Puerto Rico Receipt and Withdrawal from Partnership

Description

How to fill out Receipt And Withdrawal From Partnership?

If you require to compile, obtain, or create official document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are categorized by type and jurisdiction, or keywords.

Stay competitive and download, and print the Puerto Rico Receipt and Withdrawal from Partnership with US Legal Forms.

There are numerous specialized and state-specific forms available for your business or personal requirements.

- Employ US Legal Forms to quickly find the Puerto Rico Receipt and Withdrawal from Partnership.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Puerto Rico Receipt and Withdrawal from Partnership.

- You may also access forms you previously stored in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Make sure you have selected the form for the correct city/state.

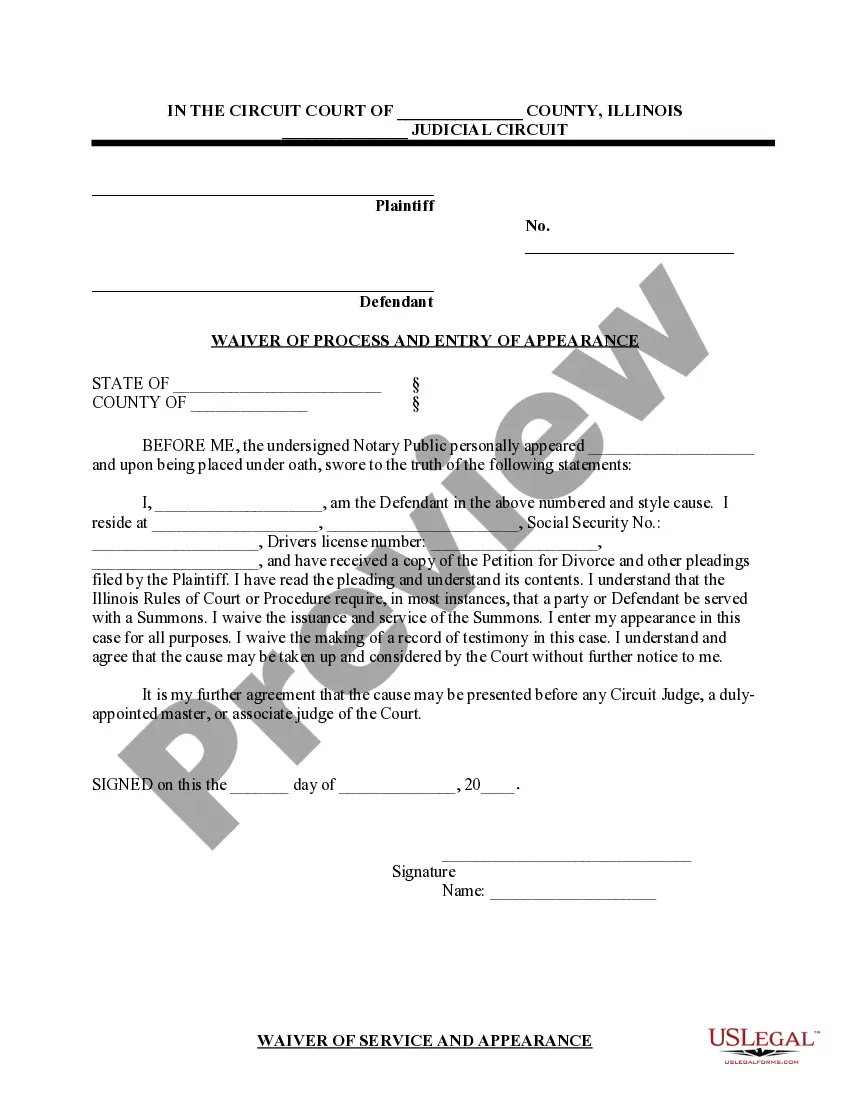

- Step 2. Use the Preview option to review the contents of the form.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other templates of your legal form.

- Step 4. Once you have found the form you desire, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Puerto Rico Receipt and Withdrawal from Partnership.

- Every legal document template you purchase is yours to keep forever. You will have access to every form you saved in your account. Check the My documents section to select a form to print or download again.

Form popularity

FAQ

Whether or not a partnership makes distributions to the partners, each partner will be taxed on the partnership's business income. A partnership, unlike a corporation, is not taxed separately and is not subject to income tax.

When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts.

The term "foreign country" does not include U.S. territories such as Puerto Rico, Guam, the Commonwealth of the Northern Mariana Islands, the U.S. Virgin Islands, or American Samoa.

Where Are Partnership Distributions Reported 1040? Schedule K and K-1 of the partnership return includes their details. On Schedule E (Form 1040), partners report guaranteed payments as ordinary income in addition to other ordinary income distributed equally among themselves.

Are Partnership Distributions Reported On 1099? If your partnership received more than $600 from your clients in 2017, it will receive 1099 forms. The total income received by the partnership from all of its 1099s results in, according to you, the most of all the income that the partnership earned during taxes.

A partnership distribution is not taken into account in determining the partner's distributive share of partnership income or loss. If any gain or loss from the distribution is recognized by the partner, it must be reported on their return for the tax year in which the distribution is received.

When that income is paid out to partners in cash, they aren't taxed on the cash if they have sufficient basis. Instead, partners just reduce their basis by the amount of the distribution. If a cash distribution exceeds a partner's basis, then the excess is taxed to the partner as a gain, which often is a capital gain.

Unlike regular corporations, partnerships aren't subject to income tax. Instead, each partner is taxed on the partnership's earnings whether or not they're distributed. Similarly, if a partnership has a loss, the loss is passed through to the partners.