Request for Proof of Debt

Overview of this form

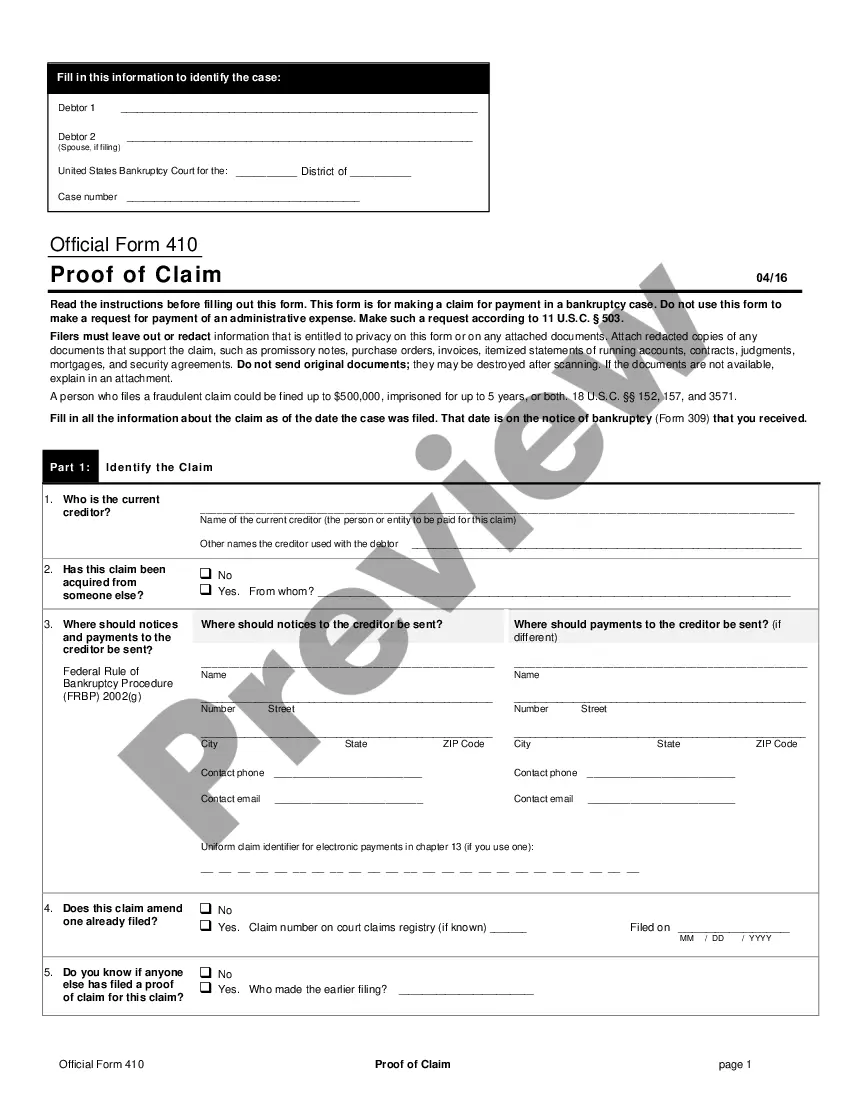

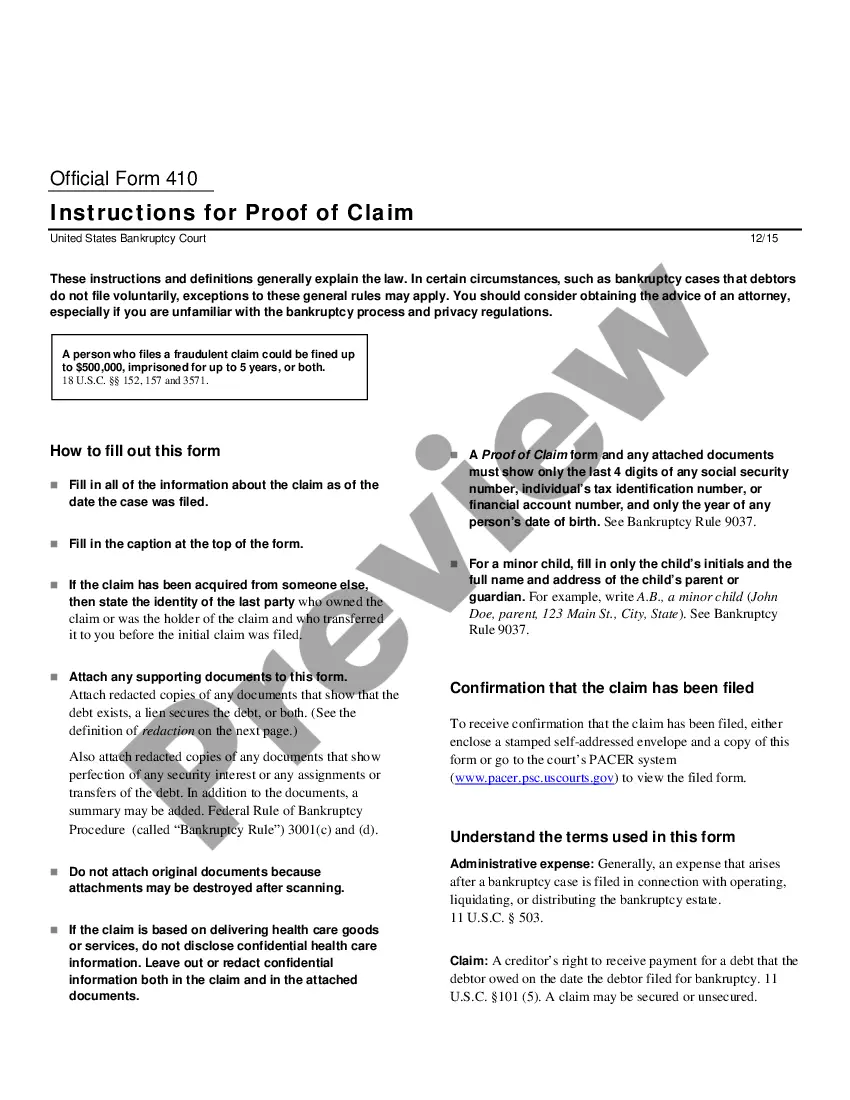

The Request for Proof of Debt is a formal document used by individuals to request evidence from a debt collector concerning a debt they are being asked to pay. This form serves to protect consumers by demanding detailed proof of the alleged debt, including original agreements and accounting records. By using this form, individuals ensure they have the necessary information before taking any action regarding disputed debts, differing it from simpler dispute letters that may lack specific requests for documentation.

Form components explained

- Date of the request

- Collector's name and address

- Statement of debt denial

- Request for specific documentation related to the alleged debt

- Instructions for reporting the dispute to credit agencies

- Signature and contact information of the requester

When this form is needed

This form should be used when an individual receives a collection notice but does not recognize the debt or believes it is incorrect. It is particularly useful in cases where the debtor has not previously been contacted about the alleged debt and demands verification before any payment is made. It can also be utilized when a debtor wishes to protect their credit report from misinformation regarding the debt in question.

Intended users of this form

- Individuals who have received a debt collection notice.

- Consumers who dispute the existence or validity of a debt.

- Persons seeking clarification or proof from a debt collector.

- Anyone wanting to protect their credit report from inaccurate debt claims.

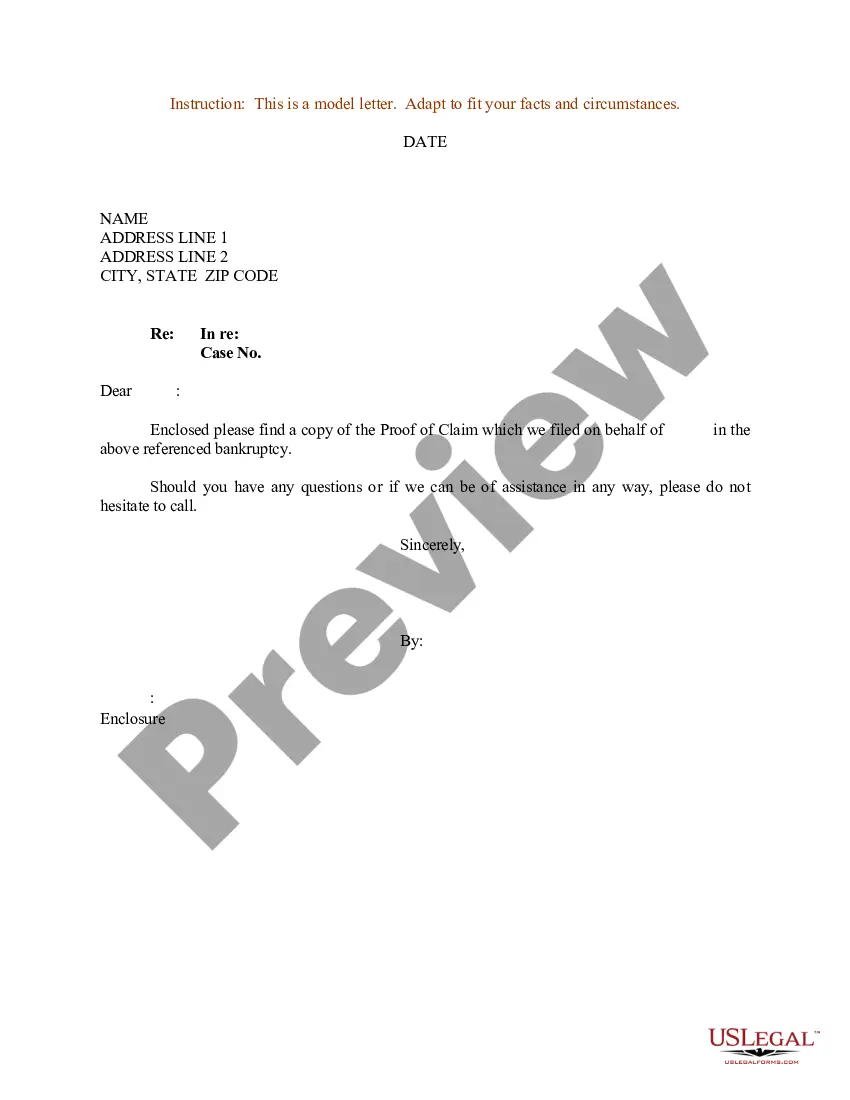

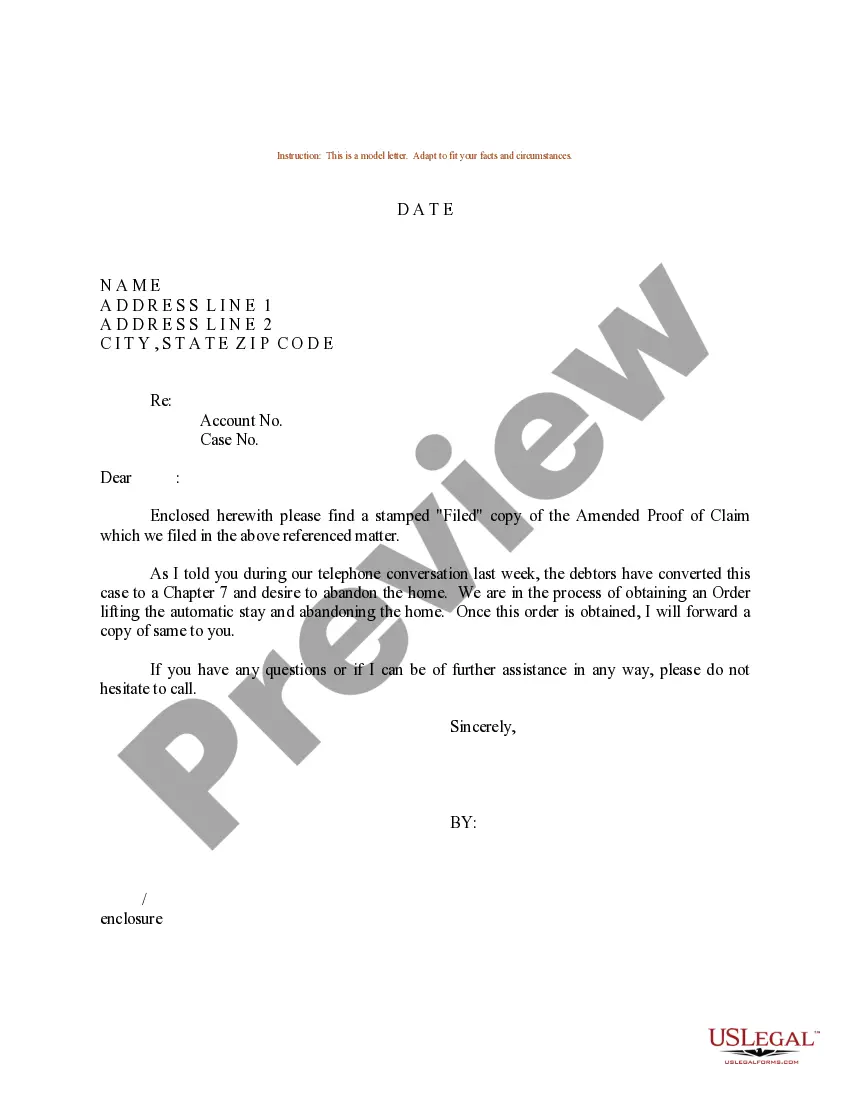

How to prepare this document

- Insert the date at the top of the document.

- Fill in the name and address of the debt collector.

- Clearly state your denial of the alleged debt.

- List all required documents you are requesting for verification.

- Include your personal contact information and sign the letter.

- Send the letter to the debt collector and retain a copy for your records.

Does this form need to be notarized?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to send the letter via certified mail, which provides proof of delivery.

- Not specifying the documents needed to prove the debt.

- Omitting personal contact information or signature from the request.

- Neglecting to keep a copy of the letter for personal records.

Advantages of online completion

- Convenience of downloading and completing the form at your own pace.

- Ensures that all necessary elements are included for proper legal standing.

- Easy accessibility to legal templates drafted by licensed attorneys.

- Editable format allows personalization to fit specific circumstances.

Quick recap

- The Request for Proof of Debt is essential for disputing unknown debts.

- Proper documentation is crucial for protecting your rights and credit report.

- Using this form can help clarify your responsibilities and ensure fair treatment from debt collectors.

Looking for another form?

Form popularity

FAQ

A proof of debt is the document on which a creditor submits details of its claim.A proof of debt may be submitted for two purposes: (i) to enable the creditor to vote on matters relating to the insolvency process; and (ii) to entitle the creditor to receive a dividend distribution from the insolvent estate.

The name of the creditor. The amount owed. That you can dispute the debt. That if you don't dispute the debt within 30 days the debt collector will assume the debt is valid. That if you dispute the debt in writing within 30 days the debt collector will provide verification of the debt.

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

This usually means producing proof that the debt was assigned to it. Often such proof will be a bill of sale, an assignment, or a receipt between the last creditor holding the debt and the entity suing you.

According to The Fair Debt Collection Practices Act (FDCPA), a debt collector must send you written validation of debt within five days of contacting you. If they don't, you can send them a letter to request a validation of debt (see this sample letter).

If your accounts have exceeded the statute of limitations and you're trying to clean up your credit report, a debt validation letter may provide you some value in attempting to achieve your goal if the collection agency has possessed the account for less than 30-35 days.