Puerto Rico Information Sheet - When are Entertainment Expenses Deductible and Reimbursable

Description

How to fill out Information Sheet - When Are Entertainment Expenses Deductible And Reimbursable?

Selecting the top legal document template can be quite a challenge. Certainly, there are numerous templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Puerto Rico Information Sheet - When are Entertainment Expenses Deductible and Reimbursable, which you can utilize for both business and personal needs.

All of the documents are reviewed by experts and comply with state and federal requirements.

Once you are confident the form is suitable, click on the Purchase now button to obtain the form. Choose the pricing plan you want and provide the required information. Create your account and process the payment using your PayPal account or Visa or Mastercard. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Puerto Rico Information Sheet - When are Entertainment Expenses Deductible and Reimbursable. US Legal Forms is the largest repository of legal forms from which you can access a variety of document templates. Take advantage of the service to download professionally crafted documents that comply with state regulations.

- If you are currently registered, sign in to your account and click the Download button to find the Puerto Rico Information Sheet - When are Entertainment Expenses Deductible and Reimbursable.

- Use your account to browse through the legal forms you have previously obtained.

- Navigate to the My documents tab of your account to get another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

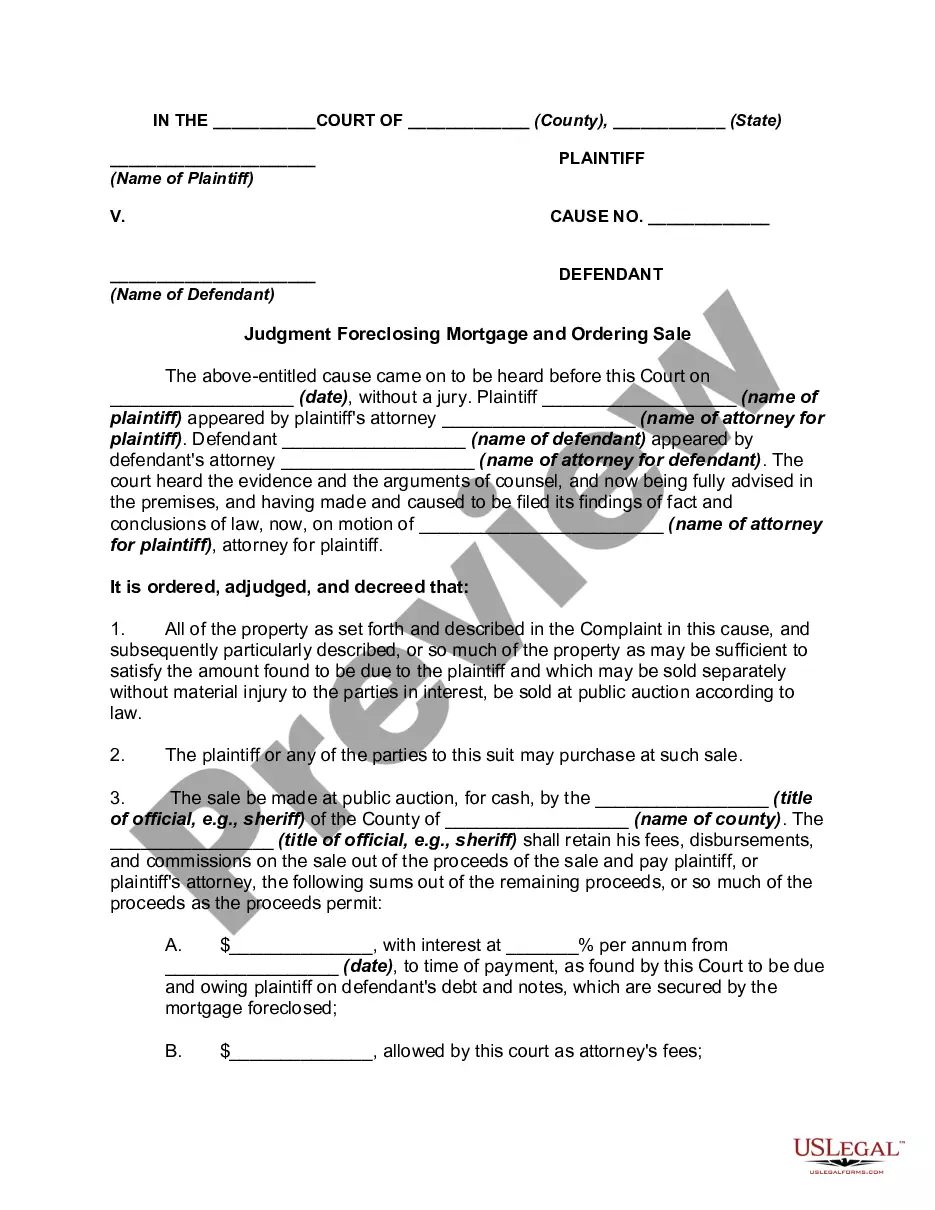

- First, make sure you have selected the correct form for your city/state. You can review the form using the Preview button and read the form description to ensure this is indeed the correct one for you.

- If the form does not fulfill your needs, use the Search field to find the appropriate form.

Form popularity

FAQ

Generally, the answer is that you can deduct ordinary and necessary expenses to entertain a customer or client if:Your expenses are of a type that qualifies as meals or entertainment.Your expenses bear the necessary relationship to your business activities.You keep adequate records and can substantiate the expenses.

Answer. In short, no. But that's provided your employer completes the pay stub accurately as part of their expense reimbursement process. If they incorrectly lump the reimbursed amount with your wages, it's taxed.

As part of the 2018 tax reform created by the Tax Cuts and Jobs Act (TCJA), Congress made several significant changes to the deductions for meals, entertainment, and employee fringe benefits, including making business entertainment expenses entirely nondeductible and reducing the deduction for most meals to 50%.

With all that out of the way, let's take a closer look at what you can deduct on your taxes in 2021.Home mortgage interest.Student loan interest.Standard deduction.American opportunity tax credit.Lifetime learning credit.SALT.Child and dependent care tax credit.Child tax credit.More items...?

Food and beverages will be 100% deductible if purchased from a restaurant in 2021 and 2022. This temporary 100% deduction was designed to help restaurants, many of which have been hard-hit by the COVID-19 pandemic. Entertainment expenses, like a sporting event or tickets to a show, are still non-deductible.

Tax relief for staff entertainingStaff entertaining is generally considered to be an allowable business expense and is therefore tax deductible. Allowable costs in this context include food, drink, entertainment, venue hire, transport and overnight accommodation.

Businesses will be permitted to fully deduct business meals that would normally be 50% deductible. Although this change will not affect your 2020 tax return, the savings will offer a 100% deduction in 2021 and 2022 for food and beverages provided by a restaurant.

The 2018 Tax Cuts and Jobs Act brought a few big changes to meals and entertainment deductions. The biggest one: entertainment expenses are no longer deudctible.

Taxable Allowances Entertainment Allowance: Employees are allowed the lowest of the declared amount one-fifth of basic salary, actual amount received as allowance or Rs. 5,000. This is an allowance provided to employees to reimburse the expenses incurred on the hospitality of customers.

Your business can deduct 100% of the cost of food, beverages, and entertainment that is made available to the general public (for example, free snacks at a car dealership or free food and music provided at a promotional event open to the public).