Purchase Contract and Receipt - Residential

Definition and meaning

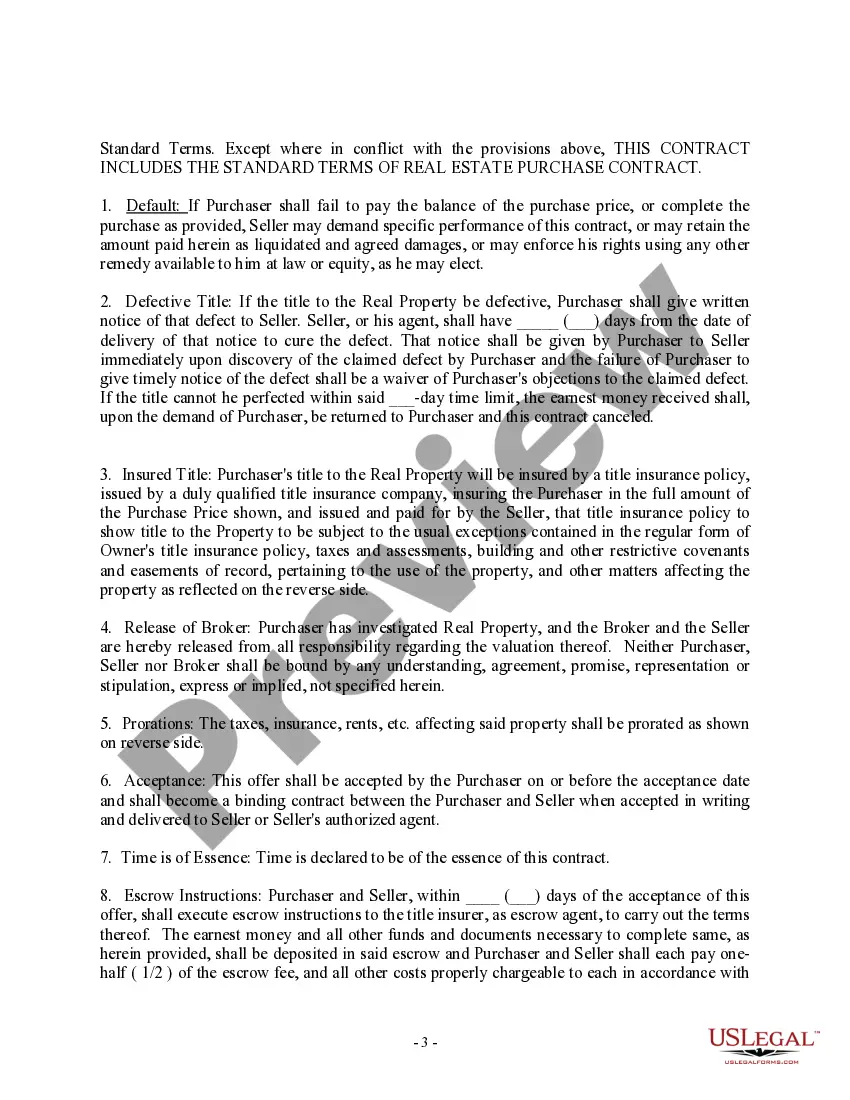

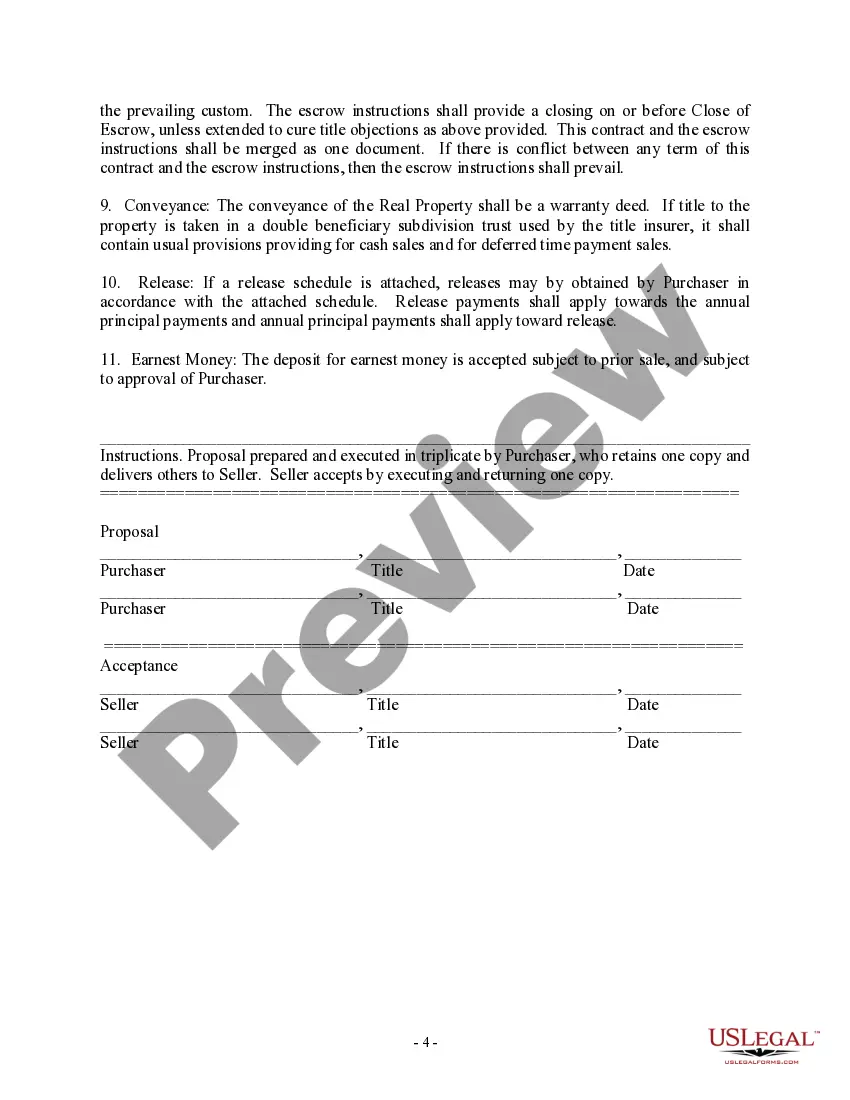

The Purchase Contract and Receipt - Residential is a legal document that outlines the terms of a real estate transaction involving the sale of residential property. This form serves as a binding agreement between the seller and the purchaser, detailing the specific conditions under which the property is to be sold, including the purchase price, payment terms, and contingencies.

How to complete a form

To successfully complete the Purchase Contract and Receipt - Residential, follow these steps:

- Begin by entering the names and addresses of both the seller and purchaser.

- Specify the location of the real property being sold, along with its legal description.

- Select how the title will be taken by the purchasers.

- List any personal property included in the sale.

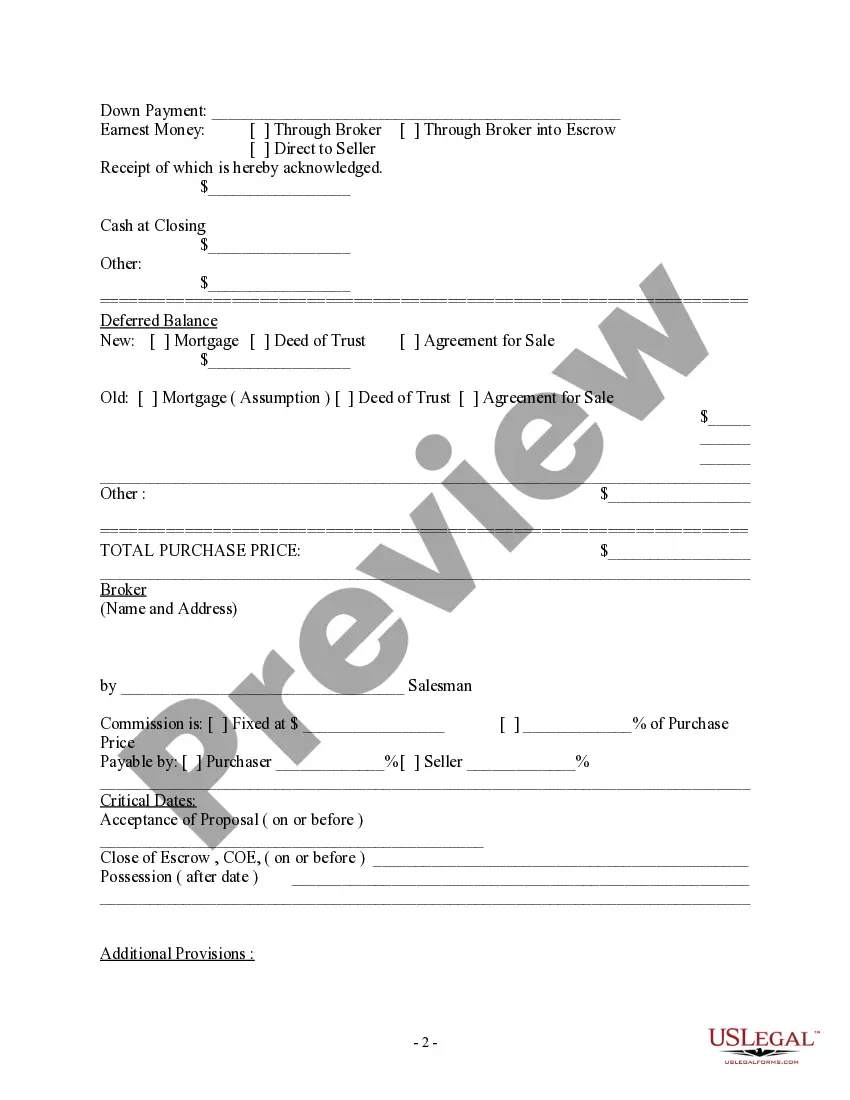

- Detail the financial aspects, including the purchase price, down payment, and any earnest money deposits.

- Include information regarding proration of expenses such as taxes and insurance.

- Finally, both parties should sign and date the contract to finalize the agreement.

Key components of the form

The Purchase Contract and Receipt - Residential contains several key components that are crucial for a clear understanding of the agreement:

- Property Details: This includes the address and legal description of the property.

- Buyer and Seller Information: Names and contact details of both parties involved in the transaction.

- Financial Terms: Details on the purchase price, earnest money, and any financing arrangements.

- Provisions for Title: Information on how the title will be taken and any contingencies related to title defects.

- Prorated Costs: Breakdown of costs that need to be shared or divided between the buyer and seller.

Who should use this form

This form is designed for individuals or entities engaged in the buying or selling of residential properties. It is ideal for:

- Homeowners looking to sell their properties

- Individuals or families purchasing a new home

- Real estate professionals facilitating transactions between buyers and sellers

- Investors who are acquiring residential properties

Using this form ensures that all crucial details of the transaction are clearly documented and agreed upon.

Common mistakes to avoid when using this form

When completing the Purchase Contract and Receipt - Residential, users should be wary of the following mistakes:

- Incomplete Information: Ensure every section is filled out completely to avoid disputes later.

- Incorrect Dates: Double-check that all critical dates are accurate to manage the timeline effectively.

- Signature Errors: Both parties must sign and date the contract; omissions can lead to legal complications.

- Misunderstood Terms: Seek clarity on any legal jargon or terms that are not understood to prevent confusion.

Form popularity

FAQ

The sale of farm land is capital gain income and it will show on schedule D and form 8949. To enter the sale in TurboTax, go to: Go to the Federal Taxes category at the top of the window. Choose the Wages and Income subcategory.

It depends on how long you owned and lived in the home before the sale and how much profit you made. If you owned and lived in the place for two of the five years before the sale, then up to $250,000 of profit is tax-free. If you are married and file a joint return, the tax-free amount doubles to $500,000.

Losses are not allowed for personal-use items. Unless you can prove that you bought it exclusively for business, rental, or investment use and never used it personally or had personal intentions for the property, the loss is not deductible.

Hanging on until the gain qualifies for favorable long-term capital gains tax treatment if you've owned the property for less than a year. Lowering your taxable income. Receiving installments. Exchanging instead of selling. Donating the land to charity.

Hanging on until the gain qualifies for favorable long-term capital gains tax treatment if you've owned the property for less than a year. Lowering your taxable income. Receiving installments. Exchanging instead of selling. Donating the land to charity.

1Exemptions under Section 54F, when you buy or construct a Residential Property.2Purchase Capital Gains Bonds under Section 54EC.3Investing in Capital Gains Accounts Scheme.4Purchase Capital Gains Bonds under Section 54EC.Best and safe way to save capital gains tax on Property Sale\nwww.ashianahousing.com > real-estate-blog > 3-best-and-safe-ways-to-save...

Short-term capital gains are taxed as part of your ordinary income, meaning that the regular income tax brackets of 10 to 37 percent apply. Depending on where you live or where the land you are selling is located, you may also be liable for capital gain taxes at the state level.

If you have sold land or investment real estate and realized a profit, the IRS is likely standing in line to collect capital gains tax on the sale. Fortunately, you can avoid paying tax by completing a 1031 Exchange, where the proceeds from the sale are used to purchase similar land or property.

Capital asset is defined to include various assets including real estate. So, any gain on sale of land or building by the owner is taxable as capital gain. Sale consideration reduced by cost of acquisition (indexed cost of acquisition for land or building held for more than 24 months) is taxable as capital gain.