Puerto Rico Agreement for Withdrawal of Partner from Active Management

Description

How to fill out Agreement For Withdrawal Of Partner From Active Management?

Are you presently in a scenario where you require documents for various corporate or personal activities nearly every day.

There are many legitimate document templates accessible online, but locating trustworthy ones can be challenging.

US Legal Forms offers thousands of form templates, including the Puerto Rico Agreement for Withdrawal of Partner from Active Management, which are crafted to comply with federal and state requirements.

Once you find the appropriate form, click Purchase now.

Choose the pricing plan you prefer, complete the necessary details to create your account, and pay for your order using your PayPal, Visa, or MasterCard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Puerto Rico Agreement for Withdrawal of Partner from Active Management template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/region.

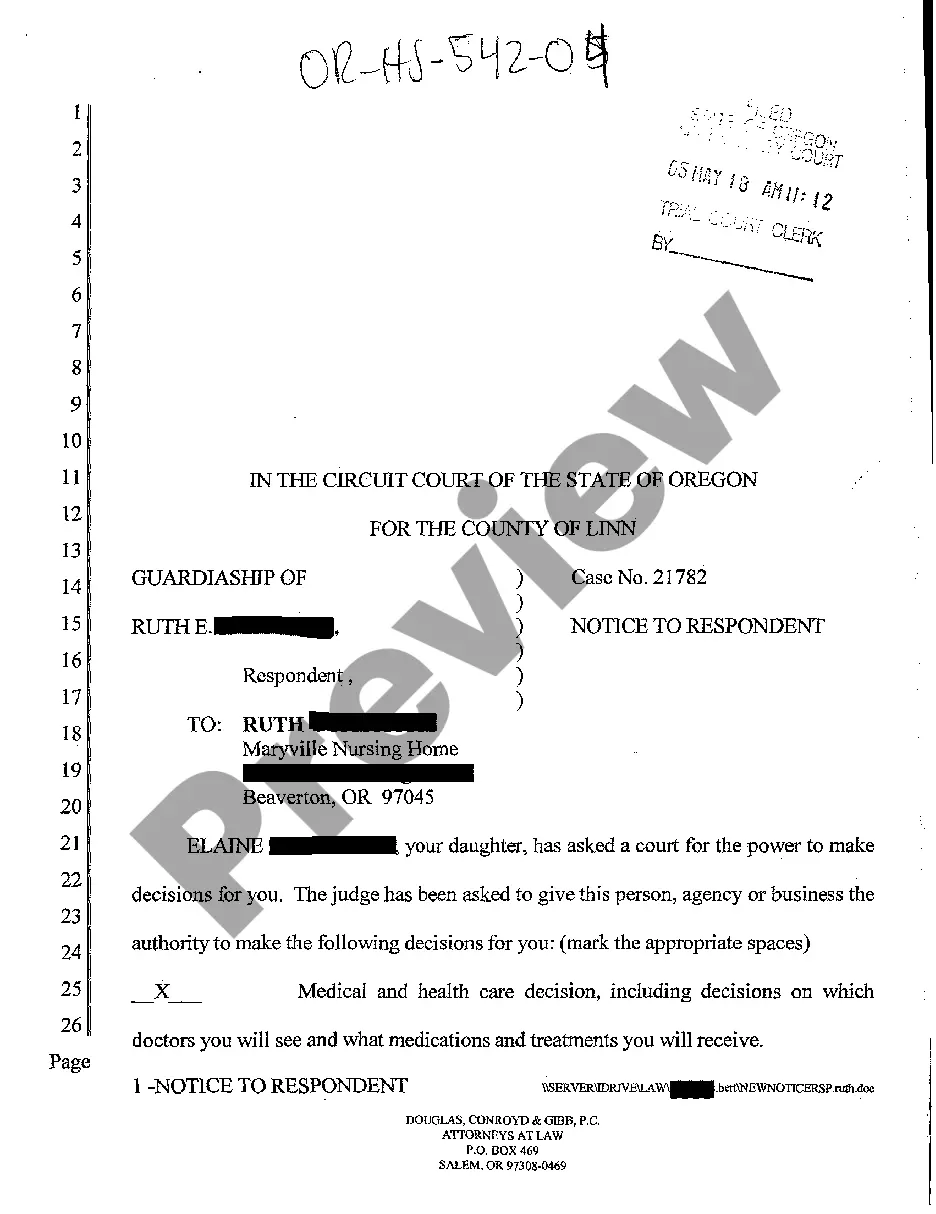

- Utilize the Review option to inspect the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you require, use the Search field to find the form that meets your needs and criteria.

Form popularity

FAQ

Yes, Puerto Rico offers various tax incentives for property buyers, particularly under Acts 20, 22, and 60. These benefits may include exemptions on property taxes or reductions in capital gains taxes, making investing in real estate more attractive. If you're considering property investments while managing a Puerto Rico Agreement for Withdrawal of Partner from Active Management, these tax breaks can positively impact your financial strategy.

Eligibility for Act 22 applies primarily to individuals who relocate to Puerto Rico and become residents. You must prove that you intend to make Puerto Rico your primary residence while meeting other requirements set by the law. If you’re assessing options related to a Puerto Rico Agreement for Withdrawal of Partner from Active Management, it’s wise to review your eligibility under Act 22.

The Puerto Rico Status Act aims to address the political status of Puerto Rico by offering its residents options for statehood, independence, or enhanced commonwealth status. This proposal seeks to empower Puerto Ricans in determining their future. Understanding the implications of the Status Act is important when considering agreements such as the Puerto Rico Agreement for Withdrawal of Partner from Active Management.

To apply for Law 22, you first need to establish residency in Puerto Rico. After residency is confirmed, you'll need to submit the application to the Puerto Rico Department of Economic Development and Commerce. The process may involve providing documents proving your residency and eligibility. Engaging with uslegalforms can simplify your efforts, especially when related to a Puerto Rico Agreement for Withdrawal of Partner from Active Management.

Act 132 focuses on promoting the tourism industry in Puerto Rico by providing financial incentives to eligible service providers. It encourages the development of infrastructure and services that boost tourism and hospitality. If you’re considering how this relates to your Puerto Rico Agreement for Withdrawal of Partner from Active Management, understanding Act 132 could reveal valuable opportunities in the tourism sector.

Act 60 provides a series of tax incentives aimed primarily at individual investors and businesses in Puerto Rico. It encourages economic growth by offering reduced tax rates on eligible income, aiming to attract more residents and businesses to the island. When dealing with a Puerto Rico Agreement for Withdrawal of Partner from Active Management, familiarizing yourself with Act 60 is crucial for leveraging potential benefits.

Act 60, which consolidates various tax incentives, was established by the Puerto Rican government as a part of its efforts to spur economic development. It merges previous laws, including Acts 20 and 22, into a comprehensive law aimed at mitigating taxes for investors and businesses. Understanding the origins of Act 60 can inform you about your options, including those related to a Puerto Rico Agreement for Withdrawal of Partner from Active Management.

To receive tax benefits under Acts 20 and 22, you must establish residency in Puerto Rico. Generally, the requirement is to live in Puerto Rico at least 183 days during the tax year. However, it's essential to demonstrate your intent to make Puerto Rico your main home. This residency requirement is crucial, especially if you are involved in a Puerto Rico Agreement for Withdrawal of Partner from Active Management.

Act 20 and Act 22 are two important tax incentives offered in Puerto Rico. Act 20 focuses on promoting export services, providing significant tax reductions for businesses expanding their operations to Puerto Rico. Meanwhile, Act 22 aims to attract individual investors by exempting certain income from Puerto Rican taxes. Understanding these acts can help you navigate your Puerto Rico Agreement for Withdrawal of Partner from Active Management effectively.

Income inequality in Puerto Rico is a significant issue, exacerbated by high poverty rates and economic challenges. Various factors contribute to this inequality, including limited job opportunities and disparities in education. Addressing these issues, while managing business ownership changes through agreements like the Puerto Rico Agreement for Withdrawal of Partner from Active Management, plays a crucial role in fostering equitable growth.