Puerto Rico Resolution of Meeting of LLC Members to Dissolve the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Dissolve The Company?

Selecting the appropriate legal document template can be a challenge. Of course, there is a multitude of designs available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Puerto Rico Resolution of Meeting of LLC Members to Dissolve the Company, that you can utilize for both business and personal needs. All forms are vetted by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to acquire the Puerto Rico Resolution of Meeting of LLC Members to Dissolve the Company. Use your account to review the legal documents you have obtained previously. Navigate to the My documents section of your account and retrieve another version of the document you need.

Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Puerto Rico Resolution of Meeting of LLC Members to Dissolve the Company. US Legal Forms is the largest repository of legal documents where you can find various document templates. Utilize the service to download professionally crafted forms that adhere to state regulations.

- Firstly, ensure you have selected the correct form for your region/state.

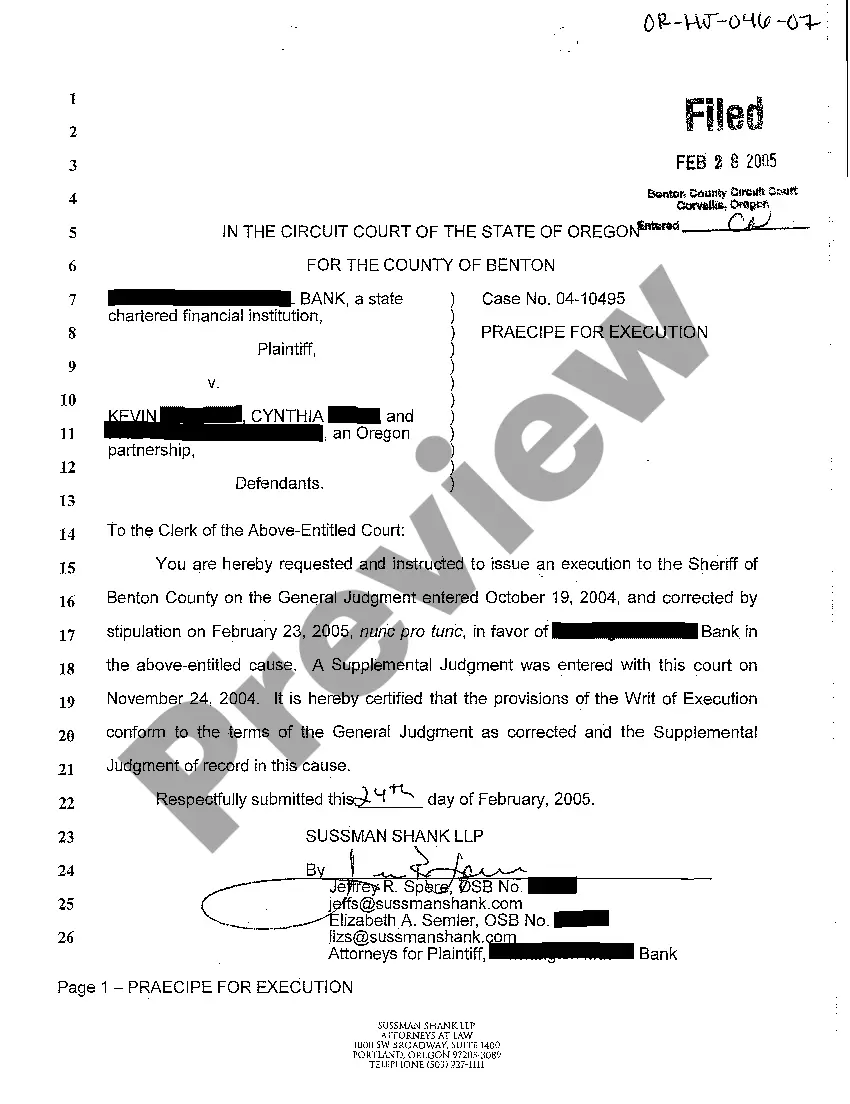

- You may review the document using the Preview option and examine the form summary to confirm this is the correct one for you.

- If the form does not fulfill your requirements, use the Search field to find the appropriate template.

- When you are certain that the form is suitable, click on the Order Now button to obtain the document.

- Select the pricing plan you desire and input the necessary details.

- Create your account and complete the purchase using your PayPal account or credit card.

Form popularity

FAQ

The report must be filed electronically accessing the Commonwealth of Puerto Rico portal, and/or accessing directly the Registry of Corporations at or through the Department of State page at .

Filing and forming an LLC in Puerto Rico requires a $250 filing fee. Under Puerto Rico law, an LLC uses a limited liability company agreement, or LLCA, to govern the internal affairs and administration of the LLC.

How to Get a Certificate of Good Standing from the Puerto Rico Department of StateFiling fee ($15 for corporations, $25 for limited liability companies (LLCs), $0 for nonprofits)Entity name.Registration number.

Follow these steps to closing your business:Decide to close.File dissolution documents.Cancel registrations, permits, licenses, and business names.Comply with employment and labor laws.Resolve financial obligations.Maintain records.

A corporation cannot distribute its assets, nor may it dissolve, until its officers have paid or made provisions for all known debts and obligations. Under Corporations Code section 1905, to make provisions for a debt, another person or entity must either assume the debt, or personally guarantee its payment.

Dissolution is permitted by an authorised officer of a business entity can dissolve the registered corporation. A corporate resolution at the time of the dissolution action must be filed. When dissolution is made effective, the name of the corporation is reserved for a maximum of 30 days since the day of dissolution.

Annual reports must be filed electronically by accessing the Department of State website at . A $150 annual fee is payable when filing the report. The payment method is a major credit card or any other method provided at the Department of State website.

Puerto Rico corporations are treated as foreign corporations for U.S. income tax purposes.

A Puerto Rico LLC (limited liability company) is a business entity that offers strong liability protection and more flexibility than a corporation in how it can be managed and taxed.

Limited liability companies (LLCs) are becoming the preferred method of doing business in Puerto Rico. LLCs may be organized by any natural or legal person by filing articles of organization (also referred to as the certificate of formation) in the Puerto Rico State Department.