Agreement to Incorporate Close Corporation

Definition and meaning

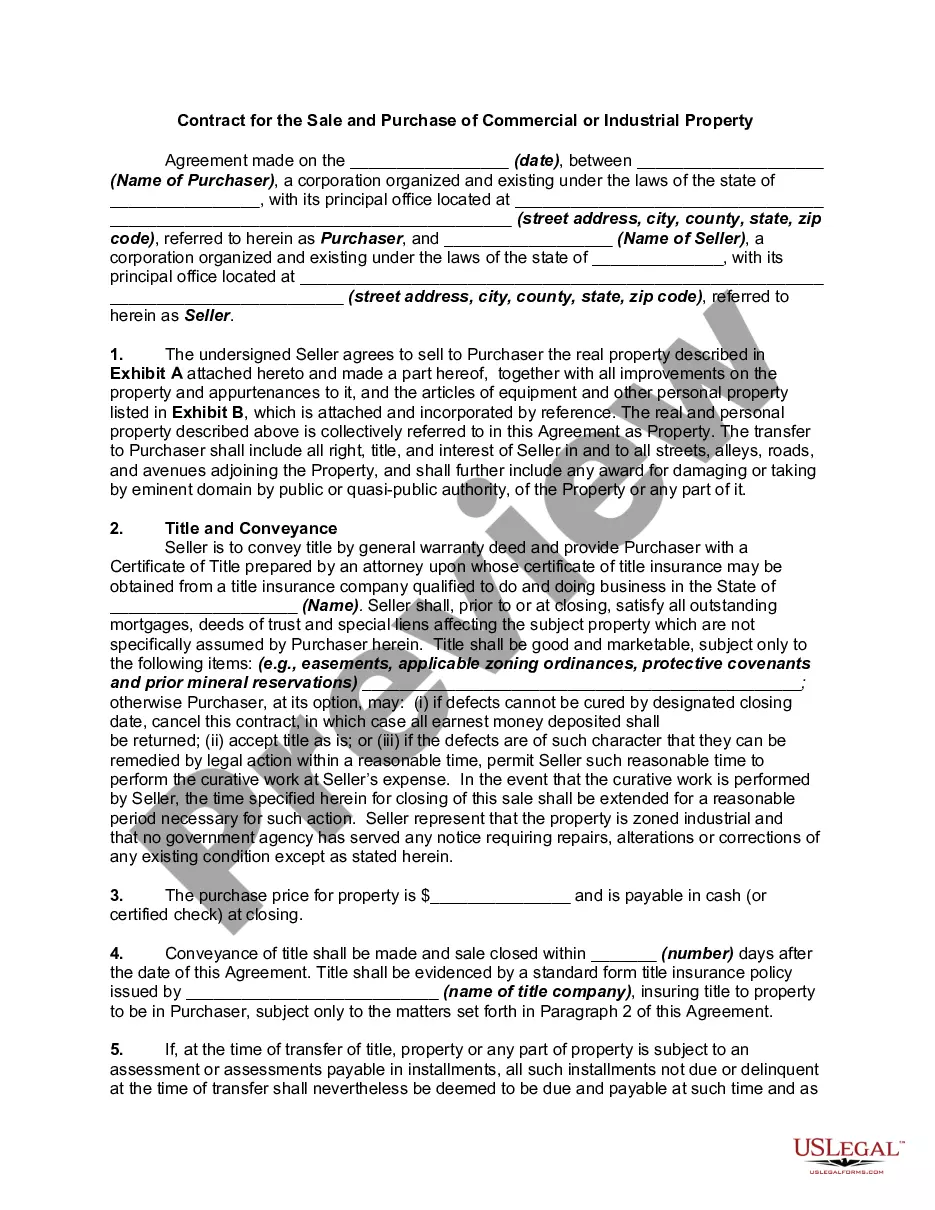

An Agreement to Incorporate Close Corporation is a legal document that outlines the formation of a close corporation. This type of corporation has restrictions on the transfer of shares and is generally owned by a small group of people, allowing for more control and flexibility in management. The agreement specifies the roles of the incorporators, the purpose of the corporation, and other essential details required for incorporation.

Key components of the form

This agreement typically includes several critical sections, such as:

- Incorporation: Identifies the parties forming the corporation and the state's laws under which it will operate.

- Purpose and Powers: Outlines the business activities the corporation will engage in.

- Capitalization: Details on the authorized capital and shares subscribed by the incorporators.

- Officers and Directors: Specifies the initial officers and directors who will manage the corporation.

These components collectively ensure that the corporation is organized properly and operates legally.

Who should use this form

This form is suitable for individuals or groups planning to start a close corporation. It is particularly relevant for small businesses that prefer to maintain a tight circle of owners to control operations and management. Those looking for potential tax benefits associated with an S-Corporation structure may also find this form beneficial.

Legal use and context

The Agreement to Incorporate Close Corporation is legally binding and must comply with the relevant provisions of the state’s Model Business Corporation Act. Businesses must ensure this agreement is completed accurately to establish a legally recognized entity that will safeguard its owners' interests while complying with state laws. The document should be filed with the appropriate state authority upon completion.

Benefits of using this form online

Utilizing online resources to complete the Agreement to Incorporate Close Corporation can offer several advantages:

- Convenience: Users can access and complete the form from anywhere, avoiding the need for in-person consultations.

- Guided Assistance: Many online services provide step-by-step instructions, making the process easier for individuals with limited legal knowledge.

- Cost-effectiveness: Online forms may be available at a lower cost compared to hiring an attorney for the same document.

Form popularity

FAQ

Close corporation (CC) A CC is similar to a private company. It is a legal entity with its own legal personality and perpetual succession and must register as a taxpayer in its own right. A CC has no share capital and therefore no shareholders. The owners of a CC are the members of the CC.

A Close Corporation may have a minimum of one member or a maximum of 10 members. However there are no limitations in respect of the number of employees in a Close Corporation. If a member of a Close Corporation (CC) is under 21, the registration document must be signed by a parent or guardian.

Step 1 : Order Online. Step 2 : Pay Fee. Pay fee of R650 by Internet Transfer (EFT) / Bank deposit details below : We require payment upfront to proceed with registration. Step 3 : Fax through, and then Post original documents through to us.

Form Cor 18.1 Application to convert a close corporation to a company. A Memorandum of Incorporation for the company to be formed (CoR15. Form CoR39 to identify the initial directors of the company. Form CoR21.

The Companies Act, 2008 has changed the regulatory framework applicable to close corporations.Close corporations can be converted to companies, but companies can no longer be converted to close corporations. Existing close corporations would be administered under the Close Corporations Act, 1984 indefinitely.

Form Cor 18.1 Application to convert a close corporation to a company. A Memorandum of Incorporation for the company to be formed (CoR15. Form CoR39 to identify the initial directors of the company. Form CoR21.

The easiest definition of a close corporation is one that is held by a limited number of shareholders and is not publicly traded. The company is run by the shareholders and is generally exempt from many requirements of other corporations, including having a board of directors and holding annual meetings.