Qualified Written RESPA Request to Dispute or Validate Debt

Description

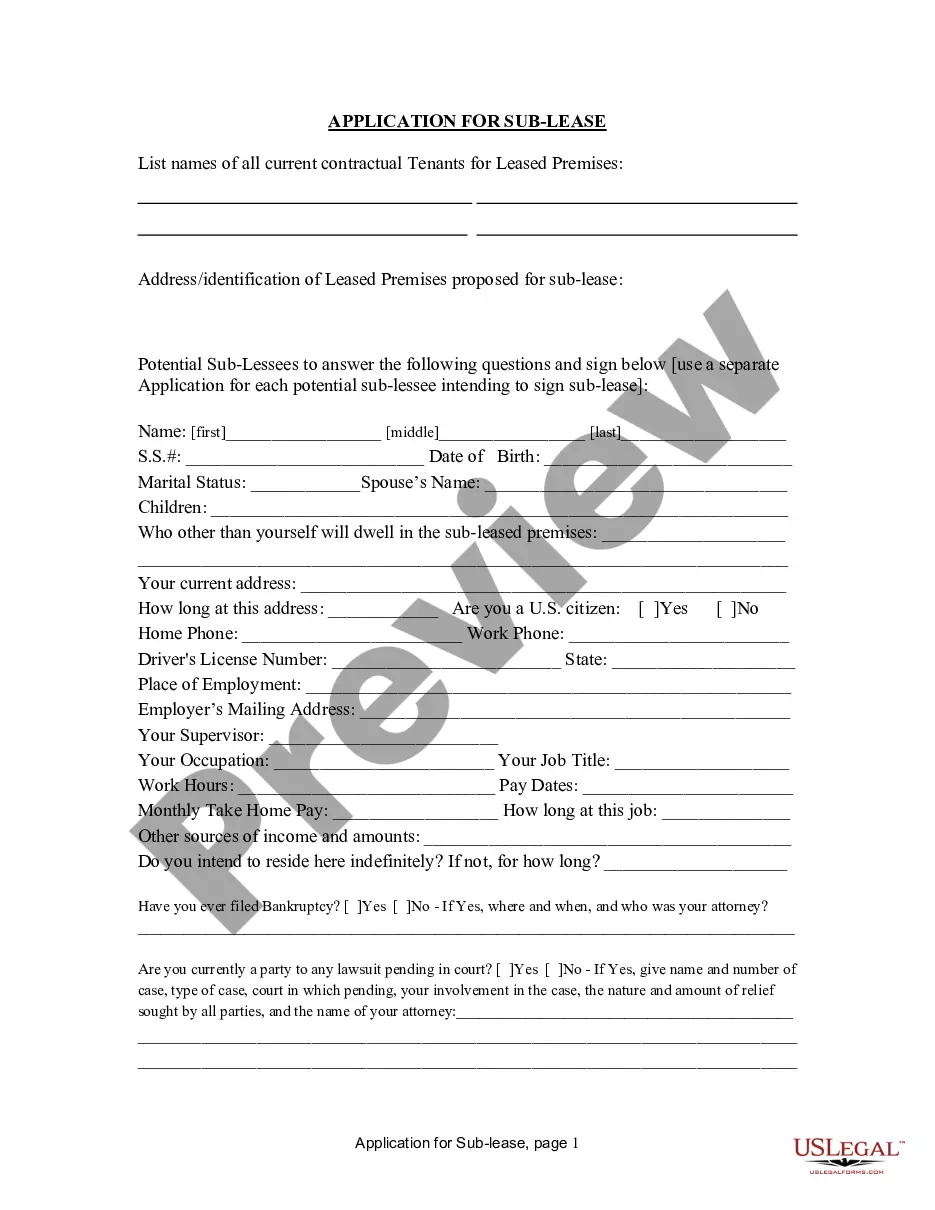

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

When it comes to drafting a legal document, it’s better to delegate it to the experts. However, that doesn't mean you yourself cannot find a sample to use. That doesn't mean you yourself cannot find a sample to use, nevertheless. Download Qualified Written RESPA Request to Dispute or Validate Debt straight from the US Legal Forms site. It offers numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. As soon as you are signed up with an account, log in, find a specific document template, and save it to My Forms or download it to your gadget.

To make things much easier, we’ve provided an 8-step how-to guide for finding and downloading Qualified Written RESPA Request to Dispute or Validate Debt promptly:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the suitable subscription for your needs.

- Make your account.

- Pay via PayPal or by debit/bank card.

- Select a needed format if a number of options are available (e.g., PDF or Word).

- Download the document.

When the Qualified Written RESPA Request to Dispute or Validate Debt is downloaded it is possible to complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant papers in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

A RESPA violation occurs when a title company has a financial interest (or ownership) in a real estate transaction where a buyer's loan is federally insured. RESPA is a consumer protection law created to make sure that buyers of residential properties of one to four family units are informed in detailed writing

RESPA applies to the majority of purchase loans, refinances, property improvement loans, and equity lines of credit. RESPA requires lenders, mortgage brokers, or servicers of home loans to provide disclosures to borrowers concerning real estate transactions, settlement services, and consumer protection laws.

A qualified written request, or QWR, is a written letter sent to the servicer that: requests information about the loan (called a request for information under RESPA), and/or. asks that the servicer correct an error (a notice of error).

A Qualified Written Request, or QWR, is written correspondence that you or someone acting on your behalf can send to your mortgage servicer.You can send a QWR to request information about the servicing of your mortgage loan or to assert that the company has made an error.

RESPA applies to the majority of purchase loans, refinances, property improvement loans, and equity lines of credit. RESPA requires lenders, mortgage brokers, or servicers of home loans to provide disclosures to borrowers concerning real estate transactions, settlement services, and consumer protection laws.

A Mortgage Servicing Disclosure Statement, which discloses to the borrower whether the lender intends to service the loan or transfer it to another lender. It also provides information about complaint resolution.

Your name and account information (or information that enables the servicer to be able to identify your account) a statement of the reasons why you believe that the account is in error, or.