Puerto Rico Partnership Dissolution Agreement

Description

How to fill out Partnership Dissolution Agreement?

Locating the appropriate legitimate document template can be a challenge.

Of course, there are numerous templates accessible online, but how can you secure the authentic form you require.

Utilize the US Legal Forms platform.

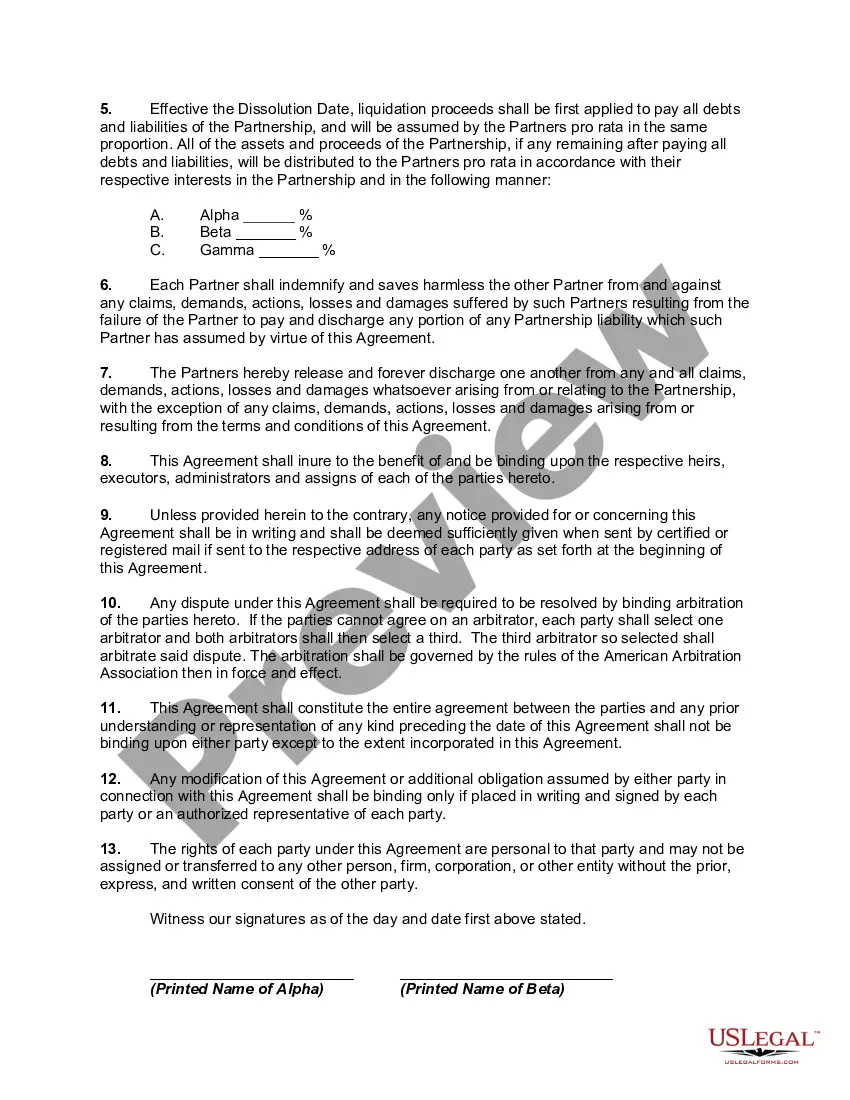

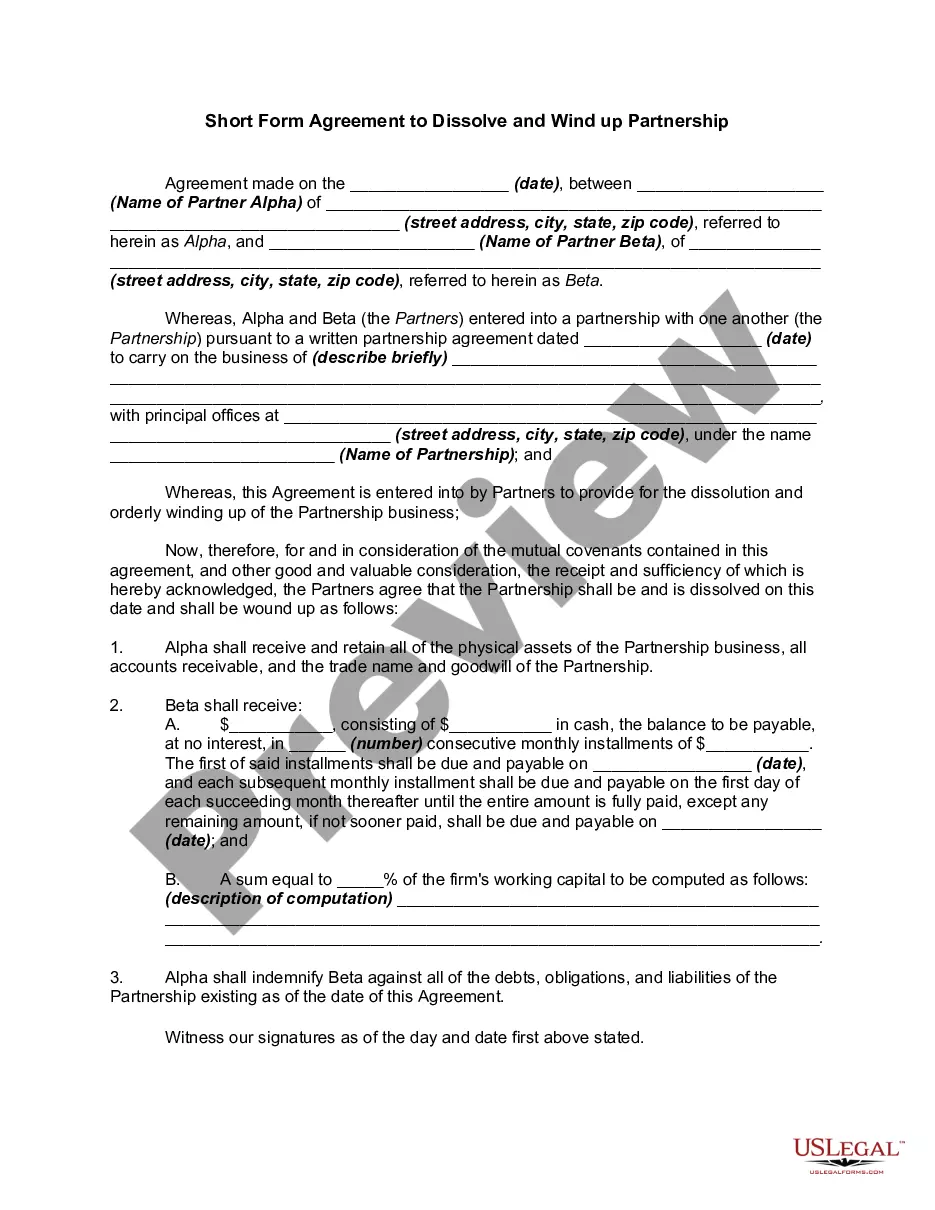

First, ensure you have selected the correct form for your region. You can preview the form using the Review button and examine the form summary to ensure it fits your needs. If the form does not satisfy your requirements, use the Search field to locate the appropriate form. Once you confirm that the form meets your expectations, click the Buy Now button to obtain it. Select the pricing plan you prefer and provide the necessary details. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Puerto Rico Partnership Dissolution Agreement. US Legal Forms is the largest repository of legal forms where you can find an assortment of document templates. Use the service to download professionally crafted documents that meet state requirements.

- The service offers a vast selection of templates, including the Puerto Rico Partnership Dissolution Agreement, suitable for both business and personal needs.

- All forms are reviewed by experts and comply with both federal and state regulations.

- If you are currently registered, Log In to your account and click the Acquire button to access the Puerto Rico Partnership Dissolution Agreement.

- Use your account to search through the legal forms you have obtained previously.

- Visit the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

Form popularity

FAQ

The primary difference between a corporation and an LLC in Puerto Rico lies in their structure and taxation. A corporation is a separate legal entity that often faces double taxation, while an LLC has pass-through taxation, meaning profits are only taxed at the individual level. Choosing the right structure is crucial, especially when drafting documents like a Puerto Rico Partnership Dissolution Agreement, as it impacts liability and taxation.

Yes, a Puerto Rico entity is considered a US entity in terms of federal recognition. However, it is important to note that Puerto Rico operates under its own tax laws and regulations. When dealing with agreements like a Puerto Rico Partnership Dissolution Agreement, understanding this distinction can help ensure compliance with both federal and local requirements.

Forming a Limited Liability Company (LLC) in Puerto Rico offers several key advantages. An LLC protects your personal assets from business debts, ensuring that your liability is limited. Additionally, an LLC provides flexibility in management and taxation, making it a suitable choice for those engaging in a Puerto Rico Partnership Dissolution Agreement or other business ventures.

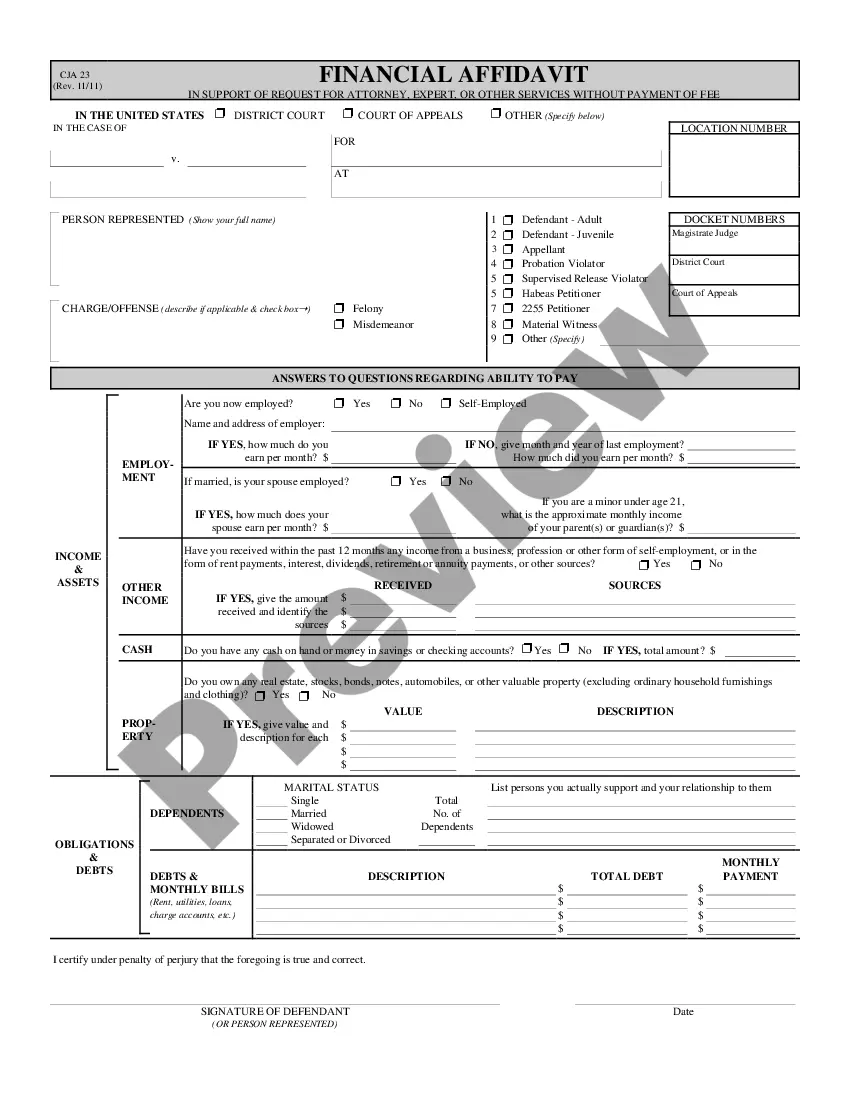

Form 480.6 C is an essential tax document specific to Puerto Rico. This form provides crucial information about income and withholding taxes for various entities, including those involved in a Puerto Rico Partnership Dissolution Agreement. If you are dissolving a partnership, understanding this form can help ensure compliance with local tax laws and avoid potential penalties.

Yes, a DBA can generally be filed online in Puerto Rico, providing a convenient option for business owners. Most local government websites offer an online filing system, allowing you to complete the necessary forms from the comfort of your home or office. Ensure that you have all required details ready, like the name of the business and contact information. By handling this online, you streamline your operations and prepare for any potential Puerto Rico Partnership Dissolution Agreement needs.

To legally write a DBA, or 'doing business as,' begin by choosing a unique name that reflects your business activities. After deciding on a name, you need to draft a DBA declaration that includes information such as your business structure and the nature of your activities. Once you've completed the declaration, you will typically need to file it with the relevant local or state government office. This process is vital, especially if you might consider a Puerto Rico Partnership Dissolution Agreement in the future.

Filing your Puerto Rico annual report online is an essential step in maintaining your business compliance. First, visit the official Puerto Rico Department of State website, where you can find the annual report section. You'll need to create an account or log in to your existing account. Finally, follow the prompts to complete your report, ensuring that you submit it on time to maintain good standing and support any future Puerto Rico Partnership Dissolution Agreement you may require.

To dissolve a Puerto Rico LLC, you must first hold a vote among the members to approve the dissolution. Following this, you should file the necessary articles of dissolution with the Department of State. Utilizing a Puerto Rico Partnership Dissolution Agreement can streamline this process, ensuring you comply with legal standards and obligations.

Yes, a US company can do business in Puerto Rico without any special requirements. Companies must adhere to local regulations, including obtaining necessary permits and licenses. This is essential, especially if considering a Puerto Rico Partnership Dissolution Agreement in the future, as compliance helps protect your business interests.

If you don't file an annual report for your LLC, you risk administrative dissolution. This means that your business could lose its legal standing, potentially affecting your Puerto Rico Partnership Dissolution Agreement. Consequently, all operations may come to a halt, and you might incur additional fees or penalties.