Puerto Rico Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

You can dedicate time online attempting to find the official document template that meets the federal and state criteria you require.

US Legal Forms offers a wide array of legal forms that have been vetted by professionals.

You can download or print the Puerto Rico Wage Withholding Authorization from our service.

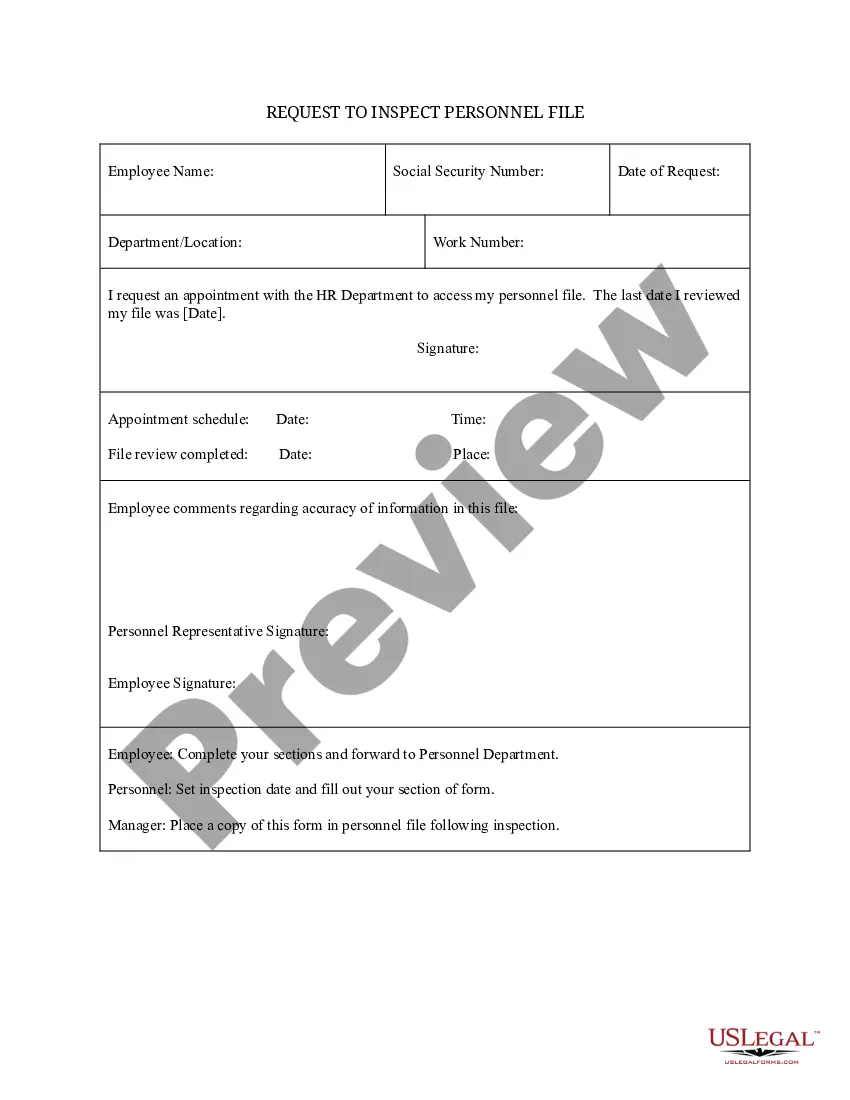

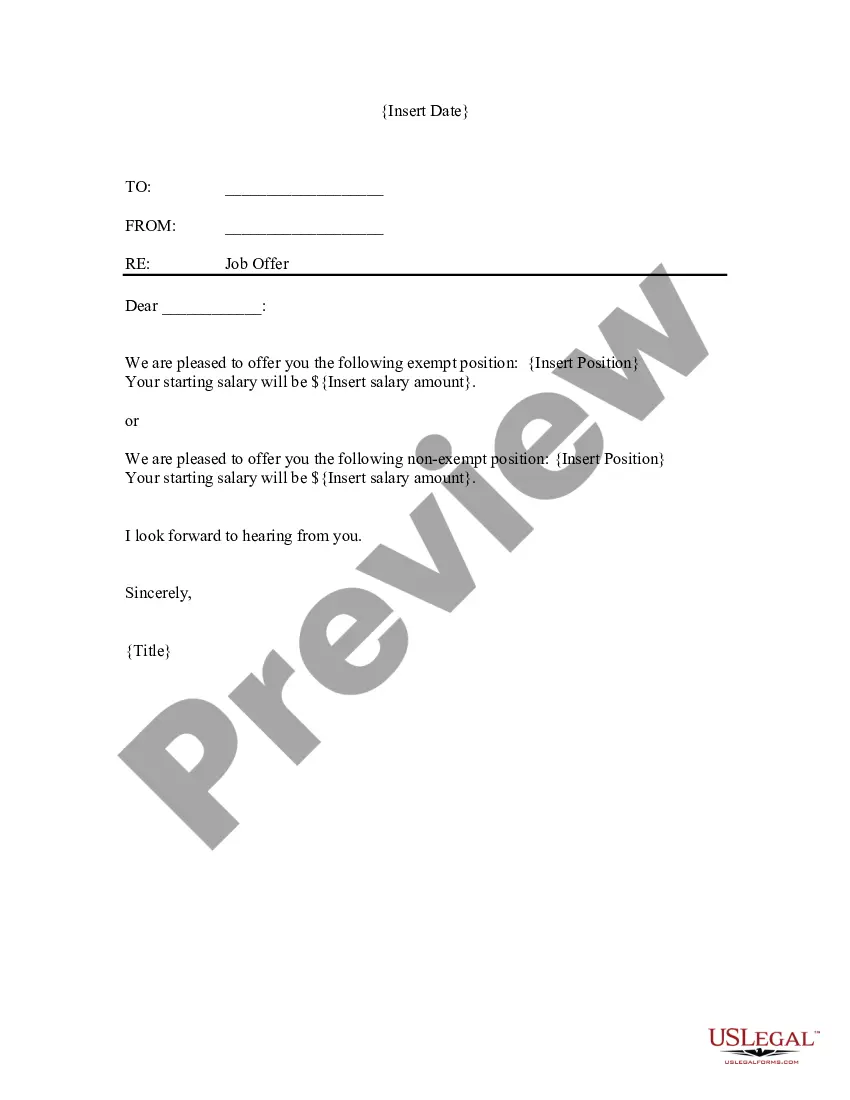

If available, use the Preview button to preview the document template as well. In order to find another version of the form, use the Search field to locate the template that matches your needs and requirements.

- If you possess a US Legal Forms account, you can sign in and click the Get button.

- Next, you can fill out, modify, print, or sign the Puerto Rico Wage Withholding Authorization.

- Every legal document template you purchase is yours indefinitely.

- To retrieve an additional copy of any acquired form, visit the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure you have selected the correct document template for your desired region/area. Read the form description to confirm you have picked the right form.

Form popularity

FAQ

Register for a withholding tax account through the Puerto Rico Department of the Treasury. Employers need to complete the application form SC4809 Information of Identification Number Organizations (Employers) (this form is in both Spanish and English and does contain instructions).

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Every entity engaged in business in Puerto Rico must obtain a federal Employer Identification Number (EIN) from the U.S. Internal Revenue Service (IRS) by filing Form SS-4. Upon obtaining an EIN, the entity must file a copy of the certificate of incorporation, and a copy of Form SS-4 at the P.R. Department of Treasury.

If you are a U.S. citizen who is also a bona fide resident of Puerto Rico during the fiscal year but receive income as a U.S. government employee in Puerto Rico, you must file a federal tax return.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

Payroll tax withholding is when an employer withholds a portion of an employee's gross wages for taxes. Payroll withholding is mandatory when you have employees. The amount you withhold is based on the employee's income. Remit the withheld payroll taxes to the appropriate agencies (e.g., IRS).

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.

Form 499-R-1C (Adjustments to Income Tax Withheld Worksheet) Form 499R2/W2PR (Withholding Statement) - This withholding statement is the Puerto Rico equivalent of the U.S. Form W2 and should be prepared for every employee.

Employers in Puerto Rico are subject to both Federal Insurance Contributions Act (FICA) tax (a payroll withholding tax, which funds Social Security and Medicare) and the Federal Unemployment Tax Act (FUTA).