Puerto Rico Business Deductibility Checklist

Description

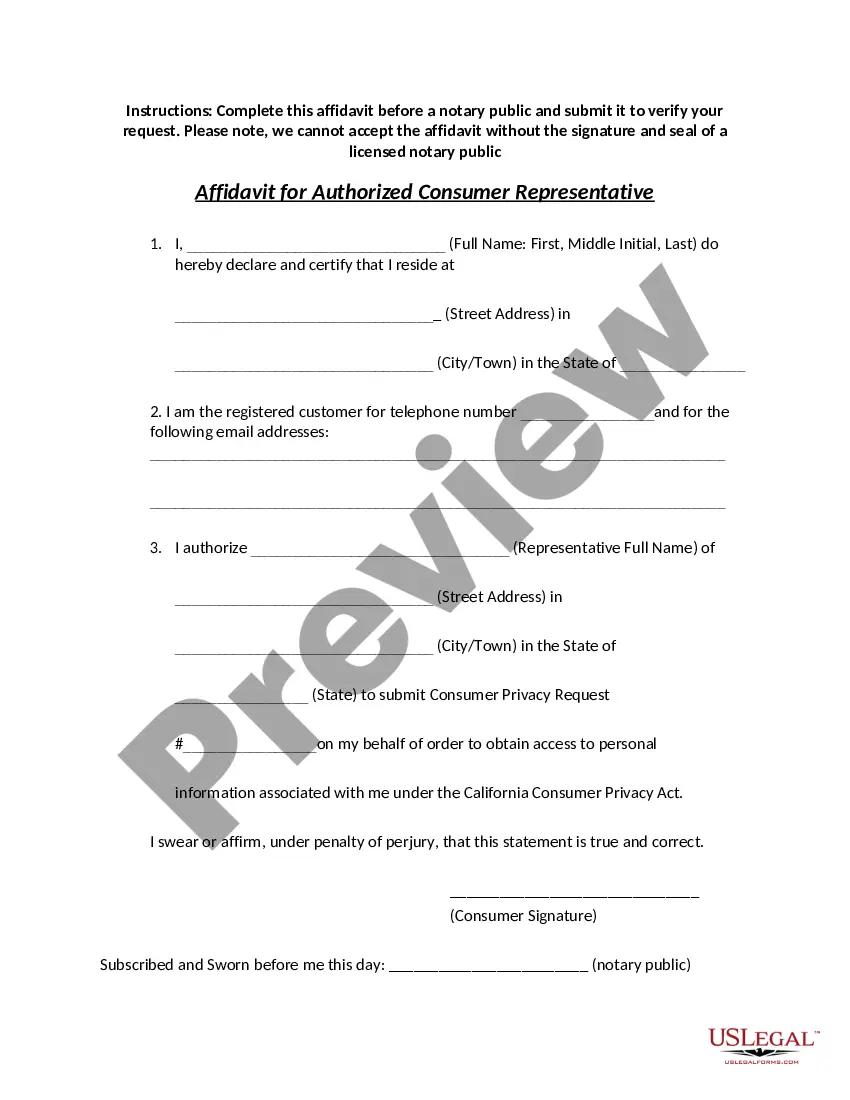

How to fill out Business Deductibility Checklist?

It is feasible to allocate time on the Internet searching for the official document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that can be examined by professionals.

You can easily download or print the Puerto Rico Business Deductibility Checklist from the service.

First, make sure you have chosen the correct document template for the state/region of your choice. Review the document description to confirm you have selected the appropriate form. If available, utilize the Preview button to examine the document template as well.

- If you currently possess a US Legal Forms account, you may Log In and click the Obtain button.

- Following that, you can complete, modify, print, or sign the Puerto Rico Business Deductibility Checklist.

- Every legal document template you purchase belongs to you indefinitely.

- To acquire another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are utilizing the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

To exclude Puerto Rico income from a return where the taxpayer is a bona fide resident of Puerto Rico, from the Main Menu of the tax return (Form 1040) select: Income menu. Other income. Section 933 Excluded Income from Puerto Rico.

Residents of Puerto Rico must file Forms 1040-SS or Form 1040-PR to claim their 2021 Child Tax Credit (CTC) for their qualifying children. For additional information on claiming this credit, please see the Instructions for Form 1040-PRPDF or the Instructions for Form 1040-SSPDF.

Terms in this set (4)Variable expenses. Expenses that vary from month to month (electriticy, gas, groceries, clothing).Fixed expenses. Expenses that remain the same from month to month(rent, cable bill, car payment)Intermittent expenses.Discretionary (non-essential) expenses.

Business expenses listRent or mortgage payments.Office equipment.Payroll costs (e.g., wages, benefits, and taxes)Advertising and marketing.Utilities.Small business insurance.Depreciation.Taxes.More items...?

Documents for expenses include the following:Canceled checks or other documents reflecting proof of payment/electronic funds transferred.Cash register tape receipts.Account statements.Credit card receipts and statements.Invoices.

If you are a bona fide resident of Puerto Rico during the entire tax year, you'll file the following returns: A Puerto Rico tax return (Form 482) reporting your worldwide income. A U.S. tax return (Form 1040) reporting your worldwide income. However, this 1040 will exclude your Puerto Rico income.

List of business expense categories for startupsRent or mortgage payments.Home office costs.Utilities.Furniture, equipment, and machinery.Office supplies.Advertising and marketing.Website and software expenses.Entertainment.More items...?

To claim small-business tax deductions as a sole proprietorship, you must fill out a Schedule C tax form. The Schedule C form is used to determine the taxable profit in your business during the tax year. You then report this profit on your personal 1040 form and calculate the taxes due from there.

Puerto Rico holds a unique position as an unincorporated U.S. territory. Under Internal Revenue Code (IRC) §933, Puerto Rico source income is excluded from U.S. federal tax.

To claim small-business tax deductions as a sole proprietorship, you must fill out a Schedule C tax form. The Schedule C form is used to determine the taxable profit in your business during the tax year. You then report this profit on your personal 1040 form and calculate the taxes due from there.