Florida General Power of Attorney - Finances and Property - Nondurable

Description

How to fill out Florida General Power Of Attorney - Finances And Property - Nondurable?

Gain entry to one of the most extensive collections of sanctioned forms.

US Legal Forms serves as a resource where you can locate any state-specific documentation within moments, including Florida General Power of Attorney - Finances and Property - Nondurable templates.

There's no need to squander several hours attempting to find a court-acceptable form. Our experienced experts ensure you receive current samples at all times.

After selecting a pricing plan, create an account. Make a payment via credit card or PayPal. Download the document to your device by clicking the Download button. That's it! You need to fill out the Florida General Power of Attorney - Finances and Property - Nondurable form and check out. To confirm accuracy, consult your local legal advisor for assistance. Sign up and effortlessly explore over 85,000 useful samples.

- To utilize the forms library, select a subscription and set up an account.

- Once done, simply Log In and hit Download.

- The Florida General Power of Attorney - Finances and Property - Nondurable document will conveniently be saved in the My documents section (a section for every form you download from US Legal Forms).

- To establish a new profile, adhere to the brief guidelines below.

- If you need to use state-specific documents, ensure you select the correct state.

- If possible, review the description to comprehend all the details of the form.

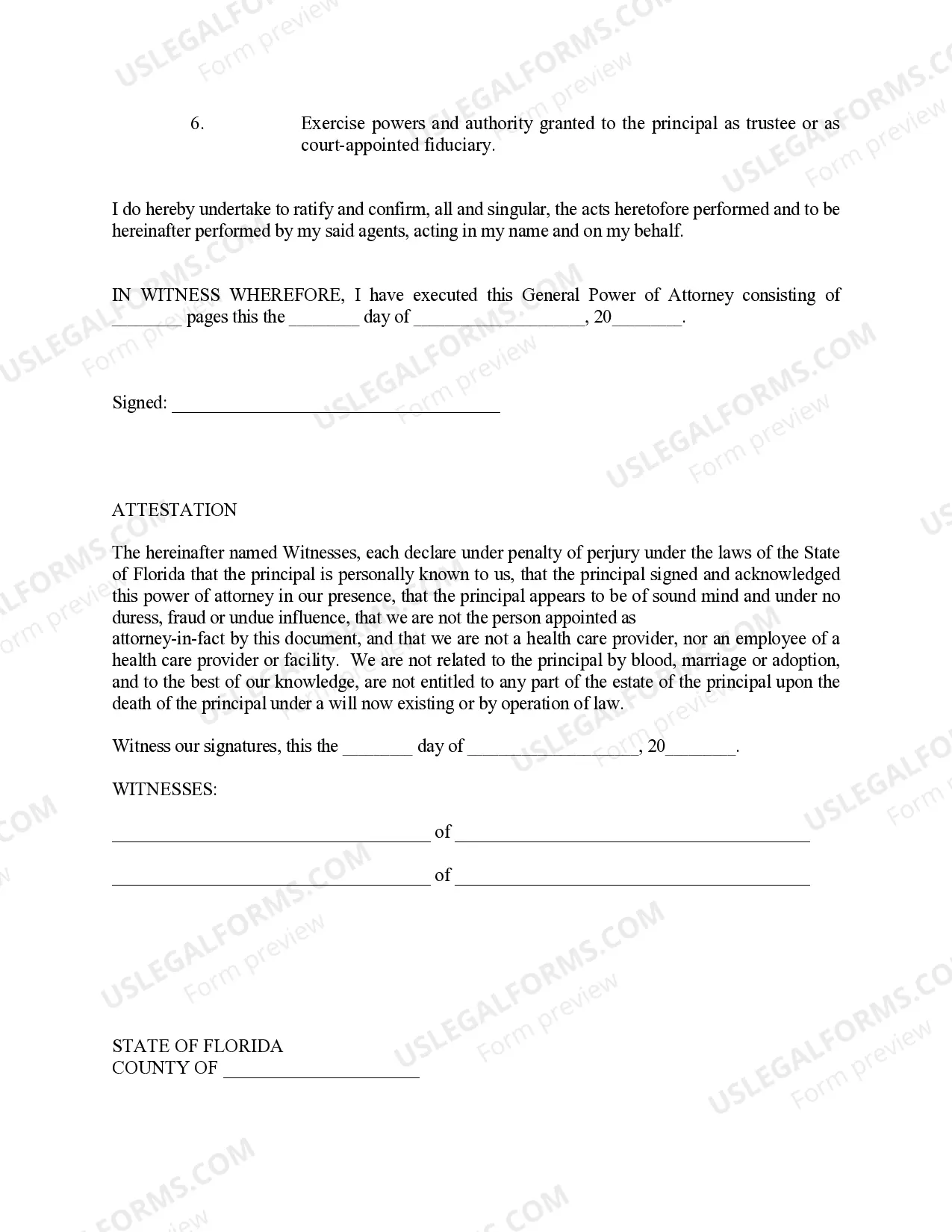

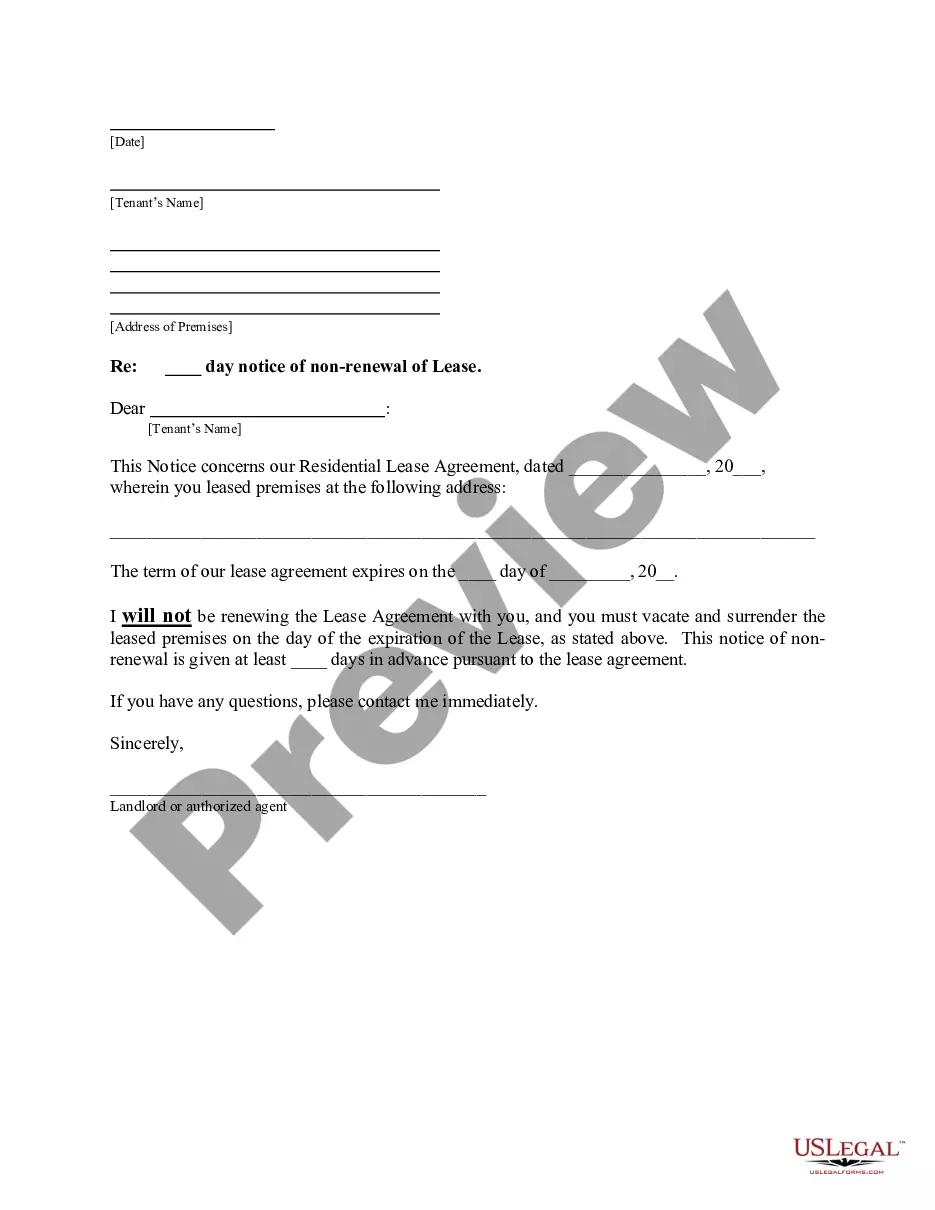

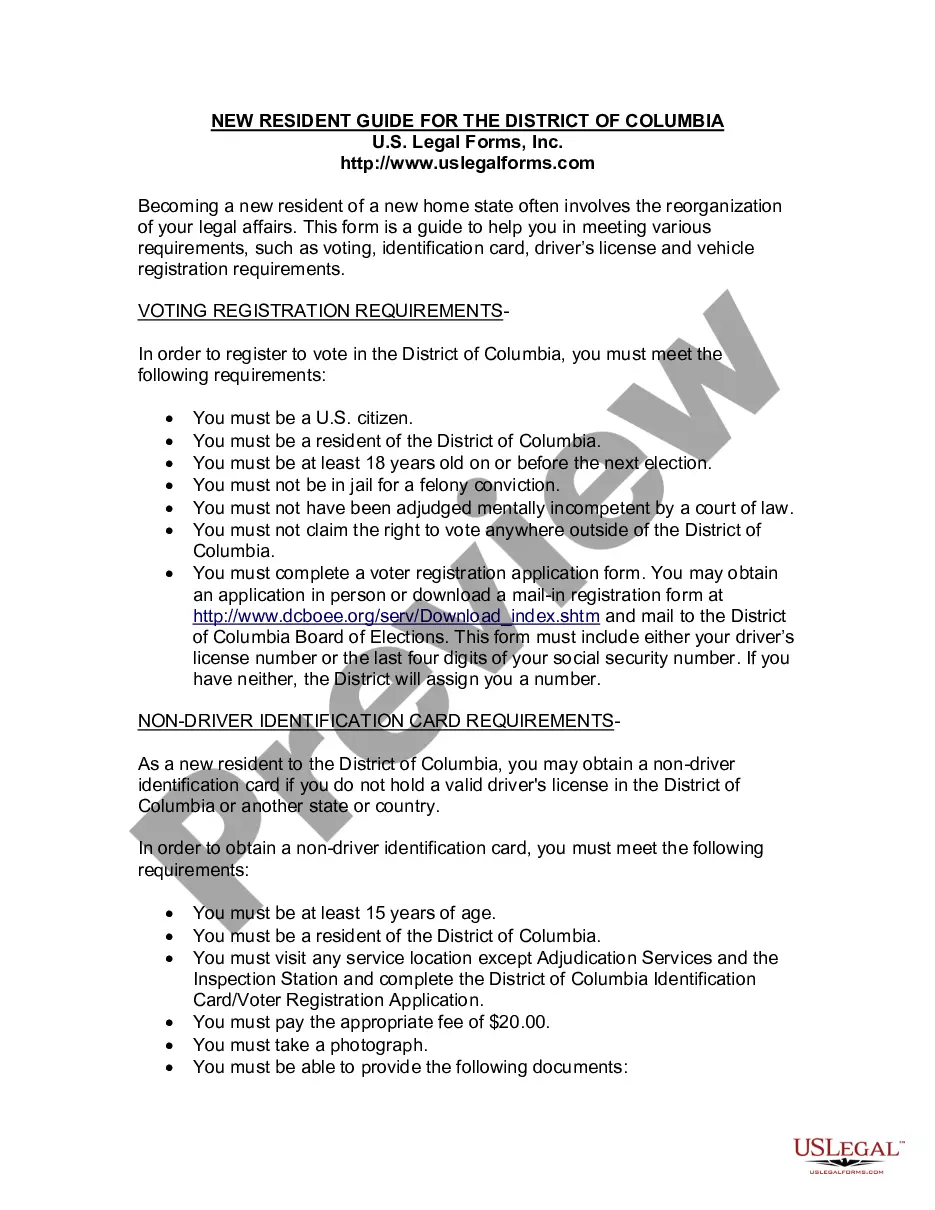

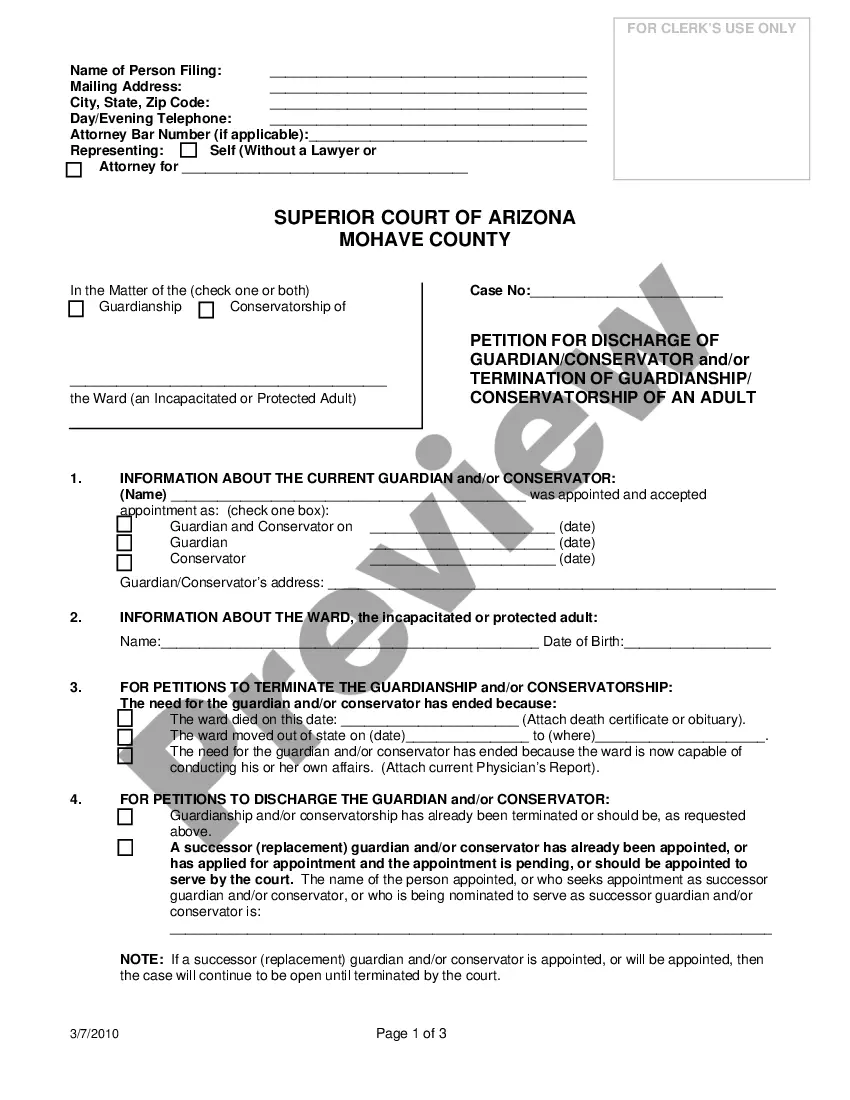

- Utilize the Preview feature if available to examine the document's particulars.

- If everything looks correct, click Buy Now.

Form popularity

FAQ

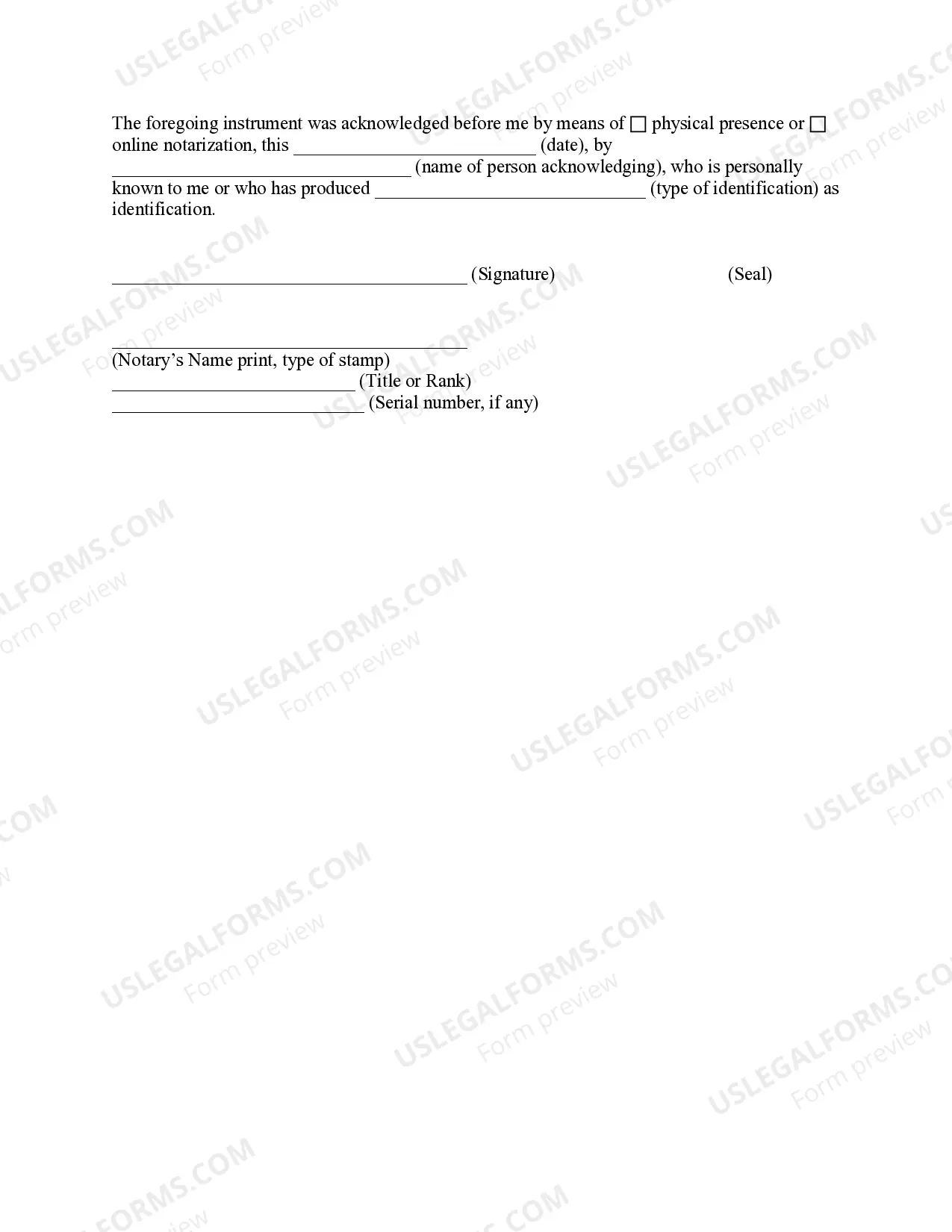

In the context of a Florida General Power of Attorney - Finances and Property - Nondurable, the agent cannot make medical decisions, create or revoke a will, or change beneficiary designations on insurance policies. Understanding these boundaries can prevent misunderstandings and ensure that the power of attorney operates within its intended scope. Therefore, it's vital to specify the limitations when drafting this document.

Taking on the role of a Power of Attorney comes with significant responsibilities and potential downsides. If a decision you make is questioned, you may face legal scrutiny or liability. Moreover, acting as an agent can strain personal relationships, especially if family members disagree with the choices made under the Florida General Power of Attorney - Finances and Property - Nondurable.

A Florida General Power of Attorney - Finances and Property - Nondurable cannot make decisions about life support, organ donation, or any form of marital status changes. Additionally, the agent must act on behalf of the principal's best interests and is limited by the authority granted in the document. It's important to clearly outline these limitations when setting up a power of attorney.

A Florida General Power of Attorney - Finances and Property - Nondurable has several limitations. Primarily, this type of power of attorney becomes ineffective if the principal becomes incapacitated. Additionally, it cannot be used to make decisions regarding healthcare or life-sustaining treatment. Moreover, the agent's authority is restricted to the specific powers granted in the document, so it’s crucial to outline these powers clearly when drafting the power of attorney.

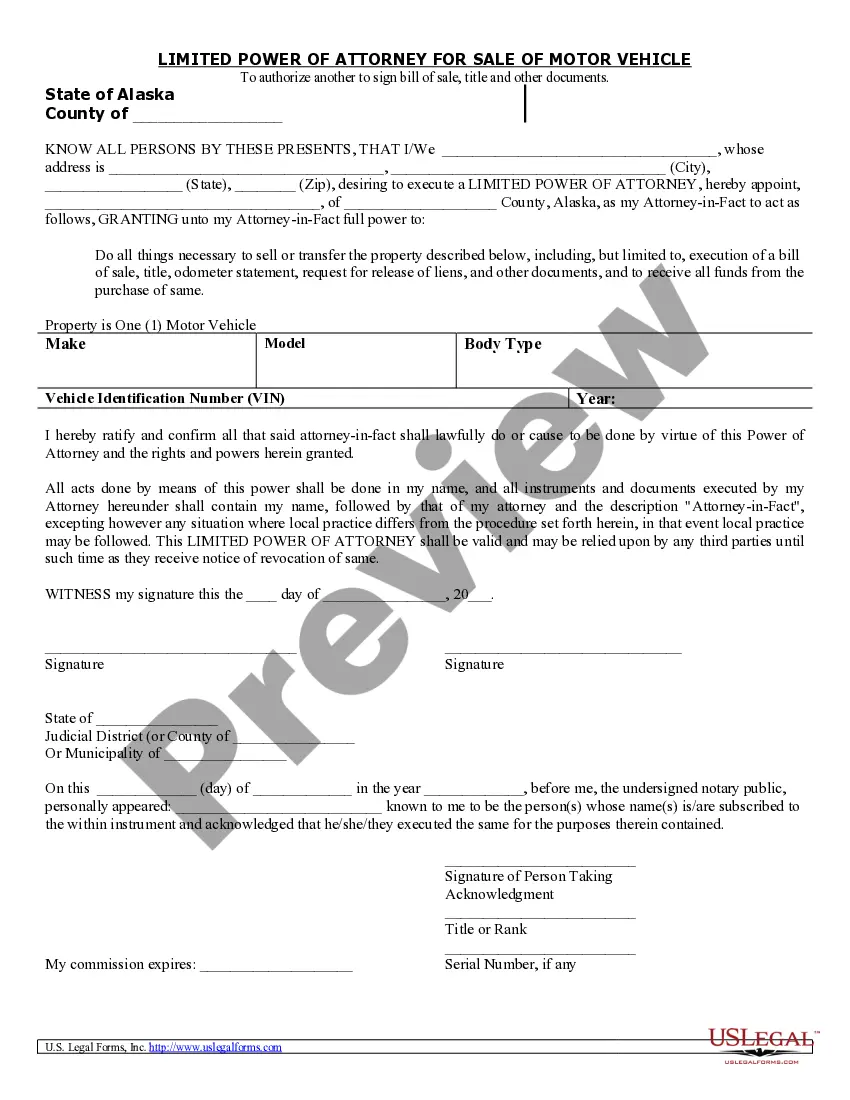

Filling out a POA form requires you to follow a clear structure. Begin by including the names and addresses of both the principal and agent. Specify the powers you wish to grant for financial and property matters effectively. Remember, utilizing a service such as USLegalForms can simplify this process, offering ready-to-use templates tailored for a Florida General Power of Attorney - Finances and Property - Nondurable.

To set up a Florida General Power of Attorney - Finances and Property - Nondurable, you need to complete a specific form that is compliant with Florida law. First, gather the necessary information, including the names of the principal and agent, and the details of the financial responsibilities covered. Next, sign the form in front of a notary public, as this step is crucial for validation. Consider using platforms like USLegalForms to easily access the correct documents and guidance.

One significant disadvantage of a nondurable Power of Attorney is that it becomes ineffective if you lose your capacity to make decisions. This limitation may leave your financial affairs unaddressed during critical times. Additionally, if your situation changes or you require ongoing management of your finances, you would need to create a new document, which can be cumbersome. Understanding these limitations is crucial when choosing a Florida General Power of Attorney - Finances and Property - Nondurable.

To file a Power of Attorney in Florida, you need to complete the document properly, ensuring it meets the state's legal requirements. After completing your Florida General Power of Attorney - Finances and Property - Nondurable, you must sign it in front of a notary public and have it witnessed by two witnesses. Once this is done, you should keep a copy for your records and consider providing copies to the relevant parties involved.

The main difference between a durable and nondurable POA lies in their validity during incapacity. A durable Power of Attorney continues to grant authority to your agent even if you become incapacitated, while a nondurable POA ceases to exist under such circumstances. Therefore, if you're considering a Florida General Power of Attorney - Finances and Property - Nondurable, it's essential to understand when you want the authority to end and how it affects your decision-making process.

A nondurable Power of Attorney (POA) is a legal document that grants someone authority to manage your financial and property matters only while you are able to handle your affairs. This type of POA becomes invalid if you become incapacitated. In essence, a Florida General Power of Attorney - Finances and Property - Nondurable allows the designated agent to act on your behalf in specified situations, ensuring your finances remain organized while you are capable of making decisions.