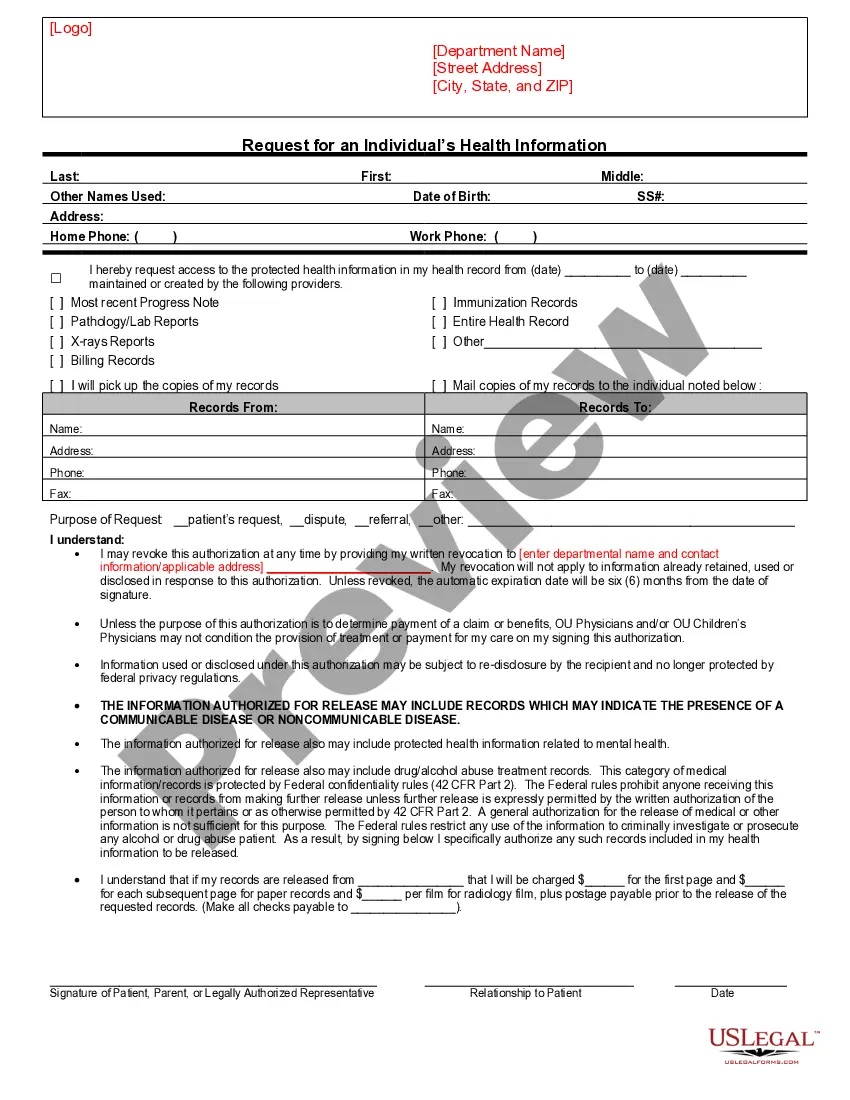

Puerto Rico Service Bureau Form

Description

How to fill out Service Bureau Form?

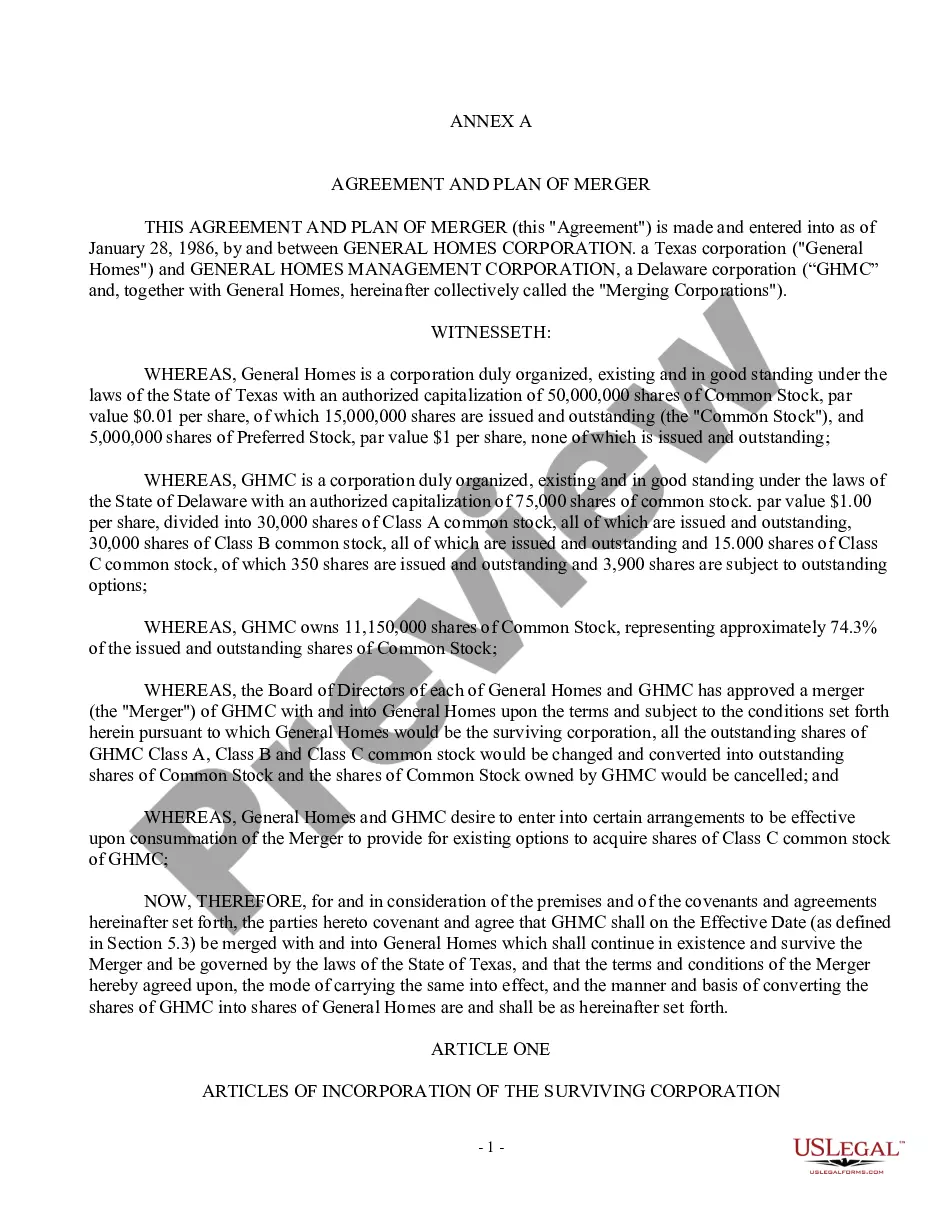

If you want to be thorough, acquire or print licensed document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Employ the site's straightforward and user-friendly search to find the documents you need.

An assortment of templates for commercial and personal purposes is organized by categories and states, or keywords.

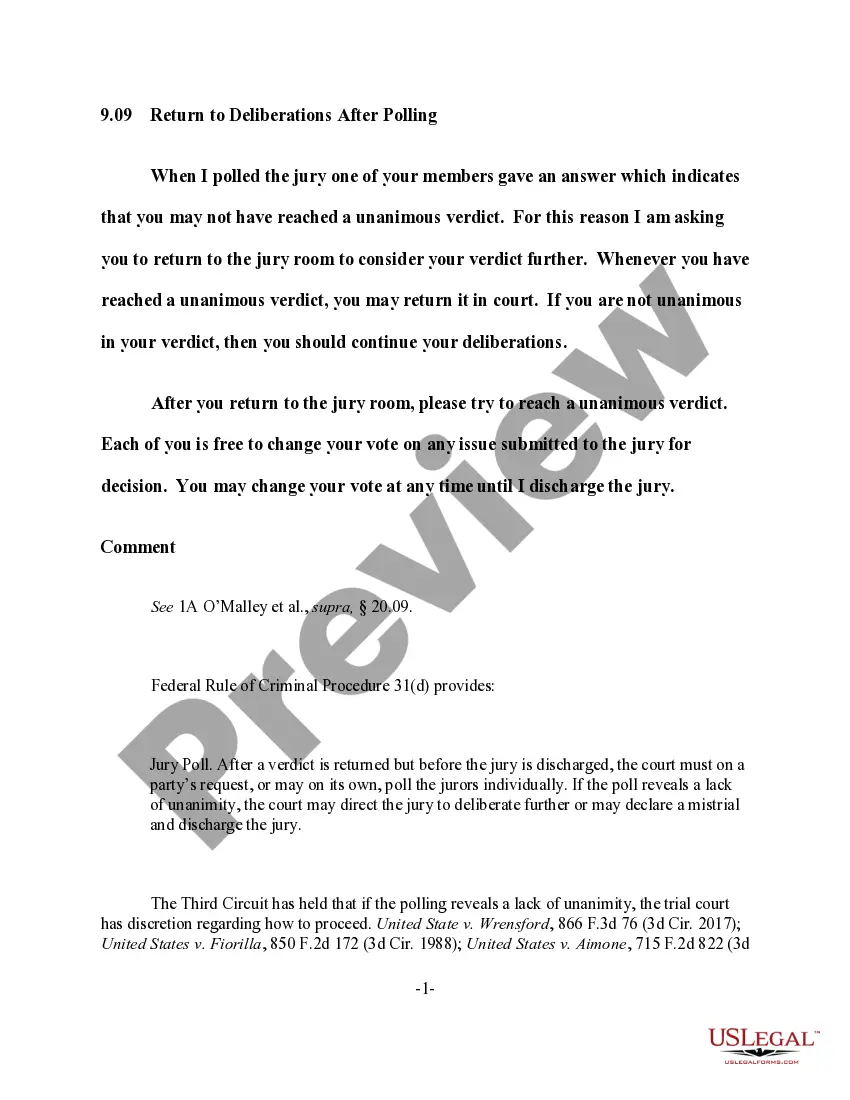

Step 5. Process the transaction. You can utilize your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Puerto Rico Service Bureau Form. Every legal document format you purchase is yours permanently. You will have access to every form you downloaded within your account. Click the My documents section and select a form to print or download again. Complete and download, and print the Puerto Rico Service Bureau Form using US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to find the Puerto Rico Service Bureau Form in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and select the Download option to obtain the Puerto Rico Service Bureau Form.

- You can also access forms you've previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have chosen the form for your specific city/state.

- Step 2. Use the Review option to examine the details of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative forms in the legal form format.

- Step 4. Once you have located the form you need, click the Get now option. Choose your preferred pricing plan and enter your details to register for an account.

Form popularity

FAQ

Specifically, a U.S. citizen who becomes a bona fide Puerto Rico resident and moves his or her business to Puerto Rico (thus, generating Puerto Rico sourced income) may benefit from a 4% corporate tax/fixed income tax rate, a 100% exemption on property taxes, and a 100% exemption on dividends from export services.

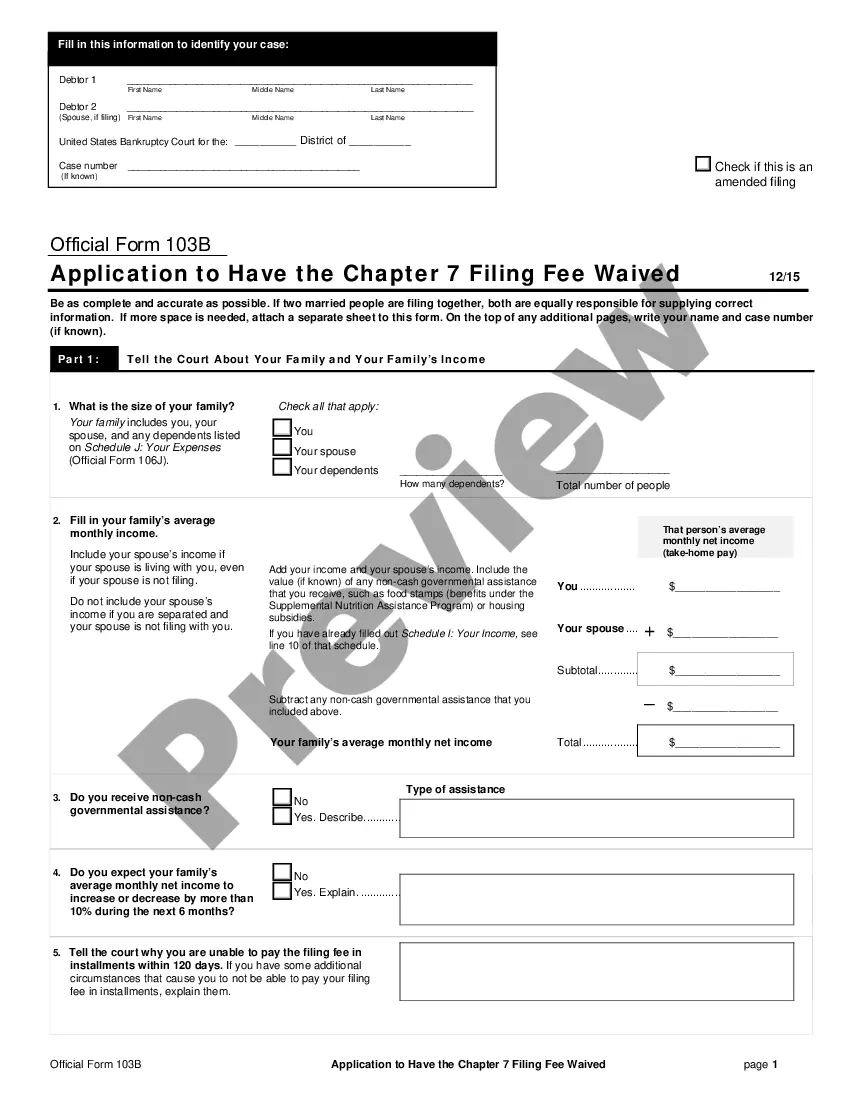

Form 1040-PR is for residents of the Commonwealth of Puerto Rico (PR) who are not required to file a United States (US) Form 1040, Form 1040A, or Form 1040EZ income tax return. Form 1040-PR is generally used to report and pay self-employment income tax to the US.

A formal 16-page typical annual report can cost anywhere from $7,500 to $20,000. Having staff take care of internal coordination and writing can lower the price to a $6,000 $10,000 range. If your annual report needs to be bilingual, add 30-40% for producing the second language.

Since you cannot prepare and file or e-File a Puerto Rico Tax Return on eFile.com or anywhere online, you can contact the Puerto Rico Department of the Treasury for information on how to do this.

But we are puerto ricans living in Puerto rico. You can use TurboTax to file your FEDERAL return only. You can NOT use TurboTax to file your PR return. Do note that on screens that ask you to select your state of residence, just select "Foreign or U.S. Possession" and you'll be fine.

How to File an Annual ReportDetermine If You Need To File an Annual Report.Find Out When the Annual Report is Due.Complete the Annual Report Form.File Annual Report.Repeat the Process for Other States Where You're Registered to Do Business.Set Up Reminders for Your Next Annual Report Deadline.

An annual report begins with a letter to the shareholders, then a brief description of the business and industry. Following that, the report should include the audited financial statements: balance sheet, income statement, and statement of cash flows.

Residents of Puerto Rico who aren't required to file a U.S. income tax return must file Form 1040-SS or Form 1040-PR with the United States to report self-employment income and if necessary, pay self-employment tax.

An Annual report is a filing that details a company's activities throughout the prior year. Annual reports are intended to give state governing authorities information regarding the names and addresses of directors or managing members of a corporation or LLC as well as the company and registered agent address.

Annual reports must be filed electronically by accessing the Department of State website at . A $150 annual fee is payable when filing the report. The payment method is a major credit card or any other method provided at the Department of State website.