Puerto Rico Resolution of Meeting of LLC Members - General Purpose

Description

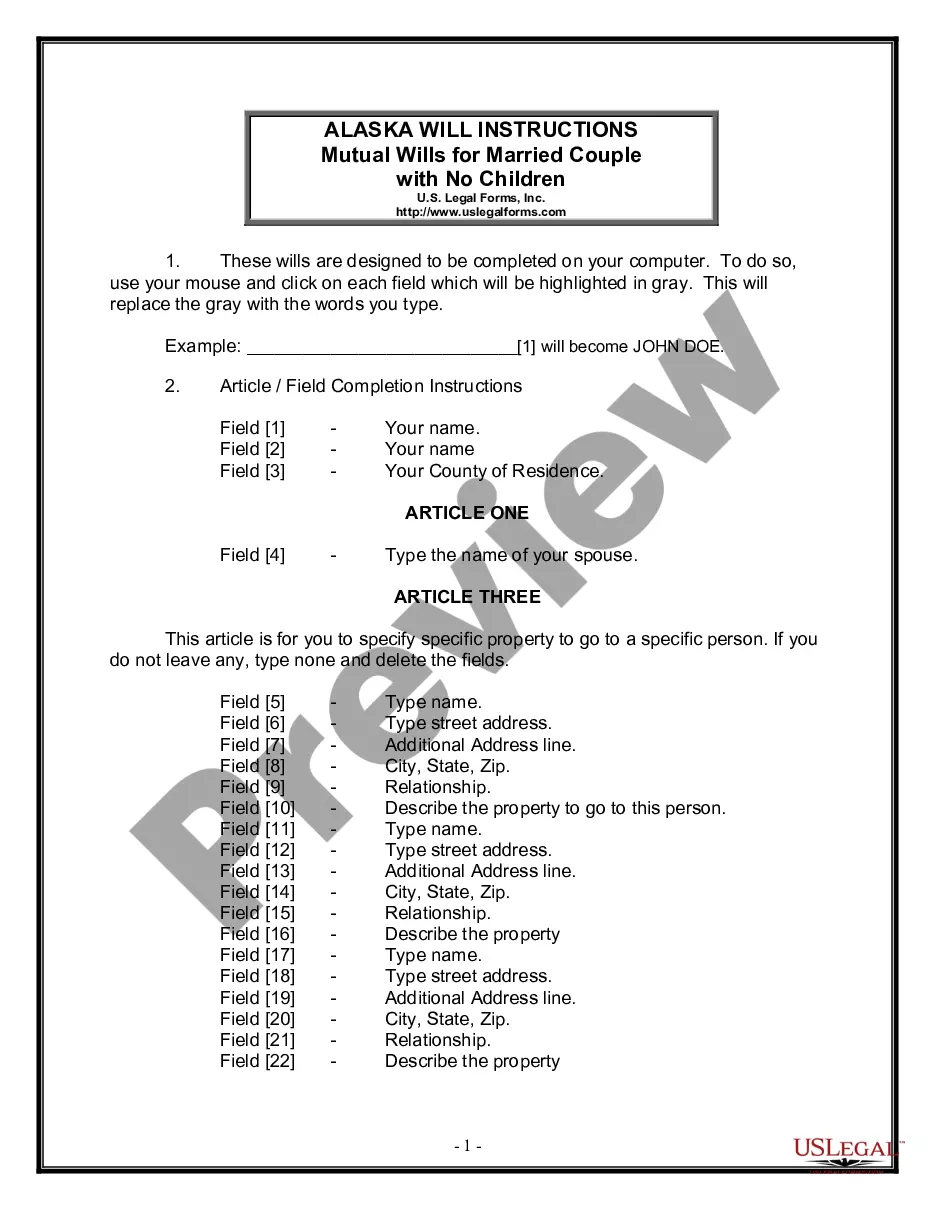

How to fill out Resolution Of Meeting Of LLC Members - General Purpose?

It is feasible to dedicate time online trying to locate the lawful document template that complies with the state and federal stipulations you need.

US Legal Forms provides a vast array of legal templates that have been evaluated by experts.

It is easy to download or print the Puerto Rico Resolution of Meeting of LLC Members - General Purpose from our offerings.

First, make sure that you have selected the correct document template for the region/city of your choice. Review the form description to confirm you have chosen the right one. If available, utilize the Preview option to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Download option.

- Subsequently, you can fill out, modify, print, or sign the Puerto Rico Resolution of Meeting of LLC Members - General Purpose.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, navigate to the My documents tab and select the appropriate option.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions provided below.

Form popularity

FAQ

To start a corporation in Puerto Rico, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by mail. The certificate costs $150 to file.

To officially start your Puerto Rico LLC, you'll need to file a Certificate of Formation with the Puerto Rico Department of State and pay the $250 fee. First, you must choose a company name and appoint a registered agent for your LLC.

First, you must choose a company name and appoint a registered agent for your LLC....Name Your LLC.Designate a Registered Agent.Submit LLC Certificate of Formation.Write an LLC Operating Agreement.Get an EIN.Open a Bank Account.Fund the LLC.File State Reports & Taxes.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

Ltd simply means 'limited' and refers to limited liability. Limited liability companies are public companies, which means the public has a certain amount of ownership. Public companies may generate revenue in this way, whereas private companies cannot.

A U.S. company that wishes to do business in Puerto Rico may choose to either form a new subsidiary entity or register an existing company. In order to determine the best option, the company should consult an attorney familiar with tax laws and the company's business activities and structure.

Minimum requirements for an LLC in Australia include: Zero minimum share capital. 1 shareholder. 1 company director....operate your company under the replaceable rules listed under the Corporations Act.create a unique constitution.incorporate elements of the replaceable rules, and include your own.

What Is an LLC Resolution? An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

Corporate resolutions are required whenever the board of directors makes a major decision. The resolution acts as a written record of the decision and is stored with other business documents. These board resolutions are binding on the company.

Annual reports must be filed electronically by accessing the Department of State website at . A $150 annual fee is payable when filing the report. The payment method is a major credit card or any other method provided at the Department of State website.