Specific at any time if needed. Just click on the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers properly crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Puerto Rico Salaried Employee Appraisal Guidelines - Employee Specific template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct area/state.

- Utilize the Review button to evaluate the form.

- Read the description to ensure you have selected the right template.

- If the form is not what you are looking for, use the Lookup field to find the form that fits your needs and criteria.

- Once you find the appropriate template, click on Get now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

Law 52 focuses on the principles of non-discrimination in employment and protects employees from discrimination based on various factors. It emphasizes the need for equal treatment in the workplace. Utilizing the Puerto Rico Salaried Employee Appraisal Guidelines - Employee Specific can help employers maintain compliance with Law 52 and ensure a fair working environment.

The law only requires employment for at least a year, whether continuous or not continuous, to be considered a regular employee. Further, the law deems repeated and continuing need for its performance as sufficient evidence of the necessity if not indispensability of that activity to the business.

These are individuals who work for someone else but are not employees....Key TakeawaysAn employee is a regular, long-term worker who gets paid a set hourly wage or annual salary for their work.The IRS sets guidelines to determine which workers are employees and which aren't.More items...?

In Puerto Rico, the payroll frequency is bi-weekly, monthly or semi-monthly. An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

Regular Employee means an employee whose employment is reasonably expected to continue for longer than two years, although such employment may be terminated earlier by action on the part of the Company or the employee.

Under Executive Order 11246, you have the right to inquire about, discuss, or disclose your own pay or that of other employees or applicants. You cannot be disciplined, harassed, demoted, terminated, denied employment, or otherwise discriminated against because you exercised this right.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

The minimum wage under the Fair Labor Standards Act (FLSA) is generally applicable to any state, territory, or possession of the United States such as Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands (CNMI).

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.