Puerto Rico Minnesota Franchise Registration Application

Description

How to fill out Minnesota Franchise Registration Application?

Choosing the best legitimate record design could be a have a problem. Naturally, there are tons of templates available on the net, but how would you get the legitimate kind you require? Make use of the US Legal Forms site. The services delivers a large number of templates, like the Puerto Rico Minnesota Franchise Registration Application, which you can use for business and private needs. All of the types are checked by specialists and meet federal and state demands.

If you are currently listed, log in for your account and click the Down load switch to find the Puerto Rico Minnesota Franchise Registration Application. Make use of account to check through the legitimate types you possess acquired formerly. Check out the My Forms tab of the account and obtain one more version in the record you require.

If you are a brand new customer of US Legal Forms, allow me to share simple instructions that you can adhere to:

- Very first, ensure you have chosen the proper kind for your personal metropolis/county. You can look over the form while using Preview switch and browse the form outline to guarantee it is the best for you.

- In the event the kind fails to meet your needs, make use of the Seach discipline to obtain the right kind.

- Once you are positive that the form is acceptable, click the Purchase now switch to find the kind.

- Pick the pricing strategy you need and enter in the necessary information and facts. Make your account and buy the order using your PayPal account or bank card.

- Select the data file format and download the legitimate record design for your system.

- Full, edit and printing and indicator the attained Puerto Rico Minnesota Franchise Registration Application.

US Legal Forms is the largest local library of legitimate types that you can discover different record templates. Make use of the company to download appropriately-made papers that adhere to state demands.

Form popularity

FAQ

MN Corporation Franchise Tax This is usually called a franchise tax, transaction tax or privilege tax. In Minnesota, it's the Corporation Franchise Tax. This tax applies only to C Corps that are either located in Minnesota, have a business presence in Minnesota or have Minnesota gross income.

There are two different types of taxes that can be assessed on businesses: corporate income taxes and franchise taxes. The difference is found in looking at what exactly is being taxed. Income taxes apply to profit. Franchise taxes do not apply to profit.

Corporations pay franchise tax if they meet any of the following: Incorporated or organized in California. Qualified or registered to do business in California. Doing business in California, whether or not incorporated, organized, qualified, or registered under California law.

All corporations (both S and C corporations), partnerships, and LLCs must pay a minimum fee based on the sum of their Minnesota property, payroll, and sales. This fee is an ?add- on? fee that is paid in addition to the tax computed under the regular tax or AMT.

Find Your Minnesota Tax ID Numbers and Rates You can find your Withholding Account ID online or on any notice you have received from the Department of Revenue. If you're unable to locate this, contact the agency at (651) 282-9999.

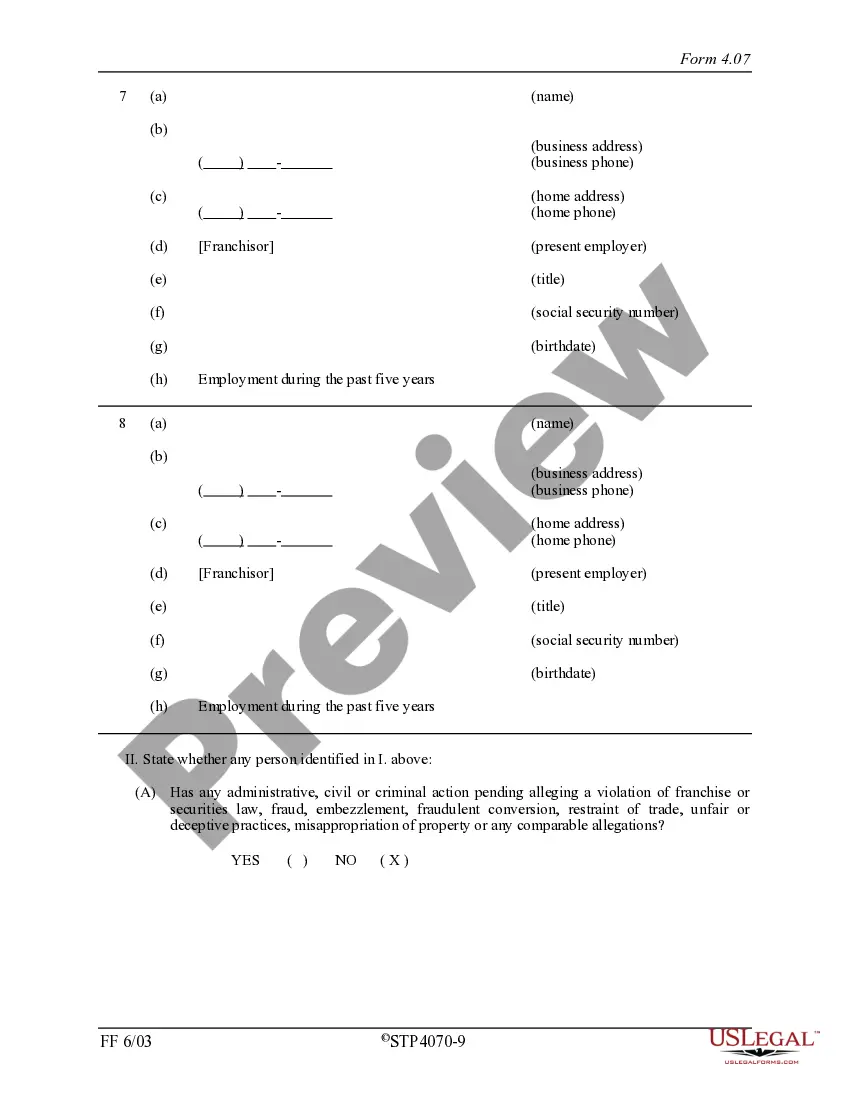

Questions? As one of several states in the United States that requires registration of franchise offerings, the Minnesota Department of Commerce-Securities Division is responsible for overseeing and helping to maintain the integrity of the franchise community in the State of Minnesota.

Contrary to what the name implies, a franchise tax is not a tax imposed on a franchise. Rather, it's charged to corporations, partnerships, and other entities like limited liability corporations (LLCs) that do business within the boundaries of that state.