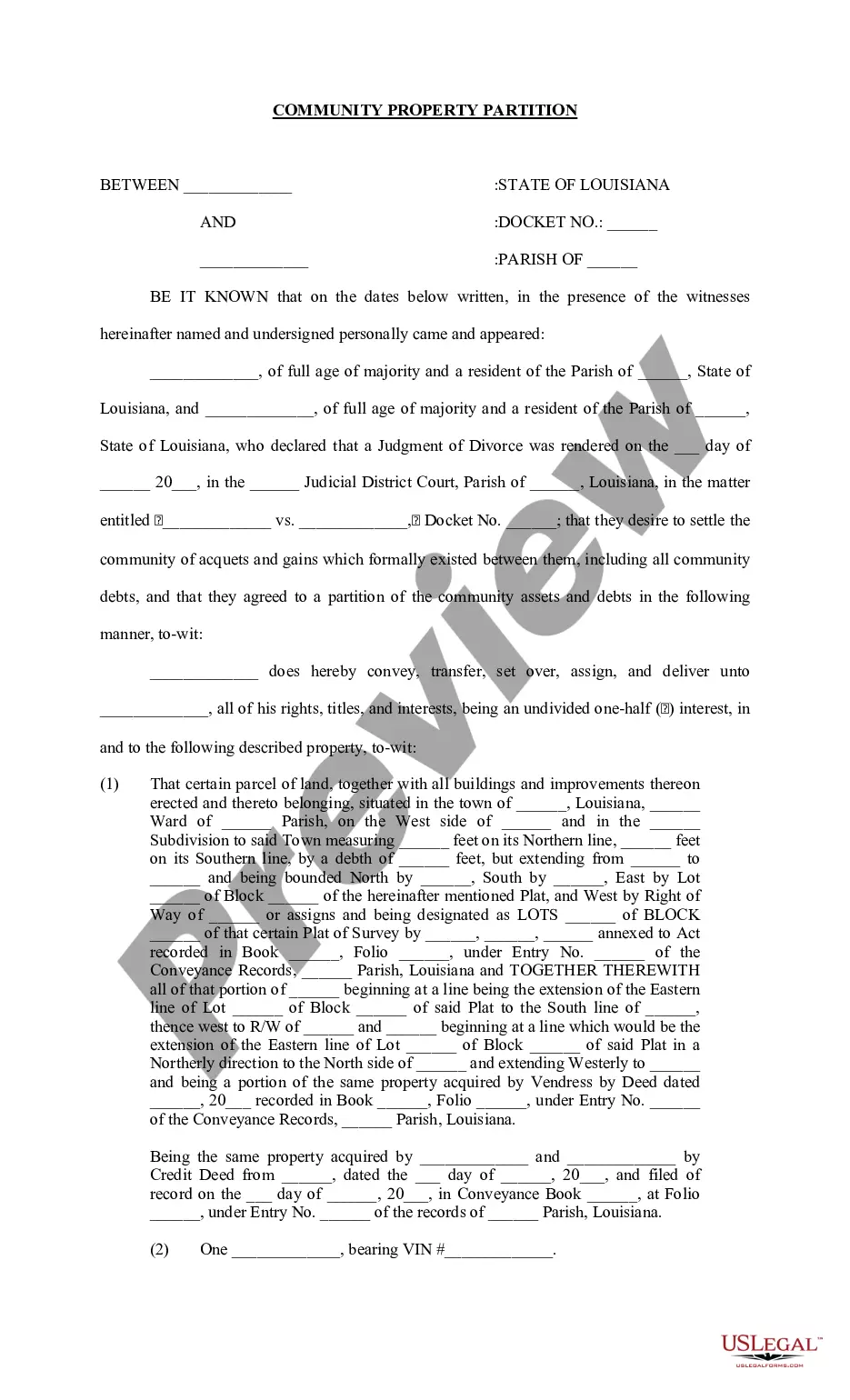

Puerto Rico Credit Inquiry

Description

How to fill out Credit Inquiry?

Selecting the optimal legal document format can be challenging.

Certainly, there are numerous templates accessible online, but how can you obtain the legal document you need.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Puerto Rico Credit Inquiry, suitable for both business and personal purposes.

You can preview the document using the Review button and read the document description to ensure it meets your needs.

- All the documents are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Puerto Rico Credit Inquiry.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents section of your account and obtain another copy of the documents you require.

- If you are a new user of US Legal Forms, here are some straightforward guidelines to follow.

- First, make sure you have selected the correct form for your city/county.

Form popularity

FAQ

The 183-day rule is a guideline used to determine if an individual is a resident of Puerto Rico for tax purposes. If you spend more than 183 days in Puerto Rico during the tax year, you may be considered a tax resident. This designation can significantly affect your tax liabilities. For those considering a Puerto Rico Credit Inquiry, knowing your residency status is crucial.

Since the average household in Puerto Rico consists of less than three children, few families could receive any benefit at all. Now the credit is available to families in Puerto Rico beginning with their first child. They can claim it by filing form 1040, the federal income tax form.

Nope! You credit score is the same. Actually, in the island the banks will look in more details to give you a loan.

Put simply, your credit score won't follow you abroad, but your payment history and debts will.

Nope! You credit score is the same. Actually, in the island the banks will look in more details to give you a loan. We just purchased a vehicle and end up financing the car with USAA since it was less hassle than the local bank.

This information is reported to Equifax by your lenders and creditors and includes the types of accounts (for example, a credit card, mortgage, student loan, or vehicle loan), the date those accounts were opened, your credit limit or loan amount, account balances, and your payment history.

The new law also prohibits employers from verifying or obtaining the credit history information or credit reports of an employee or applicant. Fines for violating this Act may range between $1,000 and $2,500 for each violation.

Credit scores are a statement of 'creditworthiness' the likelihood a borrower will default on their debt obligations. They are calculated differently from country to country, and do not follow consumers when they relocate somewhere new.

Key Takeaways. A credit score accrued in the United States has no bearing overseas; it will neither harm nor help you in overseas financial dealings. The technology doesn't yet exist for the possibility of international credit scores; additionally, laws prohibit the sharing of credit information overseas.

Nerdy tip: Although it's not a state, Puerto Rico is U.S. soil and uses the U.S. dollar as currency. That means cash-back rewards on U.S.-issued credit cards operate in exactly the same way as they do in the United States itself.